What has happened?

The NHR (Non-Habitual Residence) 10 year tax incentivised scheme to new residents will officially end from 1st January 2024.

By Portugal team

This article is published on: 2nd December 2023

What has happened?

The NHR (Non-Habitual Residence) 10 year tax incentivised scheme to new residents will officially end from 1st January 2024.

There is a new 10 year scheme introduced as a result of the 2024 Budget Law that offers benefits to select individuals. This is aimed at attracting those involved in the scientific research and innovation fields and will apply to those with roles in higher education and specific high value sectors.

Key points

Residency obtained after 1st January 2024

Those who obtain Portuguese residence after 1st January 2024 will not be able to apply for the NHR scheme unless you meet one of the transitional criteria below.

Those who cannot claim NHR status will be subject to the standard rates of Portuguese tax.

Transitional rules: applications open until 31st December 2024

Those who become resident in 2024 may still be able to apply for NHR if certain conditions are met. These are individuals with:

Existing NHR individuals

Those with NHR already will continue to benefit from the scheme until the end of the 10 year period.

Final words

It is expected that there will a high volume of applications for NHR and for embassy appointments so if you can, take action now.

If you do miss the NHR boat, Portugal can still be a very tax efficient place to live however more careful planning will be needed both before and after your move.

By John Hayward

This article is published on: 29th November 2023

Making gifts to spouses is no longer a tax worry.

In September, the Valencian government approved the draft bill reducing succession tax (Inheritance tax) and gift tax for certain beneficiaries

The reasons were that the taxes formed a very small part of the region’s revenue and many people were refusing inheritances as the tax worked out to be more than the overall benefit. Does the son or daughter in the UK really want to inherit the casita in the campo housing pigs and chickens?

We have had to wait for the bill to become law and this occurred on 24th November 2023 taking effect from 28th May 2023, the date that Carlos Mazón was elected president of the regional government of Valencia as leader of the Partido Popular. The backdating of this law is significant for beneficiaries who are dealing with deaths and inheritances since 28th May.

It is important to understand that the taxes for certain beneficiaries have been reduced but not abolished. The reduction in the tax has increased from 50% to 99% of the tax bill. This reduction applies to Class 1 and Class 2 beneficiaries and includes the proceeds of life insurance. These classes cover children, grandchildren, adoptees, parents, grandparents, adopters, and spouses. The €100,000 allowance per qualifying individual beneficiary (up to €156,000 for children under 21) will remain.

Suggesting that it is a better time to die now may sound a little crass but it would appear to be a very good time to make gifts, taking advantage of the gift tax reduction and mitigate future succession tax. Another important aspect to gifts is that they need to be formally documented.

Over the last 10 years, Valencia has changed the basis of succession and gift tax on a number of occasions. There was a 99% reduction before. This fell to 75%, then 50%, and is now back up to 99%. Therefore, it is reasonable to suggest that there could be changes to the law again.

Strangely, before these revisions, spouses in the Valencian Community did not receive an allowance on gifts and this caused a problem when planning financial structures. Spouses in the Valencian Community are now eligible for the allowance of €100,000 on gifts along with the 99% reduction on the tax on any excess. In my case, the “What’s hers is hers and what’s mine is hers” principle still applies.

Contact me to discuss ways of reducing the tax liability for those you care about no matter what the law is at the time.

By Portugal team

This article is published on: 27th November 2023

In his Autumn Statement, Jeremy Hunt announced the introduction of an Overseas Transfer Charge (OTC) when higher value UK pensions are transferred to a Qualifying Recognised Overseas Pension Scheme (QROPS).

This is to take effect from 6th April 2024.

The implication

Each individual will have an “overseas transfer allowance” of £1,073,100.

Where the transfer to QROPS exceeds this limit, the excess will be taxed at 25%.

The limit applies to the total value of transfers to QROPS, not per scheme.

For example. Mr A has 2 pensions valued at £900,000 and £600,000. He transfers both of these schemes to a QROPS after the new rules have been introduced. The excess above the lifetime limit is £426,900. This excess is taxed at 25%, therefore the tax due is £106,725.

The result

If you are considering a transfer to QROPS and your pension benefits are close to or exceed £1,073,100, this should be done before the introduction of the new rules in April 2024.

If you would like to understand how a transfer to a QROPS could benefit you or if it is appropriate, please do not hesitate to get in touch.

By Gareth Horsfall

This article is published on: 26th November 2023

I have held off this subject for a while because in the finance industry we have been waiting for some figures to confirm what has to date been expected, but as yet could not be verified: slowing inflation figures.

This has now been demonstrated in 2 countries: The USA and the UK (and it is likely that the EU will follow suit)

On November 1st the Fed announced that inflation had slowed in the States slowing from 3.8% in August to 3.7% in November. This is a good signal that interest rate rises in the USA have had the desired effect on inflation and so they decided to keep policy rates on hold at 5.25-5.5%

The UK also announced more dramatic falls in inflation, from 6.7% in September to 4.6% in October. That’s quite the fall, and resulted in the same action from the Bank of England: interest rates will be kept on hold.

Not a lot of time left for savers and higher interest rates

As a result, anyone who is looking to pick up the best interest rates on their cash will more than likely need to act fast now. It is highly likely that we have reached the peak interest rate in the cycle and so the direction will more than likely be down from here. Remember that Central Banks have a 2% inflation target and whilst there is little chance of that happening (in my humble opinion!) for some time to come yet, they will quickly want to reduce interest rates to stimulate the home buying sector, making it cheaper for new borrowers and also to alleviate the pressure on existing borrowers with higher repayments, hence stimulating overall spending and avoiding deep recession.

That doesn’t bode well for savers who have been eyeing the delicious Burrata-esque interest rates on cash in the last year. The banks will very likely be ahead of the trend and start lowering their fixed term offers before the central bank rate falls. In fact we are already seeing that a number of fixed rate offers are being withdrawn.

Therefore, is it time to Invest rather than sitting on cash?

I think this has been the second most asked question of me in 2023.

I imagine that you think that my answer has always been to invest, given that this is the main service that I offer clients. However, you would be wrong! I have, on a number of occasions advised clients to seek out better deposit rates on cash. It all depends on circumstances. In general, anyone needing cash in the short term (1-2 years) would be advised to keep the required amount in cash to cover any bigger one-off expenses and the same would apply whether interest rates are at zero or 5%. However, my advice is, and has always been, that if you have a longer term horizon i.e you intend on living on a return from capital over the next 10 or 20 years, or even longer, then investing is the better option. Why? Because quite simply cash is a terrible way to hold capital long term and trying to time entry into the markets is an impossible task.

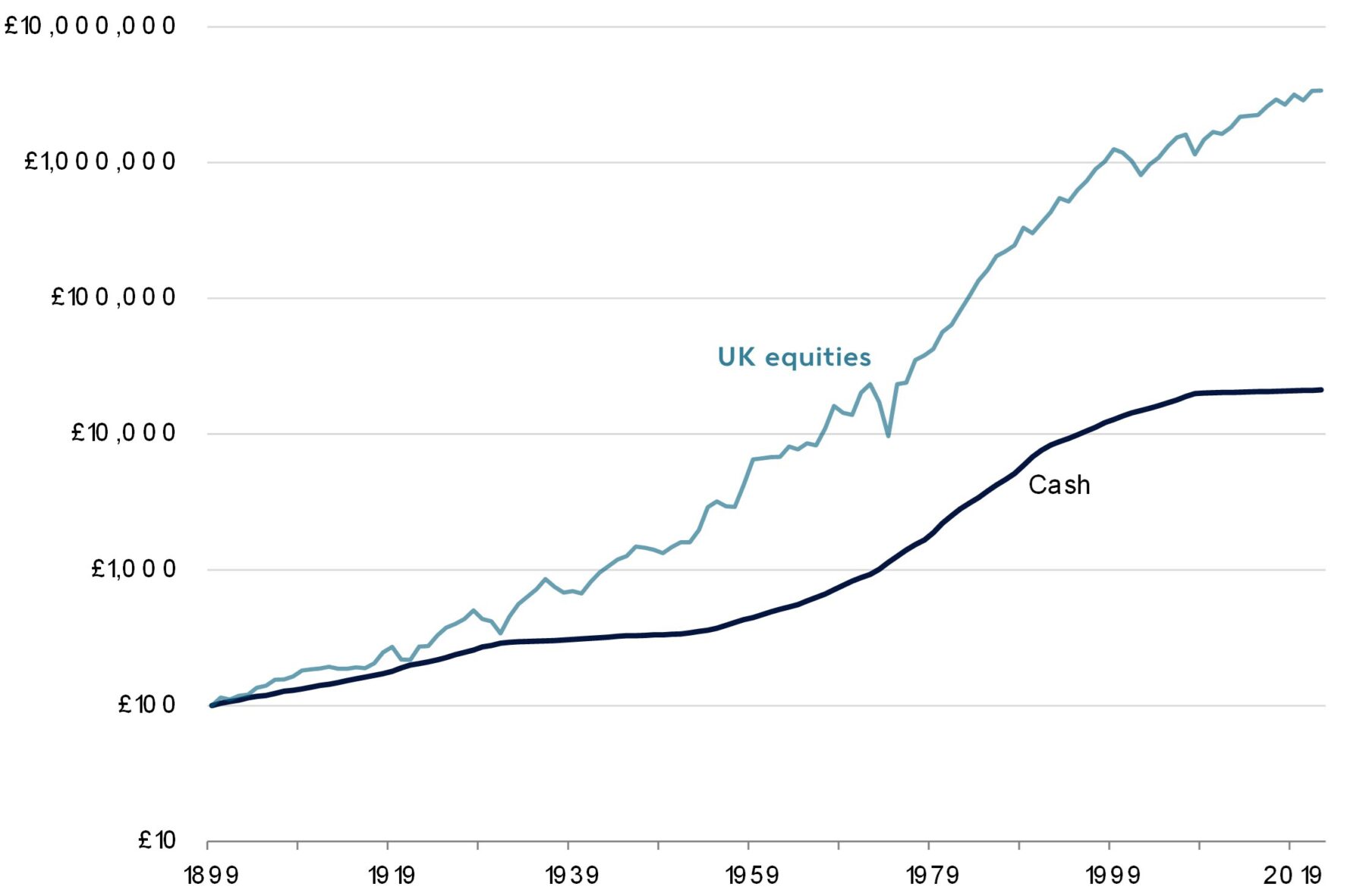

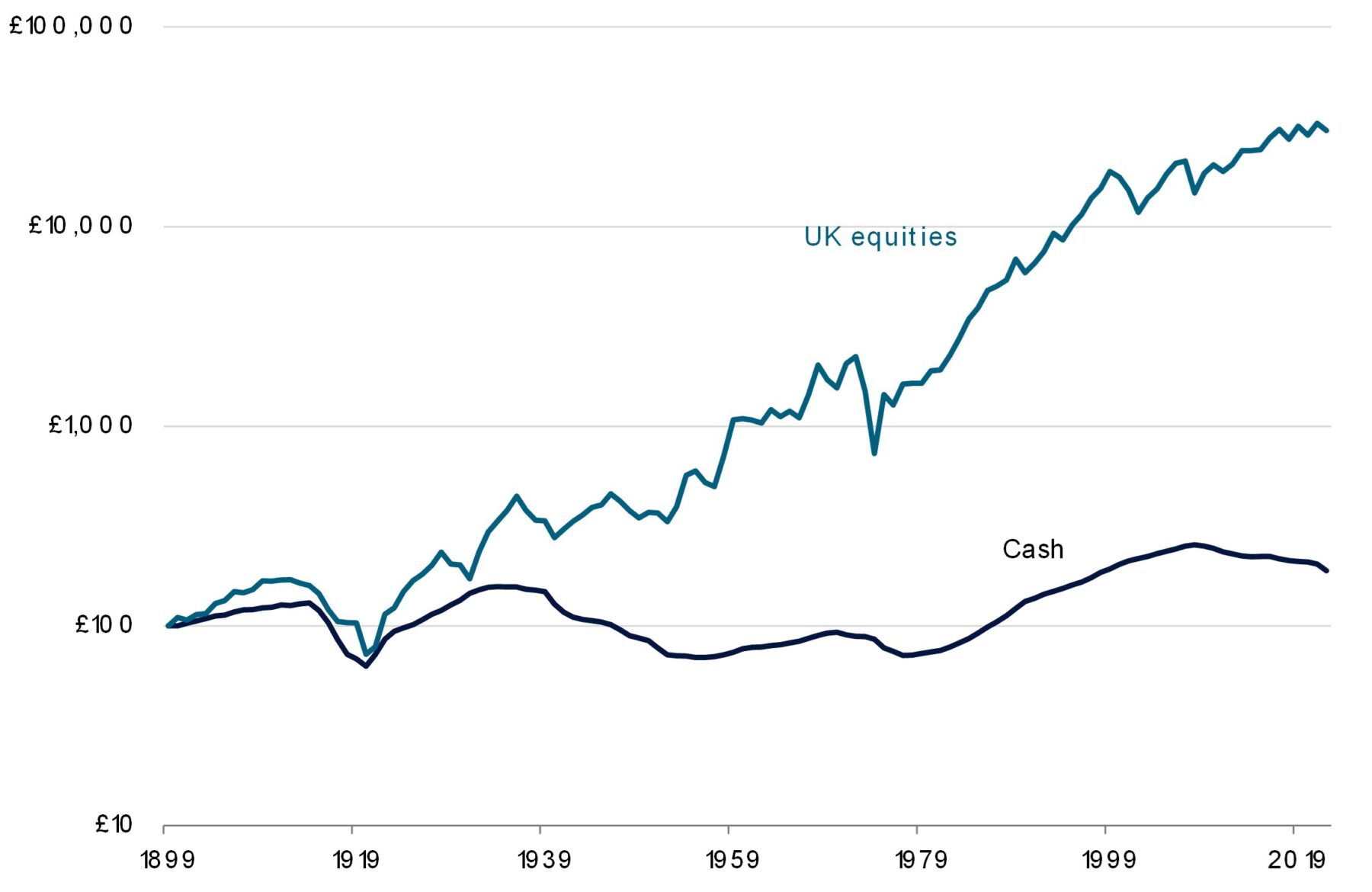

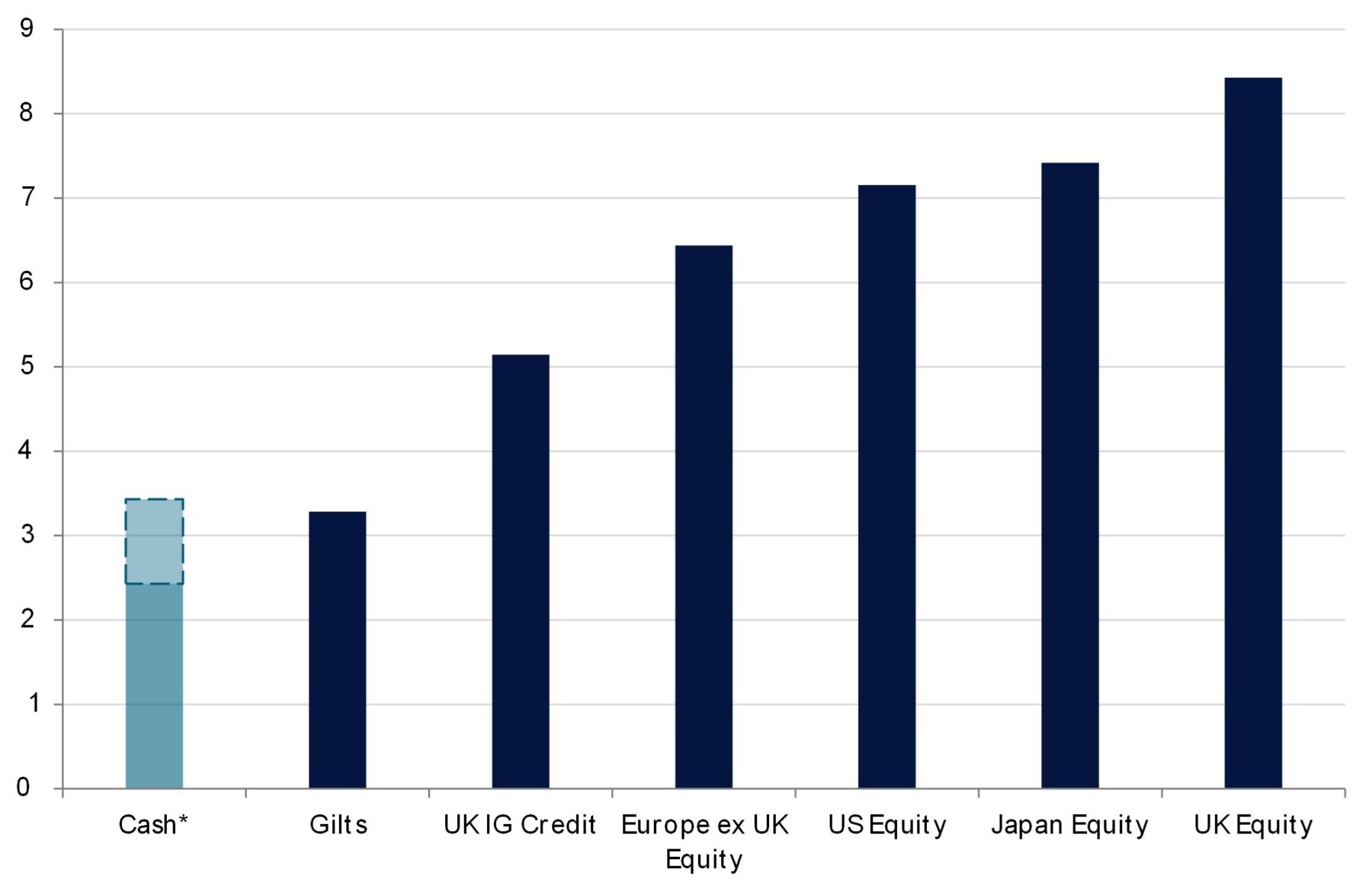

But I repeat this mantra often, so let me show you some great slides that I have received from Rathbones Investment managers recently which go a bit deeper into the understanding of why cash is a bad medium to long term option.

IN THE LONG TERM INVESTING IN EQUITIES HAS COMFORTABLY BEATEN CASH

RETURNS FROM CASH HAVE FAILED TO KEEP UP WITH INFLATION FOR LONGER PERIODS

EQUITIES ARE FORECASTED TO RETURN MORE THAN CASH OVER THE NEXT DECADE

In addition, someone I know who is a UK Independent financial advisor (thanks for sending this Chris!) sent me some other useful information which I want to share with you on the same topic.

So, does investing even make sense anymore?

First, it’s worth reminding ourselves that the laws of capitalism haven’t changed:

The bottom line is that cash sets the bar. Everything else then needs to jump over it.

Of course, it’s tempting to believe that today’s investment circumstances are unique. “This time it’s different!”. Inflation is high. Government debt levels have soared. Geopolitical hotspots are flaring up in Ukraine, the Middle East and Taiwan. Add to that the transformational developments in AI and the increasingly savage impact of climate change. But is it really different this time?

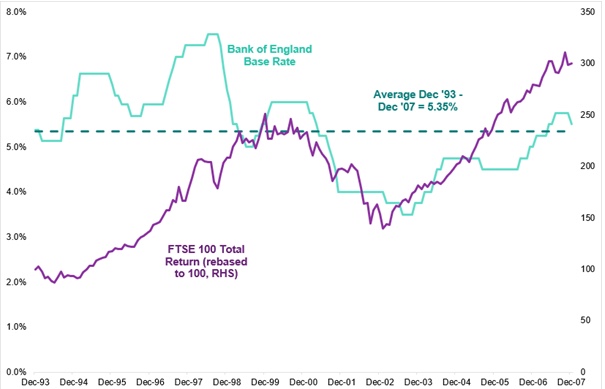

Look at the below chart. Between 1993 and 2007, interest rates averaged 5.35%. Government debt levels were rising sharply*. Geopolitical hotspots were flaring up in Yugoslavia, the Middle East and Russia. The internet was revolutionising society. In the face of all that, surely just staying in cash, at 5.25%, was best?

ABSOLUTELY NOT!

That higher cash bar created better jumpers. The FTSE 100 (with dividends reinvested) returned 8.1% annualised over that period.

The world continued to jump over the bar… and it will do in the next economic cycle too.

Markets are a forward looking mechanism

I will have a brief final word on this matter. I want to tell you a personal story.

In 2008 / 2009 my wife and I had some capital to invest, around €40,000. We had not had a lump sum of this nature to invest in our whole lives. We had mainly saved from income. At the time I had just finished Warren Buffets book ‘The snowball: Warren Buffet and the business of life’. I wanted to learn more from the great investors and understand what decisions they took to help them in their investing decisions so that I could be a better adviser for you, my clients. We just happened to have this capital now, which I knew needed investing for me and my family.

You may remember than 2008 /2009 was the height of the Financial Crisis and the financial markets and general global financial system were teetering on the brink of total collapse. It didn’t appear to be a good time to be investing. However, I knew what I needed to do.

I can only tell you that selecting the funds I wanted to purchase and then actually doing it was one of the hardest things I have ever done with money. It totally went against every grain of common sense in my body, given the state of the financial system at the time. (I was party to just how bad it was through our internal communications from fund managers and financial experts alike) Why invest when the world is in such bad shape? But, I didn’t let my heart rule out and instead went with my head.

What happened over the coming months was that the portfolio I had selected went down 20% in the next month and it left me wondering whether I had done the right thing or not. (and before you ask, I never told my wife about this until about 6 months later!) . But I stuck with the plan and 3 months after that the portfolio had bounced back and was in positive territory again.

Lessons learned

I learned 2 very important lessons from that experience:

1. You can’t time markets. So don’t even try. If you happen to have capital that you need to invest around the time when markets have fallen then it is going to be more or less the best time to get in. The valuations may go lower in the short term but in the medium to long term you are going to get the best valuations.

2. Markets will bounce back before the economy does. At the time I had invested, and the valuations had increased, we were in the worst of that economic period. The bounce came from some political decisions to stimulate the economy, but those decisions would take years before the results fed through to the general economy.

If you would like to discuss anything about this article with me, then please do get in touch on gareth.horsfall@spectrum-ifa.com or message/call me on +39 3336492356

By Gareth Horsfall

This article is published on: 23rd November 2023

It was great to recently do an interview with Michelle Smith from Real Expats Living in Italy Youtube channel. We talked about my work, life and living in ‘Il bel Paese’. Great fun. I wish her all the best with the channel and hope it helps people already living in or thinking about moving to Italy.

Thinking about making the move to Italy? Wondering if it’s all sunshine, wine, and pizza? From the moment you step foot in Italy, you’ll be captivated by its rich history, breathtaking landscapes, and vibrant culture. But beneath the surface, there are challenges and realities that may surprise you. Michelle, is an expat living in Italy, and provides an unfiltered look at what it’s really like to live, work, and thrive in this beautiful country.

This isn’t your typical travel channel or glossy brochure. It’s a no-holds-barred exploration of the highs and lows of expat life in Italy. Discover the unvarnished truth, helping you make an informed decision about your own Italian adventure.

By Charles Hutchinson

This article is published on: 23rd November 2023

The Spectrum IFA Group again co-sponsored an excellent Arts Society de La Frontera lecture on the 15thNovember at the impressive San Roque Golf & Country Club on the Costa del Sol. We were represented by one of our local and long-serving advisers, Charles Hutchinson, who attended along with our co-sponsors Currencies Direct represented by Ignacio Ortega and Carol Schleisman.

The Arts Society is a leading global arts charity which opens up the world of the arts through a network of local societies and national events throughout the world. With inspiring monthly lectures given by some of the UK’s top experts, together with days of special interest, educational visits and cultural holidays, the Arts Society is a great way to learn, have fun and make new and lasting friendships.

At this excellent event, over 80 attendees were given a talk on The Real Richard III by Tobias Capwell. Tobias is the curator of Arms and Armour at the Wallace Collection in London and an internationally acknowledged authority on Medieval and Renaissance armour and weapons. He is the author of numerous books on the subject and has been involved in many television programmes on BBC4 and Channel 4. In 2015, Toby had the unusual honour of serving as one of the two fully armoured mounted knights escorting the remains of King Richard III from the battlefield of Bosworth Field to their final resting place in Leicester Cathedral.. It would be no exaggeration to say that his lecture was incredibly gripping and interesting and at times very amusing. His knowledge of his subject was responsible for him being closely involved in the recent feature film “The Lost King” together with all the TV programmes of how they found and identified the king’s remains.

The talk was followed by a drinks reception which included a free raffle for prizes including CH supplied book The Search for Richard III and a large decorative candle. Currency Direct also supplied a Cava presentation case and 2024 diaries.

All in all, it was a very good turnout and a successful event at a wonderful venue. The Spectrum IFA Group was very proud to be involved with such a fantastic organisation and we hope to have the opportunity again at the February 2024 lecture.

By Portugal team

This article is published on: 22nd November 2023

Non-habitual residency (NHR) is a 10-year preferential tax status granted to new residents of Portugal and it has been a major draw to the country for many years.

The announcement at the beginning of October regarding the proposal for the end of NHR in 2024 was unexpected and has caused quite a stir amongst those who had longer-term plans to move to Portugal, as well as for those who may be concerned about the attraction of Portugal going forward.

The new rules have not yet been finalised and much can change before the 29th November, but what do we know right now?

The end of NHR?

At the time of writing, the proposal is that NHR will be abolished on 31st December 2023. However, the government has most recently announced a ´transitory NHR regime´ to ease in the new rules throughout 2024. This will guarantee the right of certain individuals to apply for NHR, but interestingly it also leaves the possibility open for the next government (elections to be held early March 2024) to either continue with the abolition, alter the current NHR rules, or maintain NHR in its current state.

Whilst the future of NHR is still very much uncertain, the transition rules mean that instead of a hard end to NHR at the end of 2023, qualifying individuals can still apply for NHR during 2024. This grandfathering in ensures that those who have been strategically planning their move and making life changes will not be left disadvantaged by a sudden withdrawal of the scheme.

Qualifying individuals are those with:

Recent and new residents

It is expected that there will a high volume of applications, so if you are a recent resident and have not yet applied, if you receive your residency status before 31st December 2023, or qualify in some other way as detailed above, apply as soon as you can.

Missed the boat?

More careful planning will be needed for those who move after the deadline has passed or do not meet the qualifying criteria.

As always, planning should ideally start in your originating country so you can make a ‘road map’ to take advantage of any windows of opportunity and tax reliefs in both countries. But the need for effective planning will be even more important with the uncertainty and potential end of NHR as new residents will immediately be subject to the standard rates of tax and will not have the grace period of the NHR period to soften the tax blow if restructuring is required.

Some important considerations for individuals in this position still contemplating the move are:

Current NHRs

One positive is that those with NHR can retain the advantageous tax status but even so, you should begin planning for the end of your NHR. Some important opportunities exist if you are planning to sell foreign property as the gain is tax-exempt during NHR but taxable afterwards, or if you are drawing tax-free dividends, which will be taxable at 28% post-NHR.

Planning now will allow you to time and control your tax position – this may be switching how income is generated, creating tax structures, or realising capital for the future. Leaving it too late may result in an unfavourable and irreversible outcome.

Not all doom and gloom

Regarding the end of NHR, we will just have to wait and see, but even if 2024 does spell the end of the scheme for new arrivers, Portugal can still be a very tax-effective place to live. With the right structuring, many wealthy Portuguese nationals and expats enjoy the same or even lower rates of tax than under NHR.

By Katriona Murray-Platon

This article is published on: 7th November 2023

November is here, the temperatures have dropped and it is cold and rainy outside. So here is some good financial news to warm you up!

Since the 1st January 2023, Taxe d’habitation no longer applies to the main residence. Now it is only those with a second home who have to pay taxe d’habitation on their second property. The tax statements should be on your online account on the impots.gouv.fr website in November. You have until 15th December to pay this tax.

In France, one out of ten houses are considered to be second homes by the tax office. These properties are mainly to be found on the coast (40%) or in the mountains (16%) with the remainder being mainly in the larger towns and cities (12%). These properties are usually smaller than the main home with a quarter of them being less than 40 m².

Contrary to what some newspapers would have you believe, any taxes on second homes largely affect French owners and not foreigners, since only one out of ten second homes are owned by a person living outside France. Among those owned by French residents, two out of three properties are owned by people over 60. This figure increases to three out of four along the coast. 34% of properties are owned by higher income households. https://www.insee.fr/fr/statistiques/5416748.

Make sure that you check your Taxe Foncière statement that you received in October as there could be a mistake on it. According to the French tax office approximately 1.87 billion euros have been overpaid just in 2023 because of mistakes made by the tax office.

The draft finance law has been making its way through parliament. Article 2 of the draft finance law for 2024 has increased the tax brackets by 4.8%. The new proposed tax brackets are as follows:

| Income | Tax rate |

|---|---|

| Up to €11,294 | 0% |

| From €11,294 to €28,797 | 11% |

| From €28,797 to €82,341 | 30% |

| From €82,341 to €177,106 | 41% |

| Over €177,106 | 45% |

If you are in receipt of a French pension through Agirc-Arrco, the additional pension (complémentaire) will increase by 4.9% in November. It increased last November by 5.12%. The French State pension will also increase by 5.2% from 1st January 2024.

If you haven’t already looked into carrying out work on your house to improve your heating or energy efficiency, now may be the time as the amount of the bonus (MaPrimeRenov) has increased on average by €4300.

The maximum amount that you can put into a LEP savings account has increased since 1st October from €7700 to €10,000. The interest rate on this amount remains at 6%. To be eligible to have a LEP, your taxable income (revenue fiscal de reference) for 2022 as stated on your tax return received in Autumn 2023 must be less than €21,393 for a single person, or €32,818 for a couple.

The 30th November is the date by which you must inform your bank if your taxable income (revenu fiscal de reference) in 2021 was less than €25,000 as a single person or €50,000 as a couple, so that they don’t automatically take the 12.8% tax from the interest on your savings in 2024. If you receive dividends, the income thresholds are higher, €50,000 for a single person and €75,000 for a couple. This is particularly important if your income is not taxable or in the 11% tax bracket. These thresholds remain the same as previous years and have not increased with inflation.

November is the month when you can see the most beautiful autumn colours around France. It is also a great time to review your finances and make plans for the year ahead. If you have any questions on the above or any other matters, please do get in touch!

By Jeremy Ferguson

This article is published on: 1st November 2023

This is something I am being asked a lot at the moment, as so many of my clients have money on deposit in UK banks.

Many of them are offering healthy fixed term deposit rates at the moment to clients, but very often my experience is the bank will only allow customers who live in the UK to place cash into these term deposits. This only tends to come to light after speaking with them for ages on the phone to try and move your cash, after which they will very often ‘reject’ your request due to the fact you live here in Spain. Some banks are OK with that, but the majority are not.

There are also a few ‘downsides’ to these term deposits when you are a Spanish tax resident. To explain; if you were to invest in a 1 year term deposit offering 5%, then this will of course be taxed here in Spain at maturity. The complication comes with the fact that you have to file your tax returns in Euros. Imagine if you placed that one year deposit today, maturing in a year’s time in November 2025, and then assume a scenario where the exchange rate recovered from the 1.14 ‘ish’ we are seeing at the moment to 1.18 by the end of next year, (which is entirely feasible). You would have to declare the 5% yield in euros, which would end up at approximately 8.5% in this example. Tax will then be due on this amount, having the effect of significantly reducing your actual ‘profit’.

Of course it could go the other way but this is an issue, as each year the fluctuations can ‘disturb’ the actual amount you receive. This has only really come to light this year, as people have just not experienced yields on cash deposits for such a long time.

There is also of course the risk of placing your funds with the bank you chose, or institutional risk. The compensation scheme in the UK most people are familiar with will cover a deposit loss up to £85,000 per individual account. To utilize this as best you can it can get messy trying to hold money in many different banks. The reality for most people I deal with here is they tend to have a UK bank account from when they lived there. To try and open a new UK account when you live here is nigh on impossible, so spreading your risk by having a number of different accounts isn’t achievable.

However, a solution which deals with most of these issues is available. Without getting into too much detail, you can invest in a cash ‘fund’ run by one of the World’s biggest Investment Companies. Your money ends up being invested with nearly 200 underlying banks within the fund, so the risk of a bank failure is massively reduced.

Using the right structure to access this fund means you don’t have to pay tax on an annual basis as this will only be due when you cash in your investment, and therefore each year there is no need to consider the complications of the exchange rate issue touched upon earlier.

If rates were to rise further the fund will automatically take benefit from that, and so your ‘cash’ is being actively managed with no need for you to be doing anything.

The suitability of this solution of course depends on each person’s individual circumstances, but if you would like some more information, please do not hesitate to get in touch on the form below.

By Portugal team

This article is published on: 31st October 2023

An informal round table format, we will be discussing issues such as:

An informal round table format, we will be discussing issues such as:

8th November 2023

Boavista Golf & Spa,

Quinta da Boavista, 8601-901 Lagos

10am – 1pm (with a coffee break)

9th November 2023

Magnolia Hotel,

Estr. Da Quinta Do Lago, 8135-106, Almancil

10am – 1pm (with a coffee break)

5th December 2023

Magnolia Hotel,

Estr. Da Quinta Do Lago, 8135-106, Almancil

10am – 1pm (with a coffee break)

6th December 2023

Boavista Golf & Spa,

Quinta da Boavista, 8601-901 Lagos

10am – 1pm (with a coffee break)