2023 is the year that I turn 49 years old. Where do the years go? 50 next year and strangely enough I don’t feel as anxious about it as I thought I would. I actually feel quite good about it, and I have made some personal commitments to spend more time in nature and exercise regularly, but not excessively (I suffered glandular fever a few years ago and so can’t workout as hard as I used to).

Tax time in Italy

By Gareth Horsfall

This article is published on: 22nd March 2023

It was on one of those walks in nature recently that I actually thought that it’s about that time when our commercialisti start asking us to send our financial information for tax calculation and payment. (unless you are one of those people who is well prepared and has done it already).

Of course, we always have to supply a full list of our incomes and assets (Italian and foreign), bank accounts and properties and taxable assets. However, I am not sure about you, but my commercialista doesn’t really give me much information on the corresponding list of deductions and detractions available to offset/reduce some of our tax bill, so I thought I would write this article to provide you with a full list for the financial year 2022. [A reminder to always check your tax return, once filed by your commercialista, to ensure that errors haven’t been made, especially on the foreign assets section Quadro RW . See my article on this for more information Declaring taxes in Italy

Some of these may be relevant to you, others not, but at least you have the list which you can refer to and always share with others, if you think it might help. There are distinct categories ranging from family expenses to renovation/property expenses as well. Also remember that in ALL cases now, to claim an expense you MUST have paid by electronic/traceable means i.e. bonifico (bank transfer) or carta di credito and you MUST have a corresponding scontrino fiscale in the case of things like farmacia expenses. For larger purchases a fattura (invoice) is required. Without the necessary document you will not be able to claim back the tax relief.

So, without further ado, here is the list:

SPESE FAMIGLIARI

These attract a detraction of 19% of the full value of the expense.

- The abbonamento (pass) for local, regional and inter-regional public transport, up to a maximum of €250 for the cost of the pass

- A maximum spend of €530 or €1219,14 (depending on the type of policy) for life insurance, polizze per infortunio (accident) or permanent disability policies

- All costs for deceased family members i.e. funeral

- A €632 maximum spend per child for kindergarten cost (public or private)

- The costs of infant, (scuola infanzia), junior (primarie) and secondary (secondaria) schools. Also University, Conservatorio and AFAM (Instituto Alta Forma Artistica Musicale Coreutica)

- Costs for students diagnosed with DSA (disturbo specifico dell’ apprendimento) – a category of ADHD

- A maximum spend of €210 for the costs of sport for children until 18 years old

- A maximum spend of €2633 for the costs of rent for students who are living away from their home region, including abroad

-

A full deduction of contributions into an Italian private pension scheme (previdenza complementare) up to an annual limit of €5164,57

SPESE PER LE CASE

- A 19% detraction on mortgage interest, where it has been used for the purchase or construction of the ‘Prima Casa’

SPESE MEDICHE

These all attract a 19% detraction:

- On a spend more than €129,11 for pharmaceuticals, ticket, hospital costs, specialist services and surgery costs. Analisi, thermal cures (when prescribed), medical equipment, glasses and/ or contact lenses that meet the CE standard

- Vets costs from €129.11 to €500 spend

- Costs to assist with maintaining personal independence e.g. the purchase of a vehicle necessary to get to and from hospital. (Limited to a maximum spend of €2100 for those on incomes less than €40000pa)

- A maximum spend of €750 for the cost of life insurance where the benefit is for someone with a serious disability

- Other general medical expenses attract the 19% detraction on the cost, which can then be detracted from your or your family income, where they are being supported by you (a carico)

LIBERE DONAZIONI

the full cost of donations to:

- Cultural and artistic activities

- Cooperative entities in the cultural /artistic sector

- Associations

- Scholastic institutions of every type

- Funds donated to the Italian state

BONUS EDILIZIE

Restructuring and renovation costs

For the tax year 2022, the following deductions are available:

- 60% on the full expenses of repair to the outside of your property – specific criteria apply! BONUS FACCIATA

- 50% on the cost of restructuring with a max spend of €90000 or 80% of the total cost where it was used to restructure for seismic risks. BONUS SISMA

- 65% of the cost for interventions for energy saving measures around the home.

- 50% of the cost of furniture and big elettrodomestici goods (where they meet certain criteria) BONUS MOBILI

- 36% on a max spend of €5000 for landscape work in the garden (reimbursed over 5 years) BONUS VERDE

- 50% for ordinary maintenance

- 75% for interventions for energy saving measures for condomini

- 110% SUPERBONUS for specific work

- From 2023 the 110% SUPERBONUS falls to 90% (but is likely to be fraught with the same issues as the 110% bonus, in my opinion)

- 50% of the cost of installing an electric car recharging column

Where you have an income up to €120,000 pa the expenses, as described in this article, will be fully allowed. Where your income is over €120,000pa then the detractions will be reduced according to a formula based on your total income.

And that’s it! Everything that you can detract from your income in 2022 to try and reduce your tax bill in Italy. If that doesn’t make a difference, then you may need to have a look at your overall finances to try and plan in different ways.

Possible Italian tax changes

It should be noted that the Meloni government is currently debating how they can follow through on their election promise to simplify the tax system by reducing the tax bands from 4 to 3, in the coming year, and then hopefully moving to a 2 tax band system. If they manage to pass this then they will likely reduce/remove the system of detractions/deductions by lowering the bottom rate of tax, or maybe introduce a starting rate tax allowance for everyone (unlikely, in my opinion. The talk is that an allowance may be offered to workers [not self-employed] and pensionati) However, they are in first stage negotiations and it may be some time before things come to pass.

The other thing they are currently discussing is simplification of the taxation of investment income and gains. Presently income and gains from certain types of investments cannot be offset against losses from the same investment. A system they called ‘redditi di capitale’ e ‘redditi diversi’. There is talk to remove this, what I consider a rather odd system, and have the same system as everywhere else, income, gains and losses from investment income treated in the same way.

Update on making Voluntary National Insurance contributions UK

Anyone who has a missing contribution record for UK National Insurance contributions in the UK between April 2006 and April 2016 will still have the opportunity to make up these contributions until the 31st July 2023, which will still give you the chance to increase your state pension entitlement from the UK. The previous deadline was the 5th April 2023.

The reasoning behind this decision from the UK government is that from April 2023 anyone retiring will need to have a national insurance contribution record of 35 years to receive the maximum state pension. Between 2006 and 2016 different maximum contribution periods may have applied and therefore the UK government is giving you the opportunity to maximise your contributions until July 2023. After this time, it will only be possible to repay the missing previous 6 years contributions in your national insurance record. If you want to know more, you can look at the www.gov.uk website.

Bear in mind that the state pension office will likely be overwhelmed with requests at this time, so if you need to make a request for back payments then you may need to do so immediately, otherwise they may not be able to respond to you in time.

If you are unsure of your National Insurance contribution record then you can check it online at www.gov.uk/check-state-pension. You will need your UK national insurance number handy.

Tax time in Italy

By Gareth Horsfall

This article is published on: 17th March 2023

Tax time in Italy – when our commercialisti wake up from their winter ‘letargo’ (aka – well-earned down) and start asking us to send our financial information for tax payment, if you haven’t done it already of course.

On top of the information regarding our taxable assets and income there is the list of allowable deductions /detractions to assist in lowering your tax bill.

In this article, I review that list for fiscal tax year 2022.

SPESE FAMIGLIARI – family expenses. These attract a detraction of 19% of the value of the expense.

- The abbonamento (pass) for local, regional and inter-regional public transport, up to a maximum of €250 for the cost of the pass

- A maximum expense of €530 or €1219.14 for life insurance, polizze infortuni (accident) or permanent disability policies

- All costs for deceased family members, i.e. funeral

- €632 per child for kindergarten cost (public or private)

- The costs of infant, (scuola d’infanzia), junior (primarie) and secondary (secondaria) schools. Also University, Conservatorio and AFAM (Instituto Alta Forma Artistica, Musicale e Coreutica)

- Costs for students diagnosed with DSA (disturbo specifico dell’apprendimento) – a category of ADHD

- A maximum of €210 for the costs of sport for children until 18 years old

- A maximum of €2633 for the costs of rent for students who are living away from their home/region, including abroad

SPESE PER LE CASE –

- A 19% detraction on mortgage interest, where it has been used for the purchase or construction of the ‘Prima Casa’

SPESE MEDICHE – medical expenses. These all attract a 19% detraction:

- When spending more than €129.11 for pharmaceuticals, ticket, hospital costs, specialist services and surgery costs. Tests, thermal cures (when prescribed), medical equipment, glasses and/ or contact lenses that meet the CE standard

- Vets costs from €129.11 to €500

- Costs to assist with maintaining personal independence e.g. the purchase of a vehicle necessary to get to and from hospital. (Limited to a maximum spend of €2100 for those on incomes lower than €40000pa)

- A maximum spend of €750 for the cost of life insurance where the benefit is for someone with a serious disability

- Other general medical expenses attract the 19% detraction on the cost, which can then be detracted from your or your family income, where they are being supported you (a carico)

LIBERE DONAZIONI – the full cost of donations to:

- Cultural and artistic

- Cooperative entities in the cultural /artistic sector

- Scholastic institutions of every

- Funds donated to the Italian state

BONUS EDILIZIE – restructuring and renovation costs

For the tax year 2022, the following detractions are available:

- 60% on the full expenses of repair to the outside of your property – specific criteria apply! BONUS FACCIATA

- 50% on the cost of restructuring with a max spend of €90000 or 80% of the total cost where it was used to restructure for seismic risks. BONUS SISMA

- 65% of the cost for interventions for energy savings measures around the

- 50% of the cost of furniture and big household appliances (where they meet certain criteria) BONUS MOBILI

- 36% on a max spend of €5000 for landscape work in the garden (reimbursed over 5 years) BONUS VERDE

- 50% for ordinary maintenance

- 75% for interventions for energy saving measures for condomini (apartment blocks)

- 110% SUPERBONUS for specific work

(** the superbonus has been suspended by the Meloni government because they found a hole of €38 billion in the public finances due to fraudulent activity related to the Superbonus. It is unknown when and if any applications made in 2022 will be reimbursed).

- From 2023 the 110% SUPERBONUS falls to 90% (but is likely to be fraught with the same issues as the 110% bonus, in my opinion)

- 50% of the cost of installing an electric car recharging

Where you have an income up to €120,000 pa the expenses, as described in this article, will be fully allowed. Where you income is over €120,000pa then the detractions will be reduced according to a formula based on your total income.

And that’s it. Everything that you can detract from your income in 2022 to try and reduce your tax bill in Italy. If that doesn’t make a difference, then you may need to have a look at your overall finances to try and plan in different ways.

It should also be noted that the Meloni government is currently debating how they can simplify this whole system by reducing the tax bands from four to three in the coming year, and then hopefully moving to a two tax band system. If they manage to pass this, then they will likely reduce/remove this system of detractions/deductions by lowering the bottom rate of tax, or maybe introducing a starting rate tax allowance for everyone (unlikely). However, they are in first stage negotiations and it may be some time before things come to pass.

Is Giorgia Meloni the new Mussolini?

By Andrew Lawford

This article is published on: 21st February 2023

This may seem like something of a provocative title, but I am merely picking up on the common refrain that Italy’s current government is the most right-wing since the fascist era.

It would be no minor issue for the country if indeed we did find ourselves heading down a similar path, so rather than simply dismissing out of hand the possibility that Meloni could be a Mussolini for the new age, I thought I would look into it further. We are, after all, talking about someone who as a much younger woman expressed the view that Mussolini was “a good politician”, whatever exactly that is supposed to mean. I imagine we all expressed at least some views when younger that we might cringe to think about today, but certainly Meloni’s comment on Mussolini was something of a clanger considering the office she now occupies.

Before we talk about Meloni’s politics, let’s think about the difference between the Italy of 100 years ago and today. 100 years is a useful timeframe, because 1922 was the year of the March on Rome – the moment when the fascist movement kicked into a higher gear and, notwithstanding the fact that it was poorly resourced and even more poorly organised, managed to bring Mussolini to power. The fascist movement had begun a few years earlier, populated initially by disaffected soldiers returning home to anything but a victor’s welcome following the First World War. Subsequently, the fascists managed to find their raison d’être and much broader support in the fight against socialism/communism, yet the entire movement might easily have fizzled out had it encountered even a modicum of resistance from the monarchy and the political establishment or if one of the many assassination attempts on Mussolini had succeeded in the early years of the regime* .

As fascist power grew, the desire to return Italy to its rightful place in the world, as heirs of the Roman Empire, took hold of Mussolini’s imagination, leading to the conquest of such places as Libya, Ethiopia and Albania. At home, the country was dragged into the modern age through the execution of public works programmes as well as monumental changes to cities such as Rome. The next time you wander down the via dei Fori Imperiali, consider that you are in an area profoundly changed by Mussolini, who demolished an entire area of Rome to make way for what was initially called via dell’Impero – put in place so that he could see the Colosseum from his office in Palazzo Venezia at the far end of the road. It is fair to say that from an economic and social perspective, the Italy of 1922 is almost unrecognisable compared with the country we live in today.

Now let’s consider the Italy of 2022 that swept Giorgia Meloni to power. Notwithstanding its difficulties, Italy is undoubtedly among the wealthiest countries in the world. I know there can be large regional differences and often the systems are confusing, but generally speaking Italian healthcare, education, infrastructure and other public services range from adequate to excellent. Italy is the home to world-leading industries and is certainly a place where one can rise through the social hierarchy regardless of one’s origins. If you need proof of this, consider that Leonardo Del Vecchio, the founder of Luxottica who died last year as one of Italy’s richest men, was born in 1935 to a solo mother and grew up in an orphanage.

Italy has many of the hallmarks of modern, well-heeled democracies, including an ageing population and a prevalence of small families (when people decide to have children at all). It is incredible to think, but over the course of my lifetime (I’m not quite 50 years old), the number of babies born in Italy each year has halved from about 800,000 to about 400,000 currently. The odd incentive for young families isn’t going to change that trend in any substantial way.

Imagine, now, if you will, that Meloni decided to pick up the fascist cudgel and start to take a more aggressive geopolitical stance. The current army of one-child families is probably the greatest guarantee against this because how many of these parents will permit their children to march off to war? Occasionally one does see fascist meetings – for example I recall seeing one reported in Cremona to commemorate the death of Roberto Farinacci, a particularly hardcore exponent of the black shirt, but to be honest the sight of fat old men singing “Giovinezza” (the fascist anthem, dedicated to youthful courage), was as comical as it was pathetic. It is also amusing to note that one of the main scandals so far in the Meloni era has been her decision to use the masculine article “Il Presidente” as opposed to “La Presidentessa” or something similar. This seems to me to be the kind of problem you discuss when you really don’t have any serious problems (or, perhaps more accurately, you don’t wish to discuss the various intractable problems that do exist). I also don’t think we should be particularly concerned over the apparent revival of Berlusconi’s connections to Putin: he simply can’t accept that he’s become a marginal figure, almost a caricature of himself, so he’s returned to his advertising roots and is willing to do anything to get attention.

What I do see is a general trend towards nationalism, which can, I suppose, be seen as a very watered-down version of fascism. There is at least the possibility of some expansion of state participation in business, although one can but hope that no one is considering a return to the days of IRI (L’Istituto per la Ricostruzione Industriale) – the behemoth state holding company founded during the fascist era that for decades controlled huge swathes of the Italian economy. In this context, it is disturbing to hear discussion of the potential nationalisation of Telecom Italia (TIM), although this might be best seen as an (expensive) opportunity to correct a poor privatisation that left the company imprisoned by its debt burden. It is more likely to see the state getting involved at a smaller scale, with the recent trend in the use of the state-controlled CDP (Cassa Depositi e Prestiti) for financing and even venture capital activities an indication of things to come. It is also more than likely that the state guaranteed loans issued as part of Covid support measures will eventually result in the need to absorb zombie businesses in politically sensitive sectors.

All in all, it seems to me that Meloni fortunately has neither the innate tendency towards fascism, nor a populace willing to be led in that direction. We would probably do better to think about whether the current global trend of rearmament will lead to problems in 10 – 20 years time when all the shiny new weapons are ready for use. I worry that if you build enough of them then sooner or later an excuse will be found to use them – violence is violence, regardless of political ideology.

Subscribe to my podcast:

IFA (Italian Financial Adviser) on:

Apple Podcasts, Spotify, Google Podcasts or Stitcher

The difficulties of 2022 and how to approach 2023

By Andrew Lawford

This article is published on: 10th February 2023

As we begin 2023 we find ourselves yet again in rather uncertain times. 2022 proved to be a very difficult year for investors (especially up until about the middle of October), given that there was basically nowhere to hide. The classic 60/40 equities to bonds balanced portfolio returned somewhere in the region of -18% over the year¹ ; you have to go all the way back to 1937 in order to find another negative performance greater than -15%.

The fact is though that this type of portfolio historically has worked remarkably well: looking at data from 1928 onwards, such a portfolio has lost money on an annual basis only 21 times, and only 10 times was the loss greater than 5%. Even 2008, which most people will recall as a truly atrocious year for equity markets, was not so bad for the 60/40 portfolio due to the strong support received from the bond market.

So why did this happen? Should we consider 2022 the moment in which broadly diversified, balanced portfolios stopped being a valid investment strategy or was last year simply an aberration (or the exception that proves the rule)?

It is fair to say that there had been a creeping risk in the 60/40 portfolio for some time, it’s just that this particular risk wasn’t where people were accustomed to finding it. In recent years, fixed income investors have found themselves grappling with low or even negative interest rates. In practical terms, if you buy a bond with no yield, your best-case scenario (excluding the absurdity of negative interest rates) is that the bond goes nowhere for the entire time you hold it. Our risk-free returns gradually transitioned into return-free risks. Given this scenario at the beginning of 2022, it should come as little surprise that many fixed income investments performed even worse than conservative equity investments and certainly failed to provide the support that most people would hope for in a bad year.

¹Using US market data – S&P500 for equities and 7 – 10 year Treasuries for bonds

The good news is that after the difficulties of 2022, many assets now offer better value than they did 12 months ago, but whether or not 2023 will offer great returns or is destined to test our nerves again is a matter of great debate.

It would be tempting at this point to start looking at economic forecasts for 2023 to get an idea of what to expect. The issue here is that which I examined in my article on inflation – we can’t actually know what the future holds, so let’s concentrate on putting together a portfolio that is likely to serve us well as we attempt to generate a reasonable return for the medium-long term.

Far more important than economic prognostication when constructing a portfolio is understanding your own risk profile, because this allows you to give appropriate consideration to matters that you can ascertain and that will certainly affect your investment returns. In no particular order, you need to be thinking about:

- Where are you in the life-cycle of contributing to or drawing down from savings?

- What are your overall financial resources and how adequate are these compared with your needs?

- What are your aspirations?

- What is your ability to withstand market volatility?

- How much do you worry about your money?

Once you have answered all of these questions, you can come up with an appropriate posture to risk. Whether or not you should vary this posture depending on the current market circumstances is a question that you must try to answer at the outset. If you are going to change your posture on the basis of current circumstances, then you must believe that somehow you are able to understand the current situation better than the market consensus, and also understand the affect your view might have on the markets if it happens to be correct. Your assessments might be correct occasionally, but are also likely to be wrong quite often (rather like those of professional forecasters). This leads to the maxim that for nearly all people, nearly all of the time, the appropriate posture is their neutral one based on their risk profile.

There is one other extremely good reason why you would always be well-advised to maintain this neutral posture: it will help you to avoid the cardinal sin of investing – selling low. As I explained in the article linked above, long-term investment offers magnificently favourable odds of good returns, but if you are prone to selling at the bottom, as you may well be if you decide to oscillate between “risk-on” and “risk-off” postures, those odds are turned upside down and will likely cause serious damage to your wealth. Of course, you might also end up buying high occasionally, which may lead to a period of regret, but if you have invested wisely, then time will iron out these wrinkles. It is undoubtedly better to concentrate your attention on what you can know and influence, rather than wringing your hands over economic forecasts.

These are complicated issues that all investors have to face. My advice aims to keep you focused on the important issues rather than leaving you to try and puzzle through the ever-present “noise” in the investment markets. Over the long-term, you will almost certainly find that ignoring the distractions provided by the market action in years like 2022 will contribute to, rather than detract from, your investment success. If you would like to know more, or to conduct a review your current portfolio, then feel free to get in touch for a no-obligation consultation.

Subscribe to my podcast

IFA (Italian Financial Adviser) on:

Apple Podcasts, Spotify, Google Podcasts or Stitcher

So what does 2023 have in store?

By Gareth Horsfall

This article is published on: 1st February 2023

I don’t think I have ever wanted to leave a year behind me as much I did 2022. Well, maybe 2008/2009, but 2022 recorded as one of the most brutal in my career. No matter which direction there only seemed to be bad news. Thankfully we have passed into 2023.

So what can expect from 2023?

Working with The Spectrum IFA Group means that I am invited each year to their annual conference where we are invited to listen to a number of fund / asset managers who can give us some insight into what has happened and also where things might be heading. This conference was a special one because it was the 20th anniversary of the The Spectrum IFA Group and so the event was held at Gleneagles in Scotland. Apart from the cold (average -2 degree), the conference went well and I managed to scribble some notes from the various speakers, my favourites being David Coombes from Rathbones Asset Managers, Rob Gordon from Dreihaus/VAM Investment funds and Rob Clarry from Evelyn Partners.

(Disclaimer: It should be noted the views expressed here are my own. The information collected has been interpreted by me and can only be taken as such. To protect the names mentioned above none of this article should be taken as advice, recommendations or an offer of solicitation from the fund/asset managers themselves or the companies they represent).

“Heads of State don’t have a clue what they are doing…yet they think they can predict the future”

This was how one asset manager (who shall remain unnamed) started his presentation. The point being that if we are basing our investment ideas and knowledge on economists, central banks or governments themselves, then it is almost certain that you are going to get it wrong.

But don’t just take my word for it, let’s looks at some investment examples that didn’t go well in 2022, and which prove the case:

1. Wind Power is the future…but is it? It produces only when the wind blows, it is significantly more costly than traditional energy sources. The amount of ecological damage to build wind turbines in terms of resources required and to install them probably far outweighs the benefits if you place it against other alternative energy sources. In addition, the blades have a lifespan of approximately 10 years then they need to be replaced and buried somewhere because they cannot be recycled. Yet, faced with all these facts and a sector heavily subsidised by government money, a Danish wind power company: Vestas, which has never turned a sizeable profit was worth more than Apple at one point.

2. Cryptocurrency: There is not a lot to say about Crypto in 2022 other than a complete investment disaster. Bitcoin lost 60% of its value in 2022. A pretty high risk asset if ever there was one. Crypto was also plagued by the collapse of FTX with literal losses ( i.e lost and likely never to be found) assets of $1-2 billion. Hackers also stole $4.3 billion of cryptocurrency in 2022, an increase of 37% from 2021. Yet, governments tell us that government backed crypto-currencies are the future. I will stick with cash, thank you very much!

3. Tesla and Elon: How the darling of the investment world, and government officials alike, has been ousted from his perch. A bit like crypto currency Tesla lost 65% of its value in 2022. You might argue that he is changing the world with his electric vehicles, yet did you know that Volkswagen made more electric vehicles in Europe in 2022 than Tesla? So, who is changing the world? His move to Twitter should also raise eyebrows. A company worth $40bn on the world’s financial markets which has yet to show a profit and one which he also says will ‘change the world’. Remain a sceptic!

4. Inflation is transitionary: Governments also said that when the inflation train left the station in 2020, that, at best, it would be, quote, ‘transitionary’. i.e it would go away once post Covid supply chains returned to normal. I never believed this and wrote about it on a few occasions in the last couple of years. Let me tell you that inflation is here to stay…and would you like some numbers on that? Well David Coombes from Rathbones hazards a guess that inflation will continue at approx 4% in the US, 3-4% in the EU and 5-6% in the UK as an average over the next 3 years. I suspect those are headline ‘government’ declared rates. My guess is that real inflation may be somewhat higher. Protecting those savings and investments has never been more important.

Did you know that inflation needs to only run at 7% per annum for 10 years for the value of your money to halve. 2022 ‘true’ inflation was more like 10-15% across Europe, so that’s 2 of those 10 years taken care of already.

So with all this doom and gloom, what actually did do well in 2022?

Answer: The old, out of favour, industries of the past: BP, Shell, Lockheed, Schlumberger, Caterpillar et al.

Yep, those very same industries which no one wants to invest in any longer. They turned the corner and became the star performers of the investment markets. In fact, anything moderately related to ethical / sustainable / ecological investment had the hardest time in 2022. It was enough to test anyone’s ethical investment values!

However, the truth of the matter is that with interest rates likely to be higher in the next 5 years than they have been in the last 5 years, and the cost of debt being significantly higher, we may just see some of the older, cash rich industries doing quite well, and seeing some of the newer debt heavy companies struggling or even going bust.

Take Netflix. (It has become my go to TV channel!). Netflix’s business model is built on continual expansion of its subscribers and content. However, it has been heavily funded by cheap debt. How might it progress in a world where the debt it needs to make a new series costs 5 times more than before? I suspect it might survive this new world it finds itself in, but could it become a takeover target from a more established and cash rich company, like Disney?

Another example of one of those new, sustainable, ethical businesses, potential disruptor / game changer was Impossible Meat. For those that are not aware they are producing plant-based meat alternatives. In 2022 they saw their share price fall 96% as consumers turned away from their product. (I tried them myself and can’t say I was too impressed!). An example of governments pushing us towards more plant-based and lab made foods, not to forget bugs. But can they accurately predict the future?

So, the cost of servicing debt is certainly going to reshape the investment world again, yet there is one major theme which will shape the world in years to come: SECURITY and I don’t just mean military security, but also energy and food security.

Energy Security

Energy security is being driven by the war in Ukraine and the end of the reliance on Russian cheap energy. A perfect example of how energy policy is needing to change focus is Giorgia Meloni’s recent trip to Algeria to agree access to their gas fields, and export into Europe. Algeria has the 11th largest reserves in the world and have a gas surplus. Italy is trying to line itself up as an energy hub for Europe given that gas will likely now come in from the global south rather than the north, and Italy, it would seem, is ideally placed as a central Mediterranean country and its access into the EU. The only snag, which is not much talked about, is the fact that Algeria is a Russia ally and currently buys fighter jets from Russia and supports it in the war with Ukraine, so how the Italy/Algeria agreement will work is anyone’s guess.

Military security

Military security for the EU is still going to come from NATO (i.e US led military policy). It could be argued that the Ukraine war is not in the EU’s interests, in particular Germany, but they have to kowtow to NATO/US driven policy because the EU never could agree on building an army of its own to defend itself, and hence self- determination in terms of defence policy. There is no other real option and so the EU will very likely continue to arm Ukraine and stretch out the war if that is what US policy dictates, even when negotiations to end it might be possible. The order books of most armament / defence companies will be very full for some years to come.

Food security

This was an area which provoked more discussion from the fund managers. In particular how the West will need to develop to ensure that food is still delivered to our supermarkets.

A good example of a company that is innovating in the area of food security is John Deere. The agricultural machinery and tractor marker. They have already developed a fleet of unmanned vehicles which can plant, monitor and harvest. These machines are no longer human driven one-purpose vehicles. They are machines with embedded computers, checking soil temperature and microbe levels, adding fertilizer when needed and checking weather signals, determining when to plant, when to harvest etc, and all without any human intervention in the field. The biggest customers will ultimately be the biggest producers, namely the US, Brazil and Ukraine (you may be surprised about Ukraine being in the list, but a benefit of war for large industries is that they can take advantage of disaster capitalism. Large US and International agricultural companies have been able to take advantage of new laws liberalizing the sale of agricultural land in Ukraine. Previously, Ukrainian small farmers were protected and forbidden to sell their land to large agro interests. Now, big companies are moving in to take charge of Ukrainian land. On one hand the farms will benefit from economies of scale, but the small-scale sustainable farming model will struggle to survive).

Agricultural and food production will be a big investment theme in the coming years!

So, with all these themes in mind, the broad outlook for the future and investment, according to Evelyn Partners, will be determined by 4 main Megatrends.

- SHIFTING DEMOGRAPHICS

- CHANGING WORLD ORDER

- BUMPY ENERGY TRANSITION

- TECHNOLOGICAL REVOLUTION

I won’t bore you with details in each area, but here are some points around the subjects discussed:

SHIFTING DEMOGRAPHICS. Ageing populations, more opportunity for pharmaceutical companies and drug development, more use of online doctoring and diagnosis, roll out of robots in our hospitals and clinics (robot cleaners, robot secretaries, robot surgeons, robot beds moving freely from ward to surgery room without the need for people). It’s all coming and given that 80 out of every 100 people will be over the age of 65 by 2050 in Japan, and around 60 in 100 in Europe, it is difficult to see how our world will survive without increased development and innovation in the healthcare sector.

CHANGING WORLD ORDER. The US/China decoupling will continue and accelerate. Instead of globalisation, think ‘slowbalisation’. The war in Ukraine has driven a wedge between those, already weak, alliances. Russia, Iran, China, Saudi Arabia, India, (the BRICs+) and other countries are coming together to find ways to subjugate control over their regions and wrest control away from the US, especially in the use of payment systems in USD. The US will, of course, fight its corner, just look at its policies around the semi-conductor market which you will have read in my last E-zine ( ) What investment opportunities this will throw up is anyone’s guess, but the exportation of the US model of capitalism around the world, will slow and this could throw up new investment opportunities in new companies further afield.

BUMPY ENERGY TRANSITION. We are only going one way with energy policy, and that is more towards sustainable energy production; but, if you think we will be switching off the oil taps and shutting down the coal fields overnight, as many Eco groups would wish for, you will be very disappointed. (I will place a bet that in 20 years we are still using the same amount of oil as we are today, but that’s just a personal hunch. A lot of electric cars are going to need a lot of electrical energy from somewhere). A transition will happen but technology and storage of energy will need to improve, solar and wind power will just not make up our energy needs.

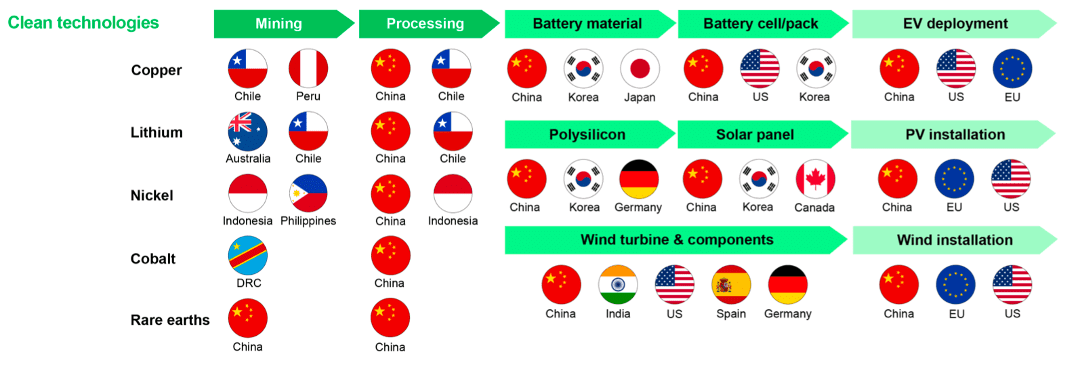

In addition, a little known point about the resources required for a sustainable energy transition: China dominates!

So, whilst the US imposes sanctions on China in the access to and production of semi conductors, China could retaliate with sanctions on the west regarding access to the materials needed to transition to our green economies. Yet, China needs to import 70% of its food from abroad as it is not able to produce enough to feed its population. The US is the biggest producer of agricultural products. So, from a bumpy energy transition we revert back to point 2, The Changing World Order. It will be an interesting time ahead for global politics.

TECHNOLOGICAL REVOLUTION. We have already seen so much revolution in this space since the year of my birth 1974 but the future will accelerate things even more. From next level automation in industry and daily life, 3D and 4D printing will become more the norm (I went to a fayre in Villa Borghese in Rome last Sunday and one stall was 3D printing some items on a wooden work bench) with the launch of 5G we will become even more interconnected, more reliance will be placed on cloud computing and storage of data, next-gen quantum computers, AI and controlled devices, cryptocurrencies, wearable devices…the list goes on.

And if that is not enough to scare you then check out the company recently purchased by Microsoft called ChatGPT. This is a learning AI application which can do just about whatever you want it to do. Think of it as an Alexa x 1milllion! It can provide you with any amount of information you need, ‘write newsletters’ – you just give it a subject and in seconds it will provide you with a written text on a certain subject, do maths, solve problems, write a website for you, some students are even using it to write essays at University. The scary thing is that it learns as it goes. Anyway, you don’t have to worry about my E-zine being written by ChatGPT; I don’t even think the best learned AI could imitate my crazy style.

And more food for thought

Rob Gordon (US citizen) from Dreihaus/VAM Investment funds thinks that Trump will win the Republican nomination again. But he thinks that Jo Biden, at 81 years of age when the election comes around, will win against Trump again.

David Coombes from Rathbones Inv Managers thinks that GBP will drift back into the range of 1.25/1.30 against the Euro within the next 3 to 4 years .

Lessons learned from this conference

This might sound like a sales pitch: something I try to avoid in this E-zines as they are written for information purposes only. However, whilst listening to our various speakers I became overwhelmed at just how complicated the world is becoming from a political, technological, economic and investment perspective. We can no longer ‘pick a stock’ and expect it will do well. Thought and research needs to be behind investment decisions. It’s easy to think that we can invest ourselves, be successful and then years like 2022 come along and there is nowhere to hide: stocks and bonds prices fall together, and then the only safe space is in some highly volatile areas of the commodity sector, which you wouldn’t normally play in. We need professional help and guidance to help us navigate these choppy waters head, but when there are so many changes afoot, it throws up the best investment opportunities. The investment managers and companies we use and talk to regularly are on top of these trends and can help you, our client, to get the best from your investments. The lesson learned from this conference: you are in good hands.

As always, if you have any questions about this E-zine or have any general financial planning concerns as a resident in Italy, or someone who is thinking of moving to Italy, then don’t hesitate to get in touch on email: gareth.horsfall@spectrum-ifa.com or on cell: +39 3336492356

Will China invade Taiwan?

By Gareth Horsfall

This article is published on: 23rd December 2022

Well, it’s nearly that time of year again and I thought I would subject you to a last dose of Gareth’s musings before the year closes.

They say that the years pass more quickly the older you get, but I am not sure just how much quicker they can fly by based on how this one has zipped by.

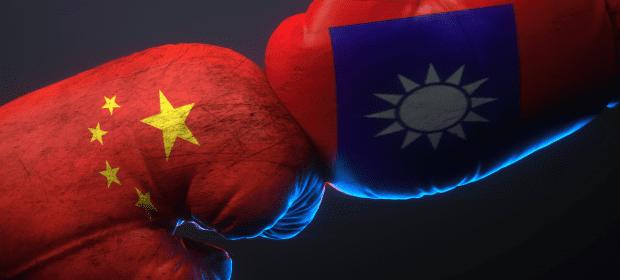

So, it is with this in mind that I thought I would write something nice and Christmassy for you: Why it’s unlikely that China will invade Taiwan…..at least for the foreseeable future! What more could put our minds at rest this Christmas than a rational argument as to why China is unlikely to start another war in 2023 just when we have plenty of others to contend with.

OK, it doesn’t necessarily have a festive feel to it, I understand that, but I bought a book this year written by Louis-Vincent Gave who is one part of a company called Gavekal. They provide very high level statistical, political and economic analysis to businesses and governments around the world. They are quite famous in this area and their work is exceptional. The book is entitled ‘Avoiding the Punch: Investing in uncertain times‘. In it there is a section on exactly why China is unlikely to invade Taiwan, at least for now. Since this was a concern expressed by more than just a few clients this year (presumably given our Western media tendency to constantly be baiting us into believing that it is imminent),I thought it might make a nice E-zine to finish the year and give us some hope for 2023. As they say, knowledge is power…and I would add less angst!!! :0)

It’s all about semiconductors.

Yes, the whole business of China invading Taiwan and the USA threatening to protect the island, whatever it takes, is all about semiconductors but if, like me, you are wondering exactly what we use semiconductors for, the following should give you a quick answer:

Semiconductors are an essential component of electronic devices, enabling advances in communications, computing, healthcare, military systems, transportation, clean energy, and countless other applications.

In essence, they are now used in almost everything that we ‘need’ to run our daily lives. From your phone to computer to thermostat, clocks, TV’s, machinery in factories, the MRI machine at the hospital, wind turbines etc. We can’t live without them. So, for any nation state it is important to have access to the companies, and countries, that monopolise the manufacture of them.

Control of the market in chip making has for a long time been monopolised by the USA through the tech firm Intel. But, in July 2020, the US were taken aback when Taiwan Semiconductor Manufacturing Co (TSMC) announced that they had technologically leapfrogged Intel in the business of high-end chip making.

(The USA started a trade war with China over semiconductors in 2017/18 when they placed restrictions on the export of semiconductors to Huawei, ZTE and other Chinese companies which brought those companies to their knees).

However, like all fairy tales, there once was a time when the USA and China sort of got along with one another. The days when Taiwan made those nice little plastic toys and bicycles that they would export into the West, and no one felt threatened. However fast forward to today and they are now arch enemies just at the time when Taiwan has now surpassed Intel to become the No 1 producer of the world’s most important commodity.

So, the real battle ground is not Taiwan itself (which interestingly, the USA recognises Taiwan is a part of China, but does not recognise China’s sovereignty over the island) but for the control and continued access to the global semiconductor market.

1. If China were to invade Taiwan it would surely result in Taiwan’s semiconductor factories being damaged and/ or destroyed. Even if China invaded by sea, Taiwan would have time to self-sabotage the factories and keep hidden any secrets in the manufacture of this precious commodity. Since a third of China’s semiconductors are supplied by Taiwan, it would shut down China’s tech industry for which there would be no other supplier. China has placed significant importance on the development of its tech industry as part of its growth strategy and so this would be a backward step.

2. Military conflict with Taiwan would limit, if not cease, China’s ability to make these semiconductors at home. Factories that produce these highly specialised chips need an investment of close to $20 billion just to be functional and most of the machinery required to make them comes from Japan, the USA, the Netherlands and South Korea. All countries which would likely cease trading with China if it invaded Taiwan.

Strangely, what might speed this process along (and a potential invasion of Taiwan) is America’s continued actions to strangle China out of the semiconductor’s market. On 7th October 2022 the USA imposed new sanctions on China by restricting the supply of equipment and tools to any manufacturer of semiconductors in China. Not only, but also any US person, green card holders and foreign national of the US are prevented from going and working in a Chinese semiconductor production facility without first obtaining a licence, therefore making it virtually impossible to do so. (Strangling the ability for China to hire the talent to train their own engineers)

You might think this would slow China down, but it’s quite the opposite because as a result of these sanctions the Chinese government have now placed an even greater importance on the development of science and innovation in their economy. The US sanctions have had the adverse effect of aligning Chinese business interests with the Chinese government itself. Both are now convinced that they cannot rely on anyone but themselves and certainly must not be dependent on US (and its allies) sourced goods/materials. Hence the Chinese government and Chinese businesses are collaborating to build domestic alternatives to imported technologies.

The question of building a domestic semiconductor sector in China has moved from being a business decision to a matter of national security, and for businesses a matter of survival.

So, you might be thinking what is the time line for China becoming self-sufficient in the manufacturing and technology surrounding its own domestic market for semiconductors? The answer: around 2030 according to various sources. So, a Taiwan invasion, might be a few years off yet! All the sabre rattling between the US and China is likely to be just that for some time to come.

If you would like to discuss this or any other subject relating to how the economic, social and political events in the years ahead might affect you and your personal financial plans, then you can contact me on gareth.horsfall@spectrum-ifa.com or on cell +39 333 6492356

And on that happy note..

Declaring your taxes in Italy

By Gareth Horsfall

This article is published on: 9th November 2022

I had a nasty surprise the other day and I just had to tell you about it. I got one of those dreaded pec (posta elettronica certificata) emails with the title ‘Agenzia delle Entrate – riscossione‘. They put the living fear into me and for obvious reasons. This time it was nothing significant, but still an issue relating to something my old commercialista did, or didn’t do, back in 2012, 2015 and 2017. My new commercialista has launched an investigation and hopefully we can park that particular communication in a draw somewhere, but I suspect I will end up having something to pay.

Why you should ask for a copy of your Unico!

With my horrible experience in mind, I decided to write this article where I want to just briefly touch on why you should really be asking for a copy of your Unico from your commercialista or whoever declares your taxes.

If you are unsure what an Unico is, it is merely a copy of your declared tax return pages that have been submitted to the Agenzia delle Entrate.

And will normally be about 20/30ish pages long, depending on how complex your financial affairs are.

You also want to request a copy with the receipt on the back pages, as this is confirmation that it has been lodged with the tax authorities.

That page should have a header as follows:

Now, you may ask why I am telling you this?

In the last few years, I have widened my services to my clients to incorporate a check on their declared financial affairs in Italy, to ensure that everything is being reported correctly. I decided to do this because it had become apparent that some errors had been made by various commercialisti and the odd client had been incurring higher taxes than necessary, as a result.

Checking your tax return may seem a complicated procedure, and you may be reluctant to do so, but actually, for most of the International English-speaking community living in Italy the entries in the tax return should be relatively simple. Apart from any declaration of income, which you would find under section Quadro RN or RT for investment income, you can also check on things like your accrued medical expenses under Quadro RP.

[An interesting point about the medical expenses section is that this year my commercialista contacted me about my receipts for farmacia expenses for 2021. However, he didn’t just asked me for the scontrini, but actually sent me a screenshot from the Agenzia delle Entrate website detailing all my farmacia spending for the whole year, where I had given my tessera sanitaria, which I found quite unsettling!]

The main sections that I would suggest that you check over are Quadro RW and RT. These are where overseas assets, incomes and capital gains have to be declared. These include properties, portfolios, bank accounts and other overseas assets, such as art or vintage cars, for example. These are the sections where I find the most errors. It might be that the market value of a property has been reported instead of a purchase value or local authority value or they have misunderstood the nature of a pension and declared it as an investment portfolio.

Also, remember when checking these figures that they must be converted into EUR from the foreign currencies in which you may have an asset. To do this you need the exchange rate for your respective currency. The Agenzia delle Entrate publishes those conversion rates and where valuations have been provided for the 31st December, for example, then you would need to use the declared rates from the Agenzia delle Entrate for that month. The link below takes you to the AdE provvedimento for Dec 2021 that provides exchange rates on all world currencies.

In more recent years, where I have started working with commercialisti more closely for my clients, I have managed to iron out these problems and, in most cases, a good commercialista will be happy to learn the nature of an overseas asset and ensure it is declared correctly. However, there are still instances where mistakes can be made.

In brief, I would advise you to request a copy of your Unico for the last financial year. A good commercialista shouldn’t be worried about providing you with a copy. There shouldn’t be anything to hide if they have done it all correctly. You can also download this directly from the Agenzia delle Entrate (AdE) website. If you have not already done so, you can request access details to register with the AdE from a local office, and then create your access point. If you have a SPID (Sistema Pubblico di identità Digitale) you can access the website using this means, which is much easier. You want to find section Cassetto Fiscale > Dichiarazioni Fiscali.

Do a check of your declared financial position! There is unlikely to be anything wrong in most cases, but you may just be the one who is paying more than you need to because of an incorrect code or misplaced figure. Do not leave the exclusive responsibility of your finances in the hands of your commercialista or fiscalista and if you are unsure of how to interpret the data in there then you can always ask for my help by contacting me on: gareth.horsfall@spectrum-ifa.com or call/whatsapp on +39 3336492356

Bonus and Superbonus Edilizia

I have been asked a number of times recently about whether I think the new Italian government will stop the current range of bonuses for doing work on your property and/or upgrading your white ‘elettrodomestici‘ goods. Well, I had written a long article explaining the hypothetical new arrangements that could be announced to begin in 2023, only to be usurped by the Italian government which have now announced how things will change for 2023, as I explain below.

My thinking has always been that they are likely start to phase the bonuses out rather than cull them altogether. But, I can’t see a long-term sustainable economic plan for the country with continued ‘Bonus Edilizia‘ at the current levels, particularly the 110% bonus.

Under the legislation brought in by Draghi the 110% Bonus would have been in place for the whole of 2023, after which it would fall to 70% in 2024 and 65% in 2025. For ‘ville‘ and properties which are classified as ‘unifamiliare‘ the bonus would only be available until the end of 2022. But this is Draghi legislation. He has now gone and the new administration want to put their stamp on things, hence the revised measures coming into force from Jan 2023.

So, the new measures announced last week are as follows:

1. The superbonus will be reduced from 110% to 90% from the 1st Jan 2023 for all condomini (buildings with more than one property).

For ‘unifamiliare‘ properties, i.e villa’s or standalone houses, the same percentage will be offered, as long as it is used on the ‘prima casa‘. However, a new measure for ‘unifamiliare‘ properties has been added. They will now also assess the ‘reddito familigiare‘ of the occupants of the property and reduce any bonus accordingly. The maximum income and formula for the reduction in bonus have yet to be announced.

Possible reductions/removals

No mention has been made as to whether the superbonus will still be available or reduced significantly for ‘seconde case‘. The proposals for the ‘seconde case‘ could range from anywhere between 50% to 65% or a complete removal altogether.

The other notable plan is that the Agenzia delle Entrate have been given more powers to ramp up the controls and investigations for bonuses. More paperwork requirements are expected to be demanded to ensure that the monies for the work end up in the hands of the people actually doing the work, at a fair price and not artificially hiked to exploit the bonus regime.

As for all the other bonuses for electric white goods, etc. It looks like they will be here to stay for the coming year/s, at the very least. (Ecobonus, Sismabonus, Bonus mobili e elettrodomestici, Bonus Verde, Bonus idrico, Bonus acqua potabile, Bonus Facciate, Bonus ristrutturazione, Bonus restauro, Bonus prima casa under 36, Bonus affitti giovani under 31)

The final details have not yet been ironed out and knowing the normal process for the Legge di Bilancio we may not know the final details until after the 1st Jan 2023.

Since the superbonus scheme started the Italian government have now paid (or are awaiting payment) of €51 billion of tax rebates. The objective is to reduce that to €31 billion for the period between 2023 and 2028.

For anyone looking to apply for the ‘Bonus Edilizia‘ right now, my suggestion would be to get your requests in and push the people who are making the application on your behalf to make sure that you qualify for the current bonus amounts. If not, you may find the amount you get back is lower than you had expected.

Have you made your ‘Folder’ ?

By Gareth Horsfall

This article is published on: 6th November 2022

I prefer to start an article on a positive note but unfortunately have to start with a sad event that happened recently in our lives. My wife’s grandmother died on the 8th October at the ripe old age of 94. She was very ill in the end and as it has been said many a time for people in her condition, that it was a blessing in the end. However, it is obviously a sad time for the family. I will remember her fondly. I knew her for 18 years and she was a very Southern Italian ‘Mamma’ type. Always keen for you to take more food from the table (resulting in my first few years in Italy coinciding with a 5 kg weight gain – I can’t blame it on her – my ‘golosità for good food was more to blame!). She was also a great support for my wife and I when my son was born and came to live with us for a period to help out in the house and provide much needed help at a tough time for all new parents. I also had a few run-in’s with her, but nothing serious. All in the name of a good healthy relationship. As I said, she will be sorely missed.

But as always, when a family member dies we are left with a number of bureaucratic and administrative hurdles which need to be dealt with. In Nonna’s case, there are various bank accounts, US social security and ‘succession’ issues which now have to be worked through. Hopefully it won’t be too complicated as Nonna had very little left in her name when she died.

This is not always the case and in fact my experience is that the deceased tend to leave quite a lot more bureaucratic matters than perhaps they would have wanted to, and certainly than the remaining family members would have wished for. But, we can make some preparations, in life, for the ‘inevitable’ and leave the best parting ‘gift’ possible for the remaining family members.

The following article is one which I wrote first back in April 2018 (https://spectrum-ifa.com/preparing-the-folder/) and since then I have shared it again on a few occasions. It seems appropriate to share it again with you now, especially since we are 4 years on since that date, we have all lived through Covid and faced with some interesting times ahead, so it would seem. (I have also made some updates to the original article to take account of changing technological developments). I hope you find it useful.

This type of article is never an easy one to write. Ensuring that your papers are in order in the event of your sudden death is incredibly important when living in another country. It will provide you with peace of mind that your loved ones will not have too much difficulty in administering your estate and your family will be eternally thankful that you did it for them.

The big problem is that as ‘stranieri’ we often have documents spread across multiple locations. The office, a house in another country, with family members and in that old box that no-one dares look in – papers that look like they came from the Victorian age in alot of cases. But whose job will it be to track all those down?

The purpose of this article is to outline a proven way of organizing ‘THE’ folder to minimise problems in the event of your death.

So what is ‘THE’ folder?

It is a single file (digital or physical – preferably both) where you keep all of your important personal and financial information together. It allows easy access to these documents in the event that you’re no longer around to help. It is really important to have it in place especially where one family member takes the lead with the family finances (typically one member of the household tends to dominate over money matters, but with the advent of shared technologies it is becoming more common to find that 2 or more family members are involved in the household finances). This includes paying bills, managing accounts and storing documents.

Is it worth the effort?

Yes, yes yes and yes. A time of loss can be stressful enough without having to try and piece together the deceased’s financial affairs. This can be a really difficult time. Don’t underestimate the kind of favour you will be doing to the executors of your estate if you have one place with all your financial and legal documents in an easy to understand format. You may not be around to hear their appreciation, but I can tell you, from experience, it will be eternal.

However, preparing ‘THE’ folder is much more than avoiding stress; if you leave behind an administrative nightmare you could delay access to inheritors’ access to funds and potentially cost a small fortune in legal fees.

According to an Independent financial adviser website in the UK (unbiased.co.uk – what is the probate process) the average time for probate to get settled is between 9 months and a year. In the USA the average time is also about a year. I also spoke to someone recently who confirmed that in their case it took over 1 year to deal with their parents’ estate.

So which is best…..physical or digital?

This comes down to personal preference, but I would always recommend both. Whether you choose to have a digital folder with all these documents in or not, you should at the very least have your documents scanned in case of fire or theft, and quite often companies will now accept scanned copies of documents instead of hard copies, if they can be certified or electronically signed.

With a digital file you can give access to a trusted individual who can access it in the event of your death. (Remember they will also get access during your life, so ensure they are a ‘trusted’ individual) A google file, for example, can be updated over time and which you and a family member have shared access to. This file can then be stored on your main computer, in the cloud or on an external hard drive. You can use a physical folder to keep all the same information together.

For what it’s worth, I decided to do both when building mine because my wife prefers paper and so is happier with hard copies of everything. I prefer digital. I have also shared the digital folder with some trusted family members.

So what should go in ‘THE’ folder?

Birth, marriage and divorce

- Personal birth certificate

- Marriage licence

- Divorce papers

- Birth certificate / adoption papers for minor children

Life insurance and retirement

- Life insurance policy documents, including beneficiary nomination forms.

- Details of any employer death in service benefits

- Personal pension documents (including any beneficiary nomination forms)

- Occupational / Final Salary pension details

- Annuity documents

- Details of any entitlements to state pensions

Bank accounts

- List of bank account numbers with account numbers, login details and passwords

- Details of any credit cards

- Details of any safety deposit boxes

(see my comments on passwords below)

Assets

- Property, land and cemetery deeds

- Timeshare ownership

- Proof of loans made

- Vehicle ownership documents

- Stock certificates, brokerage accounts, investment platform details and online investment account details

- Details of holding of premium bonds, government bonds and investment bonds

- Partnership and corporate operating/ownership agreements ( incl offshore companies)

The issue of which documents to throw away and which to keep is a common one. I always suggesting keeping everything if you are unsure

and then once a year with your financial adviser or legal professional have a clear out and keep the file tidy.

Liabilities

- Mortgage details

- Proof of debts owned

Details of gifts

- Dates and amounts / values (potentially helpful when calculating inheritance tax liabilities

(A word of warning here! If your estate is likely to be subject to Italian succession law on your death. [This might mean that you have lived in Italy for 10 yrs + before your death, as an example], then any gifts which have not been fully notarised may still make part of your overall estate and be subject to the provisions of forced Italian succession law. i.e the donee may have to give the money back and it be distributed between the rightful heirs according to Italian law, ‘should’ the beneficiaries request the funds.

Notarising gifts would normally need to be done where the benefits outweigh the costs of the action itself.

(Bear in mind that you will need to pay the notary costs of approx 5% on the value of the gift, plus any taxes and one off fees for the gift)

Income sources

- Making a list of all your sources of income, especially the ones which your family may not know about

Employer details

- A copy of your most recent tax return or accounts

Monthly expenses (so they can be continued after death or accounts closed)

- Utilities

- Insurance

- Rent / mortgage

- Loans

- Subscriptions / membership details

Email and social media account details

Essentials

- Wills / Testaments + details of the legal firm that helped create it, if relevant

- Instruction letter

- Trust documents

- Burial / Cremation wishes

- A copy of a living will, should you have ‘end of life’ instructions that you want medical professionals to be aware of should you be unable to communicate these due to severe illness or disability

Contact details

- List of names and contacts numbers for: financial adviser, doctor, lawyer/solicitor, accountant, insurance broker etc

How often should ‘THE’ folder be reviewed?

Firstly, it is sensible to note the date that it was last reviewed so that anyone using it has an idea of how up-to-date the details are.

Going forward, reviewing the file on an annual basis should be sufficient.

Online passwords

The issue of passwords has become infinitely more complicated in recent years because everything we access these days requires a password and it would be a full time job to document these and then keep them updated every time that one needed changing. There are now various Password Manager applications that you can buy to securely hold all your passwords. You can find some of the best HERE. However, if you are reluctant to use technology, which let’s face it could be hacked, then you are left needing to log all those passwords the old way…..writing them down!

And finally…

Be sure to tell someone about it. There is little point going to the effort of creating such a folder if know one knows of its existence or where to find it.

If you need help with putting your folder together or are unsure where to start then you can contact me for help on

gareth.horsfall@spectrum-ifa.com

or on my cell at +39 333 649 2356

Living in Italy

By Spectrum IFA

This article is published on: 24th September 2022

Italy’s parliamentary election 2022

I thought I would start this newsletter with a story of a recent trip to the market in Rome. As you will know, if you read this E-zine regularly, I go to the Mercato Trionfale for the weekly food shop. I like the experience, colours, sounds and chats in the market. I find that you also get a good idea of what is on people’s minds and how people are thinking in any moment. Obviously, the talk of the moment is not the Queen’s death (you may or may not be surprised to hear this) but of the upcoming elections in Italy. Both events are significant for women. Obviously, the Queen’s funeral is important because she seemed to be the glue that held the royal family and the Commonwealth together and we shall see how King Charles III gets on with that responsibility. Also, an equally important event is likely to be the election of Giorgia Meloni as first female prime minister of Italy.

Giorgia Meloni, for those of you in the know, is the leader of the Fratelli d’Italia party and is considered right wing. She is leading the polls with about 25% of the vote. Closely followed by the Partito Democratico (leftwing) with approx 21% of the vote. However, as is always the case in Italy, the parties need to form a coalition with smaller parties to gain a voting majority. Fratelli d’Italia have already announced their right-wing coalition with both la Lega (Salvini) and Forza Italia (Berlusconi). Together it is expected that they will garner about approx 45% of the vote. That is essentially a landslide in Italian politics and it is almost certain at this point that the ‘centrodestra’ coalition will be taking power shortly after the vote on 25th September.

The big worry for many is that Giorgia Meloni and Fratelli d’Italia have their roots planted in a fascist past and the feeling is that their policies will start to unravel years of democratic advancement in the name of equal rights and protection for women (which in Italy are still lacking in some many areas), gay rights, abortion rights etc. It was with all this in mind that I decided to follow Giorgia Meloni and Matteo Salvini on facebook this summer. To be honest, what I read wasn’t significantly alarming and to be fair to Giorgia Meloni she has dealt with all criticisms head on and opening encouraged discussion with her opposition, rather than just slurring them for being different. One particular instance was where someone got onto a stage when she was holding a rally and started a protest against her views on gay rights. She kindly invited the person to take the stage with her and explain their position so she could defend her own. Now, don’t get me wrong, I am no fan of Giorgia Meloni or any other right wing party in Italy but I would like to see more of this type of open discussion of differences of opinion and critical thinking rather than one side just spewing venom at the other because they have opposing views. Anyway, for someone who is a first-time voter in Italy (I gained citizenship in 2019 and so this is my first opportunity to vote in Italy) it has been an interesting journey so far. However, one other thing that piqued my interest, and I thought I would share with you here, is the centrodestra proposals to introduce a flat tax.

But, before I go into that, I will take you back to Mercato Trionfale for a moment. I wanted to tell you about the fact that I buy my eggs from the same stall, where oddly enough, he ONLY sells eggs! For as long as I have been going there (6 years) the eggs have been 35c for a ‘bio’ egg. After I arrived back from the summer break he apologised and explained that he needed to raise his prices. Now they are 40c a ‘bio’ egg. My initial reaction was whoooahh, an almost 15% increase in the price. But then I started to reflect on this whole inflation debate we have at the moment.

Quick thoughts on inflation

Obviously, prices’ rises are having a pretty big impact on our lives right now, and I don’t know about you, but I am anxiously awaiting my winter fuel bills this year. That aside, I was thinking that in the 6 years I have been buying eggs, this vendor has not increased his prices, not one cent.

In the financial planning world when I am looking at clients’ long term planning we always use a general rule of thumb of 3% inflation each year. Where do we get this figure from? Long term studies of inflation! Economists have looked at inflation over very long periods of time and established that bouts of inflation arrive in short periods, followed by periods of stable prices. If we think about the egg vendor and that he hasn’t increased his prices in 6 years, if he had done so using the 3% rule, then the price of his eggs should be more like 18% higher today than they were 6 years ago. This puts his 15% into context. Maybe we are not all that far off where we should be anyway. It’s just that when it arrives as a tsunami rather than a serious of small waves it tends to hurt a lot more.

My point is that prices’ rises are normal, and we have lived through an extended period of stability and low prices. With the significant debt creation events of the last 15 years (financial crisis 2008/2009 and more recently Covid), it is to be expected that inflation would return at least for a period of time, and even maybe rebalance to its long-term historic norm.

Flat Tax

OK, enough about inflation because I am sure that you are about as bored of hearing about it as I am. Important as it is, it doesn’t need ramming down our throats at every turn.

The talk of a flat tax rate of 15% has mainly been lauded by La Lega and Matteo Salvini; whilst the other parties have similar talk of flat taxes, there are some differences in the parties’ proposals. Let’s have a quick look at them here:

LA LEGA: A simple flat tax of 15% on all incomes. It has been calculated that this would blow a hole of approximately €50 billion euros in Italy’s public finances. Also, it is a highly unfair way of taxing people. Someone earning millions could get a 15% tax rate, in addition to someone earning €15000 a year. Clearly unequitable and favourable to the wealthier elements of society, not something I ever see coming to fruition.

FORZA ITALIA: A simple flat tax of 23% (equal to the lowest current band of income tax rates). It’s pretty much the same story as above, but instead would only blow a hole of €30 billion in the public purse!!

FRATELLI D’ITALIA: Their proposals, in my opinion, seem more do-able. Firstly, there is talk of introducing a ‘no-tax area’, which in other words would be a tax allowance on the first €120000 on income, extended to everyone. This would essentially model the UK style of taxation and is a model that I prefer. It favours the poorest in society and is a fair approach, in my opinion. However, that would come with a potential cleaning of the current system of detractions and deductions for medical expenses, vet’s bills etc. Who knows if the current system of bonuses for various home improvements will also be stripped back?

In addition, the idea is to a) (try not to laugh at this please) introduce an incremental flat tax system which will start at 15% (I have no idea what the difference is between progressive tax rates and incremental flat tax rates, but it sounds good) and then over time work towards a suitable flat tax rate, and b) tax income from properties and other financial assets at that flat tax rate of income tax .

Lastly, anyone who is currently working through a partita IVA ‘regime forfettario’ and is currently taxed at 15% up to income of €60000 pa, will have that ceiling raised to €100,000 pa.

There’s more!

Things do not stop there! One other interesting development is that according to an estimate in an article by Il Sole24Ore, Italians and Italian resident individuals have approx. €100 billion in assets and cash hidden in security boxes, either in Italy or abroad. I am not sure exactly how they come to this estimate and it certainly seems a large figure. The ‘centrodestra’ also sees this as another opportunity to try and bring these assets/cash home.

The proposal here is not a ‘condono’ (a kind of write off of any previous tax liabilities for a one-off tax payment, as it has been used frequently in the past), but to reduce the taxes on assets/cash by 50% for a fixed time period, to allow people to repatriate their funds and in addition apply a sanction of just 5% on the amount. This could be quite an interesting idea and for a number of foreigners living in Italy who have still not regularised their financial affairs, it could be an opportunity to do so rather than using the current system of fines and penalties that are significantly higher. The prevailing argument from the other side is that if someone is not ‘in regola’ with their financial affairs in Italy, then no financial benefit should be offered. However, rather than spending years of taxpayers’ money trying to find these hidden assets and cash, is it better to offer an opportunity to regularise them for a one-off payment? Who knows? The important thing is to get the money under the watchful eye of the Agenzia delle Entrate, no matter how you go about it, or at least goes the logic.

Let’s just start admitting the reality