I Do Love a Bargain

I know it’s almost summer, but is there anything better than the hope and expectation that builds around Christmas. It’s the best time of the year for me.

By Michael Doyle

This article is published on: 25th May 2025

I Do Love a Bargain

I know it’s almost summer, but is there anything better than the hope and expectation that builds around Christmas. It’s the best time of the year for me.

Not only do we get to enjoy all the trappings that come with the festive time of year but on Boxing Day the madness begins!!!!

The trainers that were €130 have been reduced to €60, the jacket that was out of reach at €400 is now €240, the sports T-shirts that just 2 days ago were €40 are now €20. What a time to buy.

There’s something similar happening in the markets right now and I just wanted to take a few minutes to explain why I think now could be a great time to invest.

The markets have been bumpy — and that’s a gift in plain wrapping. Volatility creates opportunities. Quality companies with strong fundamentals often get marked down along with the rest of the market, offering savvy investors the chance to buy value at a discount. If you’ve read my other articles, you’ll know I’m partial to the odd quote from Warren Buffett: “Be fearful when others are greedy and greedy when others are fearful.” Right now? There’s more caution than confidence. That’s your opening.

While central banks have taken us on a wild ride with interest rates, there are early signs of stabilization. Inflation is cooling in many regions. As economic data settles, interest rates may begin to ease, restoring more predictable conditions for both equities and bonds. Those who position themselves before the pivot are typically the ones who benefit most.

Time in the market beats timing the market — every time. The longer your money is invested, the more it compounds. Trying to wait for the “perfect” moment often leads to missed gains. Historically, the market’s best days tend to cluster near its worst days — miss those, and you risk missing most of the upside.

I wrote an article on this a few years back which still holds true today. You can read it here.

From AI and biotech to clean energy and space tech, we’re witnessing a new industrial revolution. These aren’t just exciting ideas; they’re multi-trillion-euro transformations already reshaping global economies. Investing now means getting in before the wave crests — not after.

The global landscape is broader than ever. While some markets face headwinds, others are thriving. A well-diversified portfolio — across sectors, regions, and asset classes — isn’t just a shield, it’s a springboard. With the right structure, you can grow your wealth through both sunny and stormy weather.

Because uncertainty is the soil where opportunity grows. Because prices reflect fear, not fundamentals. Because the future isn’t waiting — it’s happening now.

As your financial adviser, my job is to help you see the forest through the trees, and to guide you with strategies that match your goals, timeline, and comfort level — especially when others are sitting on the sidelines.

Let’s have a conversation. Your future wealth might just thank you for acting today.

The best time to invest? Yesterday. The second-best time? Right now.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here

By Michael Doyle

This article is published on: 22nd May 2025

I’m Scottish and I live between France and Luxembourg. I moved to Luxembourg in 2008 and then France around 2015 and have commuted between both for a lot of my time with Spectrum. Needless to say my French has improved over time (as long as people speak to me as if I’m 6 year old child).

One of the things though that I still struggle with is some of the terms they use, eg Pédaler dans la semoule which seemingly means going around in circles. I always wondered why people were pedalling around in semolina.

It got me to thinking that I often assume people know all of the terms we use in financial planning, so here I’ve decided to try and break down the barriers.

A stock represents partial ownership in a company. When you own a stock, you own a slice of that business — known as a “share” — and have a claim on its assets and earnings. Stocks are traded on public exchanges, and their value fluctuates based on the company’s performance, investor sentiment, and broader market conditions. Investors often buy stocks to participate in a company’s growth and, potentially, receive dividends.

A share is a single unit of ownership in a company, essentially your piece of the total stock issued. If a company issues 1 million shares and you own 10,000 of them, you own 1% of the company. Shares entitle the holder to a portion of the company’s profits (via dividends) and voting rights in some corporate decisions. Shares can rise or fall in value depending on market demand and the underlying company’s performance.

A bond is a type of loan that investors give to governments, municipalities, or corporations. In return, the issuer agrees to pay back the principal amount on a set date and provide regular interest payments over the life of the bond. Bonds are considered fixed-income investments and are often used to provide portfolio stability and predictable income, especially in contrast to more volatile assets like stocks.

An ETF, or Exchange-Traded Fund, is a pooled investment vehicle that holds a diversified basket of assets — such as stocks, bonds, or commodities — and trades on a stock exchange like a regular share. ETFs allow investors to gain broad market exposure, often at a lower cost and with greater flexibility than mutual funds. They are popular for their diversification, transparency, and ease of access for both beginners and seasoned investors.

Let’s have a conversation. Your future wealth might just thank you for acting today.

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here.

By Michael Doyle

This article is published on: 20th May 2025

I wrote an article back in 2021 which you can read here. I just wanted to offer a reminder of the 10 most important reasons why you should consider having an Assurance Vie whilst living in France:

You can now book a 30 minute zoom meeting with me (at your convenience) by clicking here.

By Michael Doyle

This article is published on: 1st November 2024

I was travelling back to Brittany by train from Luxembourg on Friday 26 July. A day that may have been remembered for it being the opening ceremony of the Olympics in Paris. I expected some disruption due to the sheer number of people visiting Paris, but I’d no idea what would happen next.

If you don’t know by now the rail network was attacked by vandals who set fire to the fibre optics on the tracks and in doing so put almost 800,000 train services “off the rails”.

What I was impressed by was the network’s response. They had police at most if not all stations affected, they increased the labour rate and what could have been a disaster was handled swiftly and efficiently, with trains back running within two days.

As financial planners, we sometimes have to deal with unforeseen and disruptive events. What happened on the rail network was totally unexpected. As a financial planner, I’ve had to guide my clients through the following over recent years:

The main thing my clients were happy with was that I provided reliable guidance on investment repercussions and how to address the events.

This was through either:

So if you had a nervous time with your own financial planning during those uncertain times, or indeed at any time, give me a call and we can work together to ensure you remain “on track” to achieve your financial goals.

By Michael Doyle

This article is published on: 29th October 2024

It can be a daunting experience!

I started my life in financial planning in Glasgow, Scotland, back in 1998. I moved to Luxembourg in 2008 and began to cover both Luxembourg and Brittany (France) from 2019. I’m not sure where the years have gone, but I am grateful to have worked with some fantastic clients during that time from the likes of KPMG, Champs, The ISL (Luxembourg), UBS, St George’s School, Greenfield Recruitment and the list goes on and on.

I understand that initially my clients sometimes feel nervous when they come to see me as they are probably about to make one of the biggest financial decisions of their lives. I try to put myself in their position to try to fully understand what they need. To help my clients I’ll ask such questions as:

After I gather all of the hard facts – the basics from name, address, money coming in and money going out, cash and investment holdings, to your immediate and longer-term planning priorities, plus your investment knowledge and attitude to risk – we call an end to the first meeting, and I start researching and preparing a suitable recommendation. This written proposal is carried out at no cost and entirely without obligation.

Why do I not charge for my reports? Simply because I want my clients and prospective clients to see how I work before they commit to using my services. Note that in our initial meeting I also explain fully how I am remunerated and the extent of my service offering, from introductory engagement through to long term reviews and support.

My report is then presented and explained, to allow clients do their homework and cross reference what I am saying with their own research. Then we have a second meeting when I will answer any remaining questions.

At this point the clients are invited to take some time to think over the recommendation and come back to me with any final questions they may have. Only at this point will we move to the final step in the advice process, which is completion of outstanding paperwork to implement the plan and set the investment in place. From here, my commitment to ongoing client service and support is open-ended. My aim in all of this is to grow and protect my clients’ wealth as tax efficiently as possibly whilst developing long-term and productive relationships.

By Michael Doyle

This article is published on: 23rd October 2024

I’m not a big fan of cars. I just never really got interested in them when I was growing up and couldn’t even tell you where to put the windscreen wash when you open the bonnet (hood for our American friends who may be reading this).

However, I can look at a car and think “Oh that’s nice”.

Saying that, a funny thing happened to me the other day while I was out walking in Luxembourg: a classic car passed me on the road and then I passed two others which were parked.

These were all beautiful cars. So much so that I stopped and looked in the window of the third car, which was an old Jaguar. The owner had kept it beautifully – the leather was still top quality and the look inside was fantastic.

Then it struck me. This car is probably expensive to keep and doesn’t have any great features.

There was no place that I could see to charge your mobile and the sound system looked like it couldn’t even play an old tape or CD.

Then I was thinking about why some people come to see me for financial advice and often it’s because they have an investment which is a classic.

These old investments were the only ones available when they took them out but:

Products these days see a minimum of 100% of your investment invested from day one. They offer flexible access without penalty. We can add a specialised fund manager to take care of the investment. Typically, they have much lower running costs.

So, take some time today, gather up all of your old classics and I’ll carry out a full review and can show you if we can move these to a more modern investment where we can add both value and growth.

By Michael Doyle

This article is published on: 21st October 2024

The 1986 movie “The Three Amigo’s” (starring Steve Martin, Chevy Chase and Martin Short) was one of my favourites in my early teens. I laughed so much at that movie and it brings back great memories watching it with my friends in the cinema.

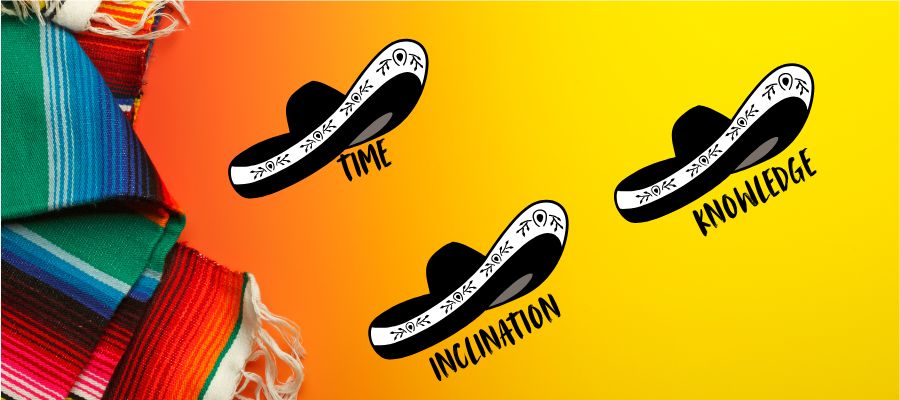

But where does this fit in with financial planning, you’re probably asking yourself.

Well, the three amigos in financial planning are:

• Time

• Knowledge

• Inclination

This is what a financial planner has.

When you are considering your financial situation, ask yourself these questions. Do I have the time, knowledge and inclination to be my own adviser? If you have all three, then you probably won’t have as much need of a financial consultant. If, however, you fall down on one of these, I can quite confidently argue that you need a specialist, and that’s where I come in.

This is my job, and after my family, this is what I’ve committed my life to. So, I have the time to do all of the research on your behalf.

I’ve been in the financial service industry for 25 years so bring a lot of knowledge with me. Not only that, I am backed by a fantastic company in Spectrum who work every day to find better products, better solutions and better advice for our clients. Why does that matter? Well because we have 50 financial advisers across France, Spain, Portugal, Italy, Luxembourg, Malta and Switzerland and have been offering advice since 2003.

Do you really want to be monitoring your portfolio monthly, rebalancing every 6 months or so? If you don’t have the inclination to do this you could see your investment going sideways.

So let’s work together and get the Three Amigos on your side.

By Michael Doyle

This article is published on: 18th October 2024

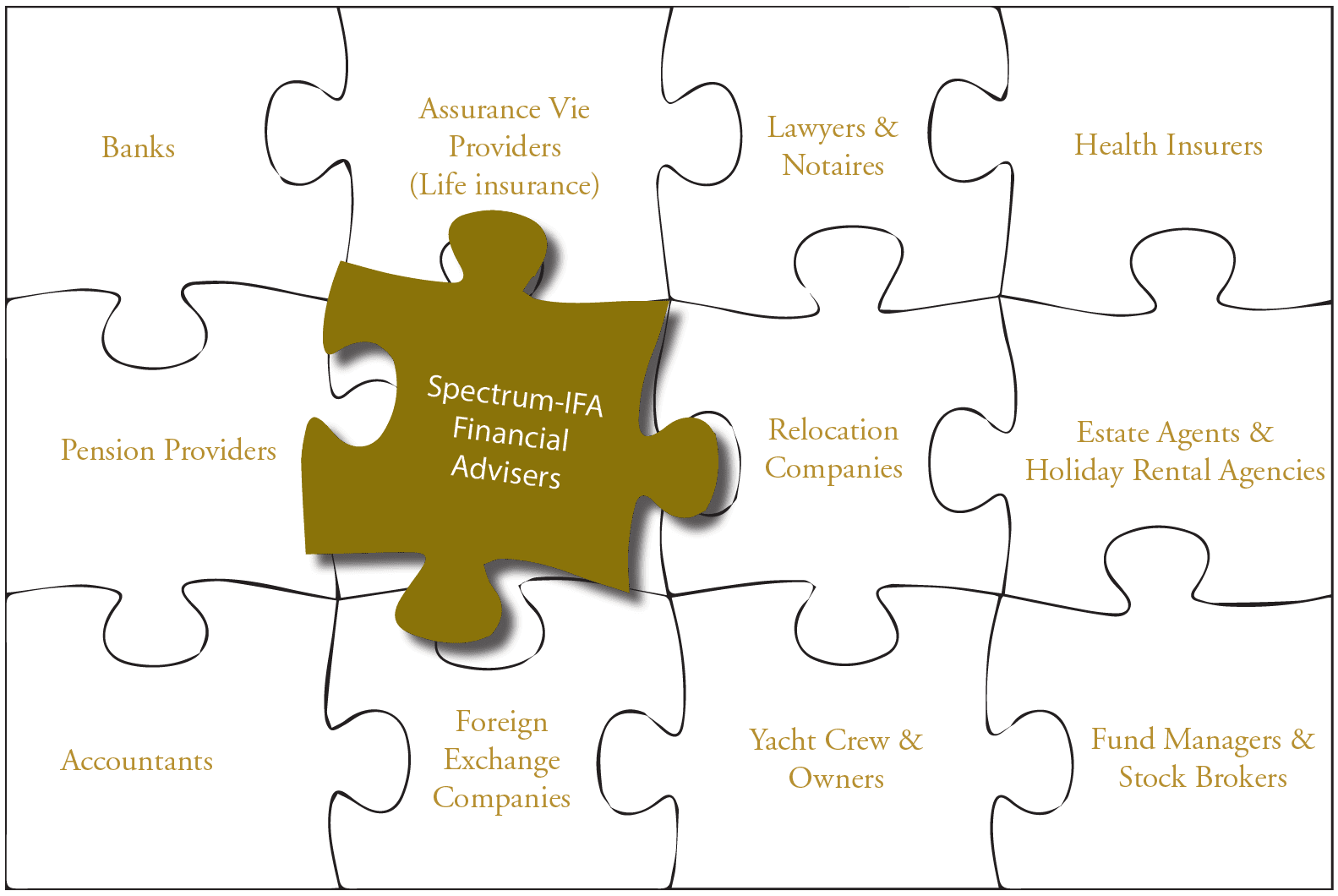

I’m not a big puzzle fan but I do like the odd sudoku grid. Recently, however, my 5 year old son has taken a vague interest in jigsaw puzzles. I like the ones for his age as they max out at around 16 pieces.

It got me thinking about my job, what I can do for my clients and how I can add value.

Typically, when a client comes to see me they have questions on investments, pensions, tax, domiciliation, inheritance, banking, life insurance and wills to name just a few.

It’s like a jigsaw puzzle.

I put the pieces of the jigsaw together for my clients so that in the end they are not left weighing up 16 individual pieces but can see the whole picture. This is where I add value.

Let me be clear – I am an International Financial Planner and I like to stay in my lane. What do I mean by that? I try not to cross into areas that are not my field of expertise (such as domiciliation, for example). But I am fortunate to be working with a wide range of clients, colleagues and professionals.

I have access to accountants, lawyers, domiciliation specialists, fund managers, investment houses … the list goes on. I’ve also been a financial adviser in the UK from 1999 until 2008 before I decided to move abroad and have been working in the same industry ever since. So as well as the specialists I can contact I also come with 25 years of experience.

What does this mean for you? Typically, this means I can contact these specialists on your behalf to get initial information and relay that to you. This could be legal or tax advice for example. I do this at no fee to my client and often save them a small fortune in fees for asking a few simple questions.

Let’s meet and start putting your jigsaw puzzle together.

By Michael Doyle

This article is published on: 14th October 2024

It has been a tough couple of years in the financial markets – there is no getting away from that.

Mortgage interest rates have rocketed (although 3% isn’t too bad, depending on the era in which you mortgaged your first property). For savers rather than borrowers, some banks in France have started offering close to 3% returns on cash deposit accounts (mostly fixed term deposits, i.e. you don’t touch your funds for 2-3 years).

When I first started in financial services in 1998 one of my mentors said to me:

“Michael, always ask this question: Who does it benefit?”

Why would banks give you 3%? Who does it benefit that you tie up your funds for 2-3 years? Will you outperform inflation? Is your money safe (what is the bank’s guarantee)?

I just listened to the late, great Jim Rohn and he said there are two different types of pain:

There’s the pain of discipline and the pain of regret.

So which pain do you prefer?

Yes, the markets have performed poorly over the past couple of years (https://spectrum-ifa.com/russias-invasion-and-its-effects-on-markets/) – so can you remain disciplined?

At Spectrum we don’t generally advise on short term investing (less than 5 years). To that extent we ask and encourage our clients to be disciplined.

Here’s what we know (https://spectrum-ifa.com/time-not-timing-investing-for-the-long-term/).

I can’t tell you when markets will recover, but I do know that there will be a recovery (this is certain) and typically assets then to go on to achieve higher valuations than achieved previously.

Is now a good time to invest? If you have a medium to long-term time horizon, it definitely becomes an interesting conversation. Whatever is going on around us (and whatever is in the new headlines), discipline and patience really do pay when it comes to investment decisions.

If you are hoping to pre-empt short term market direction (with a view to buying in at low point), I’d be inclined to say investing is probably not for you right now. Could this mean that you will miss a ‘rebound’ in the markets? Quite possibly, with the inevitable regret that follows.

Either way, if you’d like to discuss suitable investment planning for your circumstances, please feel free to drop me an email and we can set up an initial no obligation chat.

By Michael Doyle

This article is published on: 9th March 2023

I have been working with a few clients over the past couple of years who were very nervous about investing for the longer term as the markets had been volatile. Recently they decided to ‘push the button’ after we reviewed their situation together.

So, here are ten reasons why now could be a good time to invest:

1. Economic recovery: The global economy is recovering from the impact of the COVID-19 pandemic, and this presents opportunities for investors to take advantage of growth opportunities in various sectors.

2. Low-interest rates: Interest rates are currently low, which can make borrowing cheaper and provide investors with a chance to invest in assets that are likely to yield higher returns.

3. Inflation protection: Investing in stocks, bonds, and other assets can provide protection against inflation, which can erode the purchasing power of your money over time.

4. Increased savings: Many people have saved more money during the pandemic due to reduced spending on things like travel and entertainment. This has led to an increase in the amount of money available for investment.

5. Technological innovation: The pandemic has accelerated the adoption of new technologies in many industries, and investors can potentially benefit from investing in companies that are at the forefront of innovation.

6. Diversification: A well-diversified portfolio can help investors spread their risk and potentially minimize losses if one sector or asset class underperforms.

7. Long-term focus: Investing is a long-term strategy, and the current market volatility should not deter investors from thinking about the long-term potential of their investments.

8. Behavioural finance: Understanding how emotions and biases can impact investment decisions can help investors avoid making costly mistakes.

9. Education and access: There are many resources available to investors to help them learn about different investment opportunities and strategies, and technology has made it easier than ever to invest from the comfort of your own home.

10. Social responsibility: More investors are looking to make investments that align with their personal values and beliefs, and there are now many options for socially responsible investing that can potentially provide both financial returns and social impact.

Now would be a great time to review your own situation. Either speak with your financial consultant or feel free to contact me for a no obligation review.