The 1986 movie “The Three Amigo’s” (starring Steve Martin, Chevy Chase and Martin Short) was one of my favourites in my early teens. I laughed so much at that movie and it brings back great memories watching it with my friends in the cinema.

The Three Amigos

By Michael Doyle

This article is published on: 21st October 2024

But where does this fit in with financial planning, you’re probably asking yourself.

Well, the three amigos in financial planning are:

• Time

• Knowledge

• Inclination

This is what a financial planner has.

When you are considering your financial situation, ask yourself these questions. Do I have the time, knowledge and inclination to be my own adviser? If you have all three, then you probably won’t have as much need of a financial consultant. If, however, you fall down on one of these, I can quite confidently argue that you need a specialist, and that’s where I come in.

This is my job, and after my family, this is what I’ve committed my life to. So, I have the time to do all of the research on your behalf.

I’ve been in the financial service industry for 25 years so bring a lot of knowledge with me. Not only that, I am backed by a fantastic company in Spectrum who work every day to find better products, better solutions and better advice for our clients. Why does that matter? Well because we have 50 financial advisers across France, Spain, Portugal, Italy, Luxembourg, Malta and Switzerland and have been offering advice since 2003.

Do you really want to be monitoring your portfolio monthly, rebalancing every 6 months or so? If you don’t have the inclination to do this you could see your investment going sideways.

So let’s work together and get the Three Amigos on your side.

The Jigsaw

By Michael Doyle

This article is published on: 18th October 2024

I’m not a big puzzle fan but I do like the odd sudoku grid. Recently, however, my 5 year old son has taken a vague interest in jigsaw puzzles. I like the ones for his age as they max out at around 16 pieces.

It got me thinking about my job, what I can do for my clients and how I can add value.

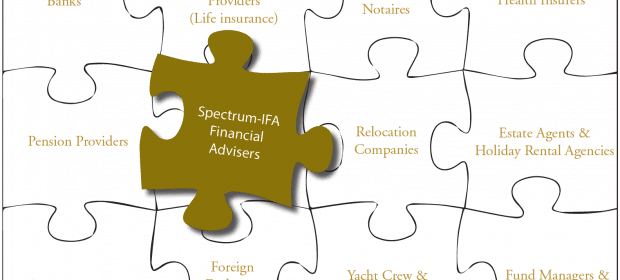

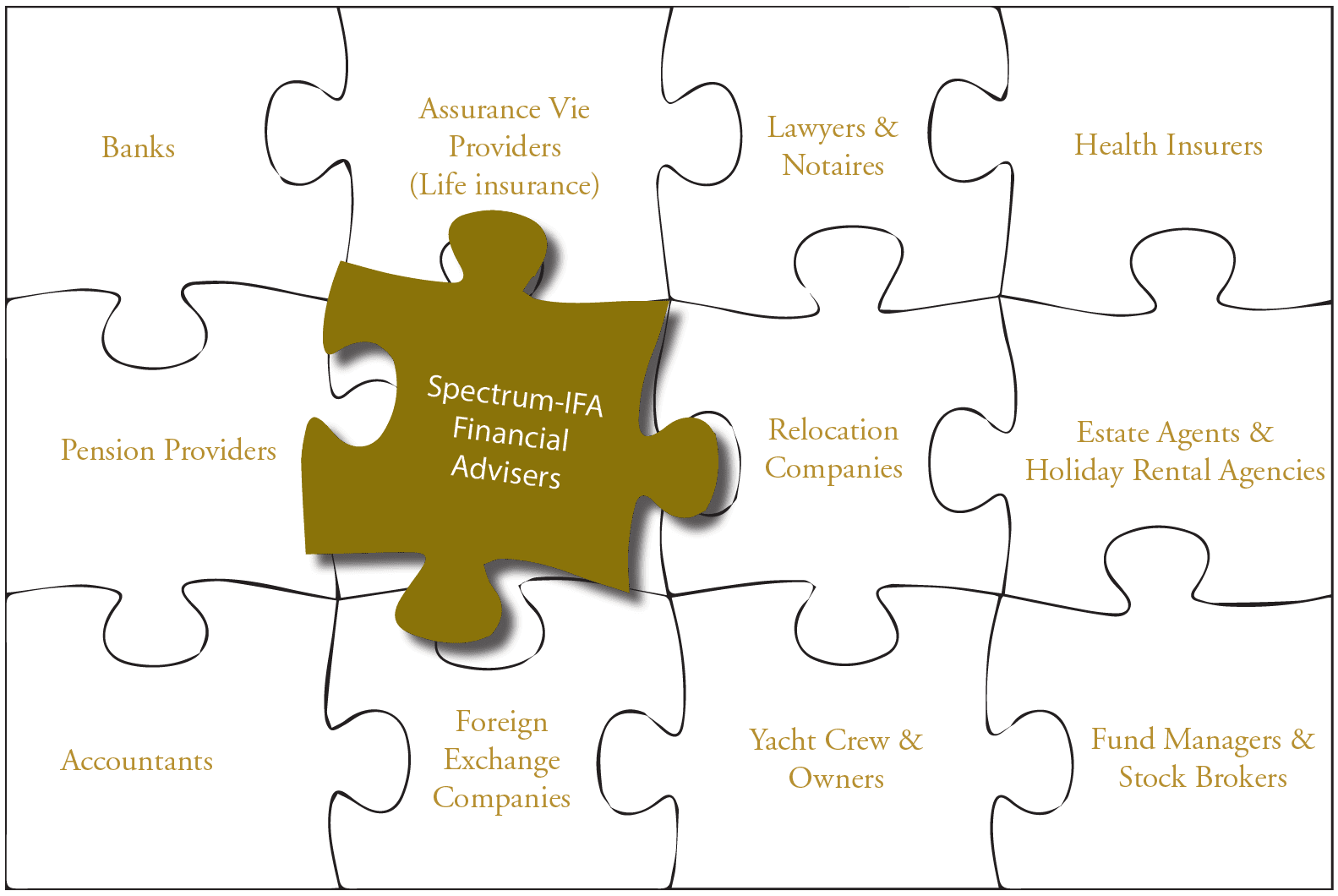

Typically, when a client comes to see me they have questions on investments, pensions, tax, domiciliation, inheritance, banking, life insurance and wills to name just a few.

It’s like a jigsaw puzzle.

I put the pieces of the jigsaw together for my clients so that in the end they are not left weighing up 16 individual pieces but can see the whole picture. This is where I add value.

Let me be clear – I am an International Financial Planner and I like to stay in my lane. What do I mean by that? I try not to cross into areas that are not my field of expertise (such as domiciliation, for example). But I am fortunate to be working with a wide range of clients, colleagues and professionals.

I have access to accountants, lawyers, domiciliation specialists, fund managers, investment houses … the list goes on. I’ve also been a financial adviser in the UK from 1999 until 2008 before I decided to move abroad and have been working in the same industry ever since. So as well as the specialists I can contact I also come with 25 years of experience.

What does this mean for you? Typically, this means I can contact these specialists on your behalf to get initial information and relay that to you. This could be legal or tax advice for example. I do this at no fee to my client and often save them a small fortune in fees for asking a few simple questions.

Let’s meet and start putting your jigsaw puzzle together.

Discipline Vs Regret

By Michael Doyle

This article is published on: 14th October 2024

It has been a tough couple of years in the financial markets – there is no getting away from that.

Mortgage interest rates have rocketed (although 3% isn’t too bad, depending on the era in which you mortgaged your first property). For savers rather than borrowers, some banks in France have started offering close to 3% returns on cash deposit accounts (mostly fixed term deposits, i.e. you don’t touch your funds for 2-3 years).

When I first started in financial services in 1998 one of my mentors said to me:

“Michael, always ask this question: Who does it benefit?”

Why would banks give you 3%? Who does it benefit that you tie up your funds for 2-3 years? Will you outperform inflation? Is your money safe (what is the bank’s guarantee)?

I just listened to the late, great Jim Rohn and he said there are two different types of pain:

There’s the pain of discipline and the pain of regret.

So which pain do you prefer?

Yes, the markets have performed poorly over the past couple of years (https://spectrum-ifa.com/russias-invasion-and-its-effects-on-markets/) – so can you remain disciplined?

At Spectrum we don’t generally advise on short term investing (less than 5 years). To that extent we ask and encourage our clients to be disciplined.

Here’s what we know (https://spectrum-ifa.com/time-not-timing-investing-for-the-long-term/).

I can’t tell you when markets will recover, but I do know that there will be a recovery (this is certain) and typically assets then to go on to achieve higher valuations than achieved previously.

Is now a good time to invest? If you have a medium to long-term time horizon, it definitely becomes an interesting conversation. Whatever is going on around us (and whatever is in the new headlines), discipline and patience really do pay when it comes to investment decisions.

If you are hoping to pre-empt short term market direction (with a view to buying in at low point), I’d be inclined to say investing is probably not for you right now. Could this mean that you will miss a ‘rebound’ in the markets? Quite possibly, with the inevitable regret that follows.

Either way, if you’d like to discuss suitable investment planning for your circumstances, please feel free to drop me an email and we can set up an initial no obligation chat.

Le Tour de Finance 2024

By Spectrum IFA

This article is published on: 14th October 2024

Despite stormy conditions locally, our 152nd Le Tour de Finance event was well attended in the beautiful setting of Chateau Val Joanis, north of Aix-en-Provence.

Our expert panel, hosted by Jonathan Goodman and Victoria Lewis of The Spectrum IFA Group, included assurance vie provider Prudential International, Novia Global Pensions, investment manager RBC Brewin Dolphin and tax lawyer AGN Avocats.

Quick-fire questions and answers on wide-ranging subjects allowed the panel to share their knowledge in an informative and interactive format over 90 minutes followed by a delicious buffet lunch and wine.

Our 153rd Le Tour de Finance event was well attended on the 9th October at the Chateau de Saint Martin in Taradeau in the Var.

Our expert panel, hosted by Jonathan Goodman and assisted by Tim Yates and Lorraine Chekir – all of The Spectrum IFA Group, included assurance vie provider Prudential International, Novia Global Pensions and investment manager RBC Brewin Dolphin.

The format was a question and answer session over a period of 90 minutes or so with some of the questions pre-prepared but many also coming from the audience. The questions were wide ranging covering subjects such as assurance vie, pension transfers, fund management, portfolio construction and tax treatment. These allowed the panel to share their knowledge on all these diverse but highly relevant topics in a lively and interactive way. A number of people commented after the seminar that they appreciated the format and that it was better than having people simply standup and lecture to them on their chosen subjects. They also found it refreshing that the emphasis was on being informative with no attempt at a “hard sell”. The event finished with an excellent buffet lunch with wine.

![IMG-20241008-WA0007[2]](https://spectrum-ifa.com/wp-content/uploads/2024/10/IMG-20241008-WA00072-900x1200.jpg)

ESG and Impact Investing

By Richard McCreery

This article is published on: 8th October 2024

Impact investing is increasingly becoming an important element of ESG-orientated investment portfolios.

Many people are familiar with the concept of sustainable investing, where a company may incorporate Environmental, Social and Governance (ESG) principles into its decision-making and risk management.

The aim is to promote positive long-term values that should improve the way a business is run by aligning its interests with those of society.

For example, in order to improve its effect on the environment, a company may introduce measures to reduce its carbon footprint, to minimize the use of finite resources or to eliminate waste. To improve the way it plays its part in society, it may insist on minimum standards in labour practices in its supply chain, it may introduce policies to expand its gender diversity or it may fund projects that build its standing in the community. When considering governance issues, a company might focus on how it balances executive compensation with performance, it might assess how ethical its operations are or it may improve transparency in its financial reporting.

Over the long term, it is believed that a more principled company culture that ultimately makes it more sustainable will improve the financial performance of that business, creating a win-win for all stakeholders. That is why the global ESG investing market was estimated to have grown to more than $25 trillion in size by 2023.

Sustainable investment funds that invest in a range of underlying companies may choose to exclude certain industries or sectors that don’t comply with ESG principles, such as gambling, tobacco or controversial weapons. But they may also choose to favour companies that have a strong ESG rating, that have made a conscious efforts to develop better behaviour along defined guidelines, such as those laid out in the United Nations 17 Sustainable Development Goals.

Impact investing goes one step further, because it favours companies that intentionally make a measurable positive contribution towards solving environmental or social problems alongside a financial return. It fills a funding gap when traditional philanthropy and government aid might be insufficient. Investments could be in healthcare, education, recycling, social housing, sustainable agriculture or climate change action. For example, investing in a renewable energy company could positively impact climate change, whilst investing in a plant-based meat company could positively impact public health and the environment.

Today, fund managers can incorporate impact investing into their sustainable funds or as part of an overall ESG strategy, ensuring that investors have the opportunity to make a financial return and generate a positive return for society. As you would expect, the addition of investment criteria other than just financial performance means that more work has to go into researching and selecting the best investments. However, clients can gain exposure through individual funds or managed portfolio services that offer liquidity, expertise and ongoing monitoring to ensure that goals are met and principles are adhered to.

If you would like to find out more about how to align your investments with ESG criteria and make impact investments, please get in touch.

At Spectrum, whilst we are committed to offering comprehensive solutions for sustainable investing, we also believe that all clients should decide freely on how to allocate their capital. We recognise too that no single, simple solution exists for how to invest responsibly. For these reasons, we include responsible investment discussion in our advice process but do not impose personal or corporate views.

Financial update France October 24

By Katriona Murray-Platon

This article is published on: 5th October 2024

As we head into October, this means that we are now three quarters of the way into 2024. When we look at the markets we can see that in spite of a short dip in August, the year to date figures for almost all of the main market indices are showing performances in the double figures.

Autumn is the season for what are known as local taxes, i.e. the taxe foncière, taxe d’habitation and tax on vacant lodgings. Whilst the taxe d’habitation only affects those with second homes, taxe foncière has to be paid by all property owners. Properties that are inhabitable but remain vacant, which are situated in one of the 3697 communes listed in the decree number 2023-822 of 25.08.23 and which have been left unoccupied for at least a year as at 1st January of the tax year may be subject to the annual tax on vacant lodgings. For a property to be liable for this tax in 2024 it must have been empty since 1st January 2023. If it has been vacant for 2 years since 1st January 2022 there may be a local tax on vacant lodgings which may apply.

The Taxe Foncière statement should already be available in your account on the impots website. This must be paid by 15th October or you have until 20th October if you pay online. It doesn’t need to be paid all at once, you can set up monthly payments so that by the time October comes along you will have paid most of it with the extra amount being paid in November. Whilst the Taxe Foncière will increase again this year, not everyone has to pay it. Those on benefits (ASPA, ASI) are exempt as are those who are aged 75 or over on 1st January of the tax year and those on disability allowance (AAH) provided that their annual taxable income is under €12,455 per person or €19,107 for a couple. If you fall under the income threshold and are over 65 on 1st January there is a €100 reduction. There is no need to notify the tax offices, any exemptions or reductions will apply automatically provided that you meet the income conditions. However there may be extra allowances granted by your local authority so it is worth making enquiries.

The housing market in France is improving in spite of a difficult first half of the year. As several of the main central banks have started cutting their rates, the mortgage rates are also falling. According to our Spectrum International Mortgages expert Patricia Nadal, the average rate over 20 to 25 years granted in September was around 4.30%, compared to the average of rate for the same length of time in June which was around 4.45%.

The banks are also being more flexible in their requirements for granting mortgages. In the UK even though the Bank of England voted to keep their rate at 5%, mortgage rates have fallen to 4% with some just under this rate.

From 24th October 2024, anyone opening a new French assurance vie or PER will now have the possibility of investing in venture capital investment funds. These are only for those with a balanced risk profile (around 4% of the investment) and adventurous profiles (up to 8% of the assets). There is no obligation to invest in such funds for cautious profiles. For PERs it will depend on the attitude to risk of the policy holder and how long they have until retirement. Also, from the same date, if you have a PER they will now be able to offer more adventurous investment strategies.

Although the weather may be getting cooler and you want to spend more time indoors, if you have any financial questions you would like answering, I would be happy to arrange a video call or I could come and meet you in the comfort of your own homes. Please do get in touch to arrange a time that would suit you best.

Financial update September 2024 – France

By Katriona Murray-Platon

This article is published on: 5th September 2024

I hope you all had a good summer. I very much appreciated the fact that it wasn’t too hot over the summer. My garden is certainly in a better shape thanks to the better weather. Now it is back to school and back to work and I am looking forward to setting up appointments and meeting people again.

For those who are eligible for the energy cheque but did not receive it this spring or if you did receive it but would like to review the amount received, you can now make a claim on the website chequeenergie.gouv.fr but you must make sure you do this before 31st December 2025.

On 1st August the interest rate of the LEP savings account reduced to 4%. To be able to open one of these accounts your taxable income needs to be below €22 419 (single person) or €34 393 for a couple. This rate reduction puts the LEP at only 1% higher than the other savings accounts such as the Livret A, the LDDS and the Livret Jeune which have an interest rate of 3%, set rate until February 2025.

If you are looking to save for your children there is a new savings plan called the Plan Epargne Avenue Climate (PEAC) which is available from 1st July 2024. It is a hybrid of the Livret A and the PER retirement scheme and allows you to save up to €22,950 with any gains being free of tax and social charges. There is no fixed interest rate, any gains will depend on the investment strategy but the investments are ESG and in “green” bonds. However not many banks or insurance companies offer this savings plan as yet preferring their own versions of assurance vies.

Since 31st July and until 4th December, those taxpayers who declared their income online can correct their declaration or amend any omissions by going onto their personal account on the impots.gouv.fr website under “accéder à la correction en ligne”. However, bear in mind that if the amendment results in less tax being paid or a higher tax credit, the tax office will probably contact you for more information or documents and can refuse to amend the tax return. If they do this, you need to make a complaint via the messenger service and, if this is refused, court action will be necessary. This comes from a decision of Paris administrative court of appeal of 28th June 2024 (no 22PA04610) whereby the the Court ordered the tax office to reissue the tax statement will the requested amendments. The online correction system does not let people know that their amendments can be refused.

As from September, if the amount of tax you pay is greater or less than the previous year, your monthly payments will change from 15th September. If you owe less or the equivalent to €300, the remainder will be taken on that date. If you owe more than €300, the payment will be spread out over four payments taken on 26th September, 25th October, 25th November and 27th December.

For those with Pru assurance vies or those thinking of investing in a Pru Assurance Vie, on Tuesday 27th August 2024 the Prudential Assurance Company (PAC) board reviewed the Prufund Expected Growth Rates (EGR) as part of the quarterly review process. Prufund aims to help customers grow money over the medium to long term ( 5 to 10 years) and it protects customers from some of the short-term ups and downs of the markets by using the unique established smoothing process. The Expected Growth Rate (EGR) is the forward looking element of the Prufund smoothing process. For this quarter the EGRs of the Prufunds in our assurance vie products remained unchanged for the € and $ but the Prufund Growth GBP dropped slightly from 7.7% to 7.3% and the PruFund Cautious GBP dropped from 7% to 6.6%. The Unit Price Adjustment (UPA) part of the smoothing process, which is a backward looking element, and which is formulaic and non-discretionary are also reviewed quarterly. This quarter there was an upward UPA for the Prufund Growth USD fund of +2.19%.

September is really the beginning of the year in France, more so than January, after the long summer holidays. Referrals are very important in our business and so is our reputation with clients. Therefore we are asking clients to kindly give a review of our advisers and our business on Trustpilot. I would be very grateful if you would kindly take the time to leave a comment using the link below: https://uk.trustpilot.com/review/spectrum-ifa.com

Please do get in touch to arrange a free, no obligation phone call or video meeting to discuss any financial or tax matters that you may need advice on. I look forward to hearing from you.

Are gifts to children taxable?

By Amanda Johnson

This article is published on: 21st August 2024

A question I’m often asked:

“I would like to gift some money to my daughter. How can I do this and what taxes do I need to be aware of? Will I need to use a Notaire?”

First, you need to determine if this is a gift or if you are providing financial assistance to a family member. You are allowed to provide financial help (subsistence support) to family members if their income is low, and in some circumstances, you can apply for tax relief on this. They will need to declare this income on their French tax return.

If it is a gift, is it for a wedding present? Is the amount you are gifting relative to your income, and have you gifted similar amounts to other children when they got married? You are allowed to gift up to 100,000€ to each child every fifteen years tax-free, but you must declare this to the tax authorities. If you die within those fifteen years, the amount you have declared will be used towards their inheritance tax allowances.

Your daughter will need to declare this amount to the relevant tax authorities. If she lives in France, she will need to make a Déclaration de don manuel if the amount is less than €15,000, and for amounts above €15,000, a Révélation de Don Manuel. If your daughter lives outside of France, she will need to contact the tax authorities in the country she resides in to declare this gift, and any taxes due will depend on the rules of that country.

The use of a Notaire is required if the gift involves a division of family assets or the transfer of property.

If you are unsure of what needs to be declared and when, you can easily email your local centre d’impôt. Their email address is on your Avis d’impôt.

Assurance Vie & inheritance planning

By Sue Regan

This article is published on: 9th August 2024

When it comes to investing in assurance vie for inheritance planning, the focus is often on the very generous inheritance benefits applied to policies where sums are invested before the age of 70. I am often asked by clients ‘is it worthwhile investing in assurance vie after the age of 70?’ The answer is ‘most definitely YES!’

As a change from the norm, this article focuses mainly on the inheritance benefits of assurance vie investment beyond the age of 70.

As already stated, it is often a misconception that investing in assurance vie for inheritance planning is only attractive for people under age 70. Undoubtedly, investing before age 70 has very attractive inheritance benefits, but there are also valuable inheritance planning opportunities for sums invested after age 70 which should not be overlooked.

As a reminder, an assurance vie policy is “outside the estate”, according to Article L132-12 of the Insurance Code. This means that in the event of the death of the insured, the capital does not go to the heirs within the meaning of the Civil Code but to the named beneficiary(ies) of the assurance vie policy.

Sums invested into assurance vie beyond the age of 70 have an inheritance allowance of €30,500 and a exemption from gains on the total sum(s) invested. The choice of beneficiary is completely unrestricted and the allowance (and profit) is shared by all beneficiaries in the proportion to which they have been nominated. If you have existing policies that were funded before age 70 the €30,500 allowance is in addition to the €152,500 per beneficiary granted with pre-age 70 premiums.

It’s probably worth highlighting here that a notable difference between the pre-age 70 allowance and the post-age 70 allowance is that the €152,500 allowance includes both the premiums paid on the policy and the gains on these premiums, whereas the €30,500 allowance relates to the amount of capital invested and all gains across the whole policy are exempt from IHT.

It is perfectly possible to add sums to an existing policy after the age of 70 and the insurance company will calculate the benefit payable on death of the life assured in accordance with when premiums were invested. However, taking out a new policy after the age of 70 has the advantage of:

- Differentiating between sums paid before and after age 70 and therefore simplifying the tax calculation

- Provides an opportunity to nominate beneficiaries that are different from those nominated in other policies

- Designate different policies for different purposes

It is worth noting that there is no limit to the number of assurance vie policies that can be taken out but the IHT allowances apply across all policies of a particular life assured (i.e. the allowances are not per policy).

Let’s take the example of a couple who are living together but have no ‘legal’ relationship (i.e. not married or PACS’d):

– A 70-year-old makes a will in favour of his/her partner. Under standard French inheritance rules the surviving partner is entitled to an IHT allowance of just €1,564 on any assets received via the will, and above that will have to pay IHT at the rate of 60%.

– If the deceased had nominated his/her partner as the sole beneficiary of an assurance vie policy opened after the age of 70, the surviving partner would then benefit from an IHT allowance of up to €30,500 and an exemption from IHT on all the gains and interest on the policy.

Exceptions as to who shares the €30,500 tax-free allowance

Beneficiaries who are exempt from inheritance tax are not taken into account to divide the overall allowance of €30,500. Exempt beneficiaries include spouses and PACS’d partners.

Thus, if the spouse of the deceased is named as one of the beneficiaries of the policy, his/her share will not be taken into account when dividing up the €30,500 allowance, which will only be divided amongst any other named beneficiaries, meaning their exempt share will increase.

If, after applying the exempt allowances, there remains a taxable element of capital invested, this can be offset against the standard inheritance allowances determined by the degree of kinship.

The potential growth in value of an assurance vie policy makes investing after age 70 attractive

Let’s look at a couple of examples:

Example 1

A premium of €30,500 is invested at the age of 70, the insured person dies at the age of 87.

For 17 years, the policy grows at an average rate of 2% per year, net of fees. At the end of 17 years the gain in value is €12,339, thus a total of €42,839 is passed tax-free to the beneficiaries. At 3% per year, the amount of gain after 17 years represents €20,259 meaning a total of €50,759 passes free of IHT. If the €30,500 had been left on deposit with interest added at a similar rate the capital and interest would fall into the estate and be subject to the standard IHT rules.

Example 2

A premium of €100,000 is invested at age 70 and the life assured dies at the age of 90, i.e. 20 years later. The beneficiaries are the life assured’s two children in equal shares.

Taking an average growth rate of 4% per year, the €100,000 becomes €222,258 after 20 years. Each child receives €111,129. This is in addition to anything they may receive from a pre-age 70 policy. €30,500 of the capital and all gains are exempt, therefore the only taxable element for each child is €34,750 (€69,500 / 2). This can be offset against the standard IHT allowance of €100,000 per parent per child if this is not used up elsewhere.

Example 3

A nephew receives €55,000 from an assurance vie policy taken out by his uncle when he was over 70 years old.

The premiums paid amounted to €40,000, the gain was €15,000. €30,500 of the premiums paid and the gain of €15,000 are exempt.

Therefore, the potentially taxable element is €9,500 (€40,000 – €30,500). However, this can be offset against the inheritance allowance between uncle and nephew of €7,967. Assuming the allowance is fully available the taxable element is €1,033 (i.e. €9,000 – €7,967) at the rate of 55%. IHT of €568 is payable (i.e. €1,033 X 55%).

The outcome, €55,000 was transferred via an assurance vie opened after the age of 70 to a nephew who pays only €568 in IHT instead of €25,868 if the legacy had not been wrapped in assurance vie (i.e. €55,000 – €7,967 = €47,033 x 55%).

In summary, if your situation allows, it is definitely worthwhile considering investing in assurance vie after the age of 70 in order to take advantage of the additional €30,500 allowance and exemption on the total gains on investment which, in some cases, could be higher than the capital invested. Not forgetting, of course, that you retain control of the policy and can spend it or change the beneficiaries whenever you wish.

If you would welcome a chat about whether investing in assurance vie is right for you or would simply like a review of your financial situation you can contact me at sue.regan@spectrum-ifa.com or call me on +33 6 89 20 32 47

Foreign exchange market update

By Victoria Lewis

This article is published on: 7th August 2024

With the help of Moneycorp, lets take a look at this month’s market update with the recent political, economic & global news. Whats happened, how has the market reacted and what the future holds.

Big shock to markets in August already – What happened!?

- The month of August has started off with a big shock to global financial markets – the US Federal Reserve are likely to cut rates much quicker than previously thought, with something like 1.00 – 1.25% of cuts this year now on the cards to bring rates down to 4.25 – 4.50%.

- That is up significantly from the 0.50% cut priced in as recently at last Wednesday (31st July).

- This is the result of poor US jobs data – non-farm payrolls – and higher unemployment figures, leading to fears of a US recession building.

- Additionally, as I flagged last week, the Bank of Japan raised rates by 0.15% and the Bank of England cut rates by 0.25% last week, feeding into the overall market volatility globally.

What has been the market reaction?

- We have entered a “risk off” period due to the rapid change of interest rate expectations in the US, meaning everyone is taking their risky investments off the table.

- This means stock markets have fallen significantly since Thursday (1st August), with the S&P 500 down 6.8%, FTSE 100 down 3.1%, and the Japanese Nikkei 225 down almost 17% before recovering today.

- Usually in risk off periods, the US Dollar is the go-to investment as a safe-haven, however as this is driven by US interest rates the US dollar has also fallen between 1-2% against most other currencies and instead Euro, Swiss Franc and Japanese Yen have been bought, rapidly strengthening those currencies.

- GBPEUR is down 1.5% since Friday.

- EURUSD is up 1% since Friday but has been 2% up earlier.

- GBPCHF is down 2.6% since Friday.

- GBPJPY is down 3.3% since Friday.

What next?

- There are no major central bank meetings for the remainder of August, so the FX market will be reacting very quickly off the economic data releases, especially from the US.

- Next Wednesday 15th we will have both UK and US inflation data released. This will almost certainly be a volatile day for FX markets.

- UK GDP released on Thursday 15th – is the UK continuing its recovery?

- US GDP released on Thursday 29th – is the US really going into recession?

- EU CPI inflation on Friday 30th – will inflation still be under control dropping towards 2% in the EU?

Forecast Snapshot

Where do the banks think FX markets will be at the end of the year?

GBP/USD

- Current 1.27

- Barclays 1.31 (very bullish)

- UniCredit 1.26

- Wells Fargo 1.27

- BNP Paribas 1.27

GBP/EUR

- Current 1.16

- Barclays 1.23

- UniCredit 1.16

- Wells Fargo 1.19

- BNP Paribas 1.20

EUR/USD

- Current 1.09

- Barclays 1.06

- UniCredit 1.09

- Wells Fargo 1.07

- BNP Paribas 1.06

Source: Bloomberg Analytics

Please do get in touch if you have forthcoming FX requirements. Along with Moneycorp, I can explain how to reduce FX risk and/or make the most of the potential volatility coming up in August, depending on your risk appetite and timeline.