Missing billions, shady finance, body-snatchers and a murder investigation.

Is it a new Netflix series?

No, it’s banking, Italian style…

By Andrew Lawford

This article is published on: 5th March 2026

Missing billions, shady finance, body-snatchers and a murder investigation.

Is it a new Netflix series?

No, it’s banking, Italian style…

Recently we have had confirmation that the proposed acquisition of Mediobanca by Banca Monte dei Paschi di Siena (MPS) will be completed. This amounts to the apparently inexplicable phenomenon of one of Italy’s best banks being taken over by what is, arguably, the country’s worst. Read on for proof that truth is certainly stranger than fiction in the world of Italian banking.

Let’s start at the beginning. Well, not exactly the beginning, because MPS was founded in 1472. We do, however, need to go back to 2008 and the disastrous aftermath of the takeover of Dutch bank ABN Amro.

Many will remember this moment as the beginning of the end for Royal Bank of Scotland, the lead acquirer, but there were in fact two other banks involved in the takeover (Santander and Fortis), which led to a curious side-show in the context of ABN Amro’s Italian assets.

Banca Antonveneta, at the time a moderately important domestic bank, had only been acquired by ABN Amro in 2005 as a result of the bankopoli scandal.

This is a whole other story involving market manipulation, a corrupt Governor of the Bank of Italy (the only one ever to have been forced to resign) and an investor group that nicknamed itself I furbetti del quartierino (the local hustlers) – but I digress. Antonveneta ended up in the hands of Spanish group Santander as part of the ABN Amro takeover and the asset was assigned a value of €6.6 billion, yet it was sold a few days later to MPS for €9 billion. The ridiculousness of this situation was summed up by one of the analysts present when the deal was announced. He posed this simple question to MPS management: “Did you even negotiate the price for five minutes?”

Of course, 2008 was no time to be doing an ambitious bank purchase and MPS soon found itself secretly counting the cost of the transaction. In order to save face, it organised a series of derivatives transactions designed to hide the reality of its deteriorating solvency position. It took a while for the truth to come out, but it was breathtaking when it did. The tone was set by the death of David Rossi, the bank’s Head of Communications, whose body was found in the alleyway beneath his office window in 2013.

Whilst officially ruled to have been a suicide, there was plenty of speculation that other, darker forces were involved. Of course, as is so often the case in financial frauds, lengthy court proceedings resulted in acquittals on criminal charges for all concerned.

Now, if the sordid story finished here with the collapse of MPS, the next chapter could not have been written, but of course politicians never want to let a good crisis go to waste and banks are always fun political toys.

Amongst the state’s interventions to prop up MPS, we can highlight the issuance of guaranteed bonds (Tremonti Bonds, named after the finance minister of the Berlusconi era, and then Monti Bonds, named after technocrat PM Mario Monti), subsequently repaid during rounds of capital increases that left the state on the hook for about €7 billion by the end of 2022. Subsequent equity sales brought in about €2.7 billion and left a remaining stake of about 12% in MPS. Following the takeover of Mediobanca, the state’s shareholding in the combined group has now been diluted to under 5%, currently worth somewhere over €1 billion. Not a great return on its investment so far.

But what of Mediobanca? Founded immediately following the end of WWII to finance the reconstruction of Italian industry, it was led by Enrico Cuccia, a legendary figure in Italian finance, until his death in 2000.

It is said that Cuccia played his cards so close to his chest that he would type any particularly important letters on his own typewriter so as not to allow the possibility of sensitive information leaking from his office.

To give you a taste of the kind of deal Cuccia was famous for: when FIAT was in grave financial difficulties in the ‘70s, Cuccia arranged for Gaddafi’s Libya to buy a 10% shareholding – it wasn’t a good look for FIAT’s Gianni Agnelli, who was rather happier in the company of friends like Henry Kissinger, but needs must. It’s not surprising that Cuccia was generally considered to be the one pulling the strings that made the stock market move – a point that was made rather morbidly when his corpse was stolen from its grave on Lake Maggiore and held to ransom. The demand, aside from cash, was that the Milan stock exchange index had to regain the level of 50,000 points (+35%!) by the end of the year. This didn’t happen, so evidently there were at least some limits to the man’s power.

The question of course is: why has this transaction occurred?

The following is from the official MPS press release following the acquisition:

The new Group structure is aimed at achieving strategic and profitability objectives and at fully achieving industrial synergies so to maximize value creation. This configuration is designed to enhance the distinctive expertise of Mediobanca and its professional resources, within a specialized operating model.

Right. This type of communication is technically known as a supercazzola in Italian. Don’t worry about the lack of subtitles – nothing he says makes any sense, which is sort of the point…

The sad reality is that Mediobanca, aside from being one of the crown jewels of Italian finance, sits atop another crown jewel: a 13% shareholding in the insurer Generali, a stake currently worth about €7 billion. It may well be that the dismemberment of Mediobanca and Generali and the distribution of value to its shareholders will be part of the Italian government’s strategy to promote nationalist capitalism. It’s hard to resist the temptation to say that Cuccia, who studiously avoided political interference, will be rolling in his grave (yes, his body was eventually returned to its rightful resting place).

By Gareth Horsfall

This article is published on: 4th March 2026

I wanted to communicate some information regarding what is going on in the Middle East with some information from Evelyn Partners ( one of our asset management partners) in an email newsletter to all advisers, which provides perspective regarding investments. If you have any questions or thoughts, do not hesitate to get in touch and fingers crossed this situation does not last long!

Escalating tensions in the Middle East have brought renewed market volatility and lifted oil prices, but diversified portfolios offer resilience in periods of uncertainty

Over the weekend, tensions between the US, Israel and Iran escalated materially. Israeli strikes have reportedly targeted Iranian nuclear facilities, while the US has signaled a broader objective that may extend beyond deterrence towards regime change. Iran has responded with attacks affecting parts of the Gulf region, including strikes impacting areas in the UAE, Qatar, Bahrain and Kuwait, as well as Israel.

This marks a significant shift from prior contained flare-ups. Financial markets are responding to the risk of further escalation.

Three key price moves frame the immediate response:

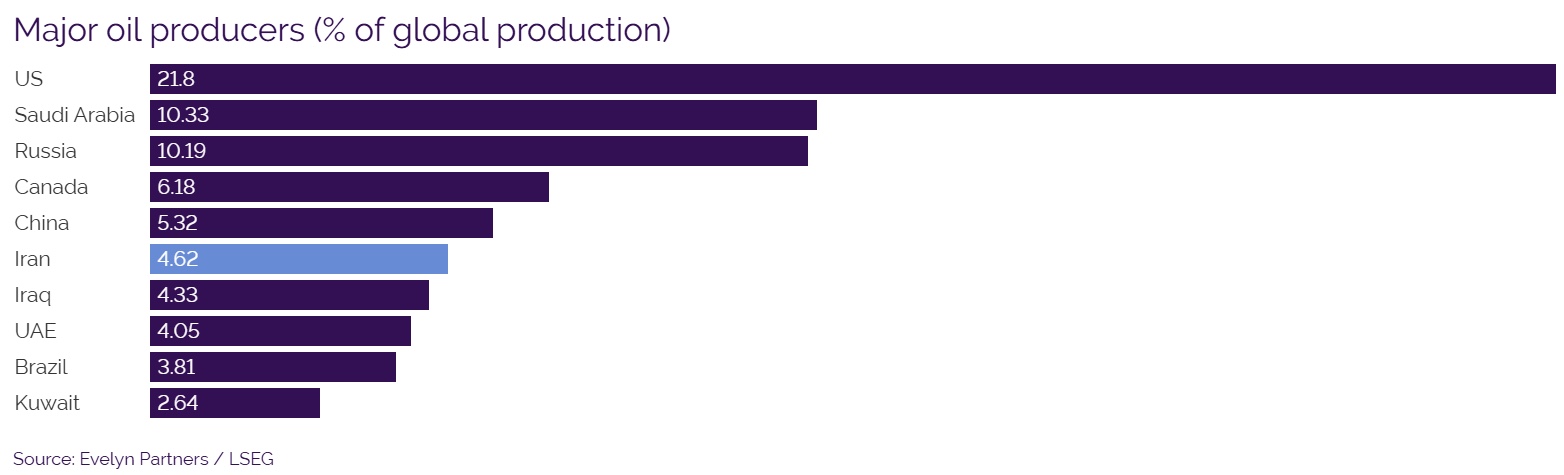

Iran is a major exporter, and critically, more than 80% of Iranian oil exports go to China. Iran is also strategically important to China’s Belt and Road initiative, is a member of BRICS, and plays a role in facilitating trade outside Western sanction frameworks.

In that context, this is not just a regional issue; it intersects with broader US – China strategic dynamics. Should the US gain greater leverage over oil flows coming out of both Iran and Venezuela, it would provide Washington with a significant bargaining chip ahead of the upcoming summit between Presidents Trump and Xi of China.

Paradoxically, such leverage could also deter China from blockading or invading Taiwan, a far larger systemic risk to global markets given Taiwan’s dominance in producing advanced semiconductors.

The primary “tail risk” remains disruption to the Strait of Hormuz, through which roughly a fifth of global oil supply passes. At present, while there are signs of disruption – including higher shipping insurance costs and some tanker hesitancy – the Strait remains open and traffic continues. A full closure or mining of the waterway would represent a far more severe shock to energy markets and global growth.

There is also the risk of broader attacks on regional energy infrastructure or US-linked assets across the Gulf, as most of the key oil infrastructure sits within short-range missile range of Iran. However, at this stage, markets are pricing heightened uncertainty rather than a sustained supply shock.

It is also worth noting that global oil inventories have been rising, which provides a partial buffer against near-term supply disruption. That does not eliminate risk, but it may dampen the impact unless escalation becomes materially worse.

Equities have softened modestly, but earnings growth remains the dominant driver of equity markets. Corporate Earnings Per Share momentum has so far offset geopolitical and tariff concerns this year, and we are not seeing signs of systemic stress or disorderly market functioning.

Periods like this are uncomfortable, but they are not unfamiliar. We have seen similar episodes – most recently during prior Israel–Iran tensions and in the 2022 energy shock.

History shows that while oil and gold often react sharply, diversified portfolios tend to prove resilient.

Across asset classes, we are seeing natural offsets:

Within equities, exposure to energy producers can help offset broader market weakness linked to rising oil prices. In fixed income, inflation-linked bonds could benefit from rising inflation expectations. Alternatives such as gold continue to demonstrate their value during energy shocks, as seen in previous episodes including 2022.

Investment strategies are designed with periods like this in mind. They are constructed to withstand geopolitical shocks, inflation pressures and bouts of market volatility, while remaining fully liquid and aligned with clients’ long-term objectives and risk profiles.

We expect markets to remain volatile in the days ahead. News flow may be intense and, at times, sensational. It is important to distinguish between media tone and market fundamentals.

At this stage, this is not a systemic market event. We are not seeing disorderly trading conditions or liquidity stress.Remain vigilant and ready to adjust portfolio positioning should fundamentals materially change.

For now, the appropriate stance is calm, disciplined and long term. Periods of geopolitical tension are unsettling, but diversified portfolios are designed to navigate precisely these environments. We will continue to monitor developments closely and keep clients informed with measured, evidence-based updates as the week progresses.

I know these are not easy time and so if you have any questions, or would just like to send me some comments then feel free to do so. I am always interested to hear your thoughts on these matters.

By Katriona Murray-Platon

This article is published on: 4th March 2026

After a very wet, windy and stormy February it is lovely see some sunshine and the first spring flowers coming into bloom.

The income tax thresholds have not been frozen as initially planned in the 2026 finance bill; instead, they have increased by 0.9%, aligning with the 2025 rate of inflation. The new tax-free allowance is €11,600 per person. The other tax bands are as follows:

| INCOME | RATE |

| Up to €11,600 | 0% |

| From €11,601 to €29,579 | 11% |

| From €29,580 to €84,577 | 30% |

| From €84,578 to €181,917 | 41% |

| Over €181,917 | 45% |

Employees can deduct a set amount of €509 from their taxable salaries for costs, capped at €14,556. The 10% abatement before tax will still apply to pensions with a minimum of €454 and a maximum of €4439.

To reduce your taxes and assist you at home you may use home help such as a gardener or cleaner. Now the cost of home delivered meals to the handicapped or elderly and their dependents also qualifies for a tax credit even if you don’t have other kinds of home help. While services may be more limited in rural areas, it’s worth exploring.

Another measure that has been scrapped is the increased VAT threshold for independent workers and furnished rentals. This threshold remains unchanged.

As mentioned in last month’s Ezine, social charges have risen from 17.2% to 18.6%. Whilst this does not apply to assurance vies nor PEL accounts, it will apply to PER retirement accounts. Also, after the recent fall in interest rates on the Livret A and LDDS accounts on 1st February, the interest rate on the LEP account has also dropped from 2.7% to 2.5%.

Assurance Vies remain the most popular investment products in France with €2,107 billion currently invested, compared with only €449 billion in Livret A and €136 billion in retirement accounts. According to INSEE, investments in Assurance Vies have increased over the years with €121 billion invested in 2005, €135 billion in 2015 and €192 billion in 2025. Whilst Euro Funds (the money that that French government and businesses borrow from the insurance companies) remain the preferred asset class, this figure has decreased from 79% to 61% in 2025 with the remaining 39% in equities. Although the average rate of Euro Funds was 2.7% in 2025, it has rarely outpaced inflation over the past 8 years. Our assurance vies offer a more diversified, cross-border approach, making them more suitable for English speaking expats.

On 25th February 2026 the Prudential Assurance Company board reviewed the Prufund Expected Growth Rates (EGR) as part of its quarterly review. Prufund aims to help customers grow their investments over the medium to long term (5 to 10 years) while protecting them from short-term market fluctuations through the unique smoothing process. The Expected Growth Rate (EGR) is the forward-looking element of the unique Prufund smoothing mechanism. This quarter the EGRs for all versions of Prufund remain unchanged.

However, there have been some upward movements to the, the Unit Price Adjustment (UPA), the backward-looking element of the Prufund smoothing process, which is formulaic and non-discretionary, as follows:

Prufund Growth GBP +2.54%

Prufund Growth Euro + 3.25%

Prufund Growth USD + 3.46%

This is positive news for Prudential International investors when they receive their quarterly statements at the end of the month.

At the time of writing, the US and Israel have launched strikes against Iran, which will have an impact on oil prices and may cause some short-term market volatility. However, our well diversified portfolios are designed to withstand periods of geopolitical tensions. In times of intense media coverage, it’s important to remain calm and focus on long-term strategies.

By Portugal team

This article is published on: 3rd March 2026

This webinar is designed to help you understand what really drives long-term investment success.

With a professional fund manager, we will explore how investing really works, what truly matters over the long term, and where complexity often adds cost without adding value.

The webinar is open to everyone, whether you are a first-time or experienced investor. This is your opportunity to learn how the professionals research, analyse and build portfolios.

The webinar is designed to provide a clearer understanding of what truly drives long-term investment success, including:

Alternatively, if you would prefer to discuss your own situation privately, we are available for individual consultations.

📅 Tuesday 10th March 2026

🕚 11:00am-12:00pm

Mark Quinn & Debrah Broadfield | Tax advisers & Chartered Financial Planners, Spectrum Portugal

Chris Saunders | Co-Founder and Chartered Investment Manager, New Horizon Asset Management

By Chris Burke

This article is published on: 2nd March 2026

We’re already halfway through the ski season — if that’s your thing — or halfway to Easter, depending on how you measure the year.

However you look at it, time seems to move faster every year — at least it does for me.

Time spent with loved ones, furry friends, hobbies, or simply resting is precious. And the time we give to our finances is precious too — even if it doesn’t always feel that way in the moment.

“Life admin” never really gets shorter, does it? Even when we automate what we can, there’s always something waiting for attention. And managing finances is often the task that quietly slips down the list.

It can sometimes look irresponsible not to manage or invest your money. But in truth, most people who don’t invest aren’t careless — they’re human. They’re making decisions shaped by emotion, psychology, past experiences, and what they’ve seen around them.

This month, I want to explore both sides of the story: why people avoid investing — and what gently nudges them to begin.

Fear of Losing Money

As humans, we feel losses much more deeply than gains.

Even though investing has historically built wealth over time, the idea of seeing values temporarily fall can feel uncomfortable — even frightening.

Common thoughts sound like:

And yet, inflation quietly reduces the value of cash every year. It just does so slowly and invisibly, which somehow makes it feel less threatening. At 3% inflation, €100,000 left in cash for two years becomes roughly €94,000 in real terms.

Feeling Overwhelmed

Terminology such as stocks, shares, bonds, ETFs, diversification, compounding, tax wrappers, fees… it can feel like learning a new language.

Many people think, “If I don’t fully understand it, I’ll probably get it wrong.”

Without someone to simplify it, waiting feels safer than starting.

Short-Term Thinking (We All Do It)

Spending gives immediate satisfaction. Investing gives delayed reward. It’s completely natural to choose what feels good today over something abstract decades away.

Past Experiences

Market crashes, hearing about scams, or seeing family members receive poor advice can leave a lasting emotional imprint. Even second-hand experiences can quietly shape our beliefs.

Too Many Choices

Ironically, modern investing platforms can make things harder. With thousands of options, people can feel they need to choose perfectly — and when perfection feels impossible, they choose nothing.

What We Grew Up Seeing

If investing wasn’t discussed at home, it can feel unfamiliar or even slightly uncomfortable. Financial habits are often inherited without us realising it.

The Real Barrier

Most people don’t actively decide not to invest. They just delay. And delay again. Until years have passed.

The biggest barrier usually isn’t money — it’s making a decision and worrying about making the wrong one.

What Prompts People to Start an Investment Strategy

There’s often a moment, something like:

Sometimes it’s simply that savings have built up and sitting in cash no longer feels comfortable. Other times it’s watching a friend or colleague invest calmly and successfully. Perhaps it’s inflation making everyday costs noticeably higher.

Often, it’s discovering that investing doesn’t require stock picking or constant monitoring — that simple, structured approaches exist. And sometimes it’s life itself: children, buying a home, career stability, inheritance, or receiving a lump sum. Those moments naturally make us think longer term.

The Turning Point

People don’t usually start investing when they feel perfectly informed; they start when not investing feels riskier than investing.

When standing still feels less comfortable than taking a step forward.

Looking Beyond the Numbers

Investing isn’t really about charts or screens — it’s about change. About making decisions that give you financial flexibility and security in the future to live a different life:

When people picture those outcomes, investing stops feeling technical or risky and starts feeling purposeful — the focus shifts from short-term uncertainty to long-term control.

If you’ve been waiting to feel completely ready, you’re not alone. Most people never feel 100% ready — and that’s okay. The goal isn’t perfection; it’s participation:

Over time, confidence grows naturally, because the greatest financial advantage isn’t intelligence, timing, or luck — it’s taking thoughtful action within a process you understand and feel comfortable with.

“With care you prosper” has always been our motto for a reason.

If this has resonated with you, feel free to reach out. Taking that first step might just be the most valuable piece of life admin you ever complete.

You can arrange an initial consultation to explore your situation [here].

You can also [read independent reviews of my advice and service here].

By Jeremy Ferguson

This article is published on: 23rd February 2026

A well-informed opinion can be highly valuable when it comes to personal finances.

A couple of weeks ago I attended the 23rd Spectrum partners’ annual conference. It was great to meet up again with my colleagues and our product providers, all of whom work primarily with expats who have moved to various parts of Europe from the UK, mainly to Spain, France, Italy and Portugal.

We get the chance to catch up with the companies we work closely with, keeping up to date with new products and services and the latest topics in the world of investing. This is extremely valuable, as our highest priority when dealing with clients’ finances when they have retired is doing our best to ensure they make money. Many people approach me when they have arrived in Spain, asking about tax efficiency for their pensions and investments. I am always at pains to say the most important thing is first to make investment gains, without which there is no tax issue to worry about. The most tax efficient investment product is one that makes no money!

With successful investing, the first question to answer is how much risk are you prepared to take to try and make money? I assess risk on a scale of 0 to 7, essentially ranging from cash in the bank, to 100% of your money invested in the stock market. Then there is the timeline – how long can we leave this money alone to give it a chance to increase in value? Once we have considered this, we can then look at various options, with attention also given to cost. The point on cost is of course important, as an expensive product will have a detrimental effect on investment returns. I spend a great deal of time when I first meet people who are about to retire speaking about the importance of taking less risk with our money as we get older. If you have a solution which has low costs, then you can effectively take less risk to achieve the rewards you are looking for.

Listening to the investment managers at the conference, I noticed that they have similar views about what may be around the corner, but with slightly different ways of dealing with this. Some managers try to make money by investing in shares of companies when they think prices are low (an opportunity to buy in at good value), others look to companies they feel have growth potential. My view is perhaps rather cynical, as nobody knows what lies ahead, and share prices can change sometimes for irrational reasons. What I do know though is that if you invest money with a good manager, keep a sharp eye on costs and leave the money there for a good number of years, the likelihood is you will achieve sufficiently healthy returns for you to be happy and for your retirement plans to work out well.

If you would like to talk about what options are available to you as a Spanish resident, whether you have recently arrived, or even if you have been here a long time and would like an impartial review of what you already have, please feel free to get in touch.

By Gareth Horsfall

This article is published on: 20th February 2026

In this Ezine I will summarise the discussions and news from our annual event which took place in Monaco this year. However, before I do that I must provide a small apology because about 3 weeks have passed since the event itself.

As you may know my newsletters are not AI generated and for this reason they take me a little time to summarise the information, and also find the time to do so. I hope that you appreciate the fact that you are not being sent existing information which has been trawled out of the internet-o-sphere, but rather real, new and original content. (AI was a big story on the conference actually, so I will be touching on this a bit further down).

Before I get on to that, I should mention a few house and land things to keep you updated on our continued transition to rural Italian life.

The first thing to admit is that I seem to have lost the winter race to complete all the jobs I wanted to do before the spring arrived and before plant life sprang back into action. The grass being the main culprit. It seems that although the air temps are still a bit chilly on sunny days, the almond tree is now in full bloom and flower buds are starting to emerge on the fruit trees, notably the apricot tree. They are not fully formed yet but I imagine it won’t be long before they flower. I just hope a random storm doesn’t pass this year at the time of flowering and destroy the flowers again. But the grass is starting its quick growth spell with the extra light during the days and I imagine it will only be a matter of time before it’s knee high again. However, the wild flowers are already starting to grow and they are always a pleasure to see.

I am still on with the potatura of the olive trees as my early morning activity. The land is full of olive tree cuttings at the moment and I am thinking I maybe need to call someone to help clear it up. But, I am still enjoying the task and although I kind of think I don’t really fully know what I am doing, I will just see what happens with the olive oil production this year and take it from there.

And so, other than that its’ business as usual. The world of finance keeps moving forward, or backwards, depending on your point of view, and when you check your portfolio valuation.

One interesting thing that occurred before I went on the conference, in fact just a few days before, was that a handful of people contacted me to say that they wanted to sell out of US based assets because they didn’t like the activities of Donald Trump and the current US administration. My advice at this time was:

It is always good to be reminded that the US stock market is valued (USD 67-69 trillion) at more than the rest of the worlds stockmarkets cumulatively (USD 55 to 60 trillion). So no matter what we think about the politics in the US at the moment, to exclude ourselves from the US stockmarket would be akin to investment suicide. We can make investment choices based on sustainable and ethical choices (and we offer these services as well for our clients) but some of the best research, technological innovation and new creative thinking comes from the US and so it still retains it’s spot as one of the best, if not THE best places for an investor.

To further explain the importance of the US market, it was explained at the conference, that should just 1% of the total value of the US stockmarket be moved at any one time, it would hardly move the markets in the US at all. That same amount would be the equivalent of the entire German stockmarket (which includes all the big names we know such as Volkswagen, Basf, Siemens, SAP, Mercedes Benz and many more) and would have a tremendous impact on the German stockmarket and in Europe, just to give context on how important the US is for our portfolios.

Saying all this, I appreciate that the Trump administration may still be a little too much to bare for some people, and so here is my summary of what is going on there:

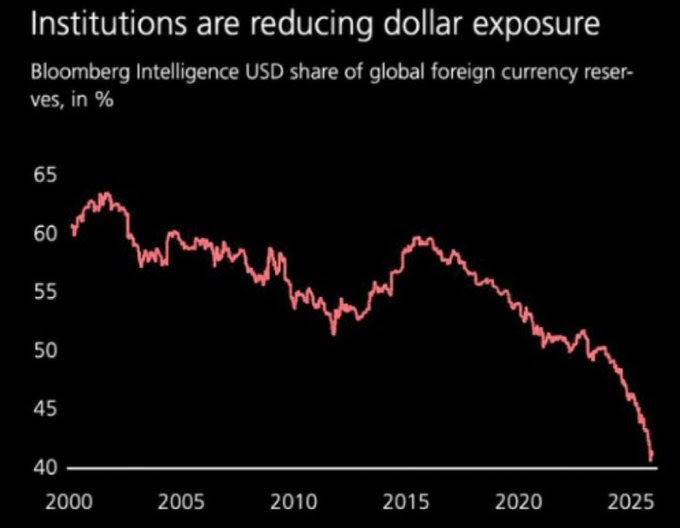

If the U.S. economy is about 30% of global GDP, then should its currency, being that it is the reserve one, account for 35%-40% of global reserves and not 50% or 60%?

It is now pretty evident that the Trump administration is aiming to push the US Dollar lower against other currencies…but why?

The old globalisation game where the US outsourced everything and let China build the factories is effectively over. The idea that cheap imports were free trade and you don’t pay the price for destroying your industrial base is something which needs to be re-addressed as many economists on both the left and right side of politics, agree. To some extent Beijing also started weaponizing supply chains, particularly in rare earths such as lithium, cobalt and graphite, because they have an almost 90% control over these rare earths, both in mining and refining. The Trump administration is aiming to protect US interests and rebuild American industry from the ground up.

Tariffs are back—and they’re not going anywhere. They have largely turned out to be a negotiating stick and strategically aimed at specific goods rather than blanket punishment, to protect US domestic producers and force companies to bring manufacturing back to the US. As DT has said: “if you want access to the world’s largest consumer market, build in the US” Produce there and employ Americans.

Not a collapse, but more than likely a deliberate, controlled depreciation to make U.S. exports competitive again and make imports more expensive. (2026 may see a further USD decline when the new Fed Chairman Kevin Walsh is put in place, and then it could stabilize)

Cheap foreign goods have flooded the US market (and Europe) for decades because the dollar was probably too strong. A weaker dollar rewards domestic production, boosts manufacturing margins, and will hopefully brings jobs back to places that have been forgotten for years! (If this strategy works then you can be assured that Europe wil adopt the same approach, no matter how much they hate to admit it!)

This could be one of the most significant decisions made by any US administration for decades. Project Vault is a $12 billion strategic plan to stockpile critical minerals, the equivalent of a Petro Reserve for the AI and defense age. The US is building a preferential trading bloc with price floors, adjustable tariffs, and enforceable rules to crush China’s predatory pricing and market flooding.

The winners will be the ones who control the physical economy—the mines, refineries, smelters and processing plants. Critical minerals and rare earth security.

Without them, nothing modern works. Jet engines. Hypersonic missiles. Wind turbines. Electric motors. Drones. Smartphones. AI data centers. Defense systems. EVs. Nothing.

And here are some examples:

Niobium—an irreplaceable steel strengthener. Adds toughness, corrosion resistance, and high-temperature performance to superalloys

(Brazil controls ~90% of global supply. The U.S. imports 100%. Zero domestic production. One mine in Canada which given the fractious nature of current US / Canada relations, the US considers this a national security nightmare)

Neodymium (Nd) and Praseodymium (Pr)—the magnetic rare earths that power permanent magnets, the strongest magnets ever made.

(Essential for EV traction motors, wind turbine generators, missile guidance, radar, precision-guided munitions, and high-performance robotics)

CHINA CONTROLS CIRCA 90% OF REFINING AND 93% OF MAGNET PRODUCTION AND 60% OF THE REFINED SILVER MARKET.

IF RELATIONS SOUR FURTHER, THEN BEIJING WITH JUST ONE PHONE CALL, COULD PARALYZE WESTERN DEFENSE AND CLEAN ENERGY SUPPLY CHAINS

And so, in a nutshell, that is what the Trump administration would appear to be doing geopolitically. (I won’t mention any US domestic issues that are….well….. questionable).

My hunch is that you will see Europe follow suit. Europe appears to have woken up (c/o D.T) to the fact that it needs to protect itself and can no longer rely on the US Military Industrial Complex. Re-arming Europe seems to be the EU leaders first objective, but if they then see progress with this economically nationalistic kind of behaviour in the US then I would say that they will start to walk a similar path, even though the EU is quite protectionist by nature anyway. It may mean that you need to stock up on TEMU goods now, whilst the prices are still low!

I have probably dedicated more time here to the Trump administration than I had wanted to, but it is clearly on alot of minds and so was worthy of a few lines.

However, on our conference we did discuss other investment matters, which arguably are not quite as important as what is happening in the US administration, but also warrant some time being spent on them.

These conferences are always interesting to get perspective on certain matters and the issue of Greenland was brought to light as follows:

From 1951 to 2004 the US had the right to place US bases in Greenland without any permission required.

From 2004 this power was taken away when Greenland gained sovereignty and fell under the supervision of Denmark.

Now, the pre-1951 agreement is being re-negotiated, and although not a ‘free to do what you wish’, the US will certainly have the possibility to expand its military presence. Was the whole ‘buying Greenland fiasco’ just a ruse to restablish this agreement?

At the 2025 conference alot was made of AI and how it would be changing the world, putting people out of work and taking over our world. Just one year on and the view from the asset managers was almost completely the opposite, but also that it is not going anywhere soon.

However, an AI bubble (like the tech bubble of 2000), it would not seem to be. AI is already helping businesses to improve productivity but not by firing staff. There is no evidence of this and the companies running AI models themselves, are already profitable. In addition the Big tech companies are cash rich. It is more likely that AI integration will more of a messy technological shift, than a huge damaging effect and it’s very unlikely that AI stocks will be the cause of a global recession, or mass unemployment no matter what you read online.

Net income from Tech + comms services companies has grown from 23.1% in the year 2000 to 35.3% in 2025

A term was used: ‘Crap in – Crap out’.

What is being found is that the AI we know: ChatGPT, Google Gemini etc cannot be relied upon for accurate results.

Search results are based on the data that is out in the internet-o sphere. If that data is flawed then it has no way of knowing how to fact check it and hence it will produce inaccurate results. (In fact caught out ChatGPT on 3 occasions, when I knew its results were incorrect. I now use Google Gemini, which appears to be better). There is also a HUGE amount of internet fraud and scam and the culprits are using the internet to deliberately put out content which furthers their devious means. So, how can we rely on such a system? Markets are worried about the inability to overcome this problem and about a lack of innovation in AI. If we are all fishing in the same pool of information and being provided the same results then innovation and creativity grinds to a halt, and that is not good for businesses who are looking to find an competitive edge and / or increase productivity.

But, AI probably has a more focussed strength in it’s ability to gather, organise and analyse large data sets. Private data is the real gem! It’s what you can’t see rather than already public data. I may have mentioned in my Ezine last year the example of the Lancet medical publication in the UK, which has archives going back 203 years. It is almost unimaginable that human beings would be able to reference a tiny fraction of that information, whereas they are already using AI tools to organise data and information in their business and to make it available to a much wider and much more targeted audience. Data is the new gold! Loyalty card data would be a perfect example of data which can be privately exploited by companies looking to gain a competitive edge with the use of AI tools.

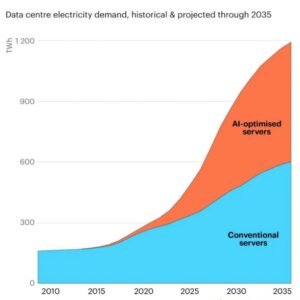

The strange thing with AI is that the people who are probably going to make money from it are not the people directly running AI tools, but more likely the periphery businesses that are needed to keep it running: energy providers and data centres being good examples: see images below to give you an idea of just how many resources are going to have to go into running and maintaining these centres.

Could nuclear and renewables be the winners long term?

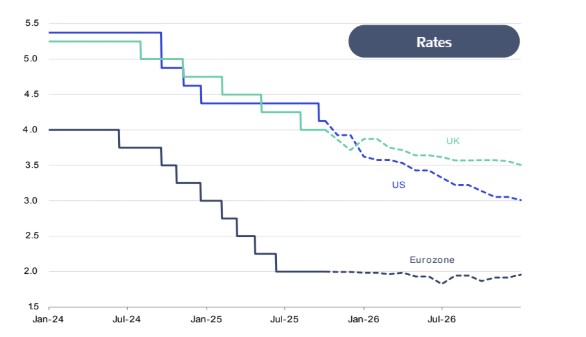

INTEREST RATES: don’t expect rates on your cash to be rising anytime soon. If you are sat with the majority of your assets in cash, then you should really be thinking about the long term implications of inflation on these monies. This is exactly the scenario that governments wanted to see. Low interest rates (which keep government benefit payments down and debt repayments low) but an inflationary economy. They pay their debts down quicker amd erode them away, and we feel the pinch. You can see the interest rate trend in the chart below.

Given the US’s influence over the world’s major oil producers (Venezuela, Saudia Arabia, Iran and Canada) , it is likely that there will be a glut of oil in the next 5 years. This will most likely push prices down. This is certainly what the D.T administration wants. Energy prices and inflation should fall which could be good for US stocks in particular. The wider US market could benefit greatly.

I hope you have enjoyed this content! Once again apologies for the time taken to get it you. Unfortunately I don’t even think AI is sophisticated enough…yet…to decipher my scribbles and handwriting when note taking.

As always, if you have any questions, or would just like to send me some comments on what you have read here, then feel free to do so. I am always interested to hear your thoughts on these matters.

Equally, if you would like to follow up individually on anything then you can do so on gareth.horsfall@spectrum-ifa.com or message / call me on +39 333 649 2356

By Jett Parker-Holland

This article is published on: 17th February 2026

Spain consistently ranks amongst the best places to live in Europe. The climate is mild, life is relaxed, and living costs, especially in Andalucía, are often lower than in much of the UK. Within a short drive, you can find mountains, beaches, vibrant cities, and quiet whitewashed pueblos.

It is no surprise that so many people, after spending decades holidaying here, decide to make it their home. However, when I speak to clients considering the move, even for those who have spent years visiting Spain, the conversation often stalls at tax.

They have sometimes heard that another country has a more attractive regime, with lower rates of income or wealth tax, or a different inheritance tax structure. The fear is that by choosing Spain, they may be sacrificing financial security for lifestyle. In practice, when we slow the conversation down and look properly at the numbers, that fear is usually misplaced. With the right planning, many clients are in a stronger financial position after moving to Spain than they were before.

Recently, I worked with a couple in their early sixties. They had adult children, a beautiful home in the British countryside and substantial pensions and cash savings. They had spent decades holidaying on the Costa del Sol and had always imagined retiring there, but they hesitated. They had read that other jurisdictions were more tax-friendly and felt they might be making an expensive mistake. Originally, they planned to keep their UK home and rent it out to generate retirement income. They also felt reliant on drawing pension income immediately to maintain their lifestyle. Thankfully, they contacted me for a consultation in which we stepped back and considered what the move would actually look like.

The timeline for our agreed plan began before they became Spanish tax residents. First, they were able to sell their UK home free of capital gains tax because it was their primary residence. Next, we withdrew the savings from their ISAs, which had served them well while they were UK residents but would not retain the same advantages once living in Spain.

Finally, we reviewed their pensions; both were able to withdraw their 25 per cent tax-free lump sums before establishing Spanish residency. The result was transformational.

The couple had sufficient free capital to purchase their dream home in Andalucía outright and make it their own. As they would be over 65 if they ever sold that Spanish home, they would be exempt from capital gains tax on its sale. We restructured their remaining cash in a Spanish-compliant investment designed to provide steady growth, avoiding the annual tax that bank interest or ISAs would trigger. Crucially, we could control how much income they drew each year, keeping their income tax exposure low while still giving them flexibility.

When we modelled their estate position, the outcome was reassuring as well. In Andalucía, children can inherit up to one million euros free of inheritance tax, with a 99 per cent reduction on amounts above that threshold. Compared with their expected UK inheritance tax exposure, their long-term position was markedly improved. In short, their finances were structured so that tax applied only where necessary and at the lowest reasonable level, while preserving full access to their wealth if they needed it. They were living where they had always wanted to live, without feeling financially penalised for doing so.

Many couples hold back from their ideal location because they fear that tax will punish them. Tax is important, but it is rarely the whole story. It is a technical problem that can usually be managed through careful asset structuring and an understanding of cross-border planning opportunities. What cannot be recreated later is time spent living in the place you truly want to be. The most effective planning happens when we look at both sides of the move. As part of our advice, we consider what should be done while still a UK resident and what should be delayed until Spanish residency begins. When handled properly, the combination of both systems can work in your favour rather than against you.

Spain offers a high standard of living, strong healthcare, cultural depth, and a climate that encourages an outdoor, social way of life. For many people, it is not just a tax decision. It is a life decision, which is why we always take the approach:

Prioritise your lifestyle, then structure your finances around it. When that order is respected, both tend to fall into place.

As a Chartered Wealth Manager based in Spain, I work with British expatriates who want clarity before making big decisions. Moving country affects your pensions, investments, tax position, and estate planning. Done casually, it can create unnecessary costs. Done properly, it can strengthen your long-term position while giving you the lifestyle you actually want.

If you are considering a move, or have already relocated and are unsure whether your arrangements are structured efficiently, I am always happy to have an initial conversation. A well-timed review can make a meaningful difference.

By Jett Parker-Holland

This article is published on: 16th February 2026

For many people who relocate to Spain, cash becomes the default position. When there are so many moving parts, “I’ll decide later” feels sensible, and in the short term, it often is. The issue is not holding cash, but holding too much of it for too long.

What tends to go unnoticed is that cash rarely keeps pace with inflation. Even when deposit rates look appealing, inflation and tax steadily reduce the real value of your money. In Spain, interest on bank deposits is taxed as savings income, at rates of up to 30 percent. Once tax is deducted and inflation is accounted for, the true return can be negligible or even negative. Five or ten years later, the same capital simply buys less. This is the silent cost of excessive caution and is particularly relevant for expatriates.

Many of the people I work with have built capital through years of disciplined saving in the UK. They may have sold a home or business, drawn a pension lump sum, or received an inheritance. The proceeds arrive in Spain and sit in a current account while life settles.

Recently, I spoke with a couple in their late fifties who had relocated to Andalucía following the sale of their UK property. After setting aside a sensible emergency reserve, they had roughly €500,000 in cash. For the first year it remained in a Spanish bank account earning modest interest. A 2% interest rate before tax wasn’t beating the 2.7% inflation we saw in 2025. When we reviewed their position, the conversation was not about chasing high returns, but creating stability, flexibility, and the reassurance that their capital would support their lifestyle and pass, in time, efficiently to their family.

We kept an appropriate cash reserve in place. The remainder was structured into a Spanish-compliant investment designed to grow steadily ahead of inflation, without triggering annual tax on internal growth.

When we modelled the expected outcomes, the difference over time was meaningful. More importantly, they felt confident that their money was finally aligned with their new life in Spain.

This is one of the most common conversations I have. Cash feels safe because it is seen as risk-free, but real safety is about making sure that your money is working for you over the long term. If you have significant savings sitting in a bank account and you are unsure whether they are working as effectively as they could be, it may be time to take a fresh look. If you have cash sitting idle and want to understand what it could be doing instead, get in touch and let’s talk through a plan that supports your aspirations in Spain.

By Andrew Lawford

This article is published on: 13th February 2026

Firstly, if you have already qualified for this regime under an earlier version, this article will not be relevant for you. There are, however, some transitory arrangements for people who became resident under the regime in the 2024 tax year but had purchased a property in Italy by the end of 2023.

If you think this might apply to you, then bring it up with your tax adviser to see which version of the regime applies to you.

If you think this might be of interest to you, don’t hesitate to get in touch. I can’t give you a tax opinion, but I can discuss living in Italy more generally and can help with your overall planning, including getting appropriate professional advice as necessary.