It’s been a horrible 2 years (almost) in investment markets. Let’s just be honest. If markets don’t pick up in Quarter 4 of 2023 then we will have been in for 2 pretty rubbish years. It’s tough to say it from someone (me) who is invested in ‘investing’ and using the markets to protect money from inflation.

Is cash king?

By Gareth Horsfall

This article is published on: 3rd October 2023

I know it’s the only way to protect our hard earned capital from the ravages of prices increases, but after 2 years of markets not going anywhere it is a tough job to convince anyone that this is still the best way to protect capital.

Until 2022 you could have almost been forgiven for wondering what inflation was. We hadn’t really seen the effects of inflation for the last 20 years, and now it’s back with a bang. Right at the moment of global political instability and war. The perfect storm!

Since Feb 2022 the markets reacted to the events between Russia and Ukraine and since then, with the onset of price increases for, just about, everything we buy, global stock markets are still trading under their highs of 2021.

Why not cash instead?

If you are someone sitting on cash, you might be cautious about investing and who can blame you? Everything around the world looks unstable and putting money in cash might earn you 5% in US CD’s, 4% in € and potentially 6% in GBP. Even though these interest rates are trailing the real rise in the cost of goods and services, you can’t be blamed for looking for some certainty in an uncertain world.

A woman’s view on the world

It is for this reason that I invited Joy Callendar of Brewin Dolphin (https://www.brewin.ie/our-people/joy-callender) to come and speak at our events in Abruzzo and Marche on the 17th and 18th October, respectively.

I wanted to invite a female Investment Manager this time as women have a different perspective on investing than men. Women are shown in numerous studies to be less aggressive and less impetuous than men in their investment decision making. This is good for me, because I will get time to hear what Joy has to say to you, but also I will get time to speak with her during the time travelling to each place and in the evenings. I myself want to hear how someone, like Joy, is going to help us navigate these rocky waters.

It is without a doubt that Joy will advocate investment as a mean to inflation protect your money and tell us that cash is, long term, a bad way to protect our real long term spending power of our money (because it is). But what about the short to medium term: is it a good idea to invest in cash now and wait until markets start to recover? Or can we invest in areas which are less volatile? Can Brewin Dolphin keep money in high interest bearing funds/investments with minimal risk and time the right moment to get into the markets for us? Can they just move in and out of areas at the right time to maximise returns?

There are so many questions that I want the answers to.

Brewin Dolphin and many other asset management firms want to get out and talk directly to people, rather than being solely based online, as they see the value in talking to people directly. They have a budget for working with companies like us who can provide an audience for them. They have services for residents in Italy and also are SEC licensed for services to US persons living in Italy. (Of course they love a few days out of the office in rural Italy as well) .

I am planning more events around Italy in the spring of 2024 (some with a different theme) and would welcome any recommendations if you think you might know a group of people who might want to listen to investment/tax planning experts for your life in Italy. Don’t hesitate to let me know.

In the meantime, if you want some answers to any investment, currency exchange or tax planning questions then please register to come along to the events below. Oct 17th in Abruzzo and Oct 18th Marche.

These events will NOT be a lecture or usual seminar,but, instead, a PANEL style approach.

The panel of experts will be open to questions and answers from any member/s of the audience and be available to listen to your concerns, worries and comments and hopefully provide some concrete and helpful information.

I am keen to put these experts on the spot and get the answers we want and to really make them work for their money, and I need your help to do that!!

Le Tour de Finance in Italy

By Gareth Horsfall

This article is published on: 16th September 2023

I’m going back on the road!

As a resident in Italy, do you make the most of your finances? Join us and our panel of guest speakers, for informed guidance on Italian resident tax and financial planning opportunities, commentary on investment markets and to meet like-minded people in your local area.

Tuesday 17th October 2023

Castello Semivicoli

Abruzzo

Wednesday 18th October 2023

Villa Anitori

Le Marche

The event starts at 10.00am with a welcome coffee, followed by brief presentations from international experts on a range of topics that could affect you now, or in the future. The morning ends with a complimentary buffet lunch and wine.

For those of you who have known me for sometime, you may remember the days when I was out on the road holding seminars and bringing experts from the world of finance to various places around Italy. After a hiatus, I was about to restart in 2020 and then the dreaded lurgy raised it’s ugly head. Well, now that all seems to behind us, I decided that since my world is more commonly becoming a series of daily video and phone calls, that I wanted to get back out and talk to people in person again.

I miss these events and am really keen to get out and listen to your comments and concerns from a financial planning point of view, for residents in Italy. So, I decided to restart them and and as you can see from the flyer above, I am doing so in Abruzzo and Marche on the 17th and 18th of October, respectively. I would love to see you if you are in the area or would just like to travel and listen to some people from the world of finance and what they have to say on past, present and future events.

In this Tour de Finance, I have organised an all female line-up

(which will make a nice change from the usual panel of men in suits):

Stefania Falcone from Currencies Direct to talk about foreign exchange and the possible direction of currency movements

Lorraine Reddaway, Business Development Manager and Joy Callender, Senior Investment Manager, Dublin from RBC Brewin Dolphin Asset Managers to talk about the risk of investing in the world today and their view on the direction of world markets and asset classes

Judith Ruddock from Studio del Gaizo Picchioni commercialisti

Are you thinking about moving to Italy?

By Gareth Horsfall

This article is published on: 9th September 2023

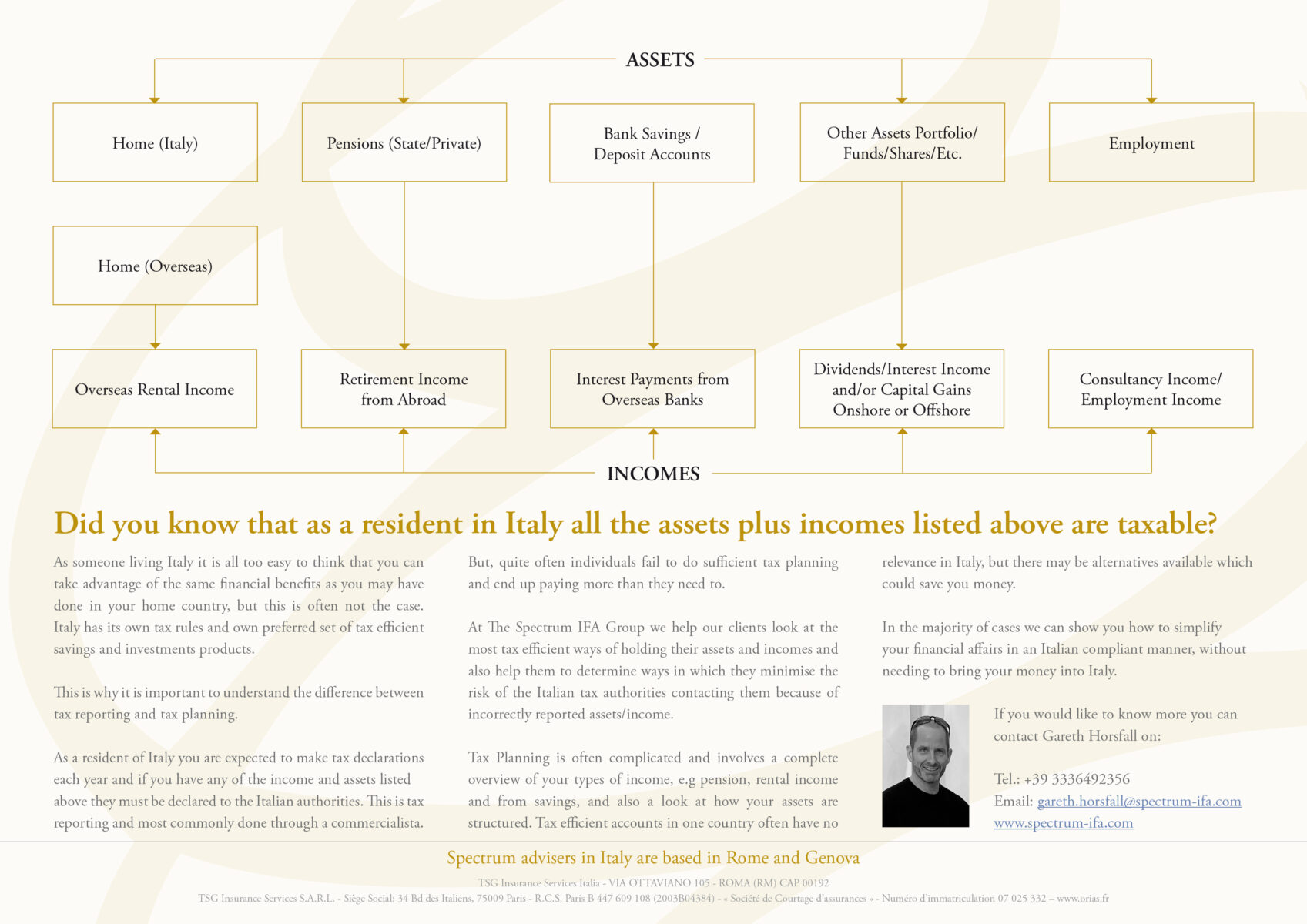

If you are thinking of moving to Italy to become a full time resident, or even a resident for part of the year, then it make sense to understand your tax and other financial liabilities before you make the move.

When you buy a house in Italy, you will very likely receive competent and complete advice regarding the cost of buying and renovating a house. The agent may also explain the difference between the cost of buying as a resident in Italy and a non resident. But, the buying process should be accompanied by a clear and concise longer term financial plan to minimise tax liabilities.

Italy has its own tax code and its own preferred set of tax efficient savings and investments products and whilst you may think that you can take advantage of the same financial benefits as you have done in your home country they may not represent the best and most efficient ways to hold your incomes and assets, whilst living in Italy. Tax efficient accounts in one country often have no relevance in Italy. But there are alternatives available which could save you money.

Sadly, and all too often, expats fail to do sufficient tax and ongoing planning for living in a country which has a very different set of rules to their own and as a result end up paying more than they need to, getting fined for simple and honest mistakes and in the worst case scenarios needing to return home.

At The Spectrum IFA Group (Italy) we can help you to not just look at the initial financial aspects of moving to Italy, but also to help you look at the longer term consequences and avoid any inevitable surprises once you have made the decision to purchase property in the country. We want to ensure that your dream move continues to be a dream.

We can help you look at the most tax efficient ways of holding your assets and incomes taking into consideration both Italian tax law and that of your home country and ultimately help you to minimise your tax liabilities.

Cross border Tax Planning involves a complete overview of your types of income, e.g pension, rental income and interest from savings, and also a look at how your assets are structured.

In the majority of cases we can show you how to simplify your financial affairs in an Italian compliant manner without needing to bring your money into Italy.

Refused Italian residency

By Gareth Horsfall

This article is published on: 8th August 2023

Living in Italy always feels like a great privilege for me. I never expected that a ‘lad’ from Yorkshire would be having the opportunity to live the life I now do. Of course, it comes with it’s issues and there are many people who, every year, also make the decision to want to come and live in ‘Il bel paese‘.

However, as I have found out this year, there are those who also get refused this opportunity when they have applied for ‘residenza elettiva’. (elective residence in which you demonstrate to the Italian ‘Consolato Generale d’Italia’, that you have the financial resources, now and in the future, to be able to live your life in Italy without becoming a burden on the Italian state). There are certain criteria which you must meet, such as minimum income levels and financial independence.

Since Brexit, of course, many UK citizens who previously only had to trot off to their local comune and register as residents in Italy, under their EU citizen rights, are now subject to much stricter assessment of their financial affiars before a visa will be granted to enter the country and life begin in Italy.

Over the years I have met many people (US citizens mainly) who have been through the elective residence process and managed to get the necessary visa to come and live in Italy. I also learned that many managed to do so without meeting the strictest financial requirements. Instead with some help and understanding of the types of accounts they held in the US they were able to assist the consulate in assessing their application, at which point the elective residency was granted.

The people I have met this year (all Brits) who have been refused the elective residency visa were refused due to failure to strictly adhere to the rules. (Strict adherence to rules not being something that Italians are famous for).

This is quite sad to see because, firstly it could be said that the British citizen might be treated unfairly due to Brexit. There is no evidence to suggest this. It is merely a hunch, but one which is shared with a few other professionals with whom I have been in touch about this. Secondly, there are certainly the rules, but interpretation is everything and as you will see from reply from the Consolato below, certain assumptions have been made by the assessor regarding this specific application which could be argued to be true and fair, but would still not affect this persons ability to live comfortably in Italy without being a burden on the state. (I can attest to this as I conducted an initial financial planning exercise with them) It would seem the absolute letter of the law is being applied here when in fact merely the extracted statement below from the legislation itself gives a significant amount of discretion to the assessor.

‘Il visto per residenza elettiva potrà essere esteso anche al coniuge convivente, ai figli minori o maggiorenni se conviventi e a carico e ai propri genitori, qualora le condizioni finanziarie suddette siano sufficienti a garantire il mantenimento di tutti i soggetti interessati.’

The point to this E-zine is to say that this application was likely refused because the application was not prepared with the help of an Italian professional (lawyer and commercialista) who could a) interpret the foreign held accounts for the assessor/s and explain how they function and b) provide a signed and certified overview that would be seen by the Italian authorities as more credible than merely statements from the applicant themselves.

I hope that if you, or someone you know is going through or about to go through the elective residence process then you can pass this E-zine and message to them. Take professional advice (lawyer and /or a commercialista) before submitting the application. Once granted then financial planning is also critical.

The applicant mentioned in the letter text below is being contested directly with the Consolato Generale d’Italia, now with legal help, but this could take up to 2 years. It might have been avoided ( possibly not) if professional help had been sought at the start.

Please feel free to pass the E-zine onto anyone you may know who this affect or of whom it might be interest to. The more we spread the word the less likely mishaps and refusals will occur in the future.

Harp House,

83-86 Farringdon St,

London EC4A 4BL,

United Kingdom

VISA SECTION

“As per Art. ,comma 2 of T.U. 286 modified by Law 30 July 2OO2 n.l-89, and Art. 6-bis of D.P.R. l-8 October 2004 n. 334 regarding visa denials, we regret to inform you that your recent application for an Elective Residence visa has been denied because unfortunately, at this point in time, it does not comply with the minimum conditions required for the issuance of such a visa.

To date, all the documentation provided with your applications do not currentlv illustrate that vou have immediate access to the minimum required economical and financial resources necessary lo guarantee continuity through time from a proven, steady & substantial income stream/s deriving from pensions, annuities, properties or other types of regular income declared in the UK ( with the “Tabello A’ Direttivo Ministero dell’lnterno dated March 7’t, 2000 ond as per D.l. 850/2077, i.e. startinq from a net amount of 37,000 euro per person), meaning not cash in the bank, savings, unrealised profits from investments subject to volatility and/or private income deriving from employment. It is worth highlighting that this office has carefully examined your recent applications, by comparing them with your previous ones; i.e. denials ref: XXXXXXXX prot n. XXXXX issued on the XXXXXX.2022 respectively, with the view to gauge if there have been any new and/or substantial changes in both your economic and financial circumstances to be considered when granting the issuance of such visa.

Unfortunately, when taking into consideration both your eligible proven and steady income streams guaranteeing continuity through time that you have provided to date i.e. combined net full pensionable entitlements from both state and private pensions (including future increases in net state pension and the potential volatility in exchange rates), we regret to inform you that,at this point in time, you do not meet the minimum conditions required for such a visa.

ln fact in particular, it appears that in the case of Mrs.XXXXX, she is yet still to reach State pensionable age (XXXX); with her only current source of income, coming from a yearly drawdown payments of circa £XXXXX per annum (subject to tax, effective from the XXXXX). These appear to be generated from a portfolio of pension investments that are in turn subject to volatility. and which unlike an annuity, do not offer a guaranteed, steady & substantial income stream that guarantees continuity through time.

As for Mr. XXXXXXX even in consideration of potential annual gross increases of 5% in line with RPl to his private and state pensions, his total net income, is unlikely to reach, at this point in time, the minimum levels required when granting the issuance of such visa.

Furthermore, in response to the letter dated XXXXXX from your legal representatives, we would like to clarify lhat, “the annual passive income requirement of €31,000 plus 20% for the dependent spouse” they have made reference to, is NOT applicable for this type of visa (i.e. elective residency), but rather to other types.

For clarification purposes, the minimum nef amount, for elective residency visas applications, starts from a guaranteed minimum of €31,000 per applicant. We appreciate that since BREXIT, you may have experienced limitations towards visa free travel arrangements previously enjoyed, but would like to remind you that, as British citizens you may still travel to the Schengen area visa free up to 90 out of 180 days. You have the right to appeal this decision by filing a formal appeal with the assistance of an attorney to the “Tribunale Amministrativo Regionale del Lazio” in Rome within 60 days from receipt of this Notice. To be valid, the appeal must be notified to the Avvocatura dello Stato (General Attorney) according to the Article !44 of the Code of Civil Procedure and Article LL of the Royal Decree no 1,61,1/1933.”

Kind Regards,

Visa Office Consulate Generale of ltaly in London

If you would like to discuss this or any other content I have posted online, or merely to discuss your financial situation for life in Italy, then please do not hesitate to get in touch:

Tel: +393336492356 or gareth.horsfall@spectrum-ifa.com

I would be happy to try and help where I can.

Citizenship or Residency in Italy?

By Gareth Horsfall

This article is published on: 10th July 2023

Cittadinanza v Residenza – which to choose?

I decided to write this article because a number of people have asked me about the tax advantages of becoming an Italian citizen. My aim here is to give some clarification on the financial planning considerations if you are thinking about a permanent stay in Italy.

I opted for Cittadinanza as a result of Brexit. When my EU acquired rights were going to be stripped away from me I needed to make some decisions and for me cittadinanza was the right thing to do (with an Italian wife and child in Italian school, it seemed a no-brainer). Thankfully, as a resident in Italy married to an Italian my cittadinanza seemed to be right of passage rather than any decision that the preffetura took. I was lucky and I also managed to squeeze in before the language test was introduced…phew! (although I could pass that now).

If you are left wondering which option is best for you, I thought I would write this article to help lay out some facts. I hope it helps.

Cittadinanza and residenza

They are 2 very distinct definitions, often confused, but inherently connected from a legal and fiscal point of view.

As ‘stranieri’ living in Italy it is not unusual to get confused by some of the terminology regarding our legal status, and for Brit’s who were resident in Italy pre-Brexit, they now have additional legal implications which they have to deal with. For the rest of the non-EU world, you have probably been experiencing some of these issues that Brits are now facing. for some time, so you could probably tell us a thing or 2 about it.

The Universal Declaration of Human Rights 1948 states that every individual, in every part of the world, has a right to legal citizenship. No individual can be arbitarily stripped of their legal citizenship, nor of the right to change it.

What is cittadinanza?

Cittadinanza is simply defined as the condition of an individual belonging to a state with the rights and duties that this relationship entails; among which are political rights, i.e the right to vote and the possibility of holding public office, and the duty of loyalty to the state and the obligation to defend the state, within the limits and methods established by law.

Cittadinanza gives the individual the right to vote, access to public services, diplomatic protection and legal recognition. It can be acquired by birth (ius soli o ius sanguinis), by marriage or naturalisation and every country has it’s own different criteria for obtaining cittadinanza.

Advantages

Cittadinanza has some distinct advantages, such as the right to vote in national elections, unlimited travel with the passport, access to social and health services and protection by the government.

Requirements for application

In the case of Italy, a language test must be passed to level B1, declaration of prior residence in other countries is required, evidence that you don’t have a criminal record in other countries and income requirements etc. In addition, specific requirements may be needed depending on whether you are applying based on birth, marriage, or residency.

What about ‘residenza’? What is it?

Residence is the place that an individual is considered fiscally resident.

Residence determines the obligation to pay taxes in a specific state or jurisidction. Generally speaking it is based on the period of time that one spends in a country but is also determined by other factors such as whether you are registered in a specific country and whether it is your habitual abode i.e the place where you spend most of your time. (Read on for more details on this).

Residence refers to the legal status of an individual in a country and guarantees the right to live and work without citizenship. Residenza, in much the samw way as cittadinanza has a number of advantages, such as the right to access health care the option to work, buy property and make investments in Italy. Residenza can be temporary or permanent and the permesso di soggirono comes in various forms. To obtain residenza an individual must satisfy various documentary requisities, financial criteria and possibly language competency (not necessarily)

Quick note 1. I am frequently asked whether being registered at the Anagrafe constitutes fiscal residency. The answer, in the main is YES. There might be situations for business people, for example, who have interests in Italy and other countries and who require residenza anagrafica but not ‘fiscale’, for their business needs. However, for the majority of people who are coming to live and reside in Italy there will be no doubt that your fiscal residency is in the country if you meet just ‘ONE’ of the criteria below.

(**US citizens can transfer their residency to Italy but will have an obligation to report in the US as well. This creates numerous tax and financial planning issues and so should be planned carefully**)

Quick note 2. Is it possible to be a resident of nowhere because you travel extensively and do not spend more than 183 days a year in any one country? This is absolutely NOT possible! By definition, every individual must have a place of habitual residency whether you spend 183 days a year there or not. You cannot choose your residency status. It is a matter of fact!

Definition of residenza in Italy

You must remember that the definition of residenza in Italy is defined through the income tax code and therefore residenza and taxation are intrinsically connected. An individual is considered subject to taxation and fiscally resident for the majority of a tax period (calendar year) if they meet one or more of the following requirements:

1. You are registered at the anagrafe

2. You spend more than 183 days a year in Italy, i.e it is your habitual abode.

3. You are domiciled in Italy. (Your domicile , by Italian definition, being the place where you have established your main centre of business and/or personal and affairs.

Differences between cittadinanza and residenza

Whilst different concepts they do coincide with each other. As we have already established, cittadinanza determines your citizenship whereas residenza determines that you are fiscally required to pay taxes in Italy. You can be a citizen of Italy but also reside in another country and visa versa. The principle differences however, are as follows:

- Legal Status: Cittadinanza constitutes a legal and political status with certain rights specific duties. Residenza fiscale relates exclusively to the fiscal rules and regulations.

- Acquisition: Cittadinanza can be acquired through birth, marraige and naturalization rights, whereas ‘residenza fiscale’ is determined, principally, by how much time you spend, or are allowed to spend, in Italy

- Permanence: Cittadinanza is usually permanent unless it is revoked or voluntarily renounced, whereas residenza can change over time according to your personal and/or economic circumstances.

- Rights and privileges: Cittadinanza offers certain rights, as discussed above, whereas residenza merely affects your tax obligations, tax benefits and residency rights in Italy.

Does your tax position change if you obtain cittadinanza

This is a particularly pertinent question for Brits who lost their EU national status as a result of Brexit but which is also interesting to other nationalities who decide to live in Italy, and who may also want to obtain cittadinanza.

The simple answer is that your fiscal tax status will NOT change as a result of moving from residenza to cittadinanza. However, there are cases, which vary from country to country and therefore you will need to either refer to the double taxation treaty yourself or get a professional to look for you.

In general the main fiscal difference between cittadinanza and residenza is regarding government derived pensions (pensions paid by the state, which you worked for, and are directly linked to the type of employment i.e teachers, military, police, health care professionals from a public setting). If you are receiving a pension from a government derived service then with residenza it will normally be taxed ONLY in the state in which the pension is being paid. However, if you obtain cittadinanza then the same pension could become subject to taxation in Italy as well. Double taxation issues are dealt with in the double taxation treaty, but it may mean you end up paying more taxation in Italy on the same pension than you would be in your home country.

***Government service pensions are NOT social security or state pension payments***

State pensions and social security payments are, in nearly all cases, taxable as a fiscal resident in Italy. (Commercialisti often misunderstand these and assume they are government derived pensions from employment, as described above. They are not!

When to move to Italy and register on the anagrafe

Knowing when to move can also make the difference between paying taxes in Italy in the year you move and paying them after the next fiscal year.

If you register after July 3rd then under the 183 day rule you will not be considered fiscally tax resident in Italy until the following full calendar year (only Italian sourced income will be taxable from the point of payment). Conversely, if you do register as resident before July 3rd in any year, then you will be considered fiscally resident for the ‘whole’ calendar year.

But don’t make the following mistake that I have seen many times:

If you make a request for residence before July 3rd and let’s say you don’t have all your documentation, so you delay the application until after July 3rd. Once everything is submitted and residenza is granted, it will be back dated to the original request. This might mean you are now considered fiscally resident for the whole tax year. Therefore, benefitting from the July 3rd rule means that you MUST NOT apply for residency before this date!

The period from July 3rd to Dec 31st is a HUGE financial planning opportunity because you potentially have the tax jurisdiction in which you are currently living to take advantage of and replan your finances for a tax efficient life in Italy. One simple move might be to sell some assets to benefit from capital gans tax reliefs that Italy does not have. Pre-planning and discussion is essential. When people contact me about a move to Italy, my first question is what date are you planning on registering, and is it flexible? It gives you time and opportunities, which could make a big financial difference.

Better the money in your pocket than in the Italian tax mans pocket!

Tales of an olive tree

By Gareth Horsfall

This article is published on: 17th April 2023

I wrote this article because during this Easter period we decided to stay in and around Rome. We took a number of long bike rides around the city and along the Tiber and I could not help but notice the spring green of Rome, once again.

It’s an amazing sight and one that I feel grateful for. It also reminded me that whilst the investment markets are still recovering slowly and tentatively from last year’s sell off due to the Ukraine/Russia war, they are cyclical by nature and whilst, as humans, we will always tend to run from one crisis to another, there will inevitably be times of abundance and plenty.

My experience of olive trees through my clients

You may have olives’ trees that you tend to in your garden or land, in Italy. I know that many of my clients do, and take great satisfaction in looking after them year in year out to harvest the precious oil that comes from them but, listening to the tales over the years, I can make many comparisons with investment markets.

The ‘Ulivo’ goes through the seasons of the years but never appears to bear fruit in a linear way. In fact, many of you tell me that some years the ‘Ulivo’ may not produce any fruit, other years it is plagued by the ‘moscerino’ (little fly), other years there isn’t enough frost or too little frost and some years you get a double harvest. In other years your friend with the neighbouring field, facing a different direction, has a bountiful year, whilst you have none. None of it seems to make any sense. All variable factors under which you have no control but you accept as part of your nurture for the ‘Ulivo’.

It seems that like every living breathing organism, the ‘Ulivo’ will provide what is needed, but not necessarily in the way you would always want it to. A defined amount of litres of oil each year, just enough to feed my family and friends would be fine. No such luck!

It is easy to forget that the component parts of investment markets are in fact living breathing human beings. Every company, government or supranational is run by people who are subject to folly, excess, corruption, huge advances forward, amazing decisions which benefit everyone, building and growing enterprises and generally trying to find a healthy balance.

Just like the ‘Ulivo’ the investment markets go through their cycles of life according to many variable factors of which we have no control. Flowers blooming (markets rising), leaves falling (market falls), harsh winds (the volatility), buds sprouting (opportunities presenting themselves) and then the cycle repeats itself. Your portfolio goes through its own cycles of life.

I have seen in the past that people new to Italy, and the ‘Ulivo’, have talked of uprooting an old tree (with those amazing architecturally contorted trunks) because it’s old and no longer bears fruit, only to be told by someone with more experience that it just needs to be trimmed in the right way, at the right time of year and creating that hollow space in the middle of the tree so the light can shine through (the equivalent of a review of your portfolio) only for the tree to once again bear fruit when the conditions are favourable for it to do so. This is not to say that dead or dying plants should not be replaced. If they have served their purpose and need to be replaced with a younger healthier variant then so be it.

There are so many similarities between our investment portfolios. The timescales and the variables may differ (wars or winter / inflation or summer) but the ebb and flow, the rises and falls and the seasonal changes are ever present.

The coming years may be lean years, or could provide us with way more then we could ever want or need. Ours is not to know, nor have any control over the variables, but only to do the best we can to make sure that we look after what we have.

If you find it difficult to stick with your investment strategies and would like to get busy trying to chase market returns (I include myself in this group, but am trained enough to know that it doesn’t generate higher returns), the research shows that it has no better effect than generating higher transaction costs and other fees associated with switching investments frequently. The only thing you can be assured of is lower investment returns as a result.

Patience is key! Live the seasons and wait

for abundance to once again raise its bountiful head.

Let’s talk cash!

OK, now that I have my hippie moment out of the way, we can get back to talking about financial things again. So, let’s talk about cash that you might have sitting around and finding a better home for it.

Unfortunately, as many of you find out, once you leave your home country and become resident in Italy, you are almost instantly excluded from taking out new financial products in your home country and instead need to look at what other offerings are available to you here. This means often looking at what Italian or EU based banks can offer, and principally in EUR.

A number of people have mentioned to me recently about the savings rates available in the UK, nearing 5% in some cases and wondering whether they can achieve anything similar in Italy or the EU. The answer is that there seems to be very few, and where they are available the interest rate varies between 2.5% and 3% gross max for 1 year deposits, rising as much as 4.5% if you are willing to lock your funds up for 3 years. In addition, you have to look out for accounts which are ‘vincolati’ i.e. they have terms and conditions attached. These may be as simple as locking you in for a specific term (fixed deposit) or requiring you to open a current account and transfer your basic banking to them as well. In true form things are made a little more complicated than somewhere like the UK.

Italians, of course, are akin to also looking at their home country government bonds which are currently paying around 3% interest gross at the moment. having dropped from about 3.38% gross around the beginning of March.

One advantage of investing in government debt directly is that it offers an attractive tax rate at 12.5% rather than the 26% for other financial instruments. Placing cash monies into short term Italian or EU government debt, if you are seeking better EUR returns on your cash, might be a useful alternative to seeking out a higher paying deposit account. (Bear in mind that if you want your capital back at the end of the bond period then you need to wait until bond term matures. Selling early could mean a capital loss). Of course, if you are seeking better returns in other currencies then you can buy government debt in that country instead. Government debt, wherever it is purchased still attracts the 12.5% tax rate on interest in Italy.

If you are simply looking for a deposit account then you could do no better than compare rates on facile.it or confrontaconti.it

The only way to purchase government bonds is through an exchange mechanism such as an investment platform. In Italy, investment and banking are highly institutionalised so speaking with your bank might be the best way to approach it if you are new to this kind of investment. Otherwise, a quick online check with throw up some other solutions.

Inflation considerations

Whilst these rates offer considerably more than the last decade it is indicative of the bigger and more aggressive trend upwards: inflation.

For perspective, the USA and UK are experiencing inflation ( measured by the Consumer Prices Index) at around 9% and 10% respectively. Italy is currently on 7.7% inflation year on year.

So, regardless of how much you might make on a deposit it is always going to be well below the rate at which the spending power of your savings is being eroded year on year. You may know my thoughts on the matter already, as I have mentioned it in previous E-zines, but I think inflation is here to stay, and I am deeply suspicious of the opinions that it will fall back to 2 or 4% within a year or so. There is so much debt in western economies and the only way to rid ourselves of it, and bring back economic stability to the west is to inflate it away. That could mean more medium term pain.

In summary

If you have cash lying around in deposit accounts, cash which you may need for an emergency or just need to live on, then seek out better interest paying accounts. A good strategy is to keep approx. 6 months cash on hand and then stagger your further 6 months cash needs in 6 month deposits, 12 month,18 month etc. In this way every 6 months you have a maturing deposit when your cash starts to run out. If you don’t need the cash then you just roll it over into another longer term deposit.

But whatever you do, don’t keep all your life savings in cash hoping that a higher interest rate will protect you from rising prices. It won’t!

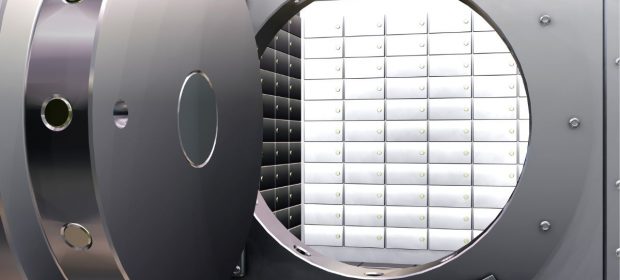

Is my money safe?

By Andrew Lawford

This article is published on: 7th April 2023

The banking sector appears to be in the midst of a wobble at present, so it seems like a good idea to examine exactly how worried we all should be about our banking arrangements.

As no doubt everyone will have read, the current concerns have been triggered by Silicon Valley Bank, an institution the existence of which I was blissfully unaware until it suddenly collapsed. On examining what happened to SVB, the most startling thing to me was that it essentially suffered a good, old-fashioned bank run: depositors lost faith, ran for the exit and, well, you know the rest. The bank didn’t even have particularly exotic lending practices – most of its problems were caused by the fact that it had purchased government bonds with relatively long maturities, which had suffered temporary losses due to rising interest rates (the value of a bond will fall as interest rates rise, but this generally won’t result in a loss if you hold it until maturity).

If the crisis had been circumscribed to SVB and a couple of other similar banks in the US, we might all have gone on without further thought, but then all of a sudden we found out that Credit Suisse was in trouble. Was this the same sort of crisis, or something new? In reality, CS had, in the words of one analyst: “spent the last decade finding astonishing new ways to lose money and embarrass itself”. Some of the best examples of this were: allowing drug money to be laundered in Eastern Europe, getting caught up in a corruption scandal in Mozambique, channelling client funds to a fraudulent trade finance lender and a spying episode involving management and former employees. It is fair to say that CS had made its bed quite well and recent events finally forced it to lie down.

Once we had digested the idea of CS’s failure, then the market started to be concerned about Deutsche Bank – another institution which stands as an example of the colossal risks emanating from global banks with a wide variety of activities, from retail to investment banking and everything in between. For the moment, at least, it would appear that the markets have been soothed somewhat, but one could be forgiven for being concerned over the safety of one’s money in the current environment.

How safe are deposits with Italian banks?

Turning to the safety of Italian banks, we need to examine the provisions of Italian depositors’ insurance, which is available up to €100,000 per account holder (so if you have a joint account, for example, you get €100k for each person). Opening more than one account with the same bank doesn’t change anything, but opening an account with another bank would give you a further €100k for funds deposited with that bank.

As always, however, there are a number of devils in the detail, and the FITD (Fondo Interbancario di Tutela dei Depositi), the entity that provides the guarantees, has its fair share. First of all, it should be noted that all banks licensed in Italy must adhere to the FITD, which functions like a mutual guarantee system. What this means is that if a bank fails, the FITD basically has a whip-round amongst the other member banks in order to make good on the guarantee. This might be all well and good when the bank in trouble is some rustic banca popolare, but if it happened to be one of the big names, then this would almost instantly translate into a systemic crisis whereby trying to prop each other up would lead to them all falling over. The image that comes to mind is that of a group of drunks staggering down the street trying to keep each other upright. At that point the big question would be whether, and to what extent, the state would step in to provide a blanket guarantee. The current orthodoxy in such matters would seem to imply that some sort of guarantee would be forthcoming, although obviously much would depend on the state of the public finances at the time.

The mechanics of FITD guarantees

The FITD has been in existence since 1987, but only recently has its name (“Fondo” meaning “Fund”) actually corresponded to the reality of the situation. Up until 2015 the guarantee was totally unfunded, but a 2014 European directive obliged member states to institute depositors’ guarantees of €100,000, and for these to be pre-funded in the measure of 0.8% of the total guaranteed deposits by 2024. As of the end of 2022, the FITD had funds of €3.3 billion to cover €740 billion of guaranteed deposits (i.e. those under €100k), so roughly 0.44% of the total. The FITD forms part of EU and Italian banking regulation mechanisms and has been used primarily as part of various solutions contrived to avoid failure for struggling banks in the first place. In fact, since 1987 the fund has paid out about €3.3 billion, of which only €77 million was used to make depositors whole, with the rest being used to fund “solutions” to avoid collapse – the most recent example of this being Banca Carige which received €530 million as part of its sale to Banca BPER in 2022.

In the background, the EU is working towards EDIS – the European Deposit Insurance Scheme – which would institute a pan-EU fund as part of the banking union, but the machinations of this project have yet to be worked out satisfactorily, so for the time being we are stuck with national systems, albeit ones offering similar guarantees.

So what does this mean for me?

Notwithstanding the inherent weakness of a system based on mutual guarantees as described above, it would appear that the €100,000 minimum would be respected in any reasonable scenario. It also seems likely, based on past form, that the state would intervene to encourage a solution in any critical situations long before even a relatively unimportant bank actually failed. The fact that the depositors’ insurance is based on an EU directive also seems to imply that any need for state intervention to guarantee the basic level of depositors’ protection would be supported by the EU. So on the basis of all this, it seems reasonable to choose your local Italian bank by considering the services it is able to provide you as opposed to any perception of its security.

The proviso to the above is that you make sure to maintain only a modest amount of money in any bank and look at more secure solutions for the bulk of your financial assets. In this context, EU investment wrappers remain the gold standard for Italian residents, offering greater levels of protection as well as myriad other benefits – please take a look at this article – and get in touch if you’d like to explore how this might work for your own situation.

Tax time in Italy

By Gareth Horsfall

This article is published on: 22nd March 2023

2023 is the year that I turn 49 years old. Where do the years go? 50 next year and strangely enough I don’t feel as anxious about it as I thought I would. I actually feel quite good about it, and I have made some personal commitments to spend more time in nature and exercise regularly, but not excessively (I suffered glandular fever a few years ago and so can’t workout as hard as I used to).

It was on one of those walks in nature recently that I actually thought that it’s about that time when our commercialisti start asking us to send our financial information for tax calculation and payment. (unless you are one of those people who is well prepared and has done it already).

Of course, we always have to supply a full list of our incomes and assets (Italian and foreign), bank accounts and properties and taxable assets. However, I am not sure about you, but my commercialista doesn’t really give me much information on the corresponding list of deductions and detractions available to offset/reduce some of our tax bill, so I thought I would write this article to provide you with a full list for the financial year 2022. [A reminder to always check your tax return, once filed by your commercialista, to ensure that errors haven’t been made, especially on the foreign assets section Quadro RW . See my article on this for more information Declaring taxes in Italy

Some of these may be relevant to you, others not, but at least you have the list which you can refer to and always share with others, if you think it might help. There are distinct categories ranging from family expenses to renovation/property expenses as well. Also remember that in ALL cases now, to claim an expense you MUST have paid by electronic/traceable means i.e. bonifico (bank transfer) or carta di credito and you MUST have a corresponding scontrino fiscale in the case of things like farmacia expenses. For larger purchases a fattura (invoice) is required. Without the necessary document you will not be able to claim back the tax relief.

So, without further ado, here is the list:

SPESE FAMIGLIARI

These attract a detraction of 19% of the full value of the expense.

- The abbonamento (pass) for local, regional and inter-regional public transport, up to a maximum of €250 for the cost of the pass

- A maximum spend of €530 or €1219,14 (depending on the type of policy) for life insurance, polizze per infortunio (accident) or permanent disability policies

- All costs for deceased family members i.e. funeral

- A €632 maximum spend per child for kindergarten cost (public or private)

- The costs of infant, (scuola infanzia), junior (primarie) and secondary (secondaria) schools. Also University, Conservatorio and AFAM (Instituto Alta Forma Artistica Musicale Coreutica)

- Costs for students diagnosed with DSA (disturbo specifico dell’ apprendimento) – a category of ADHD

- A maximum spend of €210 for the costs of sport for children until 18 years old

- A maximum spend of €2633 for the costs of rent for students who are living away from their home region, including abroad

-

A full deduction of contributions into an Italian private pension scheme (previdenza complementare) up to an annual limit of €5164,57

SPESE PER LE CASE

- A 19% detraction on mortgage interest, where it has been used for the purchase or construction of the ‘Prima Casa’

SPESE MEDICHE

These all attract a 19% detraction:

- On a spend more than €129,11 for pharmaceuticals, ticket, hospital costs, specialist services and surgery costs. Analisi, thermal cures (when prescribed), medical equipment, glasses and/ or contact lenses that meet the CE standard

- Vets costs from €129.11 to €500 spend

- Costs to assist with maintaining personal independence e.g. the purchase of a vehicle necessary to get to and from hospital. (Limited to a maximum spend of €2100 for those on incomes less than €40000pa)

- A maximum spend of €750 for the cost of life insurance where the benefit is for someone with a serious disability

- Other general medical expenses attract the 19% detraction on the cost, which can then be detracted from your or your family income, where they are being supported by you (a carico)

LIBERE DONAZIONI

the full cost of donations to:

- Cultural and artistic activities

- Cooperative entities in the cultural /artistic sector

- Associations

- Scholastic institutions of every type

- Funds donated to the Italian state

BONUS EDILIZIE

Restructuring and renovation costs

For the tax year 2022, the following deductions are available:

- 60% on the full expenses of repair to the outside of your property – specific criteria apply! BONUS FACCIATA

- 50% on the cost of restructuring with a max spend of €90000 or 80% of the total cost where it was used to restructure for seismic risks. BONUS SISMA

- 65% of the cost for interventions for energy saving measures around the home.

- 50% of the cost of furniture and big elettrodomestici goods (where they meet certain criteria) BONUS MOBILI

- 36% on a max spend of €5000 for landscape work in the garden (reimbursed over 5 years) BONUS VERDE

- 50% for ordinary maintenance

- 75% for interventions for energy saving measures for condomini

- 110% SUPERBONUS for specific work

- From 2023 the 110% SUPERBONUS falls to 90% (but is likely to be fraught with the same issues as the 110% bonus, in my opinion)

- 50% of the cost of installing an electric car recharging column

Where you have an income up to €120,000 pa the expenses, as described in this article, will be fully allowed. Where your income is over €120,000pa then the detractions will be reduced according to a formula based on your total income.

And that’s it! Everything that you can detract from your income in 2022 to try and reduce your tax bill in Italy. If that doesn’t make a difference, then you may need to have a look at your overall finances to try and plan in different ways.

Possible Italian tax changes

It should be noted that the Meloni government is currently debating how they can follow through on their election promise to simplify the tax system by reducing the tax bands from 4 to 3, in the coming year, and then hopefully moving to a 2 tax band system. If they manage to pass this then they will likely reduce/remove the system of detractions/deductions by lowering the bottom rate of tax, or maybe introduce a starting rate tax allowance for everyone (unlikely, in my opinion. The talk is that an allowance may be offered to workers [not self-employed] and pensionati) However, they are in first stage negotiations and it may be some time before things come to pass.

The other thing they are currently discussing is simplification of the taxation of investment income and gains. Presently income and gains from certain types of investments cannot be offset against losses from the same investment. A system they called ‘redditi di capitale’ e ‘redditi diversi’. There is talk to remove this, what I consider a rather odd system, and have the same system as everywhere else, income, gains and losses from investment income treated in the same way.

Update on making Voluntary National Insurance contributions UK

Anyone who has a missing contribution record for UK National Insurance contributions in the UK between April 2006 and April 2016 will still have the opportunity to make up these contributions until the 31st July 2023, which will still give you the chance to increase your state pension entitlement from the UK. The previous deadline was the 5th April 2023.

The reasoning behind this decision from the UK government is that from April 2023 anyone retiring will need to have a national insurance contribution record of 35 years to receive the maximum state pension. Between 2006 and 2016 different maximum contribution periods may have applied and therefore the UK government is giving you the opportunity to maximise your contributions until July 2023. After this time, it will only be possible to repay the missing previous 6 years contributions in your national insurance record. If you want to know more, you can look at the www.gov.uk website.

Bear in mind that the state pension office will likely be overwhelmed with requests at this time, so if you need to make a request for back payments then you may need to do so immediately, otherwise they may not be able to respond to you in time.

If you are unsure of your National Insurance contribution record then you can check it online at www.gov.uk/check-state-pension. You will need your UK national insurance number handy.

Tax time in Italy

By Gareth Horsfall

This article is published on: 17th March 2023

Tax time in Italy – when our commercialisti wake up from their winter ‘letargo’ (aka – well-earned down) and start asking us to send our financial information for tax payment, if you haven’t done it already of course.

On top of the information regarding our taxable assets and income there is the list of allowable deductions /detractions to assist in lowering your tax bill.

In this article, I review that list for fiscal tax year 2022.

SPESE FAMIGLIARI – family expenses. These attract a detraction of 19% of the value of the expense.

- The abbonamento (pass) for local, regional and inter-regional public transport, up to a maximum of €250 for the cost of the pass

- A maximum expense of €530 or €1219.14 for life insurance, polizze infortuni (accident) or permanent disability policies

- All costs for deceased family members, i.e. funeral

- €632 per child for kindergarten cost (public or private)

- The costs of infant, (scuola d’infanzia), junior (primarie) and secondary (secondaria) schools. Also University, Conservatorio and AFAM (Instituto Alta Forma Artistica, Musicale e Coreutica)

- Costs for students diagnosed with DSA (disturbo specifico dell’apprendimento) – a category of ADHD

- A maximum of €210 for the costs of sport for children until 18 years old

- A maximum of €2633 for the costs of rent for students who are living away from their home/region, including abroad

SPESE PER LE CASE –

- A 19% detraction on mortgage interest, where it has been used for the purchase or construction of the ‘Prima Casa’

SPESE MEDICHE – medical expenses. These all attract a 19% detraction:

- When spending more than €129.11 for pharmaceuticals, ticket, hospital costs, specialist services and surgery costs. Tests, thermal cures (when prescribed), medical equipment, glasses and/ or contact lenses that meet the CE standard

- Vets costs from €129.11 to €500

- Costs to assist with maintaining personal independence e.g. the purchase of a vehicle necessary to get to and from hospital. (Limited to a maximum spend of €2100 for those on incomes lower than €40000pa)

- A maximum spend of €750 for the cost of life insurance where the benefit is for someone with a serious disability

- Other general medical expenses attract the 19% detraction on the cost, which can then be detracted from your or your family income, where they are being supported you (a carico)

LIBERE DONAZIONI – the full cost of donations to:

- Cultural and artistic

- Cooperative entities in the cultural /artistic sector

- Scholastic institutions of every

- Funds donated to the Italian state

BONUS EDILIZIE – restructuring and renovation costs

For the tax year 2022, the following detractions are available:

- 60% on the full expenses of repair to the outside of your property – specific criteria apply! BONUS FACCIATA

- 50% on the cost of restructuring with a max spend of €90000 or 80% of the total cost where it was used to restructure for seismic risks. BONUS SISMA

- 65% of the cost for interventions for energy savings measures around the

- 50% of the cost of furniture and big household appliances (where they meet certain criteria) BONUS MOBILI

- 36% on a max spend of €5000 for landscape work in the garden (reimbursed over 5 years) BONUS VERDE

- 50% for ordinary maintenance

- 75% for interventions for energy saving measures for condomini (apartment blocks)

- 110% SUPERBONUS for specific work

(** the superbonus has been suspended by the Meloni government because they found a hole of €38 billion in the public finances due to fraudulent activity related to the Superbonus. It is unknown when and if any applications made in 2022 will be reimbursed).

- From 2023 the 110% SUPERBONUS falls to 90% (but is likely to be fraught with the same issues as the 110% bonus, in my opinion)

- 50% of the cost of installing an electric car recharging

Where you have an income up to €120,000 pa the expenses, as described in this article, will be fully allowed. Where you income is over €120,000pa then the detractions will be reduced according to a formula based on your total income.

And that’s it. Everything that you can detract from your income in 2022 to try and reduce your tax bill in Italy. If that doesn’t make a difference, then you may need to have a look at your overall finances to try and plan in different ways.

It should also be noted that the Meloni government is currently debating how they can simplify this whole system by reducing the tax bands from four to three in the coming year, and then hopefully moving to a two tax band system. If they manage to pass this, then they will likely reduce/remove this system of detractions/deductions by lowering the bottom rate of tax, or maybe introducing a starting rate tax allowance for everyone (unlikely). However, they are in first stage negotiations and it may be some time before things come to pass.

Is Giorgia Meloni the new Mussolini?

By Andrew Lawford

This article is published on: 21st February 2023

This may seem like something of a provocative title, but I am merely picking up on the common refrain that Italy’s current government is the most right-wing since the fascist era.

It would be no minor issue for the country if indeed we did find ourselves heading down a similar path, so rather than simply dismissing out of hand the possibility that Meloni could be a Mussolini for the new age, I thought I would look into it further. We are, after all, talking about someone who as a much younger woman expressed the view that Mussolini was “a good politician”, whatever exactly that is supposed to mean. I imagine we all expressed at least some views when younger that we might cringe to think about today, but certainly Meloni’s comment on Mussolini was something of a clanger considering the office she now occupies.

Before we talk about Meloni’s politics, let’s think about the difference between the Italy of 100 years ago and today. 100 years is a useful timeframe, because 1922 was the year of the March on Rome – the moment when the fascist movement kicked into a higher gear and, notwithstanding the fact that it was poorly resourced and even more poorly organised, managed to bring Mussolini to power. The fascist movement had begun a few years earlier, populated initially by disaffected soldiers returning home to anything but a victor’s welcome following the First World War. Subsequently, the fascists managed to find their raison d’être and much broader support in the fight against socialism/communism, yet the entire movement might easily have fizzled out had it encountered even a modicum of resistance from the monarchy and the political establishment or if one of the many assassination attempts on Mussolini had succeeded in the early years of the regime* .

As fascist power grew, the desire to return Italy to its rightful place in the world, as heirs of the Roman Empire, took hold of Mussolini’s imagination, leading to the conquest of such places as Libya, Ethiopia and Albania. At home, the country was dragged into the modern age through the execution of public works programmes as well as monumental changes to cities such as Rome. The next time you wander down the via dei Fori Imperiali, consider that you are in an area profoundly changed by Mussolini, who demolished an entire area of Rome to make way for what was initially called via dell’Impero – put in place so that he could see the Colosseum from his office in Palazzo Venezia at the far end of the road. It is fair to say that from an economic and social perspective, the Italy of 1922 is almost unrecognisable compared with the country we live in today.

Now let’s consider the Italy of 2022 that swept Giorgia Meloni to power. Notwithstanding its difficulties, Italy is undoubtedly among the wealthiest countries in the world. I know there can be large regional differences and often the systems are confusing, but generally speaking Italian healthcare, education, infrastructure and other public services range from adequate to excellent. Italy is the home to world-leading industries and is certainly a place where one can rise through the social hierarchy regardless of one’s origins. If you need proof of this, consider that Leonardo Del Vecchio, the founder of Luxottica who died last year as one of Italy’s richest men, was born in 1935 to a solo mother and grew up in an orphanage.

Italy has many of the hallmarks of modern, well-heeled democracies, including an ageing population and a prevalence of small families (when people decide to have children at all). It is incredible to think, but over the course of my lifetime (I’m not quite 50 years old), the number of babies born in Italy each year has halved from about 800,000 to about 400,000 currently. The odd incentive for young families isn’t going to change that trend in any substantial way.

Imagine, now, if you will, that Meloni decided to pick up the fascist cudgel and start to take a more aggressive geopolitical stance. The current army of one-child families is probably the greatest guarantee against this because how many of these parents will permit their children to march off to war? Occasionally one does see fascist meetings – for example I recall seeing one reported in Cremona to commemorate the death of Roberto Farinacci, a particularly hardcore exponent of the black shirt, but to be honest the sight of fat old men singing “Giovinezza” (the fascist anthem, dedicated to youthful courage), was as comical as it was pathetic. It is also amusing to note that one of the main scandals so far in the Meloni era has been her decision to use the masculine article “Il Presidente” as opposed to “La Presidentessa” or something similar. This seems to me to be the kind of problem you discuss when you really don’t have any serious problems (or, perhaps more accurately, you don’t wish to discuss the various intractable problems that do exist). I also don’t think we should be particularly concerned over the apparent revival of Berlusconi’s connections to Putin: he simply can’t accept that he’s become a marginal figure, almost a caricature of himself, so he’s returned to his advertising roots and is willing to do anything to get attention.

What I do see is a general trend towards nationalism, which can, I suppose, be seen as a very watered-down version of fascism. There is at least the possibility of some expansion of state participation in business, although one can but hope that no one is considering a return to the days of IRI (L’Istituto per la Ricostruzione Industriale) – the behemoth state holding company founded during the fascist era that for decades controlled huge swathes of the Italian economy. In this context, it is disturbing to hear discussion of the potential nationalisation of Telecom Italia (TIM), although this might be best seen as an (expensive) opportunity to correct a poor privatisation that left the company imprisoned by its debt burden. It is more likely to see the state getting involved at a smaller scale, with the recent trend in the use of the state-controlled CDP (Cassa Depositi e Prestiti) for financing and even venture capital activities an indication of things to come. It is also more than likely that the state guaranteed loans issued as part of Covid support measures will eventually result in the need to absorb zombie businesses in politically sensitive sectors.

All in all, it seems to me that Meloni fortunately has neither the innate tendency towards fascism, nor a populace willing to be led in that direction. We would probably do better to think about whether the current global trend of rearmament will lead to problems in 10 – 20 years time when all the shiny new weapons are ready for use. I worry that if you build enough of them then sooner or later an excuse will be found to use them – violence is violence, regardless of political ideology.

Subscribe to my podcast:

IFA (Italian Financial Adviser) on:

Apple Podcasts, Spotify, Google Podcasts or Stitcher