I have been rather absent this summer mainly due to my change of residence from Rome to Umbria. Works are still going on at the house although now in their final stages and should be done by the end of Sept, which I will be very thankful for because quite frankly it’s all driving me a bit mad.

Finance in Italy

By Gareth Horsfall

This article is published on: 16th September 2024

Then of course, the work of getting the house and land in order will start and which will be much longer term. I still haven’t a clue what to do with the olive harvest, although after taking a tour of the trees the other day and given the very long hot dry summer this year plus the fact that the trees themselves have not been trimmed well in many years, it looks like the harvest would not be so great anyway, save a few trees which have produced quite a bit of fruit.

So all in all I am less preoccupied with that now and I may even take a weekend to have a go myself and see what happens… there is always a first time for everything! 😉

Saying all this, the thing that is driving me more mad is the fact that my long term rental car has now been playing up for over a year and I have had it in with the mechanic 6 times (yes, that number is correct !!) and every time within 48 hours the same problem arises. I am now going mad with LeasePlan about getting another car to which I cannot be promised a similar vehicle (which I need given the amount of Kms I do and also the types of ‘strade‘ I have to drive along). I think this fight is actually ageing me a lot more than the house renovations. Being without a car which functions properly is incredibly stressful.

Anyway, enough of my travails. Let’s talk financial stuff.

From €100,000 to €200,000

Firstly, a small mention of something that cropped up during the summer, and is unlikely to affect many of us, but Italy currently has a flat tax regime for high net worth individuals (did you know that by definition high net worth starts at €/$/£ 1 million of assets exc home?). In brief, there is the opportunity for those HNW individuals who wish to transfer their residency to Italy to pay a flat tax of €100,000 a year for a maximum of 10 years without the need to enter into the general tax system. This forfeit regime usually works out best for anyone who is earning a high enough income and would be paying over this amount in income tax. For anyone with invested assets, generally speaking, they could be organised in a way to not get anywhere near €100,000 in taxation, depending on factors such as how much one might need to spend each year etc.

Anyway, my point was that the Italian authorities have chosen to increase this flat tax to €200,000 pa. for new applicants (the effective date is not clear yet).

The interesting point about this was not the increase itself but the wording used by the Minister for Economy and Finance: Giancarlo Giorgetti. He stated:

“We [Italy] are against any type of competition to create the most advantageous fiscal regime for businesses or individuals, because countries, like Italy, that have a limited fiscal capacity would be disadvantaged and destined to lose”

From my point of view these are quite interesting words especially since Italy is now trailing other countries in the EU (Portugal) and the UK in pulling their fiscally advantageous tax regimes for high net worth individuals. So, is it only a matter of time before this flat tax regime is stopped altogether? I suspect it is.

Italy also has a flat tax regime for retirees moving to one of the southern regions in Italy. The possibility to pay a flat tax of 7% pa for a maximum of 10 years (with conditions!) Has this flat tax regime also got a ‘data di scadenza’? Only time will tell but certainly the direction would appear to be that preferential tax regimes are likely to have a limited shelf life, so if you are hoping to apply then it might be best to think about doing so sooner rather than later.

Other than this I didn’t really see anything other than the norm this summer. Financial markets have performed quite well this year to date, albeit more volatile in the summer months. I will be reporting more on that in further E-zines, but for now I wanted to share with you something I listened to on a podcast one day when I was ‘working the land’ one happy day in August. This topic rang true as we are now most of the way through a year when nearly 70% of the worlds population will have voted for new political leaders and the most important one is yet to come: the USA.

But I ask you to think about the following discussion I had with my mother in law recently when she explained to me that she had stopped buying goods from Amazon because she felt like she was funding big multinationals in their continued effort to destroy small businesses and making it harder for anyone else to compete in a fair market place. Whilst I admired her conviction, and actually agree with her 100%,I disagreed that Amazon were the actual proponents of this strategy and were in fact just a business trying to maximise profits and would use whatever legal methods (and probably use lobby groups as well) available to them to achieve that aim and if Amazon were in fact paying the same level of taxes and contributions as a small business owner then it would be much more likely that Amazon would have difficulty in continuing in its present form and small business / retail etc would perhaps thrive again. My point being that whilst purchasing less from Amazon will undoubtedly help your local businesses (and I do purchase more from local businesses than Amazon), it is unlikely to solve the wider problem as it is a political one which must be addressed.

So, whilst I was listening to this podcast there was a man called Lloyd Chapman speaking and he is the founder of the American Small Business League and had some pretty interesting things to say about small business in the USA.

I imagine that the facts and figures are roughly the same in the EU as those he quoted for the USA, but they did make me think twice about my own consumer patterns, which also leads us to our own investor behaviour.

So let me give you some of those interesting facts now.

How important are small businesses to the US economy?

* 99% of all US companies have less than 5 employees.

* 98% have less than 100 employees

* The average US company has just 10 employees.

* There are 33 million small businesses in the USA.

* Most of the innovation and R&D breakthroughs in the US come from small business.

These very same companies are responsible for over half the USA annual Gross domestic product, half of the private sector workforce, over 90% of the US exports and hence are responsible for over 98% of all new US jobs.

MOST AMERICANS WORK IN SMALL BUSINESSES

Bias of Government

Lloyd went on to point out that the federal government (and I would argue the European governments too) is all for big business. They introduced the small business act in 1953 which mandated that 23% of all federal contracts should go to small businesses, of which 5% would go to women owned businesses, 13% to businesses run by minority groups, and 5% to small businesses run and owned by Veterans. On this basis the small business act looks like the largest economic stimulus programme ever passed by Congress for the American people.

However, given that the majority of federal contracts are awarded to the Pentagon you would imagine that there would be a lot of auxiliary businesses providing services to the Pentagon itself, however, Lloyd explained that this is not the case and the small business act of 1953 has been largely repealed by the Pentagon over the last 20 years. In fact, the US government has, for the last 30 years, undergone a non-stop effort to close small business administration (local support offices for small businesses) and end all federal programmes for small businesses.

* Only 1% of businesses in the USA have over 500 employees

* But over 97% of federal spending goes to less than 1% of companies in the US.

* That 1% of federal spending has not created 1 NET new job in over 40 years (since the 1980’s) and dozens of these companies are not even paying taxes. The majority are Fortune 500 companies.

This is, in the words of Lloyd, a recipe for economic suicide.

Love, life and financial planning in Italy

By Andrew Lawford

This article is published on: 1st August 2024

A quick question for all Italian residents (whether you are DOC Italians or foreigners who have moved here):

Have you thought about your family situation and how Italian family law might apply to it?

The answer for many people appears to be “not really”, which may present something of a problem considering the legal consequences of various family scenarios. Italy used to be fairly simple in this regard, in that you were either married or you weren’t. If you were married, the situation was fairly clear, and if you weren’t, your “family” situation might have been somewhat tenuous.

I will explain better below, but first a brief disclaimer: this is a complicated field and each individual situation may lead to a different outcome. This article is intended to highlight some of the issues you may face but it cannot be relied upon as legal advice – I can help you to understand your own situation with the assistance of my network of legal and tax professionals. I am also not particularly concerned here with the dynamics of the legal relationship between parents and children – my focus here is on the status of the couple.

Italy has long had “forced heirship” rules which establish certain family ties that have the right to receive a given percentage of a deceased person’s estate. For simple family situations with uncomplicated assets, this may even mean that it is superfluous to make a will, because the intestacy laws already offer an adequate solution. However, “simple family situations” are now something of an exception to the rule. You might think, for example, that being in a de facto relationship qualifies as simple, given how the treatment of this type of relationship has evolved in many foreign jurisdictions to the point where there is little functional difference compared with marriage. Not so in Italy.

Italy is somewhat more traditionalist in its approach to family life and I don’t think it is an exaggeration to say that it has been dragged kicking and screaming into recognising modern family situations and, in particular, same-sex couples, who until relatively recently had no means of making their relationships official (de facto heterosexual couples did, of course, have the option of getting married – a right that same-sex couples continue to be denied).

Italy being Italy, the modern iteration of family law is complicated and requires action by a couple in order for there to be any kind of recognition of their status. Let’s take a closer look:

Marriage

For better or worse, marriage is still the gold standard of the family relationship in Italy. For reasons that will become clear below, there is no equivalent structure that confers the same level of family rights, some of which are as follows:

• automatic recognition of heirship for each spouse;

• right of the surviving spouse to continue living in the family home, even if that home was 100% owned by the deceased spouse;

• possibility to receive any Italian surviving spouse pension (pensione di reversibilità);

• possibility to enquire as to medical status of one’s spouse;

• reduced inheritance taxes for assets passing between spouses;

• possibility of child adoption.

Unione Civile

One tier below marriage is the Unione Civile, a possibility that has existed since 2016 and which allows two members of the same sex to declare themselves a couple in a similar fashion to a civil wedding ceremony. This confers most of the rights of married couples, but does not allow them to adopt children. Initially, it was intended for the Unione Civile to be available to all couples, but in the final instance it was reserved for same-sex couples. I’m not sure of the reason for this decision, but I imagine it has something to do with not wanting to undermine the concept of marriage, which remains an important topic for certain political factions.

Conviventi di fatto

Below the Unione Civile is the registered de facto couple (conviventi di fatto). This possibility is open to all couples but needs to be registered in your local comune – you will then have a residency certificate which attests to the status of your relationship. The benefits of registering as a de facto couple are essentially that the surviving partner has the right to inhabit the family home, but only for a maximum of 5 years. You certainly don’t automatically become your partner’s heir and there is no concept of family property (although you can stipulate in advance how to deal with your relationship property in the event of a separation). If you contrast this with the effects of marriage above, it becomes clear that this type of relationship isn’t equivalent to marriage in any legal sense.

Unregistered de facto relationships

The unregistered de facto couple, even if they have been together for decades, might as well not exist from a legal perspective, especially if the partners die intestate.

Forced heirship and foreigners

The issue of forced heirship needs a bit more explanation: it specifies certain individuals who cannot be excluded from your estate: spouses (even if legally separated), children and (in the absence of these first two categories) parents have a right to receive a given percentage of your estate. You will also always have a free portion of your estate that can be left to whomever you choose. The fact of forced heirship does not prohibit you from making a will leaving everything to the local dog shelter, but it does mean that these protected categories of people will be able to challenge your testamentary dispositions. For people without a spouse, children or parents, forced heirship is not a problem as the free portion of your estate is 100%, but you must of course make a will in order to guarantee that your desired heirs benefit under your estate.

If you are foreign, you may be able to insert a choice of law clause in order to allow your estate to be dealt with under the rules of your home country. However, the rules around this are somewhat complicated and you will need specialised legal advice to make sure you get it right.

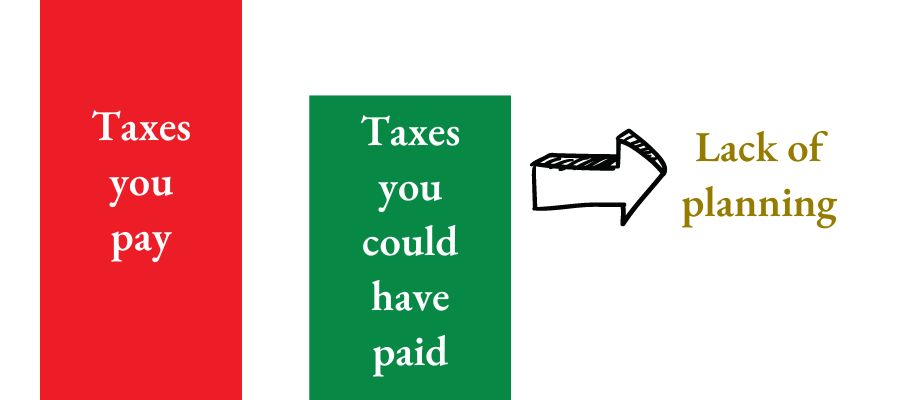

Don’t forget about inheritance taxes

You should also be aware that any inheritance tax exemptions accorded to spouses are unavailable to de facto partners, so under current rules assets left to a de facto partner would be taxed at 8% of their value (against 4% with a €1 million exemption for spouses).

Living Wills

Whilst we’re on the subject of inheritance and wills, another curious area that has evolved over the years is that pertaining to the expression of one’s desires when it comes to medical treatment. There have been some high profile and saddening cases of the medical profession in a pitched battle with the family members of someone who has had the misfortune of ending up in an irreversible comatose state.

If you would like to make clear your desired level of treatment in such a case, you can do so by using a living will (known in Italian as a DAT – Disposizione Anticipata di Trattamento). My wife and I tried to make living wills when we first married, but our notary refused to help us given the uncertain legal context at the time. The situation is now clearer, so we are in the process of sorting these out. If anyone is interested in how this ends up working in practice, send me an e-mail and I’ll be happy to help.

Where to from here?

If any of the above has struck a chord, then please do get in touch. Aside from helping to find a qualified professional to assist with your will, a general review of your assets and associated holding structures will ensure that you pay the least amount of tax possible during your life, whilst also directing your assets to the right people when you pass away. In particular, paying inheritance taxes in Italy is, for most people, a choice rather than an obligation, as they can legally be reduced to a bare minimum through intelligent estate planning.

British living in Italy

By Gareth Horsfall

This article is published on: 8th July 2024

In this E-zine I will keep things brief because house work is still ongoing from my end (hopefully completed by the end of July and moving into the new place on the 5th of August). The photo below was taken down the road from the property near a vineyard.

I know many of you already own properties near views very much like this one, or see equally beautiful sunsets, but I thought I would share this as my excitement builds!

Anyway, not wanting to burden you too much with my own personal matter, I came across a few things recently which I thought should be communicated to the British contingent amongst the readers of this article.

The first is an important announcement for anyone who is over 80 years old and a recipient of the UK state pension!

The Department of Work and Pensions is checking to make sure that everyone is still eligible to receive UK state pension benefits, and therefore requires that anyone over 80 years old, of any nationality, and who is drawing a UK state pension, complete a form and have a witness sign it before sending it back signed, in the post!. This is called a life certificate. This is a routine process with which the DWP update their records. (If you have already done this, then you do not need to do it again!)

The number of submitted life certificates so far is lower than the DWP expected and so it has extended its deadline to the 31st of July 2024.

** If the certificate is not provided, it could lead to suspension of UK state pension benefits **

If anyone over the age of 80 and receiving UK state pension benefits has not received a letter explaining this, or has not updated their address details, then the link to do so is here:

https://www.gov.uk/international-pension-centre

Anyone receiving or about to receive UK state pension benefits UNDER the age 80 will be contacted towards the end of this year, therefore you may like to check that the DWP have the correct address on file for you by using the same link above.

Please feel free to share this information if you feel anyone might be affected or just to spread the word.

Brexit – for the Italians it’s all wrapped up!

The next bit of news came from the Agenzia delle Entrate recently. Specifically their notifications page on the telegram app.. They regularly post the latest decisions taken re: specific cases submitted to them (intepelli) and also the latest announcements re: tax and various other bureaucratic measures.

The Italian government has taken the decision to close the ‘Punti Assistenza’ for both foreign investors looking to invest in Italy and also the ‘Info Brexit’ points of assistance. The reason for such a move is that they say they are rarely used. They go on to say, regarding the punto ‘Info Brexit’, that since the UK left the customs union, the Agenzia delle Entrate has provided clarification regarding most issues and hence is closing the Brexit information point.This may or may not be the case, but, certainly, questions remain and it looks like the Facebook citizens group ‘Beyond Brexit’ will be the last bastion of information regarding Brexit issues in the end. I would imagine that the UK Embassy will also be providing little to no support moving forward.

If you want to read the communication from the Agenzia delle Entrate, you can do so at the following link:

Confirmation of EU permanent residence

Charlotte Oliver, of Oliver and Partners legal firm in Rome, also put out a recent communication from the Ministero dell’Interno which has issued guidance to the Comune in relation to British citizens resident in Italy since before 31.12.2020 which marks the end of the Brexit transition period. The Circolare confirms that British citizens are still entitled to obtain a certificate of permanent residence from the Anagrafe (“attestazione di soggiorno permanente“).

In other words, as guaranteed by the UK-EU Withdrawal Agreement, British citizens continue to have the right to obtain a permanent residence certificate (as provided for in the EU Freedom of Movement Directive and article 16 of Italian Law no. 30/2007). British citizens are entitled to this certificate after 5 years of regular and continuous residence in Italy, registered with the Comune, even if part of those 5 years were after Brexit.

You can see Charlotte’s communication and the MInstero documents on her website, at the following link: https://www.oliverpartners.it/confirmation-of-permanent-residence-for-british-citizens/

A Sterling revival?

A nice piece written by Evelyn Partners, one of our asset management partners, was sent through to me on the 28th of June. It may interest you as it describes a possible revival in Sterling’s fortunes.

Some of you might remember the heady days of GBP:EUR (just after the launch of the EUR in 1999 and the uncertainty at the time) at €1.752 reached on the 3rd of May 2000. But, you may also be surprised to know that over the EUR’s 20 year history, the GBP:EUR exchange rate has averaged €.1.33. The lowest, €1.08, reached on 30th of December 2008 (financial crisis – right after the global crash) .

Due to Brexit and the political uncertainty, the average GBP:EUR exchange rate over the last decade has now fallen to €1.20.

So, why the potential revival?

Well, it may not surprise you to learn that it is all about the UK elections, the Labour win and the disastrous time under the Conservatives. (Theresa May, Covid lockdowns, rising energy prices and Liz Truss’s short-lived government).

It would seem that Labour is very likely to try and realign the interests of the UK with its nearest neighbours and Labour may try and negotiate new agreements with the EU to ease trade and the share of technology and other areas. The EU may be interested in the UK’s military equipment and intelligence capabilities, given the ongoing events in Ukraine. The UK may also decide to align with the EU market on food and agricultural products, which may maintain smooth customs arrangements for import and export, but it might be a sticking point because it may mean that the UK becomes a rule taker again rather than rule maker.

Also, the longer the UK remains non-aligned with the EU, the more its businesses are adapting to other foreign markets. The US is now the UK’s biggest customer regarding service led businesses. In reality, though, the service sector is unlikely to interest the EU anyway, because they are able to continue to take away valuable services based businesses from areas which had previously been monopolised by the UK.

This may all be rather positive for the GBP: EUR exchange rate of course, but a lot depends on to what degree Labour will be able to negotiate closer ties to the EU, without breaking the Brexit red lines.

If you are interested in the wider article, you can find it at the link below:

https://www.evelyn.com/insights-and-events/insights/get-ready-for-a-sterling-revival-under-labour/

I have for years now been advising clients to retain any GBP holdings in the currency and invest likewise. It is my long term view that a single country like the UK, will have the ability to develop its markets and economy more dynamically and quicker than a bloc of 27 states who need approval from each (in most cases) to make decisions for the bloc. I am not anti EU by any means, but the political environment in the EU is such that it does not bode well for long-term economic stimulus and development. This will always be a drag on the EUR versus other currencies, and particularly now with the situation in Ukraine and long term inflationary pressures. That all being said the UK will need to go through some soul searching to determine it’s future direction, which may or may not lead to a Sterling revival.

Long-term productivity figures seem to imply that GBP:EUR should be at a natural rate of around 1.2 to 1.25 but that does not take into account political cycles and significant economic events such as Brexit. Markets like stability and until that returns sterling will probably still be in for a volatile ride.

I will be back with more information, musings and ideas when we are installed in the new home, after August 5th, but if in the meantime you would like to discuss any tax or financial planning related issues in Italy then please don’t hesitate to contact me as I will working through the summer.

Moving to pastures new

By Gareth Horsfall

This article is published on: 3rd June 2024

“Nothing is constant but change”

– Heraclitus

(“One cannot step in the same river twice”)

You might be wondering why I have started this E-zine with one of my favourite quotes? Well, you may or may not know that I have been living in central Rome for the last 20 years of my life, between Trastevere, Campo dei Fiori, the Pantheon and for the past 8 years in Prati. I feel like I have been living a real Roman Holiday!! This is also my 50th year on this planet (how time flies) and I will be celebrating my birthday at the end of July.

Some of you may know that I whilst I do love Rome, I have become a bit of a moaning bore about the city of late. The tourism since 2019, and especially after Covid, has gone crazy. The city has always been pretty disorganised and dirty (the lack of respect for the city drives me mad!) but I have put up with it because I get to live in Rome!

However, in the last few years I have been yearning to get out into pastures new, somewhere with greenery and birds tweeting in the morning rather than the sound of traffic and wheely trolley tourism (a term coined by a client recently, one which made me laugh a lot because it’s so true – thanks Bec!).

There was always the possibility of moving out of the direct centre of Rome, in a more quieter area, but the areas we would like to go are either too expensive or badly connected and so choosing to lead a life stuck in traffic or up to my eyes in debt didn’t seem so appealing.

But the city angst was always about me rather than my family. My wife is a self confessed city girl and she can’t imagine a life without cinemas, theatres, restaurants and bars on the doorstep. My son, at 14 years old might have trouble if he were to relocate from Rome, but he is finishing terza media this summer and so Heraclitus might be right with the timing.

I had actually told my wife a few years ago that I could see myself living in Rome until I reached the age of 55, and when Alexander turned 18, then I would need to move out of the city and into the countryside somewhere. She wasn’t convinced back then to which I replied, ‘well that’s OK. You can have a small place in the city and I will have a small one somewhere quieter and we can meet up in the middle’. That’s been a kind of running joke because we did actually try and make a break for it just after Covid when we found 2 properties we liked in and around Cortona and made offers on each, only to be rather disappointingly used to bump up offers for other prospective buyers.

Anyway, that put us off the move and it worked quite well because my son enrolled in a school in Rome and my wife got a job at the Chicago Loyola University of Rome as the lead psychologist/wellness person.

However, my dreams of living outside Rome did not quell and I found that Facebook has loads of properties in the country for sale if you join enough groups and click enough links. The power of social media being that when it knows what you are interested in it just starts firing lots of options at you. The ones I liked I would send to my wife who, I joked would, in a very ‘Tinder dating’ kind of way ( not that I have ever used Tinder I might add !) swipe right for no and swipe left for yes. In about 2 years I don’t think there was even one left swipe but there was engagement and that was the thing.

Fast forward to Thursday 9th May 2024 and I finally achieved my goal and in fact we signed the ‘rogito‘ on a house in Amelia, Umbria ;about an hour north of Rome on the motorway. A property which is independent (no more condominio problems) and is surrounded by its own olive grove and fruit trees.

I have to recount the story about the olive trees though! I have never held great aspirations to do the raccolta delle olive although I can’t deny that having your own olive oil must be a great thing, I have to admit it looks like a lot of hard work. So, the property we bought, with 140 olive trees, seemed attractive because the owner had an agreement with a local coperativa who tended the land, did the tree cutting and did the raccolta but took half the oil and gave you the other half.

Now, that sounded like my kind of arrangement! Then 2 weeks out from the rogito we were told that the coperativa no longer want to do it because they have enough land to deal with already.

So Oct/Nov 2024 could be an interesting time! That being said if you are looking for oil you know where to find it!

One of the old ‘secolari‘ olive trees on the land, probably a few hundred years old.

Thankfully I made friends with the neighbour who is a farmer and he told me not to worry as he knows loads of people he can ask who will help out.

I love the countryside already!

On the subject of olive trees they have also given me a great opportunity for work. I had decided in 2024 that I was going to start doing more video content and just putting out short video content of subjects that come up regularly and which I could talk about quickly and then upload to either Youtube / Instagram or other social media platforms. One of my issues with doing these videos is that I like to be out of the house when I do them. I hate just sitting in front of the computer and doing a video, instead I prefer to be out in the open space and talk, walk, stand…whatever takes my fancy.

But, I have one slight handicap: for some reason I just can’t seem to do my videos when I have people looking over my shoulder or listening in!

I like a bit of peace and quiet (I would make a rubbish influencer!).

But, the olive trees have now given me the best back drop ever (they also don’t talk, although they may listen!) and I will be relaunching my videos with this following logo.

So, as per most properties in rural Italy it needs some work and is currently undergoing building and ripristino work. Structurally the property is sound and so it just needs bathrooms doing, walls painting and bringing up to date as it was last renovated in the 1990’s, that being said it does hide a magical jewel. It’s own very private, yet consecrated catholic chapel.

We are told that underneath the more modern exterior of the house there is an old church from the 1600/1700’s which the local monks used to pass by and pay penitence at the windows of the chapel. The knee imprints can still be seen in the travertino stone underneath the windows. A beautiful story to uncover in time.

Lastly, the exciting thing for me is the land that comes with the house. Finally some green! No more staring at cement and tourists. I must say that although I do love Rome (resident population 2.8 million, expected tourist numbers in 2024 -19 million, expected tourist numbers in 2025 [Giubileo Vaticano] – 35 million), based on these kind of numbers it seems to be the right moment to go.

Of course our Italian friends are horrified and jealous at the same time. They admitted that they would be petrified to live outside the city. That living in amongst the neanderthals, ogres and in the great unknown which they only visit en-mass on Sundays when they want some fresh air and when everyone else is going – safety in numbers – is a big no-no. Yet, some of them have openly wish they had done it themselves and they would have loved to try a similar life. For us, its probably not a forever place, although I am sure it will grow on us and we will never want to leave but we understand that life throws curveballs at you and never say never. For now, its a long term project to bring the land back into the shape and for me to save 4 old ‘secolari’ olive trees which I discovered the other day all covered in ivy and with other plants growing all around them.

I know this E-zine is a little bit off my usual subject but I wanted to write to explain why I have not written an E-zine in the last month or so and to share this journey and excitment with you. Getting the bank to agree a mortgage and then agreeing terms with the ex-owner was, as it always is in Italy, a stressful task. I am now following workmen which is equally stressful but I am determined to keep an eye on them like a hawk, and hopefully learn a few things in the meantime. And so we can move in July, when planned.

It goes without saying that once set up fully (probably after the summer) that you are more than welcome to visit and see the place for yourself if you are down this way, meet for work purposes or just to pop in and say hello. I would be more than happy to see you there. I will be with my new fast Starlink internet connection and so be connected although in the blissful countryside, for those who can’t make it in person but who would still like to hook up online.

For now, I hope you enjoy the fotos and I will be in touch again soon with more financial and tax planning ideas for your life in Italy, and small updates on the state of the house.

If you want to know more about me or the things I do then just click here

Tax deductions in Italy

By Gareth Horsfall

This article is published on: 8th April 2024

I hope you had a good Easter and didn’t eat too much. I took a break with the family to go and visit some friends in a Hotel on Lago di Garda during the Easter period. We had a great time even though it rained every day that we were there. That being said I got to see a few nice towns and learn a few new things.

We stayed just outside Bardolino, but also visited briefly Lasize. Lasize, I discovered, was the first comune in Italy. Apparently the King of Lasize in 983 a.c decided to concede the management of the town to the local civil authority, an interesting fact, I thought. We also visited Sirmione, which I know of because of the vials of sulphuric water which we used to put in a nebulizer for my son when he was a baby to clear his airways during the period of the winter cold.

Lastly, we visited a place called the Vittoriale degli Italiani, just outside the town of Salò. (https://www.vittoriale.it/). Salò was the last fascist town in the whole of Italy and the Vittoriale appears to be a tribute to that fact. It was, also, the home of the poet and soldier Gabriele D’Annunzio and a tribute to his heroism during World War I.

I can say that I am not a big fan of fascism, but it was very interesting to visit and certainly an unexpected and eye opening trip down Italy’s recent past. All of this whilst I started the book ‘The General and his Labyrinth’ by Gabriel Garcia Marquez, about Simòn Bolivar and reflections on the end of his life after the liberation of South America from the Spanish.(I think I may need another holiday after all these cultural learnings!)

Anyway, talking of fascism, it leads me nicely onto the subject of today’s E.zine: Tax and tax deductions!

I am not sure if tax authorities can be considered as fascist but certainly they fit the description in many ways:

‘An ideology and movement, centralized autocracy, militarism, forcible suppression of opposition, belief in a natural social hierarchy’

Joking aside, they do tend to operate with an iron fist and as I have mentioned on many occasions it is imperative that incomes and assets etc are declared properly and within the right time. That being said, in Italy we do get the possibility to utilise the system of detracting and deductions from income which can sometimes help to reduce our overall tax burden each year.

In this E-zine I will summarise the main ones (please be mindful of the fact that there are specific details related to each category and so I would recommend you check the link to the CAF at the bottom of the email if you are interested in any specific area).

Also please note that if you are on a forfettario tax regime in Italy, ie. 100K flat tax, 7% pensionato or partita IVA forfettario etc, then it will NOT be possible to deduct any of these expenses from your income!

But without further ado, here is the list of deductions which you might be interested in:

Medical expenses of any type: (generic, specialists, surgical, pharmacy, etc) can deduct at 19% of the total annual cost which exceeds the excess/deductible of €129,11. You need to add all your expenses together and deduct the €129,11, 19% of the final amount can be used against tax; if the cumulative amounts do not exceed the €129,11 then no deduction is allowed.

In the expenses calculation you may also include those which have been reimbursed by insurances (personal or corporate).

If your annual expenses exceed €15493,71 it is possible to spread the deduction over 4 years in equal parts.

(The deduction system, without limit of the amount over €129,11 would apply for anyone with special assistance needs e.g. car accident victim).

(Expenses of family members who are ‘a carico’ also qualify).

To use the deductions system, you must be in possession of the relevant documentation that certifies the expenditure i.e. invoice, receipt, quietanza etc. Your receipt should always show the nature of the medicine / treatment and include your codice fiscale.

***When you buy something at the farmacia with your tessera sanitaria, and it is a qualified medicine, then it is automatically registered with the Agenzia delle Entrate. This does not mean that you no longer need the ‘scontrini’. Your commercialista is required to ask for the evidence of purchase to match up with the payments received by the AdE***

Mortgage Interest relief:

For a mortgage on a ‘prima casa’, 19% of the annual mortgage interest and relevant charges, up to a maximum of €4000, can be used as a deduction. Prima casa is defined as the house where you or your family permanently reside. The individual using the detraction needs to be both the ‘intestatario del mutuo’ and owner of the property.

19% on the costs of the real estate agent when buying a prima casa (or rights linked to real estate such as ‘usofrutto’): for an expense of no more than €1000. i.e. max detraction €190, the expense must have been paid by the person requesting the detraction and confirmed as such in the contract of purchase.

Insurance premiums:

19% on the total costs of insurance policies ( Italian and overseas), as detailed below:

- Maximum total annual premium of €530 for life and accident, and non self-sufficiency type policies

- For insurance contracts covering death and permanent disability and long term care, the maximum premium total is €1291,14

- For insurance contracts covering individuals with serious disabilities, on risk of death, the maximum premium total is €750

Schooling (non university):

Nursery, primary or secondary school (private or public school) a maximum of €800 expenditure on which the 19% will be calculated i.e. max amount detraction €152 pa.

Private university education costs:

| Nord | Centro | Sud e Isole | |

| Area Medica | €3,900 | €3,100 | €2,900 |

| Area Sanitaria | €3,900 | €2,900 | €2,700 |

| Area Umanistico-Sociale | €3,700 | €2,900 | €2,600 |

| Area Tecnico-Scientifica | €3,200 | €2,800 | €2,500 |

There are other conditions, such as how close the family home is to the university which the student is attending, so it’s worth checking out the rules. The above table gives a rough idea of the kind of amounts that can be deducted depending on where the university is located in Italy.

Funeral expenses:

19% of maximum annual expenditure €1550 i.e. (maximum detraction of €294.50).

The invoice needs to be in the name of the person making the payment and paid via traceable means (not cash). Equally the name on the invoice must have a direct family relationship to the deceased.

Sporting activities for children aged between 5 and 18 years old:

19% on a maximum spend of €210pa i.e.€40 detraction .

Veterinary bills:

19% on annual expenditure between €129,11 and €387,84 i.e €49 – 19% of €258pa.

The deduction is for the person listed on the fattura and does not have to be the owner of the animal, therefore, for a couple it makes sense that you both pay at least once if you have significant veterinary bills for the year.

Cost of rent (based on income):

a maximum of €300 if your income is below €15493,71 and €150 if your income is between €15493,71 and €30987,41.

There are differences for those who are renting from an organisation rather than private individual, under 35’s, people who transfer their residence to another comune more than 100kms from their current home and also students who study at a university away from comune of residence. Check details with your commercialista if you think they might apply to you.

Costs of public transport:

as of the 1st Jan 2018 it is possible to detract 19% of the costs of an ‘abbonamento’ for local, regional and interregional public transport, up to a maximum spend of €250. This limit also applies to the family, if there are more than 1 ‘abbonamenti’ but cumulatively no more than €250 in total.

Bonus for construction work on your home:

I won’t go into detail here as the terms seems to change regularly. However, you can obtain details by doing a google search or speaking with a geometra /architetto etc…

Bonus ristrutturazione: 50% on a maximum spend of €96000 deductible from income over 10 years.

Bonus risparmio energetico: 65% deductible from income over 10 years depending on the type of work you are doing

Sismabonus: 50% on maximum spend of €96000 deductible over 5 years if you live in seismic area

Superbonus: see link below for details:

- Bonus mobili e elettrodomestici: 50% on a maximum spend of €5000, deductible from income over 10 years (only available until 31st Dec 2024)

- Bonus Verde: 50% on maximum spend deductible over 10 years (only available until 31st Dec 2024)

- Bonus barriere architettoniche: 75% the maximum depends on the type of work being performed (only available until 31st Dec 2025)

If you think you might be eligible for any of the bonuses named above, please check the details and do sufficient research or take professional advice before starting work to ensure that you are eligible for the deductions.

Pension deduction:

you can deduct from total income the contributions you make to a personal pension plan (previdenza complementare), in any calendar year, up to a maximum of €5164.57.

These are the main ones which apply to most people, if you want the full list then you can refer to the CAF website (from where I took the details) as it provides a good resource. The link is HERE

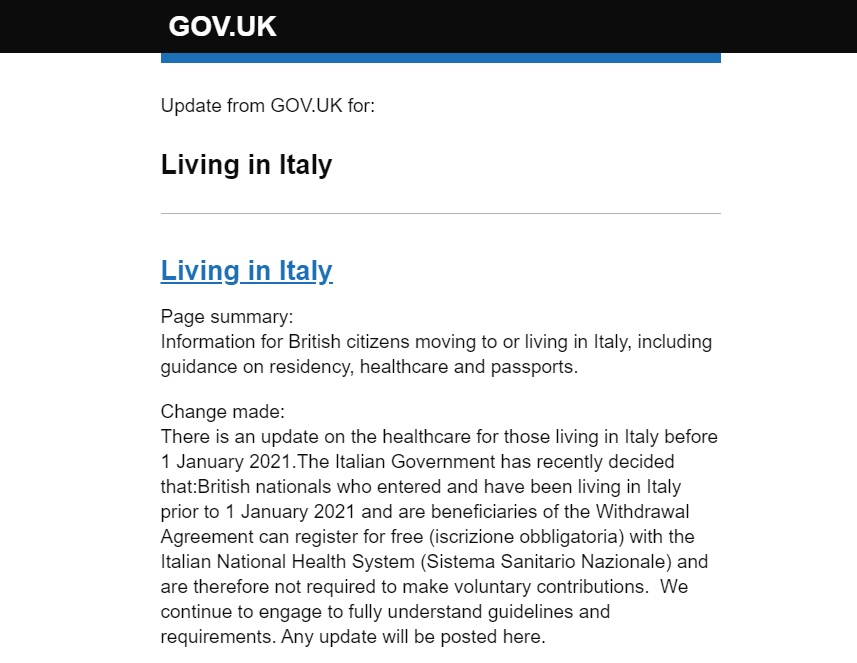

It would appear as though my timing was off slightly regarding my last E-zine, specifically in relation to the payment of the €2000 voluntary contribution to the Italian healthcare system. Two people contacted me to say that the UK Embassy website updated their website about 12 hours before my E-zine was released which I had not yet seen. The text was as follows:

As is often the case with communications of this sort it often throws up more questions than answers and so I will wait for further clarification on the issue, but at the very least, I think it can be assumed that any Brit registered in Italy before 1st January 2021 will not be paying any more than they were before for access to the health service in Italy.

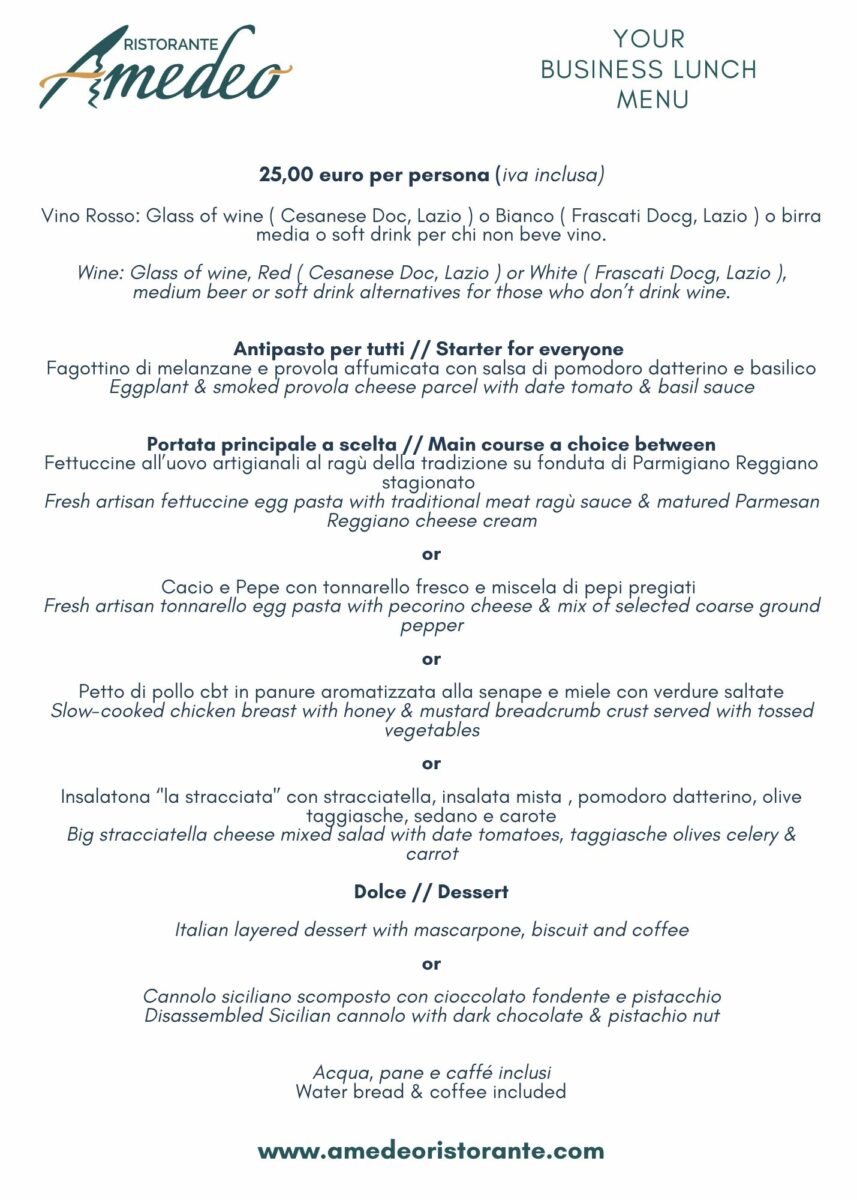

Don’t forget the Rome Business Lunch!

April 12th at 13.00

Ristorante Amedeo – nr Roma Termini

⬅️ Click on the logo below for full details.

The lunch is open to anyone, and is more about connecting people than just ‘touting for business’. People from all walks of life come along, from UN retirees, yoga teachers, online networkers, lawyers, real estate agents, English teachers, and people who just want to connect and make friends. So, if you are in Rome and would like to come along then please do so. Just please give us a few advance days notice so we can book you a place.

If you have any questions about any of these issues and how they apply to you and your financial situation, or if you think that you might be paying more tax than need to then do get in touch and I will be happy to see if I can help you with your plans.

I can be contacted on email: gareth.horsfall@spectrum-ifa.com or on cell: +39 333 6492356

You can now follow me on:

Financial update Italy 2024

By Gareth Horsfall

This article is published on: 9th March 2024

Hello again and welcome to my latest article (which was supposed to be released in February but has now ridden over into March 2024).

My delay was caused by some new found success recently as a star of YouTube (the use of the term ‘star of You Tube’ might be stretching it a bit, but I will leave it for now).

You may have seen the interview I did (you can see it again HERE) for Real Expats in Italy channel .

It has taken my name a little bit farther and wider that it had been previously and created a surge in new enquiries and queries, which I am very grateful for. It’s always nice to be introduced to new people and learn more about how people are living in Italy. The more I understand the more I can hopefully pass back to you through this E-zine. Anyway, hence why the E-zine is a bit later than usual.

There were a few things I wanted to report in this E-zine, non more so than the € 2000 flat fee charge for access to the Italian healthcare system for non-EU citizens resident in Italy (this doesn’t include students or those who are working and paying ‘contributi’ or those of you who have the S1 approval for reciprocal healthcare). You may remember from a previous E-zine ‘BIG ITALIAN TAX NEWS‘ from October 2023, that I had reported on the fact that this law was going to come into place on January 1st 2024. Well it did!

The interesting thing is that the financial impact is very different for varying groups of people. For example, I was speaking with a lady from New York recently and when I explained that she would have to pay the annual charge of €2000 to access healthcare (excluding doctors visits and prescriptions), her response was “well, I am paying $2000 already……each month!, so that would be a huge win for me”! Clearly when put into context of what people have to pay in the US for healthcare it seems a bargain.

The category which seem to have been caught out are the UK citizens resident in Italy pre-Brexit and who were accessing the healthcare system based on income criteria. (See the income calculation on the Ministero della Salute website link below). This still applies for EU citizens moving to Italy and wanting to buy into the healthcare system.

https://www.salute.gov.it/imgs/C_17_pagineAree_2522_listaFile_itemName_0_file.pdf

I was contacted by 2 people in late January to tell me that their local health offices were now asking for the full € 2000 pa. payment to renew their Tessera Sanitaria. They were not recognising the fact that they were UK citizens covered by the UK / EU withdrawal agreement. To be fair to the Italian authorities nothing was mentioned in the text stating that there would be an exclusion clause for UK citizens resident pre-Brexit, so it’s no surprise they were asked for the full amount. I asked some people I know who are still involved in the campaign to protect UK citizens rights post-Brexit and they could only tell me that the issue had been lodged with the UK Embassy, but that they had not heard anything back. I am not sure if that situation has changed but it may just be one of those cases where we just have to learn to live with it.

Alderney; Andorra; Anguilla; Antigua e Barbuda; Dutch Antilles; Aruba; Bahama; Bahrein; Barbados; Belize; Bermuda; Brunei; Costa Rica; Dominican Republic; United Arab Emirates, Ecuador; Philippines; Gibraltar; Gibuti; Grenada; Guernsey; Hong Kong; Isle of Man; Cayman Islands; Cook Islands; Marshall Islands ; Isole Vergini Britanniche; Jersey; Libano; Liberia; Liechtenstein; Macao; Malaysia; Maldive; Maurizio; Monserrat; Nauru; Niue; Oman; Panama; Polinesia Francese; Monaco; Sark; Seychelles; Singapore; Saint Kitts e Nevis; Saint Lucia; Saint Vincent e Grenadine; Taiwan; Tonga; Turks e Caicos; Tuvalu; Uruguay; Vanuatu; Samoa.

I mention this because a few people have contacted me recently who have had, or are having, an ‘expat’ professional career often working in places like Hong Kong or the United Arab Emirates and have accumulated assets in those jurisdictions; mainly investment portfolios and savings. In addition, it is not unusual for someone working overseas to invest/save in an offshore territory like Jersey or the Isle of Man as a way of retaining assets in a more familiar jurisdiction whilst living abroad. However, a subsequent move to Italy would mean that you would end up paying double the amount of wealth tax, and not only. In addition, Italy penalises some assets which are not held within the European regulatory framework so you could end up getting a double whammy tax bill when it could quite easily be avoided by re-structuring assets in a more tax efficient manner for Italian life.

As a US person moving to Italy to live, you can’t escape your own level of tax complication. The main one being that the US penalises you for owning some non US-domiciled assets but Italy does almost the same for investing in non-EU harmonised assets. Caught between a rock and a hard place! Again, a restructuring event might be the best way forward.

For anyone (UK citizen or any other national) who has contributed to a UK SIPP (Self Invested Personal pension) we now have a little more clarity on the tax treatment of the pension account. On 11th January, the Agenzia delle Entrate published an Interpello (opinion on a tax question submitted to them) specifically on the subject of this type of account. You can read the document HERE (interestingly, US retirement accounts (IRA’s) are pretty much the same legal structure as a UK SIPP and so it would make sense that the same logic is applied to them in Italy, as well).

The document pretty much confirms what I have known and been advising clients and commercialisti for some time. The first thing being that the Italian ‘previdenza complementare’ tax regime cannot be applied to these accounts, but equally neither should the wealth tax be applied to this kind of retirement accounts.

If you have any kind of UK personal pension account then I would suggest you take a look at the section RW on your Italian tax return and see if the wealth tax has been applied. The tax will be shown in the box No 15, and it should not be there! If you find this is the case you need to speak with your commercialista. Instead the box No 20 should appear with an ‘X’, in it which applies the ‘monitoraggio’ status, but not taxed. Also, do not assume that because wealth tax is not applied that it does not have to be reported…it does. It’s just that it is monitored as an asset rather than taxed on the fund each year. You will normally be subjected to tax when you make a withdrawal from the account. If you are unsure what to look at, then you can always contact me and I can take a look for you.

Tax declaration time is rapidly approaching, commercialisti are starting to be run off their feet and mistakes can be made so if you are invested in a UK personal pension plan (individual or corporate), a SIPP, or a QROP’s, then check your tax return for accuracy and ensure that you are not paying tax that you shouldn’t be paying!

On a final note for this E-zine, I wanted to let you know that I will hosting another Rome Business Lunch on April 12th 2024 at Ristorante Amedeo (nr Termini).

On previous lunches we have had people from all walks of life, not just business people. Also some retirees or people running many different activities. Most found it incredibly interesting and useful to connect with people who they may not have otherwise come into contact with in the Englsih speaking community. It’s a great way to speak with people who are providing services in a non-pushy, informal manner.

I give everyone a chance to speak and introduce themselves.. If you run a business you can explain to the group what you do, and if you are along to listen to others and gather information you can just explain why you are in Italy and tell us a story about your life. I have found it to be a great way to connect with others, for many reasons, and not just business people exclusively. The €25 a head menu is shown below for your information. So, I hope you can join us. All you need do is to contact silvia.loi@spectrum-ifa.com and let her know that you would like to be added to the list. (You need to book no later than Tuesday 9th April)

In my next article I will be looking at the subject of the expenses that you can detract from your taxes in Italy, such as medical expenses. So stay tuned for the next edition!

If you have any questions about any of these issues and how they apply to you and your financial situation, or if you think that you might be paying more than need to, then do get in touch and I will be happy to see if I can help you with your plans.

I can be contacted on email: gareth.horsfall@spectrum-ifa.com or on cell: +39 333 6492356

Tax planning in Italy 2024

By Gareth Horsfall

This article is published on: 3rd February 2024

I am back from The Spectrum IFA Group conference 2024 which this year was held in Budapest. I have been to Budapest before but had forgotten just how interesting the city is.

Getting there was relatively easy enough from Rome: Ryanair to Budapest. Getting back was logistically a bit more difficult, needing to re-route through Prague on a Friday afternoon, creating a 4 and 1/2 hr round trip. This I found quite strange. On a Friday there weren’t many flights going from Budapest to Rome. There was one that returned at some ungodly hour, but I preferred to get home earlier so took the alternative route.

Ryanair is always a variable experience for me. The big panic is always how much your bag weighs and if your hand luggage will fit in the container, because you are never sure who is going to ask and if they are going to be pedantic about the rules, or not. In my case I had packed to perfection on the way out so there was no question, but my main bag weight limit was right on the nose of 20kg. My carry on bag, quasi empty.

At these conferences we always come away with some notepads or useful items and inevitably I have to think how to pack these things. I didn’t really want to lug my carry-on full of things and run the gauntlet of the lady at the gate asking me to check the size of my bag. So, I chose to overload my main bag and take the chance.

At the Budapest end all went smoothly as my bag weighed 21.3kgs on their scales and I guess they used some discretion that my main bag was empty and so the extra could go through. Going through Prague airport was a different story. There, interestingly, my bag weigh 23.4 kgs (which was probably more likely!) so I didn’t argue that point. However, I got the Ryanair agent who went by the book. At this point I tried to argue that my carry-on was almost empty and I could just move some things across, but the overall weight would be the same, so what’s the difference? As you might imagine that didn’t work. He did offer to allow me to move to the side and unpack my main luggage and put some things in my hand luggage. I just couldn’t stand it, so I just agreed to pay the extra fee. We were talking 2kgs at the most and I didn’t have the energy to start unpacking and packing again in front of a queue of people. What a pain! Anyway, I guess I should be happy that I managed to at least survive the Budapest side without issue.

So why am I mentioning all of this? Well, one of the main themes of the conference was Artificial Intelligence (AI) and the impact it will have on our lives in the here and now and the not so distant future. The question is will Ryanair become more consistent when they inevitably use AI in their booking procedures, or maybe they will just continue, for some time to come, with their current form of ‘intelligence’ instead of the artificial type? Knowing Ryanair, it won’t take long to find out.

Talking points for 2024 and beyond

Anyway, enough about my travel woes and onto some of the talking points raised and ideas for the future which I learned from The Spectrum IFA Group conference 2024.

A quick look back at the markets – 2023

You may have noticed by now that there was a slight rally in the stock market towards the end of 2023. What you may not have noticed was that it was heavily concentrated in one specific sector: TECH! However throughout the year there were some other more interesting developments which caused market volatility during the year.

AI

The hype around AI started driving up markets early in the year. I am sure you know the hype by now: AI will take over the world, humans will become batteries for electricity generation, we are all going to lose our jobs and be replaced by machines, it will be impossible to speak with a human again etc etc. Well, let me put your mind at rest, none of the above are true….at least for now.

(MIT in the USA think that AI is unlikely to replace as many jobs as we think and even those that it does, it will probably not do the job as well as humans. https://fortune.com/2024/01/22/ai-jobs-humans-cost-mit-study/)

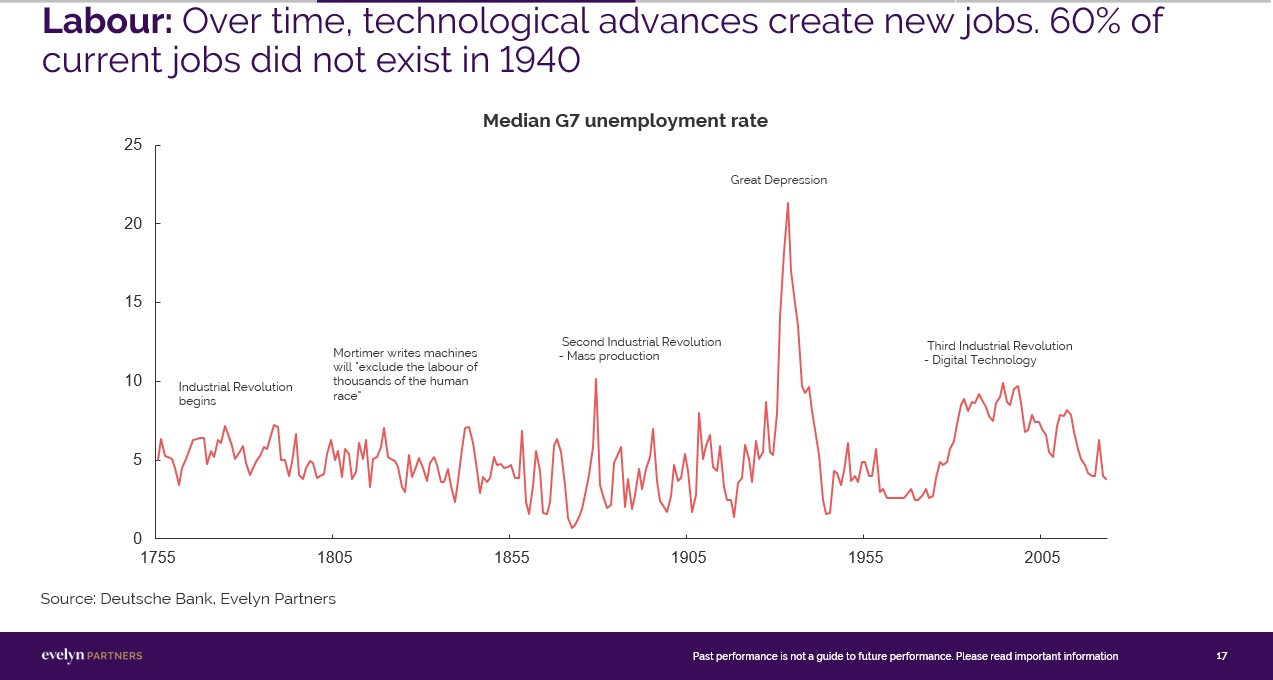

If you don’t believe me then take a look at the following slide, courtesy of Evelyn partners, which shows the G7 median unemployment rate going back to 1755! Whichever jobs are displaced by AI will likely be created in some other field, of which may not even exist yet!

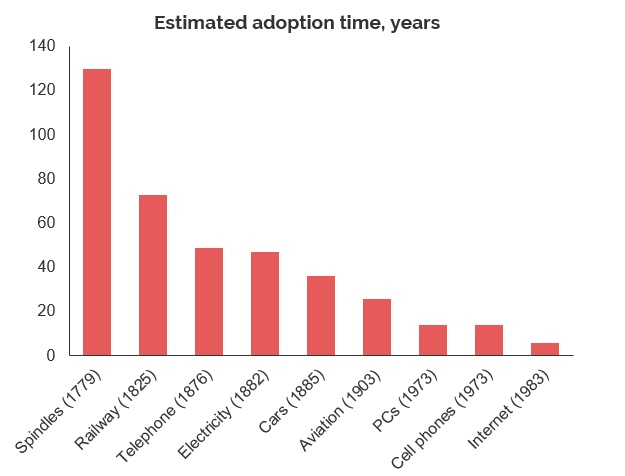

Not only, but AI is in in its infancy (think internet 2000 – if you haven’t used ChatGPT yet I would encourage you to ask it some questions and see what kind of responses you receive, you will likely be under whelmed ), but it will likely develop quicker than any technology we have ever seen in human history!

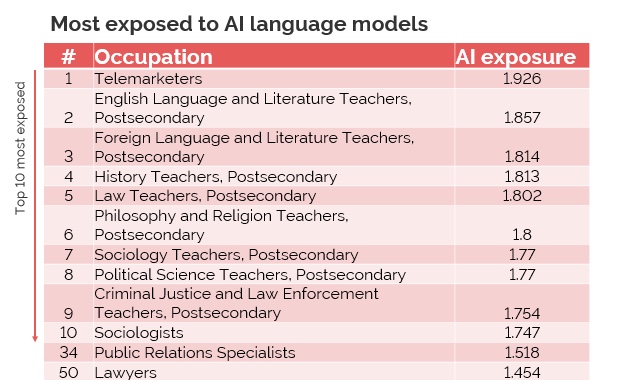

However, here is the list of the top professions which might be affected by AI (Teachers beware!!)

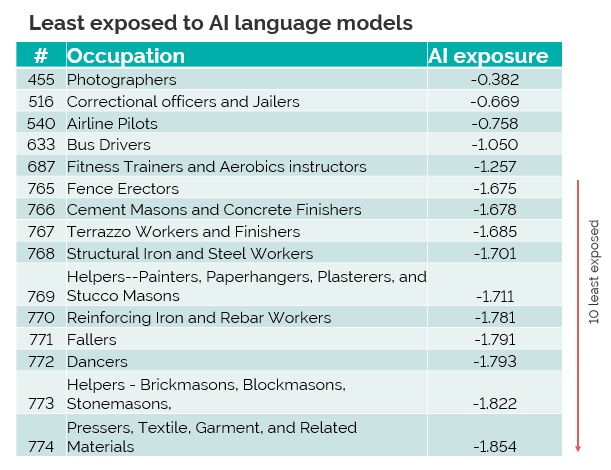

And the least affected:

Here is an interesting fact for you –

In the Federal Reserve in the USA there are approximately 500 employees of which 400 are at PhD level and above, who are all engaged in making economic forecasts. The problem is that they are absolutely terrible at forecasting. In almost every period their forward economic projections turn out to be wrong. As an example in 2021 they anticipated that interest rates in 2023 would be at 1%, when in fact they were 5.25%!

They use historical economic data to predict the future rather than forward looking models which are now readily available from many different companies. Is this an AI opportunity?

But enough of AI, some other strange hype happened during 2023….

Weight reduction drugs

A buzz started around new drugs that would help you to lose weight. Apparently, it will be as easy as taking a pill before long. Long gone will be the days of dieting and exercise!

The publicity from various celebs touting the benefits of weight loss drugs started a hype around the fact that we would no longer have diabetes, no more knee surgery would be required, nor hip surgeries and all our eye problems would be resolved. Who knew that it was all down to weight loss and a pill could cure all?

Airline company stocks rose

And if you couldn’t believe that all that was true, then airlines stock prices started to rise because it was believed that bigger seats would no longer be required as larger people would be no more, and so with more space they could fill the plane with more seats and earn more profits.

So, you might be forgiven for wondering why the markets didn’t really climb during the year when all these actors were at play. Well, the truth is that markets did climb, but they also fell back around November. The hype died. Every 3 or 4 months in 2023 there was a new theme which came to life and then quickly died away. It was almost like everyone was searching for some sign of good news in a year, which otherwise was once again occupied by concerns about global war. Thankfully the year finished on a positive note mainly because of the rise in stock prices of the Magnificent 7 – as they are now known – (Meta, Amazon, Alphabet (Google), Apple, Microsoft, Nvidia and Tesla).

To 2024 and beyond

So looking forward, what is awaiting us?

US elections

Probably the single most important event of the year will be the US elections in November, and the likelihood that our friend Donald Trump could very well become the President of the United States once again. However, as I mentioned in my previous E-zine the third candidate Robert. F :Kennedy Jr is striving to get his Independent party on the ballot and could be a contender. From what I learned, it seems unlikely that Joe Biden will be voted in again mainly due to growing concerns about his health and mental condition.

The USA is faced with multiple issues that need fixing, none more so than the illegal immigration problem, bringing manufacturing back to the US, fixing the rural rust belt crisis and the fentanyl crisis, and there is a possibility that under Trump they may also leave NATO. The USA is retreating from the rest of the world and becoming more protectionist. Globalisation is unwinding. In some ways it is starting to look very much like the period of the 60’s and 70’s: wars, geopolitical risk, and perhaps the end of the centre left and not just in the US, but also around the world. So all eyes are on the USA this year. US general election years can be good for investment markets (there are no guarantees), but often the government in power will do its utmost to stimulate the economy, consequently stimulating the markets which may help with the voters. It’s all to play for in a world which is changing very quickly.

Elections around the world

Let us not forget that there are also going to be a further 64 elections around the world in 2024, plus the European Union. This will cover 49% of the world’s population. We might see some interesting results as the year progresses.

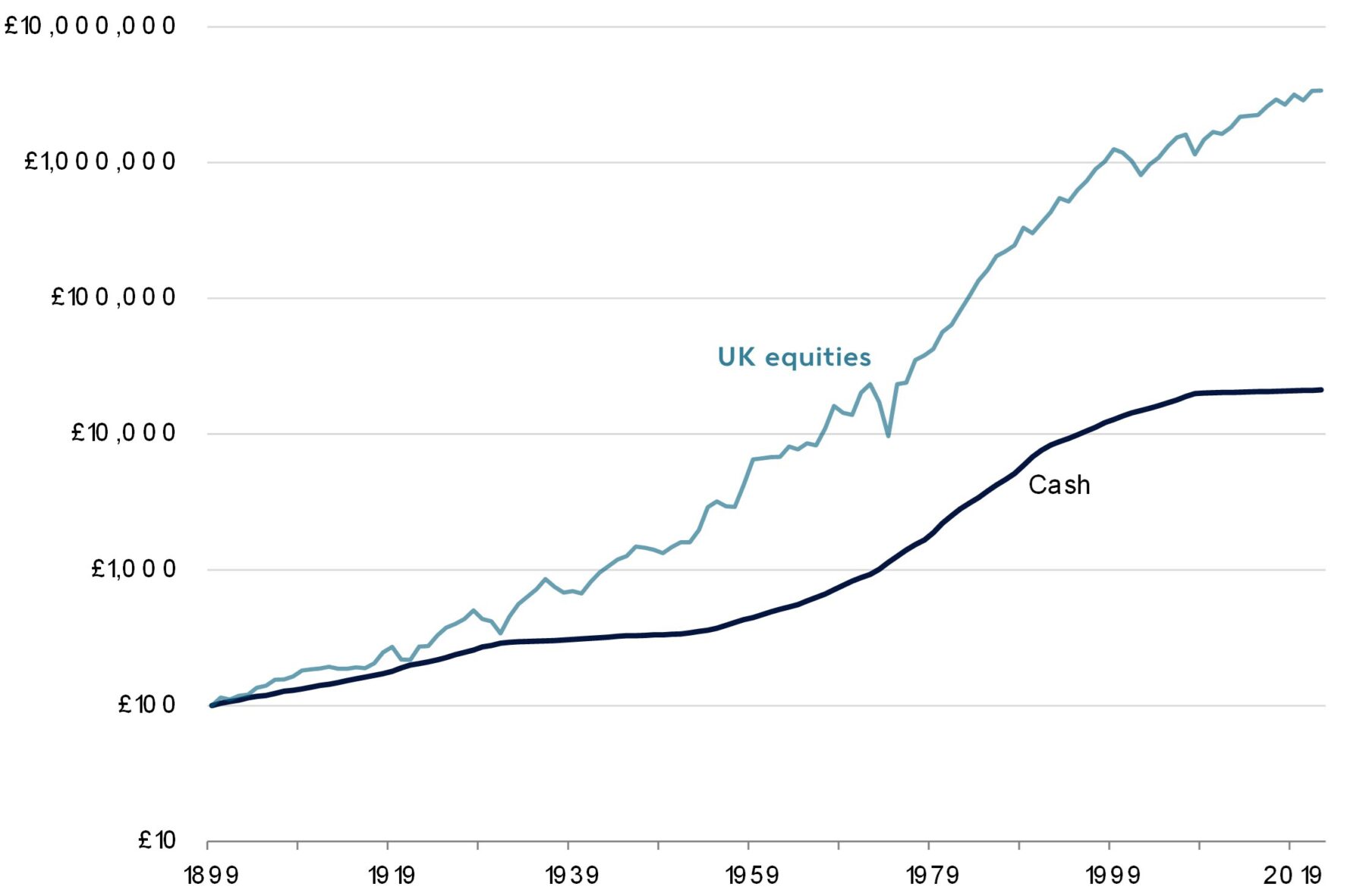

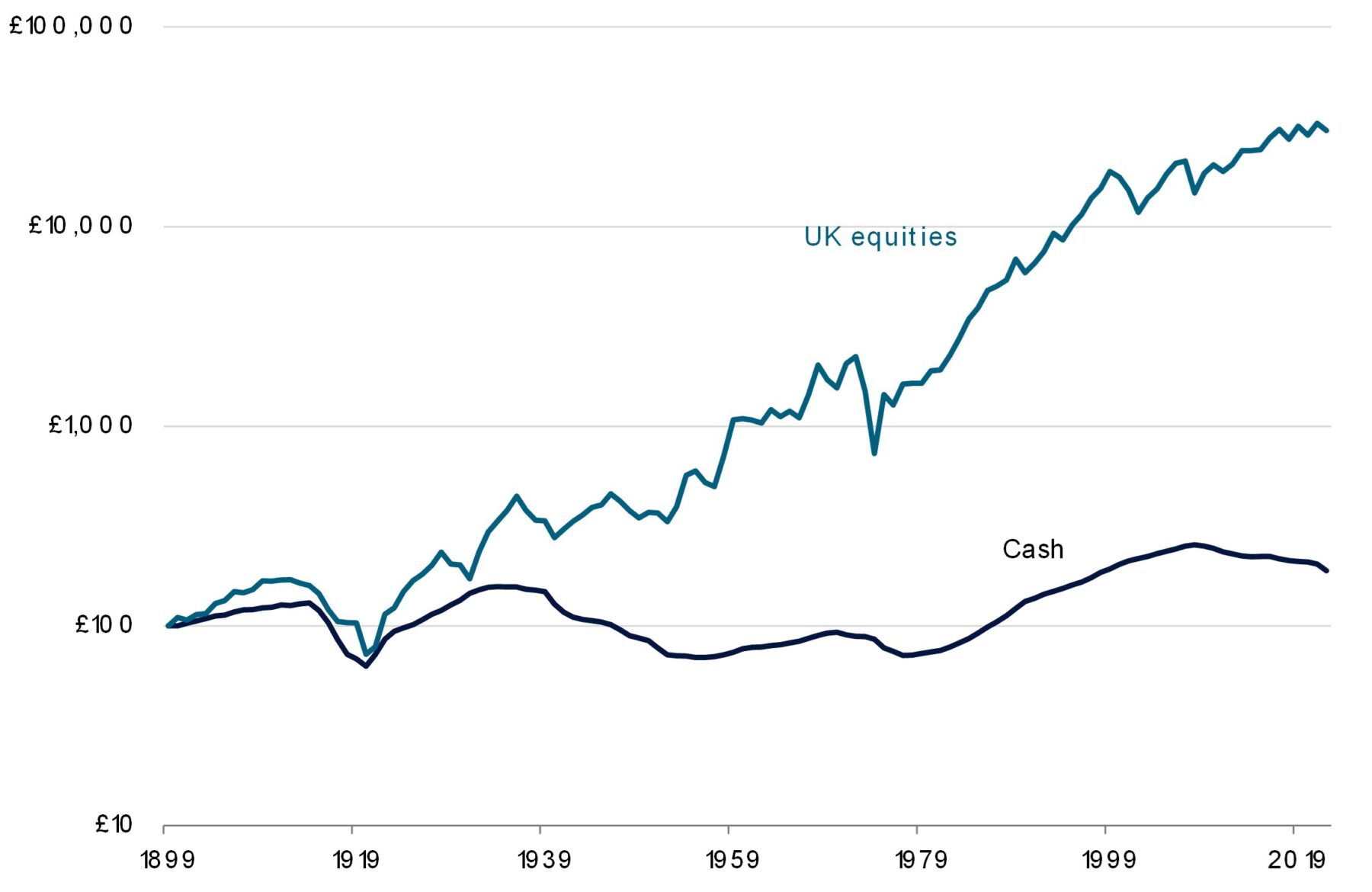

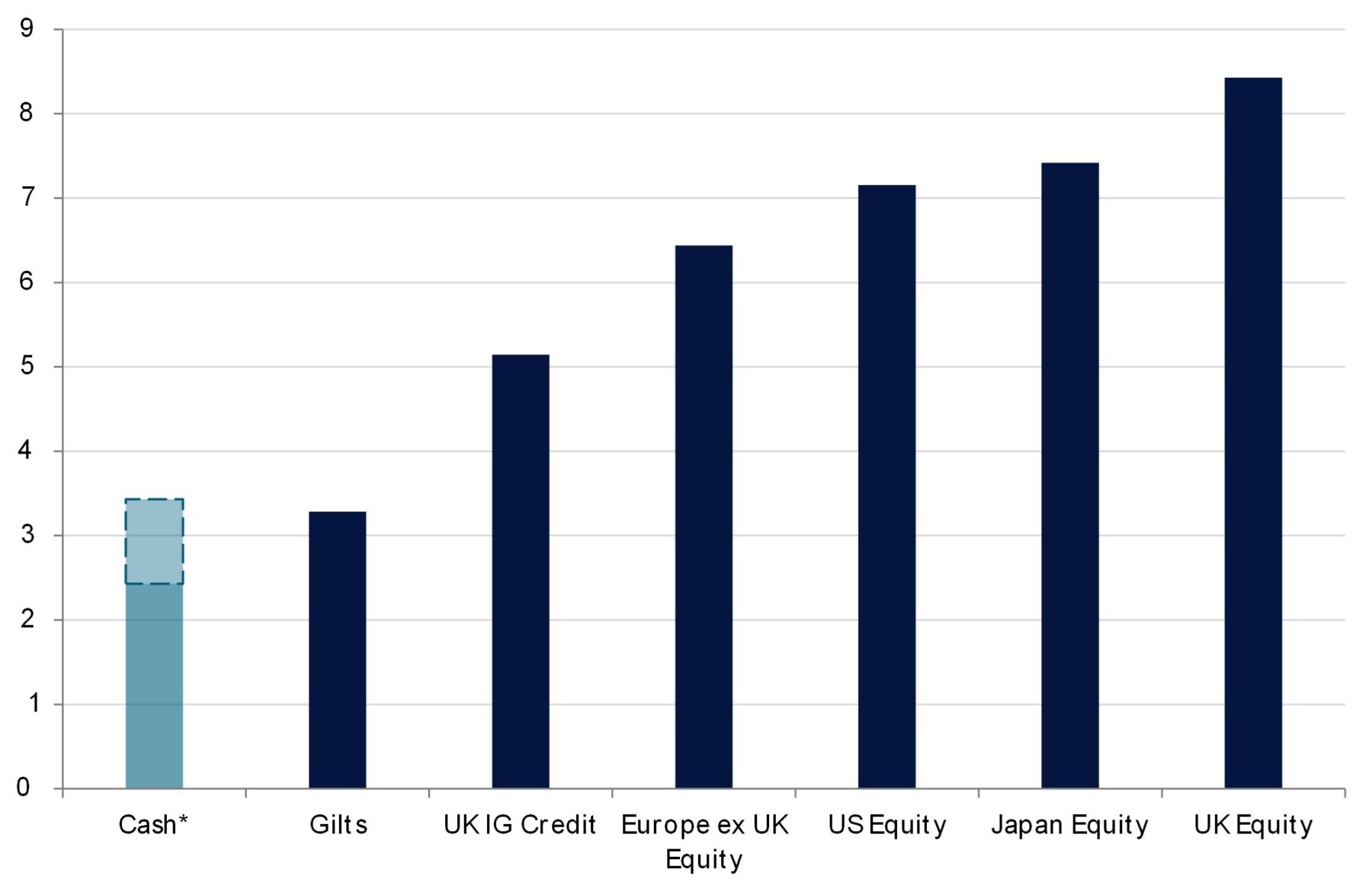

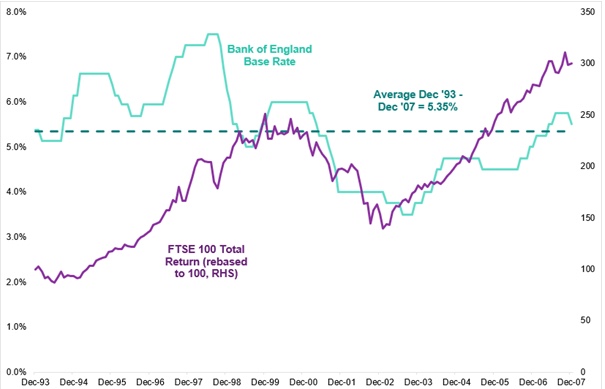

Bonds versus Equities

For years leading up to the start of the current inflationary cycle (2022) there has been debate over whether one would have more Bonds or equities in a portfolio to drive growth. Almost always, over the last 20 years, equities has won outright with interest rates at low to zero and sometimes even negative there seemed to be little value in the bond sector (I am talking mainly sovereign bonds).

However, a number of our speakers made the case that perhaps the tide has turned. Not since the 1980’s and 1990’s have they seen such value in the bond sector. Prices are looking attractive, particularly US treasuries and sovereign bonds over a 1, 2 and 5 year periods. Not only do sovereign bonds now have some potential to provide reasonable yields (interest), but also capital growth and capital protection of your portfolio as well.

Portfolio diversification in the1990’s, when I first started investing, very much looked like a 60/40 portfolio. 60% equities and 40% Bonds or vice versa depending on the way of the economy. These days we have many more asset classes to help diversify our portfolio, but it might be that your portfolio starts to resemble those portfolios of the past moving forward.

Healthcare

As I stated above healthcare was very much a hyped theme in 2023, but it will continue to play a much more important role for growth in coming years. I am not just talking about over publicised weight loss drugs but the developments in medical technology. The world is aging. Almost all developed countries in the world now have a falling or negative replacement rate (the birth to death ratio to sustain population). The Far East: China, S. Korea, Japan, for example have dangerously low replacement rates. This means that their populations are aging at a fast rate and with the benefit of better medical care they are living longer. Italy included!

Medical technology will help to relieve the stress on already over-burdened health care systems. A great example of this is my mother in law, who had polio when younger, now has difficulty walking and more importantly a fear of falling. She recently told me that she had bought an iPhone and iWatch because the iWatch will call for an ambulance if your heart rate drops and it suspects that you are unconscious and need medical help.

We might even see more of these things become mandatory if we want to receive access to our health care systems. Imagine your doctor being able to get real time access to your heart rate data if you are suffering from cardiovascular problems.

This will be a huge growth area, but identifying the tech winners might be harder than you might think.

Defence

It seems that we ‘humans’ don’t have a great capacity for living in peace with one another. We could now have about 5 – 10 years of retreating from globalisation. The retreat probably started in 2022 with the Russia/Ukraine war, if not before with China/US trade wars. If Trump pulls away from NATO then the EU is going to have to find a way to defend itself and to do that it has to re-stock its weaponry. This has already started. The US needs to do the same and almost all other countries around the world are starting to see national sovereignty as more important than globalisation.

Defence stocks will almost certainly benefit from a multi-year period of growth as armoury, weaponry and military logistical hardware be required for re-stocking purposes by nations across the world. Who will buy from who will very much depend on military and economic interests.

AI Hardware – not software

With all the hype over AI software, the real winners could be the companies who provide the hardware to build the AI infrastructure. Think nano computing chips: Nvidia, AMSL, Taiwan Semiconductor Manufacturing Company etc.

Nvidia is just one of these companies. It was valued at 50 times its earnings at the start of 2023 (average price to earnings is about 17 times across a broad range of companies), but this grew a further 3 times over the course of 2023…is this justified? Probably not. Is it likely to be a bubble? More than likely. Or is their hardware so needed for an AI powered world that it can keep on growing? Do, therefore, traditional valuation metrics still mean anything? Only time will tell!

I read the other day that to power the AI universe that the utopian thinkers would have us believe is our future, we would need so much energy that we would effectively need to cover the earth with solar panel and wind turbines, if we were to try and support it with green sustainable energy sources. To what degree that is true, I don’t know, but we are going to need an incredible amount of energy to power the tech needs of the future and it does beckon the question, where is all that energy going to come from? We need a revolution in the storage of energy and no-one is talking about that…yet.

Rewarding Loyalty

As a shopper we all like to think that we are loyal customers. A lot of our favourite places to shop and eat are digging deep to discover just how loyal we really are.

McDonalds is a great example, you can now sign up to their loyalty scheme and receive offers for free burgers and other deals. They are seeing the customer return rate increase as a result of their loyalty schemes. (Interestingly, they are, at the same time pulling away from healthy food options because they were a resounding failure because who wants to go to McDonalds for a salad and a vegan burger… right?!)

Costco is another success in the USA. They are a membership driven business. Their prices and quality of goods are second to none (I have visited one in the UK and can confirm it’s true!) but it’s not that which pulls clients in. They actually have the cheapest gas prices in the USA and this drives people to become members which then allows them to market to each and every customer according to their specific needs.

Customer focused businesses will survive in the modern world.

And finally….boring old infrastructure

(For any non-UK person reading this, HS2 is the high speed railway which the UK has been planning and building for years and is turning into a national farce. But why am I mentioning this? )

Did you know that the USA is in the process of building 50-100 equivalent high speed rail networks?

Infrastructure companies, those building tunnels, roads, railways, electricity grids, toll roads, inter-connected cities, schooling, healthcare facilities etc, leading up to 2023, were considered to be solid businesses in which to invest that would provide long lasting portfolio stability and a decent return. However like most other sectors they were also burdened with debt. In 2022/2023 the interest rate spike suddenly meant they had to contend with significantly increased debt repayments and therefore started restructuring their businesses. The markets didn’t like that and most stocks in this area were down 30-40% in 2023, that created a buying opportunity, because in the end some boring old businesses are worth investing in.

The USA is undergoing significant infrastructure build. A southern border wall is almost assured to be erected following the US election, whoever comes ino power, and besides that we need to update, modify and prepare our economies for the future. Infrastructure spend is going to continue unabated.

So on that note I will leave it there. I just wanted to add a note about some of my activities planned for 2024.

I would like to thank everyone who enjoys reading this E-zine, those who support me by forwarding it on to others and to those of you who email me to let me know. I often wonder how many people it is reaching and if you actually enjoy what I write. To hear back gives me some solace that I am doing the right thing. They take a bit of time to think about and write but are enjoyable to do. If you do find them useful then please do forward them onto others as it is one of the best ways to widen my audience and is a great help.

In 2024 I will be expanding my short video content on topics that come up during the year, and I can do a quick video about them. I will, of course expand on these subjects in my E-zine. If you are interested then you can see the videos, to date, on my page on The Spectrum IFA Group website. Just click our logo to the right to take you to the page.

Taxes in Italy 2024

By Gareth Horsfall

This article is published on: 21st January 2024

In this E-zine I am going to provide a brief summary of the taxes which mostly affect you and your lives in Italy. It is not an exhaustive list, but you can use this for reference or discussion tool with your commercialista if you need to.

There may be specific elements regarding your personal situation, but I shall discuss the most important ones hat might affect you. Throughout this article, I shall also describe the latest changes from the Legge di Bilancio which have now been introduced in 2024.

Summary of the main taxes that affect your life as a ‘straniero/a living in Italy

The first thing you need to remember, as a fiscally resident individual of Italy, is that you are subject to taxation on your worldwide earned and non-earned income: capital gains and assets (including property). It is your job to make sure that you report these to your commercialista each year to complete your tax return. But before you do it for the first time, a financial planning exercise can come always come in useful.

Fiscal residency generally means that you qualify under ‘1’ of the following criteria:

- You are registered as a resident on the anagrafe

- You spend more than 183 days a fiscal year ( calendar year) in Italy

- You have your main business, social or family interests in the country

TAX ON INCOME

NEW INCOME TAX RATES FOR 2024 (IRPEF)

In a move to simplify the tax regime in Italy the tax bands have now moved from 4 to 3 in 2024.

| € 0 – 28,000 | 23% |

| € 28,000 – 55,000 | 35% |

| € 55,000+ | 43% |

EMPLOYMENT

If you are employed or self employed then there are multiple options available, from partita iva, partita iva, regime forfettario, rientro di cervello, amongst others. I won’t go into details here as these really need to be looked at on a case by case basis, but needless to say that there are financial planning opportunities. If you are working, or intending to work, in Italy or if you have any questions in this area you can contact me on gareth.horsfall@spectrum-ifa.com

2024 Change: INBOUND WORKERS TAX REGIME

Regarding the inbound workers tax incentive. The previous tax regime was a 70 – 90% income tax (and social security contributions) deduction for a period of 5 years. This has been reduced to 50%, capped at an annual gross income of €600,000. The time spent as non-resident of Italy prior to applying has been increased to 3 years, (or 6 – 7 years if there is continuity in the employment relationship). However, Italian residency must now be retained for 4 years in Italy, whereas it was previously 2. They have also introduced a requirement for a high level of specialisation (degrees, masters etc) in the qualifications necessary for the job in question.

PENSIONS

Most of my clients are in, or planning for, retirement to some degree and so understanding how your pension will be taxed as a resident in Italy is of paramount importance.

PRIVATE PENSIONS AND OCCUPATIONAL PENSIONS

If you are in receipt of a pension income and it is being paid from a private pension provider / 401K provider / occupational pension provider or you are in receipt of a state pension / social security, then that income has to be declared on your Italian tax return and tax will be due on it.

If you have paid tax already on that income, then a tax credit will be given for the tax paid in the country of origin (assuming that the country has a double taxation agreement with Italy). Any difference between the tax rates in the country of origin and Italy will have to be paid.

I often hear stories of people who are told by their commercialista that their state pension / social security pension is not taxable in Italy, and, more recently I have seen numerous videos on Youtube of individuals who also make this claim. This is absolutely NOT the case!! The UK state pension and US social security are 100% taxable in Italy. It is not excluded from the double taxation treaties and therefore must be declared in Italy. Failure to declare could mean fines and penalties.

2024 Change: NO TAX AREA

For some time now there has been what is know as a NO TAX AREA for someone receiving a pension in Italy (“pensioner” is defined as someone who is receiving official state benefits i.e., social security or state pension). No distinction is made between pensions being paid from abroad or within Italy.

From 2024 the NO TAX AREA has been increased to €8500 per annum.

It is important to understand that this is NOT an allowance i.e., an exclusion of income tax on the first €8500 for ALL pensioners. It is a tax credit system. If your total income (reddito complessivo) is €8500 or less then all the tax payable on your pension will be provided as a tax credit. HOWEVER, the more your total income, from all sources, increases over €8500, the more of the tax credit you lose. If your total income is €55000 or above you would not receive any tax credit.

GOVERNMENT DERIVED PENSIONS

It is a good idea to define what is meant by government paid pensions. The definition according to the Italy / UK / USA double taxation convention 1988 is, paid from:

” a political or an administrative subdivision or a local authority”

This generally means civil servants of any kind and foreign office employees but would generally include teachers who have worked in a public school, health care workers, military personnel, police fire service etc. In these cases, the pension awarded is taxable only in the state in which it originates, and tax is generally deducted at source in that country of origin.

But there are some tax idiosyncrasies to look out for here. On the positive side, this income is not taken into account when calculating the tax on your other income sources in Italy, e.g. rental income, and it is not declared on your tax declaration in Italy.

On the negative side, for those of you who are thinking of becoming citizens of Italy, these pensions are only taxed in the state of origin UNLESS you become a citizen of Italy, or are one already, in which case it becomes taxable. So for anyone thinking about cittadinanza, plan before you leap!

My final note on pensions is to say that ensuring that they are filed correctly on your tax return in Italy is essential. There are only various shades of grey when it comes to how to declare overseas pensions correctly. Speaking to the right experts might mean the difference between paying more tax than you need to.

INVESTMENT INCOME AND CAPITAL GAINS

As of 1st January 2017, interest from savings, income from investments in the form of dividends and other non-earned income payments stands unchanged at a flat tax rate of 26%. Realised capital gains are also taxed at the same rate of 26%.

(Interest from Italian government bonds and government bonds from ‘white list’ countries are still taxed at 12.5% rather than 26%, as detailed above. This is another quirk of Italian tax law as this means that you pay less tax as a holder of government bonds in Pakistan or Kazakhstan, than a holder of corporate bonds from Italian giants ENI or FIAT).

Property which is located overseas is taxed in two ways. Firstly, there is the tax on the income and, secondly, a tax on the value of the property itself.

THE INCOME FROM OVERSEAS PROPERTY