Well, as you might have expected I have decided to write to you at this particularly fragile moment in world politics, and which has now reverberated around world investment markets. As of Friday last week a sell off started in the equity markets which effectively created a bear market situation around the world for fears of global recession based on the Trump tariffs. (as of today we have seena slight rebound, but more volatility is likely)

When markets turn volatile

By Gareth Horsfall

This article is published on: 10th April 2025

Given this, you may be forgiven for wondering why I am leading this E-zine with a picture of one of my apple trees in full blossom on my land?

Last weekend I was away from home, spending time in the North of Italy with friends, to celebrate my wife’s 50th birthday. Seeing what had happened on Friday, starting with the sell off in equity markets, I returned home wondering how to deal with it. I could have thrown myself in front of the computer and sent you a lot of charts about how you need to ‘sit tight and ride it through the rises and falls’ or ‘it’s time in the markets that counts not timing the markets’ and ‘the real threat is inflation, not investment market volatility’, (you won’t get away from these points…….you can find these further down the page!), but instead I took an hour in the morning to get my thoughts together and went out on the land to do some tidying up after the olive pruning and to check out the health of the blooming trees.

This apple tree made me take stock of the situation and I will explain why.

When we bought the house last year, the land and house itself had been left abandoned for quite some years and it needed not just a clearing up, but also some TLC. This apple tree was a case in point. Last summer this tree produced 3 very ugly and unhealthy looking apples. The tree itself looked like it had given up the hope and it entered its winter phase looking like it was on its last legs.

I was in 2 minds to pull up the tree and plant something else. However, I thought I would give it another chance, so, I spent the winter pruning the tree and giving it some nutrients. I cut off the bad old rotten wood and reshaped the tree into a form which would allow it space to breath and allow the light to penetrate deep into the centre, so that flowers and fruit could develop.

I was careful not to over do it so as not to stress it too much!!

This, I am happy to say, is the result. What looks like a pretty healthy tree! It is now in full bloom, the bees are all over it and I expect that it may very well provide some decent fruit this year, albeit still quite a young tree.

Comparisons with markets

You will have guessed by now the point I am trying to make about the apple tree. Sometimes, when all hope seems to be lost there may just be hope around the corner with the right care and attention.

I will caveat the rest of this E-zine by stating that I am not wholly against the Trump’s tariffs. I am 100% against the way he is going about it: his morally dubious behaviour, his manner and potentially corrupt allies but we will leave that for another time! I can also kind of understand what he is trying to do, (bringing business back to the US from overseas), but the way he is going about it is nothing short of ludicrous.

In my opinion, what seems to be happening with the Trump’s administration is that there is a pull back from the last 20/30/40 years ( I am not quite sure of the length of time) of globalisation. We are moving more towards nations becoming more protectionist, rather then more global in nature. Is this a bad thing? It’s difficult for me to tell.

Certainly when we look at tariffs, the US has had a reasonably free and open market for most of this time and yet most other nations around the world have not played by the same rules. Free market capitalism works fine when everyone plays by the same rule book and reduces tariffs respectively, but when one plays by one set of rules and another by a separate set of rules, then imbalances are going to arise. I think this is what we are now seeing a push back against. Pres. Trump is saying that the imbalances have been one sided (true or not, I am not at liberty to say) to the detriment of the USA. To some degree I can see his point, although I understand that it is not as black and white as that.

European cars

This morning I saw that Pres. Trump was referencing the fact that European car manufacturers have always had a relatively easy time importing cars into the USA and that the US has lots of BMW’s and Mercedes and VW etc, but that you don’t see many American cars in Europe. On that point he is right. Now, that might be due to the fact that they are too big and we don’t want them, or that they consume so much fuel that they don’t make sense based on the price we pay at the pump, or it could be that there are restrictive trade measures to prevent US cars from entering into the EU market. I don’t know the details but maybe it’s a combination of them all.

Yesterday, I also went to our local Chinese store to get a few bits and pieces and was reflecting on the low prices of goods in these Chinese stores and on the new Chinese online store Temu. Again, I am not an economics expert or even know anything about tariffs between the EU and China, but, just by observation I ask myself why these Chinese goods are so cheap in Europe and yet we have a lack of Italian businesses manufacturing similar goods. Is it that the Chinese are willing to work harder and be paid less to produce the same goods? Have we really sold out EU manufacturing to lower cost countries? Is it tariffs are lower in the EU for Chinese goods than reciprocal tariffs in China, I have no idea but this particular moment in global politics does get me wondering.

If anyone knows please do feel free to let me know!

My point is, what if Trump is right? What if there are imbalances in world trade that need to be corrected and this is the way to do it? What if it can reindustrialise the USA?

(I very much doubt this by the way as I saw a list of companies who have announced significant investment and manufacturing in the USA since this trade war started and they are mainly AI firms and manufacturers of high level semiconductors etc. These firms are very unlikely to need rust belt workers to work in factories where they are more reliant on robotics and highly sophisticated machinery. That being said, bringing back the production of essential computer components for industry and defence also has some merit).

However, to give him the benefit of the doubt, what if there is some merit in taking short term pain to try and achieve long term gain?

If Pres. Trump can pull even a small % of manufacturing from China to the USA and create more national independence on its goods and services, and improve national security , may he have achieved his goal? It does feel like an end of empire last grasp at power, scenario, but maybe this will mean that the USA can retain it’s No 1 global economic powerhouse status for some time to come.

Markets speak in the US

So moving away from my random hypotheses, let’s dwell on markets and the horrible news that our portfolios have fallen in value once again but, before I do, if you have been an investor for years, I would ask you to reflect on just the last 5 years for a moment.

What did you think when a global pandemic hit? Businesses were shut, schools too, everyone was told to stay at home and not interact with each other without a mask on and to stay 6 metres away from others? The markets tanked as a result.

What was your reaction? Maybe we were too distracted by the pandemic to really pay much attention – and rightly so! but what about when Russian invaded Ukraine and it sent global markets into a panic and a global inflation spike, sending us from years of disinflation and near zero interest rates, to an overnight significant rise in prices which to date continues. Did you panic sell off your portfolio?

Probably the answer is no and you did the right thing because markets rebounded (albeit more slowly after the Russia Ukraine war) but they did and the same happened after 2008 Financial Crisis and 2010 Euro crisis: hanging on and riding through the panic was the best thing to do… and it is now!

You might argue ‘It’s different this time’ ; the whole world is changing and markets will never recover. If you think this then I would coach you to read the book, ‘It’s different this time -Eight Centuries of Financial Folly’ by Reinhart and Rogoff. Largely financial markets are governed by human behaviour and that has not changed since time began, or at least over the last 8 centuries according to the data they present.

Please also bear in mind that success for every US President is judged on the US stock market. Most, if not all Americans, have significant assets invested in the US stock market and so it is a sign of health of the US economy and more importantly a measure of the US Presidents success at home ( interestingly, Pres. Trump’s favourability ratings have increased from 48% at election time to 53% now. clearly, he is increasingly approved of in the USA).

After reading so much on this topic and trying to syphon through the almost hourly noise, my view is that he is front loading all the bad news now to get it out of the way. He knows that come the mid-terms in 2026 he needs to have made significant inroads into making good on his promises to the American people and for that reason he is getting the worst out of the way now, whilst he can, after which a flurry of good news will likely follow.

Trump’s strategy

So, moving away from the media hype and screaming economists for a moment, let’s take a look at what Pres. Trump is really trying to achieve.

Pres. Trump watches consumer confidence closer than anything and in order to keep it high he has to achieve 3 goals:

1. Get oil prices lower

Gas at the pump is the beating heart of the America middle class and the Trump administration will go to any lengths to reduce the price of oil at the pumps. (When I was in New York in February the gas at the pump, I calculated, cost €1 a litre!!!!!!! – compare that to the the €1.59 a litre, this morning, that I just paid for diesel. Petrol was €0.20 higher still). So, if this administration can reduce gas prices further that could stimulate a mini economic boom in the US.

Bear in mind that the US is already the worlds largest producer of oil at 40% higher than its nearest competitor ( Saudi Arabia). Pres. Trump has stated clearly that he wants to aim for 100% energy independence and I think they will not just aim for it but do it at any cost.

(It should be noted that I paid €1.59 a litre for diesel this morning. 1 week ago it was €1.67. – Is his strategy working?)

2. Mortgages are the second lever to pull

If he wants the American public to gain confidence in his policies then he needs to give them breathing room economically (i.e. more money in their pockets) and he can then continue to go about reshaping the US economy . (At time of writing, with pressure building on a possible recession, pressure is equally being heaved on Jerome Powell – head of the Federal Reserve, to reduce interest rates). Was the market correction manufactured to some degree, or at least expected, to pressure the Fed to reduce interest rates?

This administration has also openly stated that they will also look to deregulate the banking industry, to release them from overly administrative and bureaucratic procedures and to allow them to get back to banking. This will also assist in bringing interest rates down. (This point I can fully agree with :banking regulation, anti money laundering legislation, source of wealth and origin of wealth obligatory requirements have become, quite frankly , out of control and any simplification in this regard, in my opinion, is warranted).

3. Lastly – the Trump administration will focus on food price inflation

Remember to watch out for the first 100 days of the Pres. Trump term which is often linked to his early successes; the 100th day lands on April the 29th!

So, there you have it, a few thoughts of my own on the Trump administration and why it might not be as bad as it seems.

So, let me turn to the technical for a moment: some data about market volatility.

The data below courtesy of one of our investment management partners, New Horizon Investment Management.

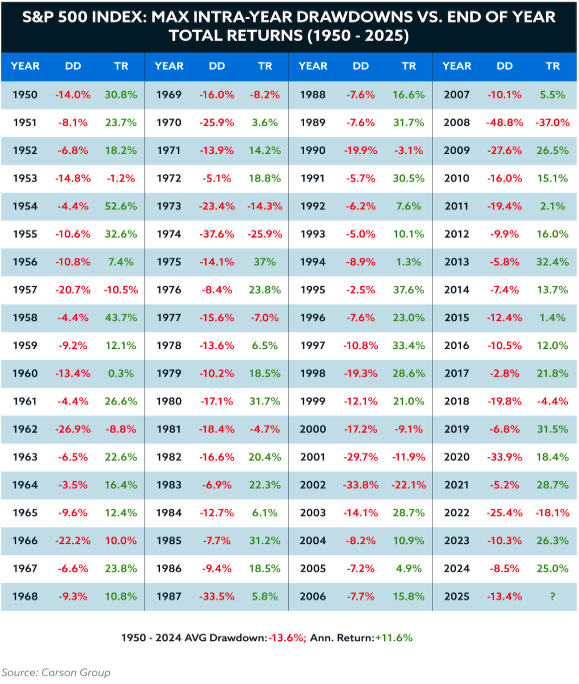

When markets turn volatile, perspective is everything

This market volatility feels tumultuous but, of course, we’ve been here before. The table below reveals that after severe drawdowns, the market has often recovered the full decline and finished the year strongly positive.

Years to Note:

- 1970: Market fell -26% from peak to trough… yet ended +3.6%

- 1975: Dropped -14.1%, but closed the year up +37%

- 1987 (Black Monday): Down -33.5% mid-year, still finished +5.8%

- 2009: Deep in the Global Financial Crisis, dropped -27.6%, yet ended +26.5%

- 2020: COVID crash brought a -33.9% drawdown… ended +18.4%

On each occasion, the best course of action would have been to avoid the noise and stay invested.

“History doesn’t repeat itself, but it often rhymes.” – Mark Twain

Whatever happens in the market we have bigger things to worry about!

Besides, when markets sell off, why on earth would you not buy into them at these prices? They are at bargain basement prices and as the saying goes ‘fill your boots!’ I had a measly amount of cash available to invest and have taken advantage of these prices.

Let me tell you a couple of my own investment tales:

My first tale which I have written about before was during the financial crisis of 2008 ( which by the way was a many times worse than what we are going through today) and my wife had just sold a house in the UK and we had some cash to invest. I knew I had to invest but I was very nervous because, working at the coal face of what was happening at that time, I knew that things were very serious. However, I also knew the theory of markets and that the best time to buy was in the height of the chaos. I went for it and the next 3 months were tragic and I lost 20% in value on the portfolio. (I never told me wife!) 6 months later the portfolio was up 45% ! It should be noted that I am an adventurous investor profile and so was invested 100% in equity ; it was a wild ride I can tell you but I knew the logic and I just had to be patient. Later we needed that money for something else and had to sell a sizeable portion of it, but it did its job.

My other tale is that at the start of my career as a financial planner I thought I was smarter than the market itself and that I could time my way in. I waited and waited and…. waited for the right entry point, waiting for a decent correction to buy in at the price I deemed to be right. I arrogantly waited 6 years before buying in! (What an idiot!) I can’t even bring myself to calculate the gains that I missed in those 6 years even with the correction that happened.

Lesson: It’s time in the markets, not timing the markets, that counts…

As I said to someone recently “I have made all the mistakes in the books, so you don’t have to!”

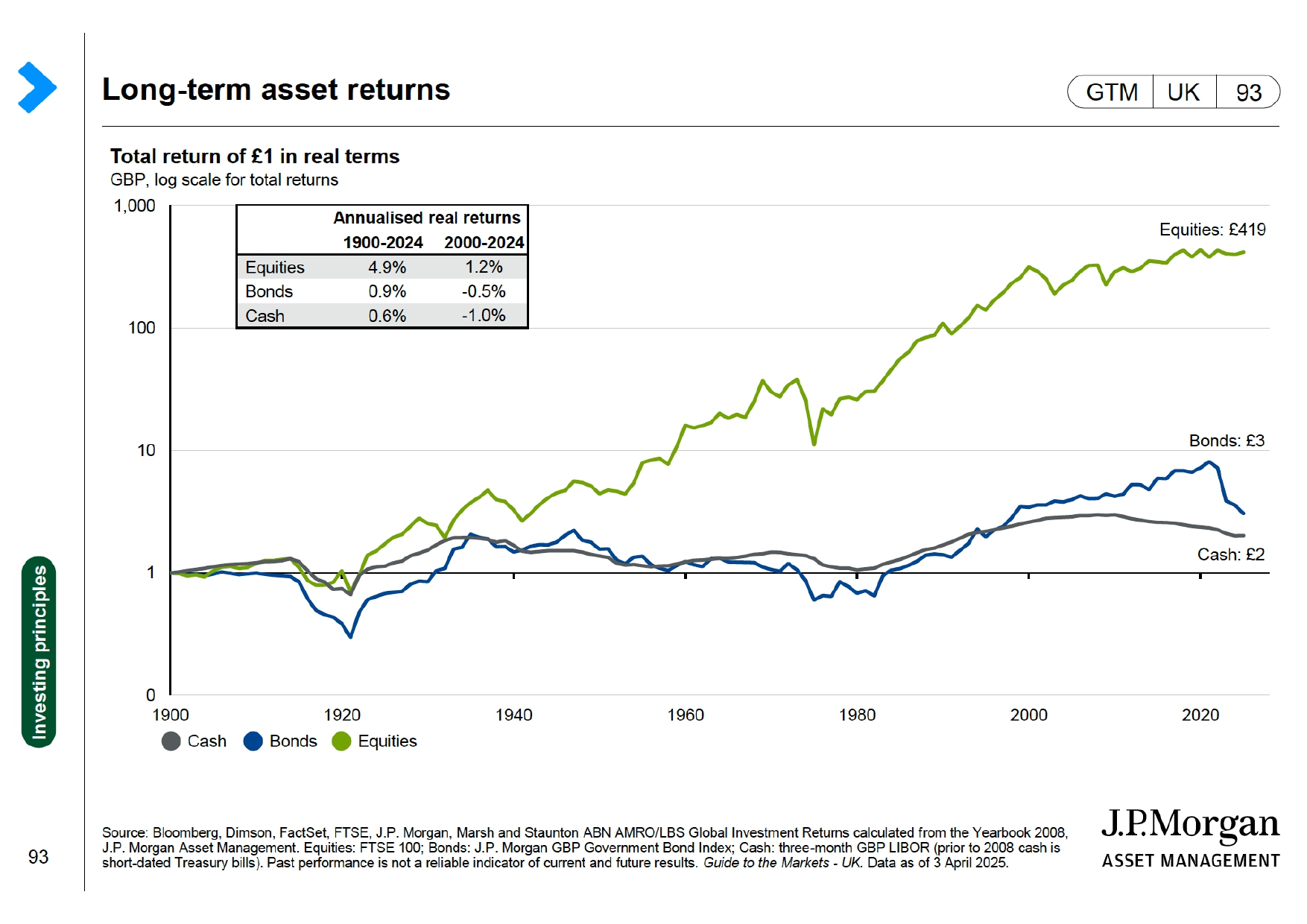

Inflation

Finally, let’s talk about inflation. Here I take the words of Charles D Ellis who wrote the book ‘Winning the Losers Game – Timeless strategies for successful investing’.

“For individual investors, inflation has usually been the major problem – not the attention getting daily or cyclical changes in security prices that most investors fret about. The corrosive power of inflation is truly daunting. At 5% inflation the purchasing power of your money is cut in half in less than 15 years and cut in half again in the next 15. At 7% your purchasing power drops to 25 % of its present level in just 21 years- the elapsed time between early retirement at age 61 and age 82, an increasingly normal life expectancy“.

Again, it might be useful to provide some perspective here because the all so surreptitious march of inflation is often upon us when we notice it, by which time it is far too late to do anything about it.

1. The price of my journey to Rome on the autostrada from Orte has increased from €4.50 in 2024 to €4.80 in 2025. That’s a 6.6% increase. I track this price and it has never, in my 20 years in Italy, increased at inflation levels or under. Always above!

2. The water machine in central Amelia, where I go to fill our drinking water bottles was 5 cents for a litre and half, they have just changed the machine and it’s now 5 cents a litre. That’s a 33.3% increase. (It’s hardly breaking the bank but a great example)

3. The news on RAI announced a few nights ago that the price of Colomba Easter cake is up 31% year on year and Easter eggs up 26%.

4. I took my son to KFC 2 weeks ago, reluctantly, and asked for the 4 large pieces of chicken. The last time I went to KFC was about 15 years ago and I remember these 4 huge pieces of chicken. Now, the 4 pieces resembled the size of 4 larger nuggets. Shrink inflation in practice so if you can’t increase your prices, reduce the amount of product. It has the same effect !

OK, I hear you say ‘These are not everyday items’ but they do reflect the general trend of the stealthy march of inflation.

Be under no illusion that this is your main financial enemy and investing is your only tool to protect yourself from it!

Investing requires patience and courage…or a financial adviser who you can ring and let off some steam. Make sure you can tap into any of these things if you get concerned about world events and market volatility!

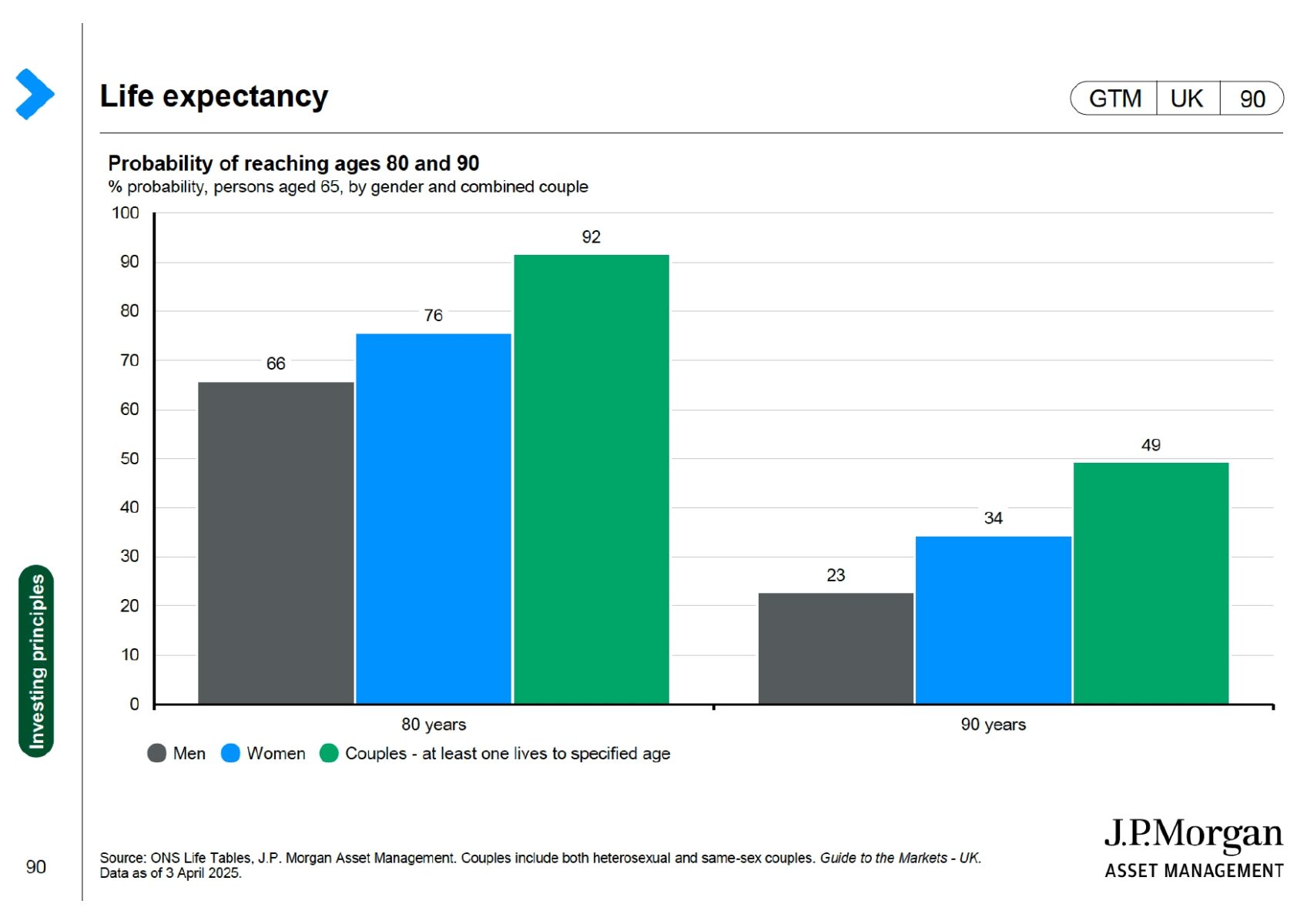

So, on this happy point let me leave you with this information about the life ahead of you.

Life Expectancy

More people needing to finance live beyond 90th birthday

- Ratio of women over age 90 to men was about 2:1 in 2023

- The number of people aged 90+ has doubled over the last 30 years

- The ratio of women over age 90 to men was 2:1 in 2023 compared to 4:1 in the 1980’s. About one in every 100 people is now aged at least 90.

- The odds of living to beyond 90 are high enough that people shouldn’t assume it can’t happen to them. Historically, this has been mainly women but the numbers of men are catching up fast.

- For those who are age 66 this year there is about a one in 3 chance (33%) for men and nearly an evens chance (46%) for women of making it to at least age 90 and if they do get to age 90 there is nearly an even chance they will survive to beyond 9%

The message: Think long term and not Donald Trump term!

If you would like to let off some steam with me or discuss any of what is going on in the world, tax or financial planning related issues in Italy then please don’t hesitate to contact me on: gareth.horsfall@spectrum-ifa.com or call / message on +39 3336492356

Always happy to help where I can!

New UK inheritance tax rules

By Gareth Horsfall

This article is published on: 10th March 2025

I didn’t intend on starting this E-zine with information about the house and country life talk, but this morning I awoke to the most beautiful sunny day, the first for a while, and whilst the man is at work doing the ‘potatura’ of the olives, I just couldn’t resist taking a photo of the beautiful daises which have popped up on the land. It’s like a fresh spring meadow!

The grass is starting to grow again and I was thinking about cutting it, at least outside the front of the property, but then I thought to myself why would I want to spoil such a beautiful thing? So, for now the grass can grow and the wild flowers can enjoy their moment in the sun. As mentioned, the man is now here doing the potatura of the olive trees and thinks it will take him about 20 days! He is on his own, but seems to have a passion for it. I daren’t go and stay too close to him otherwise, I keep him chatting and I don’t want him to have to take more then 20 days given the amount of work that is required for his sake more than mine.

Anyway, that’s a short update on the property and land. I have also just returned from a short trip to the Big Apple, NYC. My son was performing in a piano competition and got invited to play at Carnegie Hall and also the Italian Cultural Institute of NYC. What an experience for a 15 year old….and he won his age group competition! We are, quite frankly, in shock. Onwards and upwards I guess.

One thing I noticed in NYC was the cost of living. Now, I will caveat the following comments with the fact that we were staying near Times Square so I imagine there is a certain % you can add to the price of goods and services for being in such a touristic spot, but the price of basic goods in America now is very high. One day I went to the 7 Eleven and bought 2 bottles of water, a container with about 20 grapes in it, a banana, 2 cups of tea and a box of biscuits and left the shop $40 (€37) less in my pocket. Compare that to a shop at the local grocery shop in Amelia this morning and I got about 3 kgs of oranges, 2 kgs of apples, 2 fennels , 2 lettuces, 1/2kg of green olives, a pineapple, some tomatoes and about 2 kgs of lemons and it cost €21 ($22). A huge difference! We also met some American family members for a day in NYC and they confirmed that it is almost more expensive to buy fresh produce and cook at home than it is to eat at a diner.

I have made reference to this in a few videos which I have on my YouTube channel, (https://www.youtube.com/@Gareth-Spectrum) but to experience it first hand was quite something. Needless to say we gorged ourselves at the diners!

My last comments before I go onto the main subject of this E-zine are on President Trump.

It is certainly an interesting time and a few people have called/messaged to ask what I think.

Firstly, the debacle at the White House with President Zelensky was quite the scene!!

I watched the whole meeting after initially seeing a few short video clips and it was quite difficult to watch, if I am honest, but to be fair to President Trump he was hammering home the message about peace and stopping the deaths on both sides. I am not exactly sure what President Zelensky’s objective was but it certainly didn’t sit well with the Trump team. In the end I presume that America will get what it wants. It’s doubtful it won’t and if Pres. Zelensky has managed to garner support in the UK and France and the wider but it remains to be seen how they can spport Ukraine either financially or militarily without the US.

Whilst I don’t like Donald Trump in the slightest, if he manages to stop the wars, killing (on both sides) and find some sort of peace deal, then that has to be good for everyone, in my opinion.

There is also the tariff war which appears to be now in full swing; I saw that he announced the other day that the Taiwan Semiconductor Manufacturing Company had committed to investing $160 billion in a new production facility in the US. Also, Trump reiterated in his recent address to Congress that if companies want to avoid tariffs on goods into the US then all they need do is relocate production to the US itself. Therefore, it would seem like the message is clear and I expect more businesses to relocate production /invest in the US as a result. It will likely stimulate US small and mid sized companies and US consumers are more likely to turn to home produced products than those more expensive products brought in from abroad.

So, moving on from my travels, country experiences and President Trump , in this E-zine I am dedicating it to the new rules on inheritance tax which were introduced by the UK government in October 2024. (Please accept my apologies that it has not been sent until now, but there have been a number of clarifications which we have been waiting for, but which are yet to transpire. The UK government is seeming more like the Italian one every year with announcements which have not been fully thought through and which then get slowly modified and tweaked as the years go by, only for there to be numerous potential pitfalls which could lead to legal cases, until matters are clarified).

However, despite this we have a fair idea of what the new rules entail and of which I will detail below.

(thanks to Jessica Zama at Russell Cooke solicitors in the UK and Barry Davys, my colleague in Spain, who provided their summaries of the changes as well).

I come bearing gifts!

Writing the words ‘ bearing gifts from the tax man’ is not something which I am very used to. In fact, 99.9% of the time it is quite the opposite. However, in this case it might just be that, as Brits’ living abroad or anyone with UK citizenship living outside the UK for more than 10 consecutive years, you may be able to reduce inheritance tax liabilities significantly with some careful planning.

It could be as easy as following a few basic steps.

BACKGROUND

The UK has an Inheritance Tax system where the estate of the deceased is assessed based on worldwide assets if they were considered ‘domiciled’ in the UK at the time of death. The term domicile and its meaning has been the important factor to consider up to now, and in the UK it has a different meaning to “resident” or “residency”.

Domicile in the UK is different from the Italian “domicilio”, which is akin residence. The test of where one is tax-domiciled is to establish the jurisdiction in which an individual is most connected to, and would be very much influenced by where that person intended to live the rest of their life. If, upon a death, a person was considered “deemed domiciled” in England by the HMRC, inheritance taxes in England (“IHT”) would be applicable on that individual’s worldwide assets. This would be regardless of where the deceased was physically resident at the date of their death.

This meant that even if you left the UK 30 years ago to live in Italy, if HMRC for any reason considered that you were most closely connected to the UK and therefore “deemed domiciled” in that country, your estate would not only be taxed on your worldwide assets in Italy, or in whichever country you are resident at the time of death, but also in the UK, where inheritance taxes are far higher.

This concept has caused much confusion over the years and not least caused issues for professionals who could not give their clients a straight answer when providing estate planning advice, as to whether they would be considered deemed domiciled upon death. HMRC could not provide any guarantees as to what the final decision would be upon death.

Residency basis

Fortunately, the 2024 Budget has changed these rules, which will provide more clarity as to whether a person’s beneficiaries are going to have to pay IHT on the deceased’s worldwide assets.

The concept of “deemed domiciled” will disappear, and a new residence-based system will take its place. An individual will be considered a “long term resident” if they have lived in England for 10 out of the past 20 years; these years do not have to have been consecutive, and one will simply have to add up all the years that the individual has lived in the UK in the past 20 years, to see whether they are considered long-term resident. If they have, then their estates will be subject to IHT.

Generally speaking, that individual will continue to be considered long-term resident in the UK for ten years after they have left the UK, as there is a “tail”, this is a tapering, and this ‘tail’ is shortened if you lived in the UK for less than 20 years. The length of his tail will depend on the years actually lived there.

But , if you have lived outside the UK for more than 10 CONSECUTIVE years, your non UK-assets will not be liable to UK IHT. The rule is as follows :

- From 6 April 2025, the test to determine whether non-UK assets are within the scope of IHT will be whether an individual has been resident in the UK for at least 10 out of the last 20 tax years immediately preceding the tax year in which the chargeable event (including death) occur

How beneficial is the change to ‘Residency Basis’ of assessment?

The benefit will depend on our personal circumstances, where your assets are based, where, potentially, they are being managed from, and the value of your assets.

The case study below illustrates:

Mr & Mrs Bloggs

- More than 10 consecutive years out of the UK in the last 20 years

Assets outside the UK include Italian compliant bonds, bank accounts, QROPS pension and a property, all jointly owned, as follows:

| Italian bank accounts | €33,000 |

| Italian compliant bonds | €580,000 |

| House (mortgage free) | €525,000 |

| QROPS pension | €345,000 |

| TOTAL | €1,483,000 |

- UK based assets £325,000 jointly owned (ISA’s, investment accounts)

Under the new rules, Mr and Mrs Bloggs can return to the UK and if death occurs within 10 years of the return the following will apply.

- UK assets assessed for UK IHT fall within the UK nil rate band. Tax due £0

- Assets outside the UK NOT ASSESSED under the residency basis €1,483,000

The savings from NOT having these assets taxed in the UK would be a whopping £593, 200. (£1,483,000 * 40%)

And here is the icing on the cake

Complete more than 10 consecutive years outside the UK, then return to the UK and be unfortunate enough to pass away in the next 10 years and your estate will get the following additional benefits (on top of being IHT exempt on non-UK assets):

- If you and your spouse were both long term non-resident, you will receive the spousal allowance – 100% IHT free transfer of your assets to your spouse, if directed by your Will

- Each spouse receives an IHT allowance of £325,000 with only UK assets above this amount being taxed

- If you have a main residence and your total individual wealth is less than £ 2 Million you will get the main residence relief of £175,000

If you pass away outside of the UK and your beneficiaries are in the UK, they will pay no UK IHT if you have met the long term non-resident criteria. This is because your non-UK assets will not be taxed in the UK. As the UK government taxes your estate, not the beneficiary receiving the bequest, no IHT will be payable.

And because you live in Italy, your UK based beneficiaries will be assessed on their residency and as they are outside Italy they will not have to pay Italian IHT on non-Italian assets.

How to save UK IHT when living in Italy – top six tips

1. Take professional advice

2. Don’t move back to the UK until you have more than ten consecutive years out of the UK.

3. Keep your investments outside the UK outside if you qualify under the new residency test.

4. If you are planning on making Italy your home for more than 10 consecutive years then plan to move your assets away from the UK financial system and plan like a European, for example ISA’s, which are not tax free in Italy anyway. There is now merit in disposing of them in favour of non- UK situated assets.

5. Pensions in the UK are liable to IHT from April 2027 and it is therefore doubly important to keep non-UK pensions beyond the scope of IHT.

Unfortunately, the possibility of moving pension assets away from the UK has now finished as the UK government also imposed, in the same budget, a 25% tax surcharge on pensions transfers outside the UK. However, not having the pension managed by a UK financial adviser (who shouldn’t anyway due to regulatory issues), and also the assets managed by an EU based manager and/or invested in non UK domiciled assets, should prove that links to the UK have been separated as much as possible.

6. When drawing income or capital from your investments and pensions, take advice on the manner and order in which you do this, as it makes a difference to your IHT exposure and also how long your savings will last.

*** An additional note about invested assets is probably worth a mention here. One of the criteria for determining UK deemed residency for IHT purposes under the new rules is something called UK-situs assets. i.e those assets which you hold in the UK. The obvious asset to mention here is property. Owning UK property could mean you fall within the scope of the new residency rules as UK resident for IHT purposes. However, less obvious things could also fall under this rule, i.e having assets managed in the UK by a UK based financial adviser and/or asset manager or even having an active bank account in the UK.

Whilst we are waiting for further clarification on these points it is thought that these could fall into the realm of ‘grey area’ awaiting a legal judgement. Hence, for this reason we would recommend that wherever possible you start to move your banking and/or invested monies across to EU licensed and authorised financial professionals to be managed, if you are intending on a long-term or permanent move away from the UK.

New Tax Residency Rules in Italy

By Andrew Lawford

This article is published on: 5th March 2025

Changes and Complications

As many of you may be aware if you read these updates, 2024 brought in changes to the concept of tax residency in Italy. We’ll be looking at the changes from the point of view of an individual but do be aware that they apply also to corporates and other entities.

Towards the end of 2024 (yes, more than 10 months after the new rules came into effect!) the Italian Tax Office, the Agenzia delle Entrate, published a 30-page circular to clarify the evolution of various concepts, which in its turn prompted the publication of various articles and guides on the subject. Let’s dive in and try to make sense of the situation.

First, though, I must preface today’s article with the following disclaimer: this is a complicated area and I am not an expert on the subject, so please make sure that you get proper advice before making decisions that will potentially affect your status as tax resident. Taking advice is really the only way for anyone who finds themselves in a grey area to gain some comfort, because unfortunately the Agenzia will not provide an advance ruling on matters of tax residency: they’ll tell you what they think if and when they decide to check!

I think it is probably useful to have a quick look at how the letter of the law itself has been modified (please note that these are not official translations):

Original Text

For income tax purposes, residents are those persons who, for the majority of the tax period, are enrolled in the registers of the resident population or have their domicile or residence in the territory of the State pursuant to the Civil Code.

New Text

For income tax purposes, residents are those persons who, for the majority of the tax period, including fractions of a day, have their residence pursuant to the Civil Code or domicile in the territory of the State or are present there. For the purposes of applying this provision, domicile means the place where the person’s personal and family relationships primarily develop. Unless proven otherwise, persons enrolled for the majority of the tax period in the registers of the resident population are also presumed to be residents.

The new text may seem somewhat similar to the old text but it is, in fact, an example of my general rule about life in Italy: things will only change to the extent that they can be made more complicated!

Let’s start by looking at the distinction that has been made between the concept of domicile as per the Civil Code and domicile for the purposes of establishing tax residency. The Italian Civil Code defines “domicile” as the place where an individual has established the centre of their business and interests. This may or may not coincide with their place of residency, which is defined as the usual place of abode. So we have a first distinction: domicile, for tax residency, now means where your personal and family relationships primarily develop and not, as before, where your business and interests were based.

Taking a step back, we can say that up until 2024, you would be considered Italian tax resident if any one of the following was true for at least 183 days in any given tax year (which in Italy coincides with the calendar year):

• You were enrolled as a resident in your local comune;

• You had your domicile (civil code definition – i.e. your centre of business and interests) in Italy;

• You were resident (i.e. you had you usual place of abode) in Italy.

From 2024 on, the criteria are as follows, referring always to the minimum period of 183 days in any given tax year:

• You were resident (i.e. you had your usual place of abode) in Italy;

• You had your domicile (new tax code definition – i.e. where your personal and family relationships primarily develop) in Italy;

• You were present in Italy, counting fractions of days as well as whole days;

• You were enrolled as a resident in your local comune – this final criteria now being a rebuttable presumption unlike before.

A few words on what is generally considered to be your usual place of abode: this doesn’t necessarily mean the place where you spend most of your time, although obviously it is reasonable to expect that you would have to spend an appreciable amount of time there.

Subjective factors are particularly important and these relate to your lifestyle and the presence of family and other important social ties.

Another important change is the focus now put on your physical presence in Italy. Before 2024, you could own a property in Italy and spend more than 183 days a year there, yet potentially maintain that your usual place of abode was outside of Italy (think of the situation where you maintain a substantial property in another country where most of your social and financial connections are). This possibility has now been precluded, making counting the days an important task in order to avoid being considered Italian tax resident.

The rebuttable presumption of being enrolled as a resident will depend, according to the circular, on being able to prove that none of the other three criteria were applicable. As always, maintaining clear documentation to support any interpretation you are applying to your particular situation remains of prime importance.

There may of course be situations where an individual appears to be tax resident of two countries and in these cases it will be important to look at any double-tax agreements. These will contain “tie-breaker” rules which often come down to the concept of the individual’s primary place of abode. Again, these are complicated areas and careful planning is required in order to give you confidence in your position. Please don’t hesitate to get in touch if you would like to discuss your situation; I can provide contacts with professionals who can help you to make sense of all the above.

Tax & financial planning in Italy 2025

By Gareth Horsfall

This article is published on: 6th February 2025

Hello again and welcome to this E-zine. (Picture from the olive grove last Sunday morning as the sun was rising)

(Just a quick note to those people who are awaiting my promised E-.zine on the new UK IHT rules which came into force in Oct 2024. I have now completed a draft and will be sending it out soon!)

Since my last newsletter, back in December, I have received many emails of congratulations on the new house and equally many tips of how to manage the land we have. Thank you to you all. Please keep the tips and tricks coming: for example, leaving wild areas for the health of the fruit trees and encouraging diverse wildlife – seems logical but then to one who has never had to deal with these things, it is all new. I am learning new things all the time and interested in the land and seeing it develop. My wife is taking on the task of the house and making sure it is furnished as we would eventually like it to be.

Thankfully, the land doesn’t need a lot of money spending on it, it’s more brute labour force which I am maximising to my benefit by staying fit in the early mornings before I throw myself at the computer.

I have also enlisted the help of a local gardener who , in the last week or so, has helped free 3 very old olive trees from years of being covered by ivy and by other much larger pine trees. They are now free to breath again and will get their well earned ‘potatura’ in a few weeks. (See photo below – there is one in the background, if you can see it!).

I have been busy piling the wood cuttings from the various trees to provide me with a varied menu of BBQ wood this summer! Finally, (the last thing about the house in this Ezine, I promise!) the trattorino tagliaerba arrived recently. Thank god for that because the grass is starting to grow again with the warmer weather and I was starting to worry about managing all the grassy areas with just the push mower. It certainly kept me fit, but in the end it was a bit too much. Now, I just have to decide which bits to mow and which to leave to nature….decisions, decisions!

Anyway, enough of my land management problems.

In this E-zine I wanted to tell you about The Spectrum IFA Group Annual Conference which I attended between the 20th and 24th Jan, this year in Casablanca, Morocco.

We had some of the usual asset managers and specialist firms there from Rathbones Asset Managers, Evelyn Partners, New Horizon, LGT Wealth management amongst others. Interestingly the first day of the conference was Donald Trump’s inauguration day and so we were observing live some of his first actions. He was very much a topic of conversation during the conference; so much so, that since his first day in office things have moved so quickly that I was thinking of not writing this E.zine because almost as soon as I wrote something then it either came to pass, or was wiped aside with another executive order. However, in the last few days a number of people have contacted me about what he is doing and if it is going to cause inflation, an economic downturn in the US and across the world and how it will affect your investments. So, with this in mind I decided to provide some of the information that I gleaned from the investment managers’ minds. Those people who are right at the coal face of what is likely to be a profitable period for America, but one with increased investment market volatility.

PRESIDENT TRUMP….again

I will provide an abbreviated version of what his Presidency is likely to entail because by the time I have written this and then edited it, it is highly likely that things will have changed again. So here are some bullet points we learned from the conference:

Whatever your view is on President Trump the consensus is that he is going to be good for the American economy. He is also about trying to bringing business back to the USA, putting the USA first and stimulating business in the US itself.

He can only run for this final term as US President therefore he has 2 years before the mid terms when the situation could all change again. So, the thinking is that he is in it to make a BIG splash and create large improvements for the US economy in a short time frame. What has he to lose?

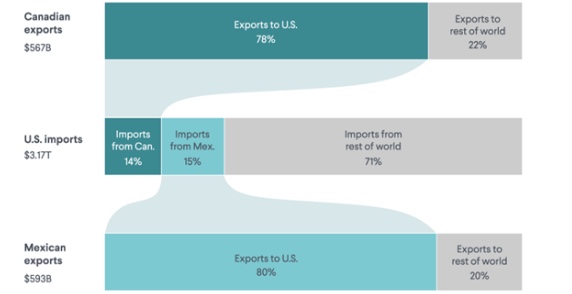

We have already seen that he is going to use tariffs as his weapon of choice, at time of writing Canada and Mexico already seem to have caved in to his demands. The tariff threat is being used merely as at a threat with the idea to create change. And it’s no surprise, re Canada and Mexico, given the figures that we can see below.

** Don’t listen to what he says, watch what he does **

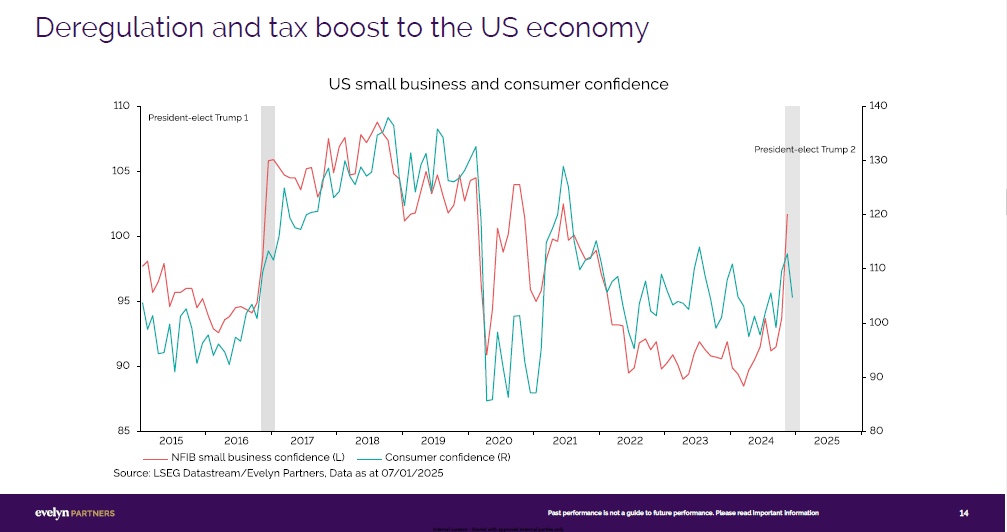

DEREGULATION: Expects big things in this regard: less red tape, cutting the tax code, stimulating business and if you think this is a bad thing, then have a look at the slide below courtesy of Evelyn Partners:

Small business and consumer confidence rose significantly as a result of deregulation during Trump’s first term in office and confidence is rising once again.

DRILL: Some of the best performing stocks in 2024 were mining and explorations stocks: Chevron, Shell and Schlumberger, to name only 3. President Trump has made executive orders to drill for shale gas and open oil fields in the USA as well as mining for rare earths. He wants the US to be energy and resource independent again and become a net exporter. This has obviously come at the price of withdrawing from the Paris Climate Agreement and he has turned back investment in ethical/sustainable projects which poses the question whether this could mean difficult times for wind and solar?

IMMIGRATION: Regardless of the headline news re: illegals being sent back home, the main point is that he is going to make it harder to get into the USA, but it might be important to remember the following:

- 72% of workers in US agriculture are immigrants

- 40% of which are illegal

- and, of which many are employed in Republican Trump states

- so would he want to alienate too many of his core voting states?

Unlikely.

DOGE: (The Department of Government Efficiency headed up by Elon Musk): One of the first orders from the new department was that all government workers must get back to work in the office 5 days a week. Is this good for productivity?? Elon Musk cut 80% of Twitter staff when he bought it, is he about to do the same at Government agencies? Certainly some of the news coming out of this area already is quite interesting from USAID being involved in funding groups to overthrow foreign governments, to blank cheques being written in government agencies without checking what they are being allocated for. The goal is to cut $2 trillion from the government budget, even Elon Musk said that this was a long shot, but watch this space!

(On a more realistic note, there are real life effects of these cuts. One of our relatives in the US is a dog trainer and Professor in animal training and was applying for a job in a California University, all hirings have now been put on hold in academia and she may be back to living in a camper van again as she goes from job to job!)

JYNA: Did you know that this is how President Trump refers to China? (I had no idea)

Apart from the recent 10% tariff imposed on Chinese goods into the US, there is really only one thing to be concerned about re China and the US: Taiwan.

China holds the greatest stock of rare earths which are required in all the latest technology and chips, so China holds an ace card in its hand.

* In fact 90% of high end chips produced by Nvidia require these rare earths.

* 80% of Japanese trade goes through the Taiwanese Strait.

* Access to technology is the US’s main priority. So if China were to invade Taiwan ( considered unlikely – what could they benefit from it?), then what would be the US’s response?

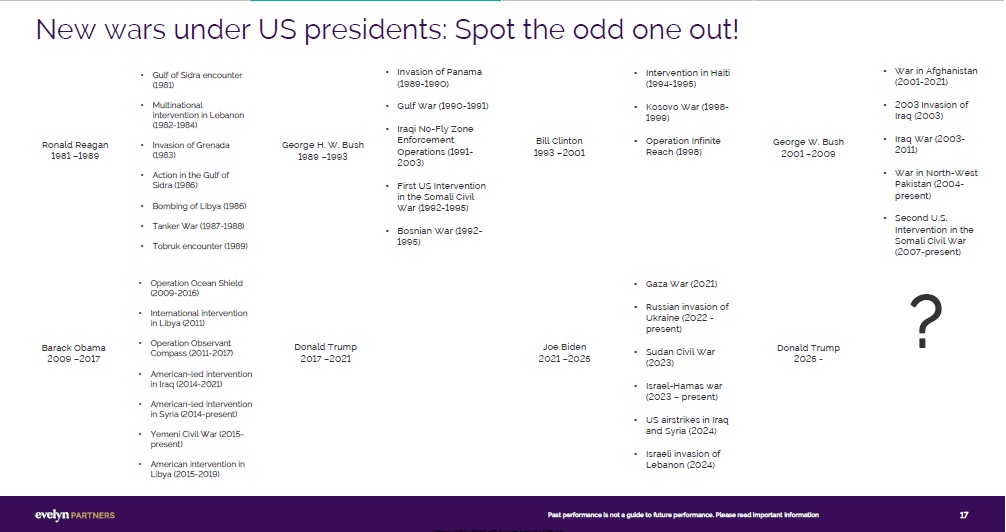

Whilst the US / CHINA spat is the pretext political risk to the world, President Trump is about making deals, not starting wars and compared to other Presidents he has a good track record:

Whilst the US / CHINA spat is the pretext political risk to the world, President Trump is about making deals, not starting wars and compared to other Presidents he has a good track record:

(This slide might be difficult to read, but it’s worth expanding the text to see which US Presidents started the most new wars. A big surprise to me was that Ronald Regan and… Barack Obama! share the record (7 each) – Donald Trump – zero!)

So considering all this, what was the message from the investment managers at the conference?

Trump will be good for America, he will stimulate growth in small to mid sized companies in the US. He will bring jobs and businesses back to the US and he will likely be good for your investments where you have exposure to the US stock market. We may also see a bull market in commodities as well.

But it will come at a price and one which we, as investors, must be mindful of.

INCREASED VOLATILITY: More swings in assets prices based on what I stated above:

** Don’t listen to what he says, watch what he does **

Markets will respond to what he says, but as investors we need to keep our eyes on the actions he takes and cut out the noise. It will certainly be an interesting time but could turn out to be a profitable one for those who ride his Presidency out, and, yes, markets will likely fall at some point and we will all feel some pain for a short period, but remember that investing is mid to long term and most of us have been through something similar, if not a lot worse , before…

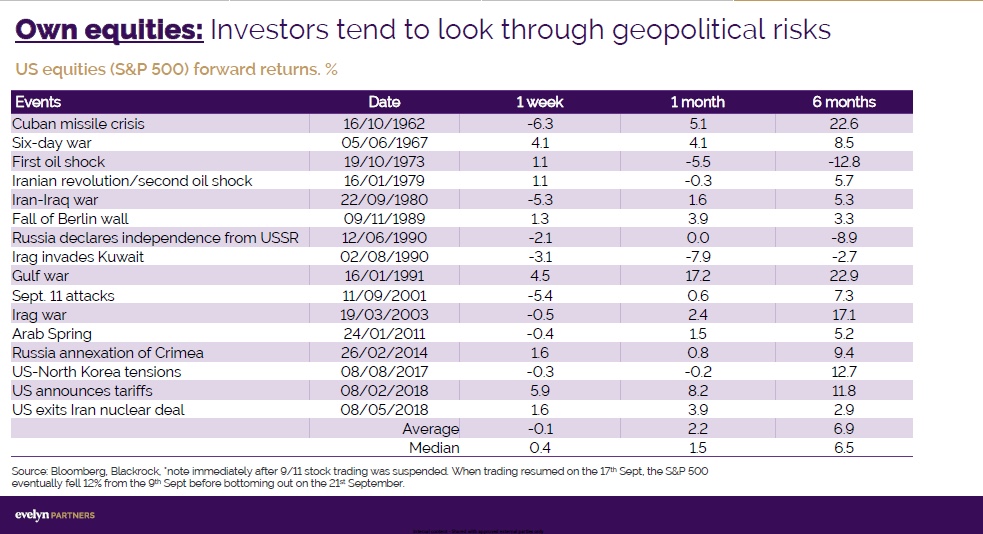

And if you need confirmation of this then check out the following slide:

Equities/stocks are the drivers of growth in most portfolios, what you can see here is that by riding out any invasions/wars, investors in US stocks, in most cases, after just 6 months were experiencing positive returns once again. A good sign for holding your nerve through equity market volatility.

The next E-zine will be the update on the new UK IHT rules which came into force in Oct 2024, which could have an impact on any UK person living in Italy.

If you would like to discuss these or any other tax or financial planning related issues in Italy then please don’t hesitate to contact me on gareth.horsfall@spectrum-ifa.com or call / message on +39 3336492356

Always happy to help where I can!

Finance in Italy 2025

By Gareth Horsfall

This article is published on: 5th January 2025

Buon Anno 2025

Happy New Year to everyone! I hope that you are reading this feeling relaxed and rested. Who knows what 2025 will throw at us from a political and financial point of view, but the most important thing is our health (physical and mental) and making sure we all keep communicating with one another.

So, in this January 2025 Ezine I just wanted to just follow up on my year with you. After sending out my last few Ezines, and writing about our new house and move away from Rome in 2024, many of you have written back to congratulate us and offered many words of support and also wisdom because I know that many of you have also been through, or are continuing to go through a similar experience. I have to say that I wake every morning now feeling fresher and more mentally alert than before. I even started my year this morning (2nd Jan) with some early morning outdoor exercise (no need for the closed gym anymore) to get back into the normal health and fitness regime that I follow (after all the panettone and other goodies during this period).

I wanted to thank you all for your words and thoughts of support in 2024 and thought this E-zine might be a good opportunity to send you some fotos and afterwards to provide some of my own thoughts about the year ahead from a financial and economic point of view (my own thoughts, I must add!)

Below are some pictures from my house adventures in 2024.

The house as it is now – day and night.

The living room, then and now:

My wife has got quite handy at sunrise and sunset shots as well:

Then I am sure you will all be happy to see me doing some hard manual labour for a change:

*From left to right:

My first decespugliatore experience (in 38 degs!), picking pears, excavating a random pipe which led to nowhere, re-laying the same pipe which now goes somewhere!

And my famous ‘trinchea’ for laying the new pipes, which is now filled in and working like a dream!

And finally, our famous kitchen which was finally installed 100% on the ‘Virgilia di Natale’ and we were able to make Xmas dinner in it. (Thankfully, as I didn’t fancy trying it on the camp stove in the outhouse).

My job over the next few months, apart from ongoing work, will be to get all the necessary papers together to present to my commercialista and take advantage of the Bonus Edilizia for 2024. In the end we probably maxxed them all out, playing with the main one of 50% on most works, bonus eletrodomestici and then the other detractions such as the cost of the estate agent. The paperwork will be a mission in itself but I have been quite good at documenting and filing everything as we went along so its just a case of putting it altogether for the commercialista. (I can’t advocate enough for keeping good and regular records if you embark on this kind of journey as the paperwork requirements to take advantage of the bonuses are quite something).

THE YEAR AHEAD

And so, as my thoughts now move away from building to ongoing maintanence, I thought I would share some of my thoughts for what I see from 2025 and to touch on some of the things which are probably in everyone’s mind. (I should add that, as usual, I will be attending the Spectrum IFA Group annual conference again around the 22nd January and will be reporting back on the opinions of the people at the investment coal face, as they see it).

As far as I see things, I think we are in for a volatile ride. This is not to say that I see things turning out negatively for use in 2025, far from it. It could actually turn out to be positive for investment returns, but it will likely come with some periods of volatility during the year, certainly more so than 2024, I suspect this will be driven primarily by President elect Donald Trump. He has been voted for a second term and knows he cannot be voted for a third so he really has nothing to lose. His rhetoric already has been quite interesting, from wanting Canada to become the 51st State of the USA to purchasing Greenland.

It is easy to write him off as a lunatic, and certainly I suspect the Canada comment was really a way to wind up Justin Trudeau, but Greenland would be a much more strategic and important asset for the USA, because of the Arctic shipping corridor which Russia is already utilising to it’s advantage. Rising arctic temparatures now mean that it is open for the whole of the year. (Goods shipped from East Asia to the UK could save up to 10-12 days in shipping time over the traditional Suez Canal route and save over 40% in costs!). Donald Trump is probably very aware of this and would prefer that Russia does not get power and control of this route.

Apart from that he is going to come out of the gate on the 20th January with the tariff gun, is my thinking. I imagine he is going to hit everyone and everything with tariffs, where it is not in the interests of the USA. (The EU needs to prepare itself) I would think that his biggest target will be China to try and balance trade between the 2, but even more so to encourage businesses to return to the USA rather than offshoring production in China. He has also fired off a comment about imposing 100% tariffs on any country that joins a currency union in the newly formed BRICS economic community, so as to preserve the dominance of the US dollar.

However, the BRICS economic community are not going to be phased by this because they are unlikely to be ready to launch any common currency for quite some time and can always wait 4 years until Donald Trump is no longer in power. (Countries and economic unions have a much longer time outlook than a US Presidential term).

One thing which I hope he will achieve is his desire to put an end to the Ukraine Russia war. I am not sure what form this will take, but will likely mean Ukraine ceding already lost territory to Russia in exchange for calling a ceasefire to the war. Whilst I may not agree with the outcome, it will stop a war which seems more like a killing ground than anything else and has only demonstrated that Russia is significanlty more advanced militarily than we may have thought. The recent dropping of their ballistic Oreshnik bomb, as a warning to NATO, was a bit of an eye opener given that reports seem to confirm that it travels so fast that Western/NATO allies have no system to effectively intercept such a weapon. On that basis it’s better that Russia never has a reason to use it, in my opinion.

I suspect the situation in the Middle East, Israel and Gaza and Syria will not get any better in 2025. I can’t see any reason why anything will change there, sadly. More of the horrific images coming from Gaza and human rights abuses on both sides. I was taken a bit by suprise by the falling of the Assad regime in Syria, not more so than by an ex-Al Qaeda second in command, who is now a western ally. Somehow I don’t see that ending well.

And lastly, I will touch on the EU because it warrants some mention given Donald Trumps re-election.

It has become evident that EU nations have been riding on the coat tails of the USA for defence, through NATO since World War 2. I remember when Donald Trump was President first time around that he started demanding that NATO allies contribute their fair share of the defense budget to NATO and ‘requested’ that they increase their expenditure to 3% of GDP. I don’t remember the facts but I don’t think many EU countries did, apart from Estonia if memory serves me correctly.

This time I have seen reports of Donald Trump requesting 5% of GDP or he may withdraw the USA from NATO. This would seem to be a significant worry for the EU, and rightly so because ultimately any defense/borders/war with Russia are going to have to be funded/managed by the EU and no longer by the USA. Additionally, USA Tariffs on goods and increased defense expenditure are going to have a significant impact on EU member states. Already with the increased gas prices that we are paying (DT will also de-regulate energy exploration and production in the USA so they can start drilling and mining and become more resource independent again) many businesses are moving to the US or to places like Dubai to benefit from lower costs and /or lower taxation. This is a long-term serious problem for the EU and the bureaucrats in Brussels are going to have to step up to the plate. In the very short term I see this as having a serious economic impact but could lead to an economic boom time in the EU, especially in defense, as it relies less on the USA for support in the medium term.

There is so much more to say here and I could make some more predictions. The fun thing is that none of this will not define your investment returns in 2025. Would you have predicted that in 2024, whilst Russia was at war with Ukraine, Israel/Gaza were was committing their deeds, the fall of Syria and the re-election of Donald Trump, would produce of return on the US stock market of over 20%? The analysts predict a return of around 14% on the US stock market in 2025.

I will finish this E-zine just by saying that I am a great believer in the Black Swan event. For anyone who is not familiar with this theory it was coined by Nassim Nicholas Taleb in his book The Black Swan. The theory goes that until Western colonial powers discovered and colonised Australia it was believed that all swans were white. N0-one had ever seen a black swan. Therefore to see such a creature was a moment of shaking belief and requiring a re-thinking of ideas and plans.

He overlaid this onto the investment markets explaining that there are events of which we are ignorant, even to go as far as saying we have no knowledge whatsoever, until such time as they become evident, normally because of problems occuring in their respect markets: think mortgage backed securities (2008/9), Long Term Capital Management (Russian debt crisis 1998) The point is that we can never measure, prepare or be cognisant of these things before they happen, but they inevitably have significant consequences and create more stress for investors. The good thing is that they come along rarely and they pass, and we move on.

As always we need to remain diversified, manage costs where we can and have the right people managing our money to get us through such events.

In this E-zine I have shared some thoughts about what will happen politically and economically in 2025, but I remain postive for the year ahead from an investment focus. Good luck to all of us for the year ahead.

From the new house in Amelia….. Auguri alla Befana !!!!

Finance in Italy – November 2024

By Gareth Horsfall

This article is published on: 1st December 2024

Before I get into things I thought I would share a picture of my olive oil container (fusto), all 50 ltrs of it! The raccolta, which I did at the start of October with the help of some locals, produced approx 150 ltrs of oil, of which we split 3 ways.

It seemed only fair given I had no equipment and had no idea what I was doing and this will easily cover our annual consumption and maybe some gifts to friends and family. What a great experience though!

Next year I will get more organised and see what I can arrange. The olive oil may be virgin but my virgin olive oil raccolta days are now finally over! I am now starting to really earn that Italian citizenship!

On the property front we are finally getting to the end of the things to be done….at least for now.

After a disastrous first kitchen fitting we had to order another one and will receive that in the coming weeks. We have been cooking and eating in an out house for the last 4 months, but as the colder weather is now settling in it’s becoming more difficult to say the least!!

All the other little bits, which take time and effort, are getting completed meanwhile I am still loving the surroundings, olive trees and watching autumn turn to winter and the changing landscape. I am also finding that on our ‘terreno’ we have a whole load of wild plant foods growing: cicoria, wild finocchio, asparagus, and numerous other edible plants.

I would never have known if it wasn’t for the ex-owner who came around and pointed them all out and advised to do some foraging rather than keeping the grass short everywhere. I will see how that pans out, but it could be interesting and I am keen to try and use the land rather than just curate it (mainly because cutting grass every 2 weeks is hard work) and so I have lots more to learn. A fresh organic larder on the ‘terreno’ might just be the thing; in the areas that I have let grow wild to date the insects and birds seem to be having a ball anyway and some interesting wild orchid type plants have popped up as well.

Anyway, moving swiftly onto financial matters because I imagine you are more interested in that than my explorations of country life…

I refrained from writing an E.zine directly after the US election because everyone seems to have their own opinion of Donald Trump so it matters not what I think. In the end what does matters, for our purposes, are the financial markets and how they react to such events.

If you hadn’t noticed the immediate reaction was very healthy indeed and stock markets rose on the back of the news. Trump is a self confessed businessman after all !!

I saw him doing an interview the other day in which he said that he had spoken to lots of business people since his last time in the Oval Office and had asked what was more beneficial for them: reducing taxes or reducing regulation and bureaucracy. He explained that every one of them said that reducing over-burdensome regulation and bureaucracy was more important by far. So, it might be reasonable to assume that should he be able to follow through with this aim that he can provide a healthy landscape for US companies to flourish.

Certainly the indicators are good! He also has his Department of Government Efficiency head – Mr Elon Musk, rationalising the US government agencies so that should be something interesting to watch if his firing of employees when he took over Twitter is anything to go by.

I myself can confirm that over-burdensome regulation affects our business tremendously these days; there seems to be more and more paperwork than ever before, and much of it could be eliminated or reduced significantly. However, I don’t see that happening any time soon especially from the direction of EU, who set the rules, so we will continue to deal with it. Tech now plays an important part for us in gathering and dealing with client information and it saves you and I a lot of time.

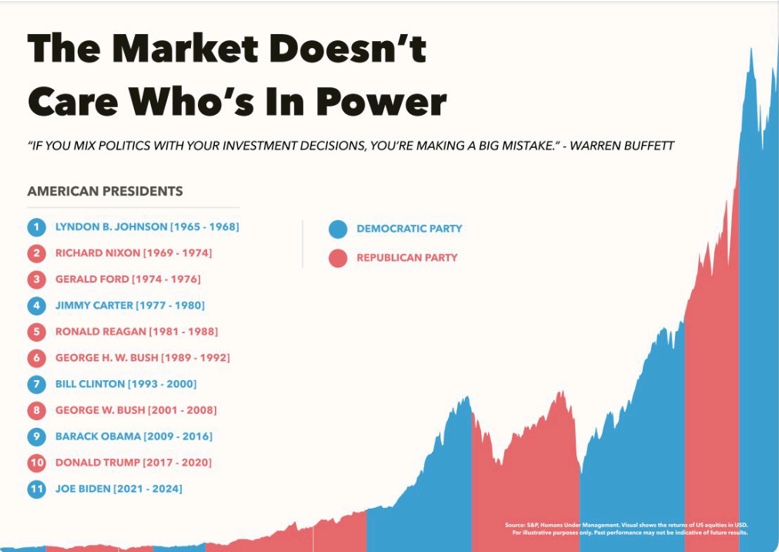

But regardless of all of this, we have to consider how financial markets will continue to react and, at the time of the election someone shared on LinkedIn a graph which I will share with you below:

As you can see, the stock market doesn’t care who is in power, we can all have our own views on Donald Trump and his effect on the world, but in the end it doesn’t matter one tiny bit; but there are 2 takeaways from this graph:

1. The market rises over time

2. In every period there is market volatility and there will be moving forward.

The stock market may have risen since the election and Bitcoin is equally flying, but be under no illusion, at some point markets will correct.

The best thing to do is be invested in solid companies and diversify your portfolio. Match it to your risk profile and decide how much of those ups and downs you can stomach. Patience will take care of the rest for you.

Your financial enemy is not Donald Trump nor anyone who will come after it is simply inflation! The rise in the cost of goods and services over time. Keep your eye on that and not on the daily swings in markets.

On the subject of inflation, it continues its rise – I can’t believe how much things cost in relation to the new house we bought. I asked for a quote from a local gardening firm to cut a long hedge, which is quite overgrown, and when I got it back my eyes started to water. So, like a good Yorkshire man I went out and bought a chainsaw for €180 and thought I would just do it myself, piano piano. In the process I saved myself a whole load of money! Equally, the daily rate for builders, electricians, plumbers etc is now so high! Obviously their cost of work has increased and that is being passed onto us.

Crypto Investors

Are you an investor in crypto currencies? Well there is some rather alarming news for you moving into 2025, if you are an Italian resident for tax purposes.

From 1st Jan 2025, the capital gains tax rate on crypto currency speculation will increase from the flat standard CGT rate of 26% to a whopping 42%! Not great news for you if you have been investing in crypto and are sat on healthy gains, certainly given the fact that Bitcoin has risen significantly over the last few months, effectively doubling in price.

One way to mitigate the higher tax rate on your historic gains might be to cash out before the end of the year and pay your 26% on historic gains in next years tax return. At the same time you can buy back in and in that way you reset the clock on the purchase price, to the new amount. Clearly this means paying 26% CGT on your gains to date, but if significant then it could be worth it. From there on in it will be 42% on realised gains.

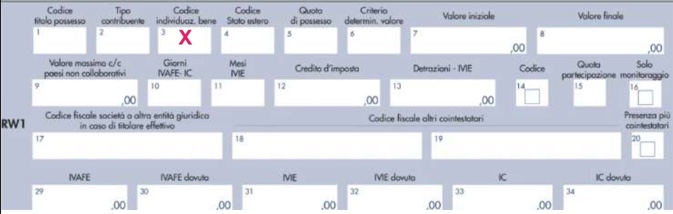

Checking your Italian tax return – it might save you money!

One of the things I help my clients with these days is taking a look at their tax returns and making sure that the section Quadro RW ( declaration of overseas assets) is prepared correctly.

This year I found a number of incorrect entries from commercialisti and got them corrected, saving some clients thousands in tax. However, to be fair to commercialisti they are often bombarded with information which is in English and on statements which they don’t know how to interpret. It is no wonder they sometimes get it wrong and we can’t expect them to understand non-Italian portfolio or cash transaction statements. However, that’s no excuse and either we or they have to be more attentive.

So, here’s one tip for checking your own Quadro RW.

You will find in that section that there are lots of little boxes, in which various values need to go. In box No.3 you will find the title.

‘codice individuazione bene’

This is nothing other than the number which you (or your commercialista) must select to identify the type of asset that you hold abroad, but clearly it’s not much good if you don’t have the list of identifier numbers. So, here, below, I have included a list of all the different codes:

| CONTI CORRENTI E DEPOSITI ESTERI | 1 |

| PARTECIPAZIONI AL CAPITALE O AL PATRIMONIO DI SOCIETA NON RESIDENTI | 2 |

| OBBLIGAZIONI ESTERE E TITOLI SIMILARI | 3 |

| TITOLI NON RAPPRESENTATIVI DI MERCE E CERTIFICATI DI MASSA EMESSI DA NON RESIDENTI | 4 |

| VALUTE ESTERE DA DEPOSITI E CONTI CORRENTI | 5 |

| TITOLI PUBBLICI ITALIANI EMESSI ALL'ESTERO | 6 |

| CONTRATTI DI NATURA FINANZIARIA STIPULATI CON CONTROPARTI NON RESIDENTI | 7 |

| POLIZZE DI ASSICURAZIONE SULLA VITA E DI CAPITALIZZAZIONE | 8 |

| CONTRATTI DERIVATI E ALTRI RAPPORTI FINANZIARI CONCLUSI AL DI FUORI DEL TERRITORIO DELLO STATO | 9 |

| METALLI PREZIOSI ALLO STATO GREZZO O MONETATO DETENUTI ALL'ESTERO | 10 |

| PARTECIPAZIONI PATRIMONIO DI TRUST, FONDAZIONI O ALIRE ENTITA GIURIDICHE DIVERSE DALLE SOCIETA | 11 |

| FORME DI PREVIDENZA GESTITE DA SOGGETTI ESTERI | 12 |

| ALTRI STRUMENTI FINANZIARI ANCHE DI NATURA NON PARTECIPATIVA | 13 |

| ALIRE ATTIVITA ESTERE DI NATURA FINANZIARIA E VALUTE VIRTUALI | 14 |

| BENI IMMOBILI | 15 |

| BENI MOBILI REGISTRATI (es. yacht e auto di lusso) | 16 |

| OPERE D'ARTE E GIOIELLI | 17 |

| ALTRI BENI PATRIMONIALI | 18 |

| IMMOBILE ESTERO ADIBITO AD ABITAZIONE PRINCIPALE | 19 |

| CONTO DEPOSITO TITOLI ALL’ESTERO | 20 |

Each number relates to the different type of assets you may hold. No 1 being conto correnti e depositi, which is current accounts and deposit accounts. However, be aware that there are different interpretations because National Savings Certificates or money market accounts, for example, will not fall into this category in Italy even though they may seem as though they should based on our interpretation.

A good start is to get a copy of your Unico tax return and check that the numbers are inserted correctly. You can work the figures out as well, but an asset declared incorrectly i.e bank account instead of stock portfolio, could end up costing you!

Remember, that you can down load a copy of your tax return now on the Agenzia delle Entrate website if you have a SPID or the carta d’identità elettronica which you have linked to the app. We have all the tools, so let’s use them or alternatively, just ask me!

On that note, I will leave you with this shorter E-zine. I will be writing about UK Inheritance tax and the very important changes that have occurred in the 30th October budget in my next E-zine. For once some tax changes could be a huge bonus for anyone looking to live in Italy for the rest of their lives and then pass on as much as possible to their heirs. The rules have been changed to make it much more clear on how you can now escape UK inheritance tax. For the likes of us who live in Italy, where from an inheritance tax point of view the country is like a fiscal paradise, we have a clearer path to taking advantage of Italy’s rules rather than the UK, but like almost everything it will require carefully planning and a full understanding of the changes.

I will certainly get that Ezine to you before Xmas !!

Wealth taxes in Italy

By Andrew Lawford

This article is published on: 15th October 2024

If you follow Italian media reports, you may have picked up on the idea that a one-off wealth tax may be on the way to help lower the levels of government debt.

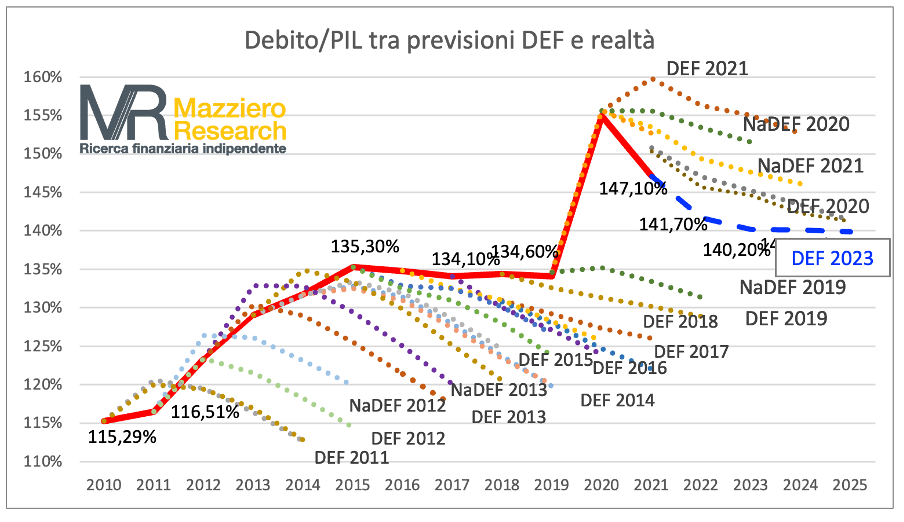

It probably comes as no surprise that Italy has a long history of over-promising and under-delivering when it comes to reducing its debt levels. If a picture is worth a thousand words, then the graph below shows how each budget forecast (dotted lines) promised a reduction in the ratio of Debt/GDP, whilst the actual level (solid red line) generally heads in one direction only.

Of course, the Debt/GDP ratio is one thing, the absolute level of indebtedness is quite another. I note with some uneasiness that over the last 20 years Italian Government debt levels have increased by almost 100% whilst nominal GDP has only increased by around 60%. Soon I fear that Italy will cross the threshold of €3 trillion in debt. That’s €3,000,000,000,000 for those who like lots of zeros.

Is a wealth tax a likely route to try and bring the public finances back into line? Italy has seen this sort of thing before, and the mention of a wealth tax (una patrimoniale) is enough to provoke any Italian who had a bank account at the time to start grumbling about the “patrimoniale del ‘92”, when Giuliano Amato, the recently appointed prime minister, did an overnight raid on Italian bank accounts, withdrawing 0.6% of the value to try and bolster the parlous state finances. Interestingly, Mario Draghi was Director General of the Italian Treasury at the time, apparently willing to do whatever it took even back then.

In considering the likelihood of new wealth taxes, it must be noted that Italian residents already suffer an annual 0.2% tax on the value of their financial holdings (either through stamp duties or the foreign assets wealth tax known as IVAFE). A one-off wealth tax of 0.6% would be preferable to 0.2% per annum in my opinion, but getting both would be a bit rough.

One must also consider the current political landscape compared with 1992. Back then, the system was beginning to crumble as the tangentopoli bribing scandal was getting started. This eventually led former prime minister Bettino Craxi to flee to Tunisia and brought about a supposed cleansing of the political classes dominant in the post-war period. The new system, known as the Second Republic, continues to this day and is currently dominated by Giorgia Meloni. Notwithstanding her somewhat inauspicious background and the fact she is surrounded by a cast of more or less unsavoury individuals, she has managed to convince the world that she is a force for good. My own view is that she is an able political operator and figured out fairly quickly that, if you play by the rules of modern conservatives, you get invited to far better parties – have a look at this video from the Atlantic Council who recently gave her the Global Citizen Award. From minute 1.30 you can hear what Elon Musk has to say about her.

As far as Meloni’s attitude towards raising taxes, she has recently declared them to be una cosa di sinistra (a left-wing thing), presumably meaning that any dirty work of raising extra taxes will be left to a technocrat like Mario Monti or Mario Draghi at some point in the future.

Whatever the case, it is always prudent to maintain a solid asset base outside of one’s country of residence and it should be clear that any overnight raid on financial assets could not include those deposited outside the Italian financial system.

Foreign assets may well be dragged into the tax net in other ways, of course, but at least you won’t wake up one morning suddenly poorer than when you went to bed. In extreme circumstances, which admittedly are almost unimaginable for the moment, capital controls and the like could severely reduce your financial flexibility in the event that all your assets were held in Italian financial institutions. This may seem like scare-mongering, but remember that the unthinkable has happened in the EU in recent memory, so it pays to be prepared. If the weather is uncertain (and when is it not?) then it’s always a good idea to have an umbrella with you. If you end up not needing it, all the better.

If you feel like discussing your own financial set-up to see if it can be improved, then do get in touch. I’m happy to provide a no-obligation consultation to discuss any concerns you might have and the options you have available.

Income tax rates in Italy 2025

By Gareth Horsfall

This article is published on: 7th October 2024

Welcome to this E-zine once again. I thought I would share a few bits of news which have cropped up in the last week or so and which may interest you, non more so than a rearrangement of income tax rates in Italy from the 1st Jan 2025.

But before I get into that I thought I would just give you an update on the house situation here in Umbria.

Thankfully all the major works have now been completed, the last of them being the installation of the new windows and persiane and the painting of the outside of the property. These were all finished last week (thankfully before some of the rains moved in). I also spent the last weekend in September digging a trench to run water pipes and a new electrics cable through.

It has been asked why I didn’t just get someone with an excavator to come and dig it, but we learned that there were a number of hidden pipes in the ground and cables which no-one knew exactly where they were positioned and so it was digging the old way – by hand. That was a big job, but now completed and once the new ‘impianti‘ are in place then I can have the enjoyment of filling the long trench back in again. The ‘idraulico‘ has nicknamed me ‘la talpa‘ for my efforts!

We are still living among boxes, but after the kitchen is finally fitted correctly (the first attempt was a complete mess! – Apparently they were not used to working with ‘wonky’ walls in old houses), then we should be able to move forward with unpacking and start to reassemble our home again. My son, Alexander is loving his new school, despite the 6 days a week and 40 min bus ride to school, so that makes everything much more easy to withstand. (They got a day off today on Thursday 3rd Oct due to high winds and torrential storms in the area!)

Anyway, I know many of you have been through similar experiences and much worse, so I finally feel like I understand your pain and despite all of this I am loving living among the olive trees, nature and the fresh air. I need to take some trips back to Rome regularly enough to see clients so I will get my city fix often enough.

So onto the new and interesting things which might affect you, the first is for everyone who is a resident in Italy.

IRPEF

From Jan 1st 2025 the IRPEF scaglioni (income tax bands) will be changing again. The government is following up on its promise at the elections to modernise the taxation system and move to simpler and more ‘interesting’ tax bands.

Giancarlo Giorgetti (Finance Minister) said ‘ We are committed to not only cutting the tax rates and reducing the 3 tax bands, but also realising them from the next tax year [2025]’

So, the current and proposed (but not yet confirmed) IRPEF rates for 2024 and 2025 respectively are as follows:

| 2024 | Tax rate% | 2025 |

| € 0 - 28000 | 23% | 23% |

| €28000 - 55000 | 35% | 33% |

| €55000+ | 43% | Here they will likely leave the rate at 43% but instead increase the band to income over €60000 |