The old globalisation game where the US outsourced everything and let China build the factories is effectively over. The idea that cheap imports were free trade and you don’t pay the price for destroying your industrial base is something which needs to be re-addressed as many economists on both the left and right side of politics, agree. To some extent Beijing also started weaponizing supply chains, particularly in rare earths such as lithium, cobalt and graphite, because they have an almost 90% control over these rare earths, both in mining and refining. The Trump administration is aiming to protect US interests and rebuild American industry from the ground up.

Tariffs are back—and they’re not going anywhere. They have largely turned out to be a negotiating stick and strategically aimed at specific goods rather than blanket punishment, to protect US domestic producers and force companies to bring manufacturing back to the US. As DT has said: “if you want access to the world’s largest consumer market, build in the US” Produce there and employ Americans.

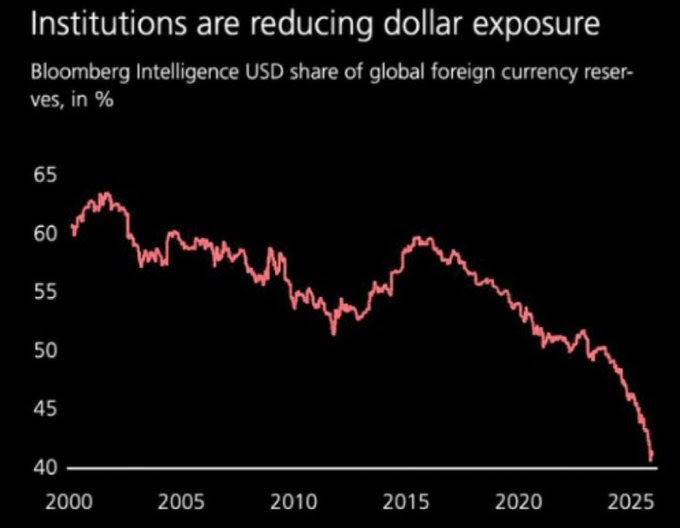

A WEAKER DOLLAR IS PART OF THE PLAN

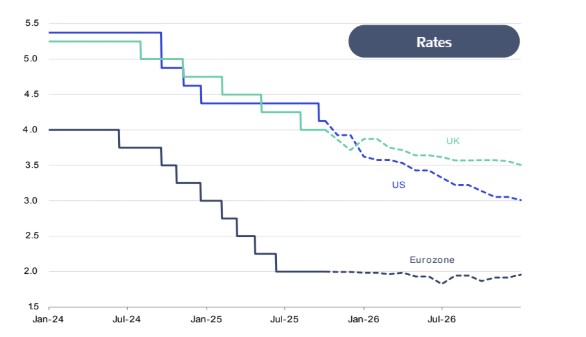

Not a collapse, but more than likely a deliberate, controlled depreciation to make U.S. exports competitive again and make imports more expensive. (2026 may see a further USD decline when the new Fed Chairman Kevin Walsh is put in place, and then it could stabilize)

Cheap foreign goods have flooded the US market (and Europe) for decades because the dollar was probably too strong. A weaker dollar rewards domestic production, boosts manufacturing margins, and will hopefully brings jobs back to places that have been forgotten for years! (If this strategy works then you can be assured that Europe wil adopt the same approach, no matter how much they hate to admit it!)

PROJECT VAULT

This could be one of the most significant decisions made by any US administration for decades. Project Vault is a $12 billion strategic plan to stockpile critical minerals, the equivalent of a Petro Reserve for the AI and defense age. The US is building a preferential trading bloc with price floors, adjustable tariffs, and enforceable rules to crush China’s predatory pricing and market flooding.

The winners will be the ones who control the physical economy—the mines, refineries, smelters and processing plants. Critical minerals and rare earth security.

Without them, nothing modern works. Jet engines. Hypersonic missiles. Wind turbines. Electric motors. Drones. Smartphones. AI data centers. Defense systems. EVs. Nothing.

And here are some examples:

Niobium—an irreplaceable steel strengthener. Adds toughness, corrosion resistance, and high-temperature performance to superalloys

(Brazil controls ~90% of global supply. The U.S. imports 100%. Zero domestic production. One mine in Canada which given the fractious nature of current US / Canada relations, the US considers this a national security nightmare)

Neodymium (Nd) and Praseodymium (Pr)—the magnetic rare earths that power permanent magnets, the strongest magnets ever made.

(Essential for EV traction motors, wind turbine generators, missile guidance, radar, precision-guided munitions, and high-performance robotics)