France has a new prime minister (again), actually – no we don’t – another one gone! However, time is of the essence to ensure that the Finance Law is approved and passed into law by the end of the year. Prior to the government reshuffle, there was a plan to freeze the tax rates at their current level and not adjust them in line with inflation as has been done in the past few years.

Financial update France October 2025

By Katriona Murray-Platon

This article is published on: 6th October 2025

There was also a plan to set the 10% abatement on pensions at a maximum of €2000 per pensioner rather than the current maximum of €4399. Whether these measures will be adopted into law by the end of year, only time will tell.

According to a study published by the French National Statistics Body (INSEE, Focus 354), in 2024, 78% of French residents have a Livret A Savings account, compared with 42% who have an assurance vie and 27% that have a property savings plan (PEL/CEL). Only 19% of French residents have a retirement account (PER) and only 16.5% are part of an employer’s savings plan. Clearly the French prefer to keep their investments in assurance vies rather than in share accounts since only 9.8% of French residents have PEAs and only 9.6% have ordinary share accounts (compte titres). With the interest rate for the Livret A now at only 1.7%, this means that a large amount of French savings is not protected from inflation. Since money in an ordinary share account is subject to both tax and social charges, it is more tax efficient to invest in either an assurance vie or a PEA.

After another hot and dry summer, which has affected ground conditions in many areas, a decree has been published on 6th September 2025, which grants a subsidy to property owners in 11 departments to diagnose and remedy the potential damage of clay soil shrinkage and expansion.

This financial assistance could cover up to 90% of the costs up to a maximum amount of €2 000 for a “vulnerability diagnosis” of the property and up to 80% of the work costs up to a maximum amount of €15,000. Both will be means tested.

This autumn child care benefits (“complement de libre choix du mode de garde” or CMG) are changing. The CMG is a family benefit which covers part of the costs of a child being looked after by a carer (assistante maternelle) or at home by a nanny employed directly by the parents. This benefit is being amended in order to better assist families in certain situations. From 1st September 2025, the amount of this benefit will also change. In particular, single parents can now receive CMG until their child is 12 years old instead of 6 years old previously. From 1st December 2025, for parents with shared custody of their child, each parent can receive CMG under certain conditions. The calculation of the amount of benefits will be done automatically by Urssaf on the Pajemploi website and families will be informed of the new amount of benefits they will receive in the September 2025 declaration.

The Taxe Foncière statements are now available on your online account on the impots.gouv.fr website. You have until 15th October to pay the tax or20th October if you pay online. If you are already paying your taxe foncière monthly and the amount is higher than last year, then you will pay your regular amount on 15th October and the excess on 15th November.

Most people will have noticed an increase in their tax foncière of 1.7% due to the annual revaluation of the rental value which is the basis on which this tax is calculated.

There may also be an additional increase if your local council has voted for one. Other subsidiary taxes such as the tax to manage aquatic areas and the prevention of flooding may also have increased in certain areas. As for the tax for the refuse collection, a table produced by the Environmental and Energy efficiency (Agence de l’environnement et de la mâitrise de l’energy) published in Le Monde newspaper on 25th August showed that more than half of local authorities charge more than what it actually costs them to collect and treat the rubbish. If your tax foncière seems excessively high this year, it may be worth raising this issue with your local council.

If you have any questions on your financial situation in France, or know someone who does, please do get in touch and I would be happy to arrange a free, no obligation, phone or video call.

Le Tour de Finance September 2025

By Spectrum IFA

This article is published on: 18th September 2025

The latest stages of Le Tour de Finance brought together investors, financial experts, and international residents for two highly successful events that highlighted the importance of planning, transparency, and trusted advice. Both gatherings were very well attended, with participants eager to engage, ask questions, and share experiences in an open and interactive setting.

Across the two days in Granzay-Gript and Cognac, our expert panel delivered insightful presentations covering key topics such as pensions, investments, tax planning, estate structuring, and regulatory changes that affect expatriates in Europe. The sessions were designed to provide practical, up-to-date knowledge and were followed by lively Q&A discussions. Attendees made the most of the opportunity to ask specific questions relevant to their own circumstances, sparking valuable exchanges and deeper understanding.

We would like to extend our sincere thanks to all the partners; RBC Brewin Dolphin, Novia Global, The Prudential and Currencies Direct, whose ongoing support ensures the continued success of Le Tour de Finance. Their expertise and commitment to providing clear, professional guidance is at the heart of these events. We are also deeply grateful to the venues and hosts, who created such a welcoming and professional environment for our community.

Most importantly, we would like to thank all of the attendees who joined us. Your engagement and thoughtful questions helped make these events so dynamic and rewarding. The high level of interaction reflects the genuine need for clear, reliable information in the ever-changing world of financial planning.

As Le Tour de Finance continues, we look forward to building on this momentum and bringing more valuable insights to international residents across Europe. We are proud to provide a trusted platform where people can connect directly with experts and gain clarity for their financial future.

Webinar – Buying your dream home in France

By Peter Brooke

This article is published on: 6th September 2025

Join our expert panel

Wednesday 24th September

6pm – 7pm UK time

Karen Tait – Host and Presenter

Lisa Greene – French property expert (LEGGETT Immobilier Intl)

Jonathan Watson – Currency Specialist (LUMON)

Paulette Booth – Insurance expert (AXA International)

Tracy Leonetti – Relocation & French admin expert (LBS in France)

Sharon Revol – Mortgage expert (Cafpi)

Peter Brooke – Tax and Wealth Expert (The Spectrum IFA Group)

Join our live webinar about moving to and living in France.

Speak to the experts about the property buying process in France, currencies transactions, insurance, the relocation paperwork…, mortgages in France, plus the all important financial and tax questions about moving to France.

Sign-up to the webinar – and if you have some specific questions, enter them on the form and our panel of experts will do their very best to answer your questions during the webinar on Wednesday 24th September

Le Tour de Finance France

By Spectrum IFA

This article is published on: 6th September 2025

Le Tour de Finance – France

Are you thinking of moving to France?

Interested in finding out how to make the most of your finances as an expatriate?

Do you have questions about Assurance Vie, tax efficient investing, pensions (including QROPS), investment markets, estate planning etc?

Join us, and our panel of guest speakers, for informed guidance on French resident tax and financial planning opportunities, commentary on investment markets and to meet like-minded people in your local area.

Le Tour de Finance is the financial forum for English speaking expatriates which can help you with a range of different financial products and services. Just as Le Tour de France takes a route throughout the regions of France, so too does Le Tour de Finance, plus we now journey into Italy and Spain.

We want to reach expats where they live so that everyone can seek specific advice relevant to your local area. Tax advice, pensions, mortgages, healthcare, schools, business advice and making the most of your assets are just some of the subjects that expats need to know more about when living as an expat. Le Tour de Finance is the ideal opportunity to find answers to the most pressing questions facing British people living in France, Spain or Italy.

The forum will bring together key players who assist English speaking expatriates settling or already living in these countries. It will also be an ideal opportunity to socialise by enjoying a free Buffet lunch and meeting people in similar circumstances in your neighbourhood.

Financial update in France – September 2025

By Katriona Murray-Platon

This article is published on: 4th September 2025

After a long sunny summer it is nice to get properly back to work now that my children have returned to school. It is also nice to have had some days of rain since the garden was in desperate need of it.

Over the summer you should have been notified that your tax statements are available online. If you paid too much tax this was reimbursed on 25th July. If you are not paying your tax by direct debit from your account, you must pay your tax by 20th September. If you have provided your bank details to the tax office and you have more tax to pay, your monthly payments will increase from 15th September and, if you have more than €300 to pay, you will have to pay off this amount over the next four months on 25th September, 25th October, 25th November and 29th December. If you have less than €300 to pay, it will be taken out in one payment on 25th September. Please do check your tax return as mistakes often occur.

Most people don’t notice the mistake until they are asked to pay an unusually high amount of tax and then they realise that other mistakes were made in previous years. If you do notice something wrong, you must first pay the tax that is requested on the statement and then submit an amended return. Any tax overpaid will be repaid once the new statement is produced.

As announced in my previous Ezine, the interest rates for the Livret A and LDDS savings accounts fell from 2.4% to 1.7%, the LEP interest rate fell from 3.5% to 2.7% and the interest rate for the CEL account fell from 1.5% to 1.25% as from 1st August 2025.

The markets continued to perform well in July and August, with US equities hitting record highs. This was in part due to concerns over tariffs diminishing, as numerous trade deals were signed leading up to the Trump administration’s 1st August deadline. Although the Trump administration considered these deals frameworks, including deals with Japan, the European Union (EU) and South Korea, as a political victory, they were vague on details and lacked clarity. However the markets appear to be less reactive over such tariffs, at least for the moment, which may indicate that volatility will not be as severe as it was in April. Strong corporate earnings and solid jobs data also buoyed equities.

UK inflation accelerated to 3.8% in July, the highest level since January 2024, while Eurozone inflation held steady at just 2%. This marks the widest gap between the UK and its European peers in nearly two years. Meanwhile the US dollar rose 3.2% in July, its best month since 2022, as the Fed indicated it was still in no rush to cut rates. With inflation above the Fed’s 2% target, and the full impact of tariffs on inflation unknown, the Fed seems to be taking a ‘wait and see’ approach.

For those with Pru assurance vies or those thinking of investing in a Pru Assurance Vie there is good news as, on Tuesday 26th August 2025, the Prudential Assurance Company (PAC) board reviewed the Prufund Expected Growth Rates (EGR) as part of the quarterly review process.

The Prufund aims to help customers grow money over the medium to long term ( 5 to 10 years) and protect customers from some of the short-term ups and downs of the markets by using the unique established smoothing process.

The Expected Growth Rate (EGR) is the forward looking element of the Prufund smoothing process. Pru announced that the EGRs for the GBP versions of Prufund were increased by 0.1%. So the Prufund Growth GBP is now 7.4% and the Prufund Cautious GBP is now 6.7%. The EGRs for all the Euro and USD versions of the Prufund remain unchanged. The Unit Price Adjustment (UPA) part of the smoothing process, which is a backward looking element, and which is formulaic and non-discretionary, is also reviewed quarterly. This quarter there was an upward UPA for the Prufund Growth USD version of 3.55%. There were no Unit Price Adjustments in the other PruFunds.

Going into the Autumn with varying inflation levels across key economies, continuing uncertainty with tariffs and ongoing geopolitical concerns in the Middle East and Europe, all which impact market performance, it is as ever important to maintain a well-diversified long-term investment approach, rather than reacting to short-term market swings.

With careful planning, and appropriate advice and reassurance, our clients can navigate through periods of volatility and uncertainty.

If you have any questions on the above or any other matters, please do get in touch to arrange a time to discuss your personal financial situation.

Smart Money Moves for Autumn in France

By Amanda Johnson

This article is published on: 2nd September 2025

As we head into the colder months, it’s a great time to take stock of our household budgets. Rising costs, unexpected bills, and day-to-day living expenses can all eat into our savings — but there are plenty of ways to trim costs without cutting back on the lifestyle you enjoy. Here are some simple, practical money-saving tips for life in France this autumn.

1. Make the most of supermarket loyalty schemes

Most major French supermarkets offer loyalty cards, digital coupons, and newsletters that give access to discounts and special offers. Signing up to your local supermarket’s loyalty scheme is free, and the savings soon add up. Keep an eye out for “10% days” or product-specific promotions, which are often advertised via email or app notifications.

2. Check your electricity tariff

Energy bills are one of the largest household costs, and yet many people are still on outdated or less competitive tariffs. It’s worth checking with your supplier to make sure you’re on the most cost-effective option. Some tariffs offer cheaper off-peak rates, which can be especially useful if you use storage heaters or large appliances. Even a small monthly saving soon adds up over the course of a year.

3. Stay on top of household maintenance

Regular servicing might feel like an expense, but it usually saves money in the long run. Having your boiler serviced, chimney swept, and car checked before winter can prevent costly breakdowns later. In France, annual servicing of boilers and sweeping chimneys is often a legal requirement, and insurers may refuse to pay out on claims if you haven’t kept up with maintenance. Think of it as an investment in avoiding future headaches.

4. Simple housekeeping habits

Small, everyday changes can also make a difference. Switching off appliances at the plug rather than leaving them on standby, adjusting heating slightly lower, and making use of draft excluders and thick curtains can all reduce bills. Many communes also run recycling and re-use events where you can pick up second-hand furniture or household items at little or no cost.

5. Plan ahead for big purchases

French retailers often hold significant sales in January and during the summer (les soldes). If you can plan your bigger purchases — whether that’s household appliances, clothes, or even furniture — around these sales periods, you can save a substantial amount.

Thinking Beyond Everyday Savings

While these steps can help you save money on day-to-day expenses, the real key to financial security lies in what you do with the money you’ve saved. Once you’ve cut unnecessary costs, you have an opportunity to put those savings to work for you.

That might mean setting money aside for future plans, investing to generate long-term growth, or making sure your finances are structured as efficiently as possible here in France.

If you’d like to explore how your savings could work harder for you — and discover what investment opportunities are available to expatriates living in France — I’d be delighted to talk with you.

Contact me today to arrange a no-obligation chat. Small changes in your daily spending can make a big difference over time — especially if you turn those savings into investments for the future.

Whether you want to register for our newsletter, attend one of our roadshow events or speak to me directly, please call or email me on the contacts below and I will be glad to help you.

We do not charge for our reviews, reports or recommendations.

French financial update June 2025

By Katriona Murray-Platon

This article is published on: 7th June 2025

Although the official beginning of Summer is not for a few weeks, these last few weeks of lovely sunny weather already makes it feel like summer is here.

Tax season is almost at a close. Those in departments numbered over 55 have until Thursday 5th June to finalise their tax declarations. I hope you managed to submit your returns in time.

If you now realise that you missed out some income or misdeclared income, you can still amend your tax return on the online webpage. Please note however that as the return has been filed by the deadline, this will generate a tax statement and any tax due on this first statement must be paid promptly. If you amend your return on the website now, this will generate a second statement which may request more tax from you and therefore adjust your monthly payments or will result in a tax rebate. Whichever the case, you must pay the first tax statement first and wait until the second statement is issued.

In June there is still one more declaration to complete if you are a trustee of a trust for which one of the beneficiaries, settlors or trustees are French resident. A trust must also be declared if it contains French based assets.

Although Trusts do not exist under French law, the French courts have accepted that Trusts set up in other countries can have effects in France (Paris Court of Appeal decision, dated 10 January 1970, Epoux Courtois and others of Ganay) provided that they have been set up in compliance with the laws of the country in which it was set up and that they don’t contain any provisions that go against French public policy (ordre public) especially as regards the réserve heriditaire (mandatory heirs rights).

Although generally, if it says Trust in the document, then it needs to be declared, there are some exceptions such as Unit Trusts, a company trust, or an investment trust. Also pension trusts do not need to be declared in the annual trust declaration provided the trustees of these pension trusts are subject to the law of a State which has signed an agreement with the French state to provide administrative assistance in the prevention of fraud and tax evasion (https://bofip.impots.gouv.fr/bofip/7886-PGP.html/identifiant=BOI-DJC-TRUST-20220330). This includes pension trusts in Malta.

There are two declarations that need to be done, TRUST 1 (https://www.impots.gouv.fr/formulaire/2181-trust1/declaration-de-constitution-de-modification-ou-dextinction-dun-trust), if you have never declared the trust before or it is a new trust and TRUST 2 (https://www.impots.gouv.fr/formulaire/2181-trust2/declaration-annuelle-de-la-valeur-venale-au-1er-janvier-des-biens-droits-et- ) which is the annual trust declaration which must be done every year. Unfortunately, you cannot submit these forms online like you can when you do your income tax return, they must be submitted in paper form and sent to the Non-Residents tax office in Noissy-le-Grand before 15th June every year.

For those with Pru Assurance Vies or those thinking of investing in a Pru Assurance Vie there is news as, on Tuesday 27th May 2025, the Prudential Assurance Company (PAC) board reviewed the Prufund Expected Growth Rates (EGR) as part of the quarterly review process. The Expected Growth Rate (EGR) is the forward looking element of the Prufund smoothing process. Pru announced that the EGRs for all the offshore versions of Prufund remain unchanged. The Unit Price Adjustment (UPA) part of the smoothing process, which is a backward looking element, and which is formulaic and non-discretionary are also reviewed quarterly. This quarter there is a negative UPA for the Prufund Cautious fund in GBP of – 2.3%.

At the beginning of June, I shall join some of my colleagues and some of our product providers for our adviser meeting in Paris. It will be interesting catching up with my colleagues and also hearing our providers views on the markets in what has been a very interesting first part of the year!

After all the May bank holidays, I am looking forward to having some normal working weeks and getting lots of work done before the summer holidays. If you have any questions or would like to organise a meeting to discuss your finances, please do get in touch.

FEIFA Annual Adviser Conference

By Peter Brooke

This article is published on: 30th May 2025

I recently attended the FEIFA Annual Adviser Conference in London and wanted to share a brief summary of the latest market insights, along with how advisers are continuing to evolve their approach to best serve clients in today’s environment.

The Federation of European Independent Financial Advisers (FEIFA) – not to be confused with the football governing body! – was founded 16 years ago by a group of experienced IFA firms across Europe. They saw the need for an organisation that could uphold professional standards and represent the interests of advisers and their clients with both industry bodies and regulators across the continent. Spectrum is proud to be one of the original founding members, and we continue to support and build on those standards through our ongoing involvement.

The annual conference brings together FEIFA members and leading industry voices to discuss the unique challenges of advising cross-border clients. As Head of the Spectrum Investment Committee, it remains a valuable and important event in my calendar.

Staying the Course Through Market Volatility

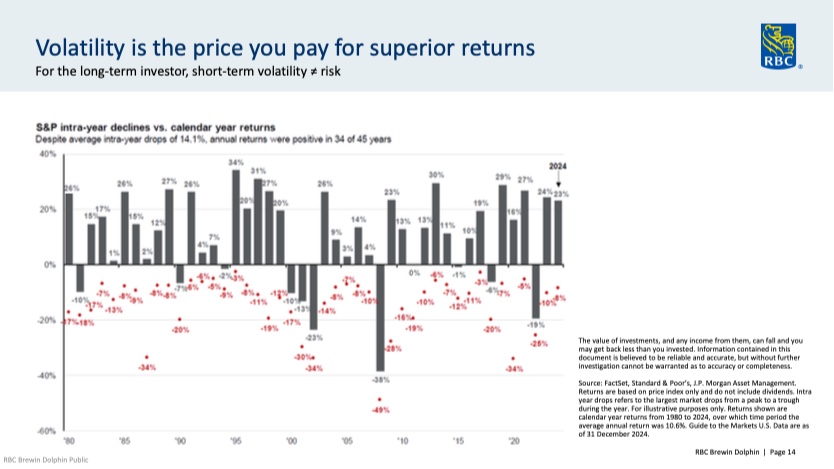

Richard Flood (RBC Brewin Dolphin) reminded us that global events—whether pandemics, wars, or political wrangling —are a constant. Despite this, markets rise over time. The key is to focus on long-term fundamentals rather than react to short-term noise.

Volatility, he stressed, is a normal part of investing and “the price you pay for superior returns.”

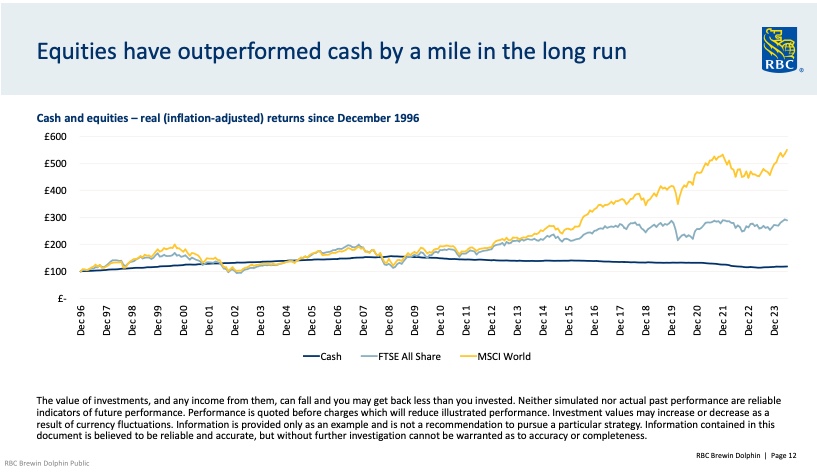

Avoiding volatility by sitting in cash is not a good idea either as Inflation diminishes the purchasing power of cash – as illustrated in this Equities v’s Cash ‘inflation adjusted’ performance chart.

Navigating an Uncertain 2025

David Coombs (Rathbones) highlighted the ongoing impact of geopolitical events like Trump’s executive orders and Tariffs on trade and compared them to other countries ‘protectionist policies’ like unbalanced tax rates (eg Ireland), agricultural subsidies (eg France).

He also stressed the unconsidered challenges that passive investments (eg ETFs) pose to market stability due to being “forced sellers & and forced buyers” therefore adding to volatility.

Active management, in his view, remains vital, especially in 2025, and he shared a wonderful example of how active he has been in the last year:

The below chart is the Shopify share price, a share he has held for some time, the red dots are where he sold some shares (trimmed) and the yellow dots are where he added money – this shows that active management is much more than strategically choosing which companies to own or not own, but how to add value through tactical decisions.

The Passive Investing Paradox

Henry Wilson (LGT Wealth Management) discussed the risks of over-reliance on passive funds, including the concentration risk in a few large companies (eg MAG 7). Because of this concentration of returns (and risk) to fewer, larger companies he believes that true diversification is under threat, valuations are higher, future returns are compromised…

… BUT as Harry Markowitz, the architect of Modern Portfolio Theory & Efficient Frontier said “Diversification is the only free lunch to investing”.

Therefore while passive investing remains a useful tool, LGT and Spectrum advocate for highly diversified, actively managed portfolios to help manage risk and improve long-term returns.

If you are going to own passive investments you have to be active with them.

Model Portfolios & Adviser Alpha

Matthew Lamb (Pacific Asset Management) explored the evolution of model portfolios and the increasing role of technology. With many portfolios becoming similar, the real value lies in the advice given—not just the investments chosen.

This fits strongly with my recent newsletter about risk (click here) – If most ‘Balanced’ portfolios are similar to each other and most ‘Growth’ portfolios are similar to each other then the outcome for you, as my client, is not in picking between two balanced funds or two growth funds… it’s ensuring we choose correctly between Balanced or Growth in the first place!!

Good risk profiling conversations make sure we start in the right place.

Planning for the Summer

After almost 13 years, we’re finally heading to Australia for a long-overdue family holiday. We’ll be visiting my wife’s side of the family, who all live in Queensland. She’s been able to make a few trips in that time, but between school schedules, travel costs and a global pandemic, the children and I haven’t been back since 2013. We’ll be away for five weeks from the end of June and are really looking forward to the trip.

I’ll still be checking emails and messages periodically, but if you’d like to catch up — whether by phone, Zoom or in person before we go — please do get in touch or book something in the calendar before Friday 27th June.

All being well, I’ll be back at my desk (with a fair dose of jet lag) on Wednesday 6th August.

Lions V’s Australia

Of course, seeing family and friends is the main priority — but I’d be lying if I said there wasn’t something else I’m particularly excited about.

As a lifelong rugby fan, getting the chance to see the British & Irish Lions take on Australia in both the 1st and 3rd Test Matches — plus the Queensland Reds in early July — is nothing short of a bucket list experience for me.

As always, if there’s anything you’d like to go over before I head off, just let me know. And if anything comes up while I’m away, I’ll do my best to ensure it’s handled smoothly.

Contact me if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

Mobile & Whatsapp: +33 6 87 13 68 71

Email: peter.brooke@spectrum-ifa.com

Calendly booking system: https://calendly.com/peterbrooke/30min

Why Now Is a Surprisingly Good Time to Invest (Yes, Really!)

By Michael Doyle

This article is published on: 25th May 2025

I Do Love a Bargain

I know it’s almost summer, but is there anything better than the hope and expectation that builds around Christmas. It’s the best time of the year for me.

Not only do we get to enjoy all the trappings that come with the festive time of year but on Boxing Day the madness begins!!!!

The trainers that were €130 have been reduced to €60, the jacket that was out of reach at €400 is now €240, the sports T-shirts that just 2 days ago were €40 are now €20. What a time to buy.

There’s something similar happening in the markets right now and I just wanted to take a few minutes to explain why I think now could be a great time to invest.

Volatility is a Discount in Disguise

The markets have been bumpy — and that’s a gift in plain wrapping. Volatility creates opportunities. Quality companies with strong fundamentals often get marked down along with the rest of the market, offering savvy investors the chance to buy value at a discount. If you’ve read my other articles, you’ll know I’m partial to the odd quote from Warren Buffett: “Be fearful when others are greedy and greedy when others are fearful.” Right now? There’s more caution than confidence. That’s your opening.

Inflation Is Cooling. Rates May Follow

While central banks have taken us on a wild ride with interest rates, there are early signs of stabilization. Inflation is cooling in many regions. As economic data settles, interest rates may begin to ease, restoring more predictable conditions for both equities and bonds. Those who position themselves before the pivot are typically the ones who benefit most.

The Power of Time Is on Your Side

Time in the market beats timing the market — every time. The longer your money is invested, the more it compounds. Trying to wait for the “perfect” moment often leads to missed gains. Historically, the market’s best days tend to cluster near its worst days — miss those, and you risk missing most of the upside.

I wrote an article on this a few years back which still holds true today. You can read it here.

Innovation Hasn’t Slowed Down — It’s Accelerating

From AI and biotech to clean energy and space tech, we’re witnessing a new industrial revolution. These aren’t just exciting ideas; they’re multi-trillion-euro transformations already reshaping global economies. Investing now means getting in before the wave crests — not after.

Diversification Is More Powerful Than Ever

The global landscape is broader than ever. While some markets face headwinds, others are thriving. A well-diversified portfolio — across sectors, regions, and asset classes — isn’t just a shield, it’s a springboard. With the right structure, you can grow your wealth through both sunny and stormy weather.

So, Why Now?

Because uncertainty is the soil where opportunity grows. Because prices reflect fear, not fundamentals. Because the future isn’t waiting — it’s happening now.

As your financial adviser, my job is to help you see the forest through the trees, and to guide you with strategies that match your goals, timeline, and comfort level — especially when others are sitting on the sidelines.

Let’s have a conversation. Your future wealth might just thank you for acting today.

The best time to invest? Yesterday. The second-best time? Right now.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here

Basic Investment Terms Explained

By Michael Doyle

This article is published on: 22nd May 2025

I’m Scottish and I live between France and Luxembourg. I moved to Luxembourg in 2008 and then France around 2015 and have commuted between both for a lot of my time with Spectrum. Needless to say my French has improved over time (as long as people speak to me as if I’m 6 year old child).

One of the things though that I still struggle with is some of the terms they use, eg Pédaler dans la semoule which seemingly means going around in circles. I always wondered why people were pedalling around in semolina.

It got me to thinking that I often assume people know all of the terms we use in financial planning, so here I’ve decided to try and break down the barriers.

What is a stock?

A stock represents partial ownership in a company. When you own a stock, you own a slice of that business — known as a “share” — and have a claim on its assets and earnings. Stocks are traded on public exchanges, and their value fluctuates based on the company’s performance, investor sentiment, and broader market conditions. Investors often buy stocks to participate in a company’s growth and, potentially, receive dividends.

What is a share?

A share is a single unit of ownership in a company, essentially your piece of the total stock issued. If a company issues 1 million shares and you own 10,000 of them, you own 1% of the company. Shares entitle the holder to a portion of the company’s profits (via dividends) and voting rights in some corporate decisions. Shares can rise or fall in value depending on market demand and the underlying company’s performance.

What is a bond?

A bond is a type of loan that investors give to governments, municipalities, or corporations. In return, the issuer agrees to pay back the principal amount on a set date and provide regular interest payments over the life of the bond. Bonds are considered fixed-income investments and are often used to provide portfolio stability and predictable income, especially in contrast to more volatile assets like stocks.

What is an ETF?

An ETF, or Exchange-Traded Fund, is a pooled investment vehicle that holds a diversified basket of assets — such as stocks, bonds, or commodities — and trades on a stock exchange like a regular share. ETFs allow investors to gain broad market exposure, often at a lower cost and with greater flexibility than mutual funds. They are popular for their diversification, transparency, and ease of access for both beginners and seasoned investors.

Let’s have a conversation. Your future wealth might just thank you for acting today.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here.