Following my outlook in January I am writing with a quick update on the year so far and a look forward for the rest of the year and into 2025.

2024 Market Update

By Peter Brooke

This article is published on: 28th July 2024

One important point I would like to make is that many global issues, especially Politics and the outcome of the many elections we have in 2024, might feel very important to us on a day-to-day basis but might have a very different impact on investment markets and so do please read the following through the lens of investing.

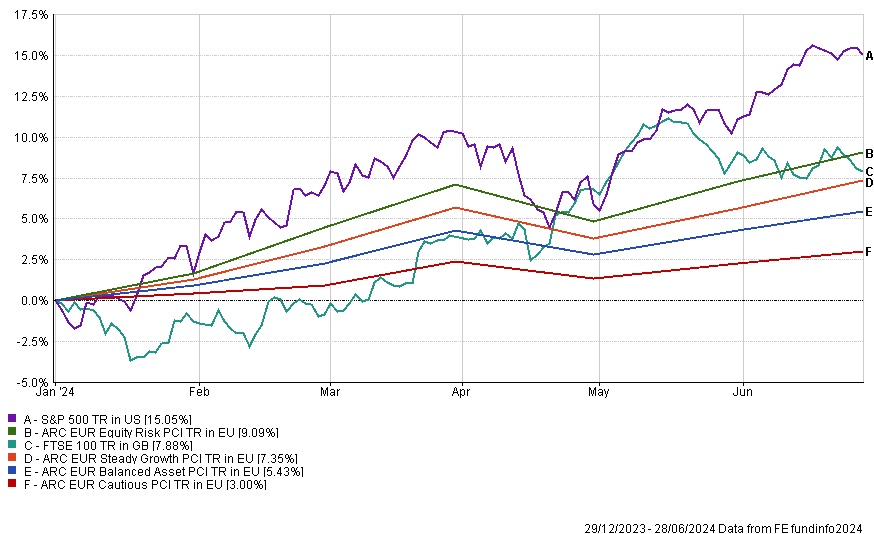

Global equities have been performing well, with US equities gaining 15% in the first half of 2024, led by companies like Nvidia, Microsoft, Alphabet, Amazon, Meta, and Apple, which contributed significantly to market progress.

The economic outlook indicates that the global economy is expected to grow by 2.6% in 2024, with improved growth prospects in the US and China due to factors like loose fiscal policy, immigration, and government stimulus programs.

Market ‘breadth’ has been a concern, with the above five technology stocks driving over half of the returns in the US market; as global growth continues this should lead to opportunities in other sectors like industrials that are connected to the Artificial Intelligence theme; very recently we are starting to see a broadening of market returns.

Market risks related to inflation and interest rates are expected to shift to a positive tailwind in the second half of the year, which should be good for both shares and bonds. Central banks, like the European Central Bank (ECB), are already cutting interest rates and others are likely to follow suit.

Here is a chart of four different Risk Benchmarks and the main UK and US Stock markets so far in 2024; steady, but the US continues to serge ahead… for now.

Inflation

Inflation hasn’t yet returned to pre-covid levels and is unlikely to drop back this much any time soon. Goods, energy and food inflation have all fallen but services inflation is still high, though this has started to fall slightly in recent weeks. ‘Services’ includes ‘shelter’ e.g. rent and other services such as hospitality.

Interest rate cut forecasts from the ‘experts’ have see-sawed so far this year but the current consensus view is that the first US interest rate cut should now be expected in September. The ECB has already started cutting rates, very slowly, and UK rate cuts might be pushed out into 2025 as services inflation in the UK remains ‘stickier’ than elsewhere.

Elections

Elections do pose sporadic risks to markets, though normally election results don’t truly matter in the longer term; but with the huge volume of elections this year and the swings from left to right (and back again) the volatility caused by the outcomes of elections will probably have much greater short-term impacts than normal.

US – The upcoming election is a key risk, with potential market volatility depending on the election result, especially following the attempted assassination of Donald Trump and the withdrawal of Joe Biden.

If Kamala Harris is selected as the Democratic candidate then Democratic party policies are likely to remain unchanged and so volatility in markets could be short lived, but if they enter the time consuming process of selecting a different candidate (increasingly improbable at the time of writing) then the inevitable political uncertainty could drive US share and bond volatility for longer.

According to the polls and bookmakers the Republicans are now more likely to win, but what might that mean for investors? Potential tax cuts, more deregulation, more protectionism and more oil drilling could be good for US corporate profits and might help bring down inflation. This might not be great for the planet and society but could be good for business.

In addition tariffs on goods entering US from China (and the rest of the world) could add to the short term inflation problem.

Europe – there has been a backlash against various EU led initiatives, like climate change policy and immigration leading to a swing towards the right in many countries.

France – President Macron called a snap election as the Far Right were gaining traction in EU elections; several left wing, centrist and right wing alliances formed as tactical voting led to a deadlock. The major coalition is now on the left of the house which is probably negative for French investment returns but any law changes are very unlikely for at least 12 months when another round of elections is expected.

UK – the new Labour majority government was not a big surprise with ‘time for change’ as a leading driver; but will they be able to do what they said they would do? So far they remain quite centrist and don’t appear to be planning on drifting back to the ‘old labour’ way. They are likely to be more fiscally responsible and will target growth BUT can they actually do it as the challenges are significant and the budget is tight – for example the demands on the NHS and the hot potato of immigration.

There might, however, be a big shift with the relationship with Europe, which must be positive for both sides, especially with respect to defence, cybersecurity and trade and even more so if the US becomes more self protectionist under Trump.

Currency

Here are some thoughts from our friends at Moneycorp:

As many predicted the Labour Party secured a strong majority, and the FX markets remained relatively stable. We’ve seen GBP strength, with GBP/USD rising by 1.7% and GBP/EUR up by 0.8%.

The French election results, however, were unexpected. We had anticipated significant market movements, but the outcome has been a 3-way hung parliament, with all other parties joining forces to prevent the far-right Rassemblement National (RN) from gaining power. This situation suggests potential political turmoil in France for at least the next 12 months until another election can be called. This is not a favourable outcome for President Macron or Europe as a whole. Despite this, the FX markets have remained stable, as the EUR had already weakened prior to the election.

Inflation data and interest rates continue to be the primary drivers of the FX markets.

Here is a Forecast Snapshot of where the banks think FX markets will be at the end of Q3 (30th September).

GBP/USD

Current 1.2840

Barclays 1.28

UniCredit 1.26

Wells Fargo 1.26

BNP Paribas 1.27

GBP/EUR

Current 1.1860

Barclays 1.22

UniCredit 1.16

Wells Fargo 1.19

BNP Paribas 1.20

EUR/USD

Current 1.0825

Barclays 1.05

UniCredit 1.08

Wells Fargo 1.06

BNP Paribas 1.05

I am, once again, very grateful to the teams at Evelyn Partners, Rathbones, New Horrizons and Moneycorp for their help in putting this summary together and hope it is useful in framing where we are today and how we got here.

Here are some further links to supporting views on the above:

https://www.evelyn.com/insights-and-events/insights/investment-outlook-july-2024/

https://www.rathbonesam.com/knowledge-and-insight/review-week-biden-bows-out

https://www.rathbonesam.com/blog/guess-whos-back

If you listen to podcasts I can highly recommend the Sharp End Podcast from David Coombs at Rathbones Asset Management

Talk to me

As always, please remember that financial decisions should be made with careful consideration of individual circumstances and professional advice, I am here to support you.

If you have missed any previous news and updates these can all be found on the archive page here.

I am away on holidays until 5th August but if you have any questions or need further assistance, please feel free to reach out via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

For now, have a great day, and a wonderful summer

Best regards

Peter Brooke

The Financial Review Process

By Peter Brooke

This article is published on: 9th July 2024

… why, what and how …

Whether you are an existing client of mine or not, and following on from my previous article on ‘The Value of Seeking Financial Advice’, I wanted to take this opportunity to go through the steps in our ‘Client Financial Review Process’.

WHY?

Firstly, and most importantly, it’s crucial to regularly check in on your financial journey, ensuring that we’re on track to meet your goals.

Secondly, we have a regulatory obligation to conduct a review at least once per year for all of our clients, whether this is in person or remotely.

Thirdly, we have a relationship which is built on trust and my understanding of, often, very personal details, so a regular catch up is a great way to nurture this relationship and ensure important issues are raised and discussed; and its a good excuse for a cup of tea and a biscuit [even if via Zoom].

WHAT?

A review won’t just be looking at what has happened over the last year but is designed to identify potential financial planning adjustments we might want to make if your circumstances are changing.

The review should, and will, include the following:

- An update of your situation – incomes, bank balances, asset values, expenditures.

- Changes to your situation – retirement, moving house, changing jobs, school fees etc.

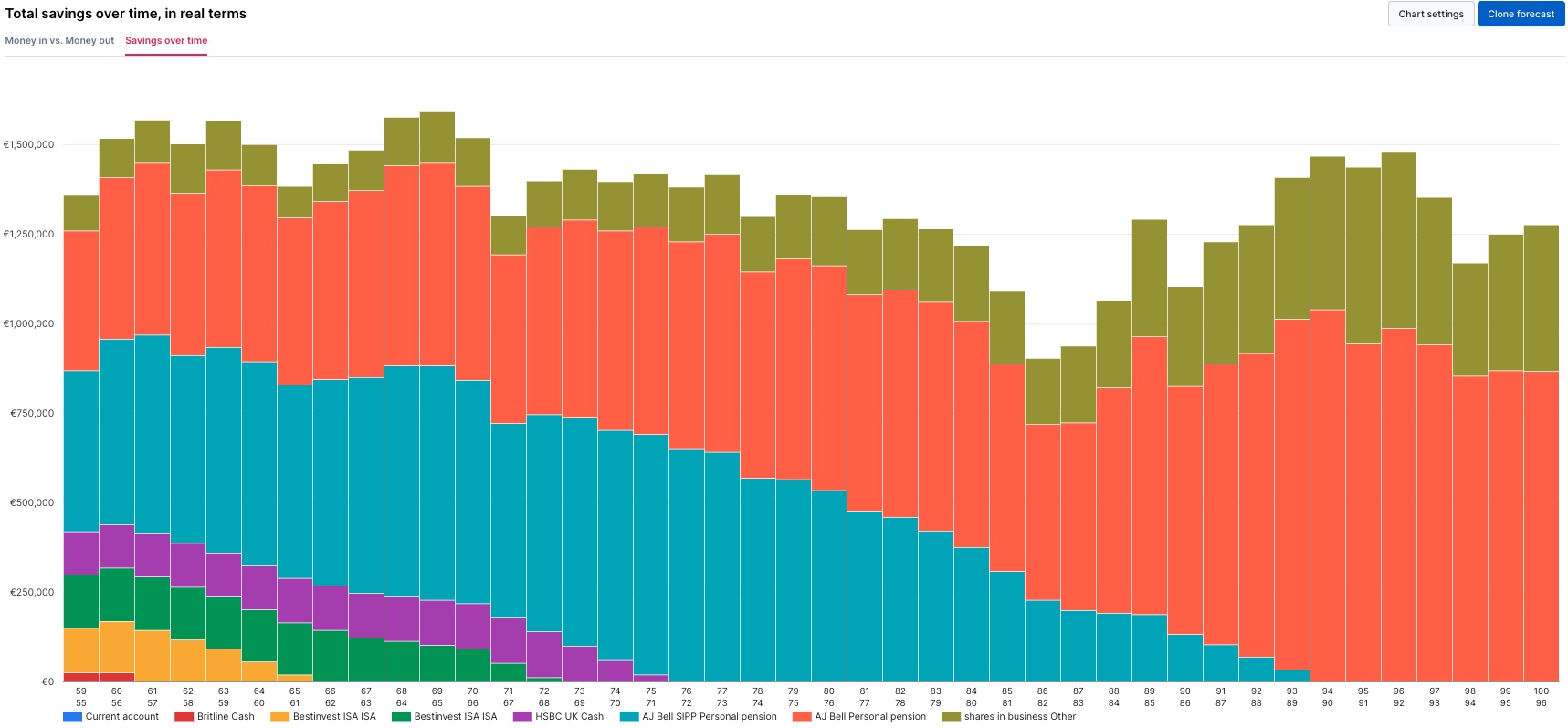

- Cash Flow planning update – are we still on target to meet your goals? … “am i going to be ok, and if not what do I need to do to make sure I am?”

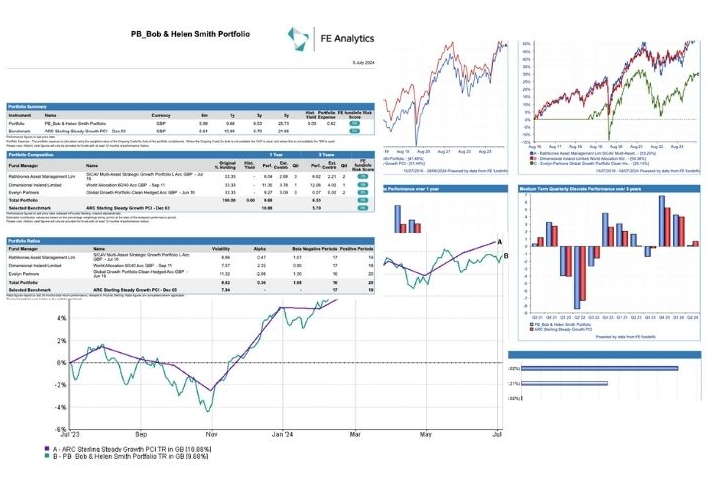

- Investment Portfolio performance update – has it out-performed or under-performed the risk ‘benchmark’ we have allocated? If so, why? Are any changes needed?

HOW?

Many of my clients have been through this review process over the years but I have made a few tweaks and so I wanted to take you through the steps.

The biggest change for us is that I will be asking many of my clients to update their situation directly onto the Secure Cash Calc Portal prior to our review, so I have the most up to date information in advance. This will give me a chance to review your situation before our meeting to ensure we get the most from our time together.

Of course it is not obligatory to use the portal as it is not appropriate for everyone, but if you would like to then do let me know.

The following summary explains each step.

Options for you…

The above summary is focused on the normal Face to Face or Zoom meeting review process, but I can also provide your review as an email or I can even record a video presentation of my update on your portfolio and cash flow plan which you are then free to watch at your leisure; then we can discuss any steps necessary and update any administrative requirements afterwards.

Please do let me know if you prefer to have an email or video review?

As you can see, it’s a collaborative process and financial reviews are a great way to check-in on how things are going and where adjustments need to be made, so if your situation changes, please don’t wait for the next review, get in touch and we can review early.

If you have any questions please use the the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day,

Financial update July 2024 – France

By Katriona Murray-Platon

This article is published on: 4th July 2024

During one of the presentations that we received in January at our annual conferences, we were told that this year 40% of the population would be going to the polls. Now, with Macron’s decision for an election, that figure has increased to almost half the world’s population.

Having already voted in the European elections earlier in June, I will now be voting in both the French elections at the end of June and the UK elections in July. Three elections in the one year! The first round of the French elections was on Sunday 30th June and the second round on the following Sunday, 7th July.

What does this mean?

Well, notably it means that any law reforms that had been going through the French parliament have now been suspended. What will be on the parliamentary agenda will be determined by whichever party gets the majority.

So far the markets seem to be less interested in the elections and more interested in the decisions of the central banks. With the European Central Bank reducing its interest rate by 0.25% on 6th June 2024, all eyes are on the Fed and the Bank of England to make a decision about their rates in the coming months.

As from 1st July 2024, Autoentrepreneurs carrying out a non-regulated ‘liberal’ activity under the micro-BNC regime will have to pay increased social contributions. The rate will increase to 23.2%.

Come the autumn months we will have to pay taxe foncière and taxe d’habitation for those with second homes. These taxes increased by 7.1% last year because of inflation and they are predicted to increase again this autumn by 3.9% due to the reassessment of the rental values. There may also be an additional increase if the local authorities of towns of more than 100,000 inhabitants so decide, which will be 1.2% on average.

From 31st July and until 4th December, you will be able to amend your online tax declaration on the impots.gouv.fr website if there is any information you missed out or you realised there were mistakes made but you were just trying to submit the return before the deadline.

Your tax statements will be available over the summer from 24th July and end of August. If you have paid too much tax, your statement will be available between 24th July and 2nd August online or between 24th July and 29th August by post. If you still have some tax to pay after your monthly contributions your statement will be available online from 26th July and 2nd August or by post between 25th July and 23rd August. If you opted not to receive paper statements, you will receive an email letting you know that your tax statement is online.

If you have less than €300 to pay in tax, this amount will be taken on 25th September 2024 but if you have more than this, then the payment will be spread out into 4 payments taken 25th September 2024, 25th October 2024, 25th November and 26th December 2024. You will continue to pay your normal monthly tax payments on 15th of each month but these will be adjusted as from September.

July is a busy month for me as I still have a few review meetings to do before the summer holidays. So please do use this time to get in touch if you have any questions or any matters you want to address before the summer.

I shall not be doing an Ezine article in August but instead will look forward to bringing you all the latest financial and tax news in September!

Buying your dream home in France – webinar

By Peter Brooke

This article is published on: 20th June 2024

WATCH THE WEBINAR HERE

I have worked with many of the panelists for a number of years and their knowledge and experience is valuable to me and my clients; so if you are looking at buying and/or relocating to France then please join us for this live webinar.

Our experienced panelists are here to discuss all nature of topics to do with buying and relocating to France:

Karen Tait – Webinar host

Peter Brooke – Wealth & tax planning from The Spectrum IF Group

Joanna Leggett – French Property Expert from Leggett

Jonathan Watson – Currency Expert from Lumon

Paulette Booth – Banking and insurance expert from AXA

Tracy Leonetti – Visa & paperwork expert from LBS

Sharon Revol – Mortgage expert from Cafpi

Financial update June 2024 – France

By Katriona Murray-Platon

This article is published on: 5th June 2024

Tax season is pretty much over for another year, and by the time of publication most of the deadlines for filing will have passed. However, if you have an accountant who does your tax return they will usually be given extra time to file the returns. If you submitted your own return but have questions about whether you did it right and would like to speak to an accountant about it, you should try to speak to them late June, early July or early September to submit an amended return.

May is always a busy month for me, not least because of all the tax enquiries. However I also found time to write an article on French pensions. If you haven’t seen it already you can find the link here (https://spectrum-ifa.com/french-pensions/). If you have any questions on this article or your French pensions in general please do let me know

People often ask me whether they have to send in documents with their tax return or whether they are likely to get asked about what they have entered. The fact of the matter is that very often the tax office only really focuses on the tax returns of the very high earners (income tax, wealth tax, inheritances etc…). The French tax office generally go after the biggest fish, notably those with an income of over €1million per annum or gross assets that are subject to wealth tax of more than €6.9 million. However if you do start to do a wealth tax return you may find that your local tax inspector will take more of an interest on this one.

In 2020 there were a lot of people who, after many years of holidaying in France and owning a property here, decided to be considered resident in France before the Brexit deadline of 31st December. For wealth tax purposes you are exempt from declaring your worldwide assets for the first five calendar years of your residency. Unfortunately, even if you arrived late in 2020, this would still be considered your first calendar year. This means that as from 2025, if your world wide assets are worth more than €1.3million as on 1st January 2025, you will have to do a wealth tax return next year. You only have to declare your property assets, irrespective of where they are in the world. If you have money in investments or assurance vies, these are not included in your wealth tax return.

At this time last year, after having completed our tax returns, we still had to do the property declaration. This was an online declaration. Now, almost a year later, the tax authorities have produced a paper format of the declaration. You can download the paper form here https://www.impots.gouv.fr/formulaire/1208-od-sd/declaration-doccupation-des-locaux-par-le-proprietaire or some tax offices may have copies available if you cannot print it yourself.

Every year I get a lot of people contacting me about Trusts. Many years ago I wrote an article on Trusts which you can find on our website (https://spectrum-ifa.com/trusts-and-french-residency/). I have not updated the article because the law has not changed a great deal on this subject and much of the information is the same. If you are the trustee, settlor of beneficiary of a trust and you are resident in France you have to declare the existence of the trust using the form Trust 1 (https://www.impots.gouv.fr/formulaire/2181-trust1/declaration-de-constitution-de-modification-ou-dextinction-dun-trust).Then every year you have to declare the value of the Trust as at 1st January of each year using the Trust 2 form (https://www.impots.gouv.fr/formulaire/2181-trust2/declaration-annuelle-de-la-valeur-venale-au-1er-janvier-des-biens-droits-et-)

The deadline for filing the annual value declaration, which must be sent to the Non-Residents tax office, is 15th June.

Finally, for those with Pru assurance vies or those thinking of investing in a Pru Assurance Vie, on Tuesday 28th May 2024 the Prudential Assurance Company (PAC) board reviewed the Prufund Expected Growth Rates (EGR) as part of the quarterly review process. The Expected Growth Rate (EGR) is the forward looking element of the Prufund smoothing process.

For this quarter the EGRs of the Prufunds in our assurance vie products remained unchanged. The Unit Price Adjustment (UPA) part of the smoothing process, which is a backward looking element, and which is formulaic and non-discretionary are also reviewed quarterly. This quarter there was an upward UPA for the Prufund Growth USD fund of +2.71%.

If you have any questions on any of the matters mentioned above please do get in touch. I would be happy to arrange a phone call, video meeting or in person meeting to answer your questions or review your financial situation.

French pensions

By Katriona Murray-Platon

This article is published on: 17th May 2024

Many people come to France for “la belle vie” in retirement, but a large number of us (myself included) moved to France way before retirement and have even spent several years working in France contributing to the system here. Therefore when it comes to retirement, in addition to any other state or private pensions, we will need to apply for our French pension(s)..

Since 2017 the procedure to apply for your French pension has been simplified. You make one application and all your pensions from the various pension organisations will be paid to you. However, in practice things may not always go as smoothly and there have been numerous complaints from those trying to claim their French pensions.

No matter how long you have worked in France, or which pension body you have contributed to, you can consult your pension rights on this website www.info-retraite.fr. This is the website that you need to use to apply for your pension. You can also download from this site your pension entitlement statement. If you are getting close to retirement it may be advisable to download this document and keep a copy of it in your paper or computer files as it is updated each year so it is important to check it every year. The website may not take into consideration any years that you have worked in other countries in Europe, so you may need to email them to ask for more detailed information showing all the countries you have worked in.

If you can see that any periods of work in France have not been recorded, rather than asking for them to be investigated, it is better to ask whether you can buy any trimestres. By doing this, the pension authority will then have to investigate whether you can in fact buy any trimestres or whether you are fully up to date on all the periods you have worked.

Since 1st September 2015, is has been possible to obtain a provisional payment of your French pension even if your application is not “complete” and then have your pension recalculated once you have been able to provide the missing information. To do this you must apply for the pension four months before the planned date of retirement.

It is important to plan ahead and start the process of applying for your French pension 4 – 6 months before your intended retirement date. By requesting your retirement this will prompt the pension authority to start to calculate all the periods you have worked and what you may be entitled to.

If you have lived in France for any amount of time you know how it is important to have the necessary documentation ready. With some French authorities I have found that they may request documents you have already sent, so make sure you have several paper copies or scanned copies on your computer ready to send off.

If you do not think that the amount is correct you have five years to get any unpaid amounts paid to you, and if you have any issues with your pension authority you should contact them directly. You can usually do this by email or on your online account messenger service.

If you are not satisfied with their response there is a mediation service available. You have 10 days for an urgent request, 40 days for non urgent requests, which may be extended to 90 days in more complex cases, and two months to apply to the Commission de Recours Amiable (CRA). If you are still not satisfied with the decision you can apply to the Defenseur de droits.

For those whose deceased spouse worked in France they may be entitled to a French widow/ers pension. Like other pensions, this should also be paid to you within four months of the date of application. However, this pension is means tested according to your annual income so you may find that you don’t qualify for it.

It is important to plan ahead and there are many things you can do at various stages:

-

- Throughout your working life in France, keep all paperwork. As cumbersome as this may be, it is important to keep all payslips, pension letters, social security payment statements, as you may need them when you apply for your pension.

- From age 50, if you haven’t already created and consulted your account on the www.info-retraite.fr website, now is the time to do it. You should regularly download the career statements and save a copies. Sometimes any missing periods may appear on earlier statements but not on later statements.

- From age 55, you can request pension simulations. The closer you get to retirement the more accurate these simulations are likely to be.

- Once you reach 61, think about working part time from age 62 as a progressive retirement and look at buying back any missing trimestres. You have to buy back the trimestres before going part time. Once you start receiving your pension you cannot buy back any missing trimestres.

- 4-6 months before your retirement date, start applying for your pension.

Can an employer force you to retire?

Strictly speaking an employer cannot force you to retire before you are 67 years old. If you want to retire before this date you have to request to do so and comply with the requisite notice period. Only when you are over 70 can an employer require you to retire without consulting you. Between 67 and 70 they can retire you, but only if you agree to leave. It is better to be asked to retire rather than voluntarily taking retirement since the statutory amount of retirement benefit is higher than the voluntary retirement benefit when it is the employee that requests it. You may have even more favourable provisions in your Convention Collective. This retirement benefit is exempt from income tax (except the higher amounts) whereas the voluntary retirement benefit is taxable in the same way as your salary.

For any questions about your pensions or planning your retirement, please do get in touch.

Alpine Property Live Webinar Series

By Alan Watson

This article is published on: 7th May 2024

Buying your dream home in France

Join our on-line seminar

Talk to the experts and have YOUR question answered

Wednesday 15th May – 7pm – 8pm CEST

Our highly experienced panelists are here to discuss all nature of topics to do with buying and relocating to France.

Submit the questions you would like covered so we can make this time as valuable as possible. It is important to do this at least 24 hours before the start of the webinar to ensure we have time to cover as many topics as we can.

Financial update May 2024 – France

By Katriona Murray-Platon

This article is published on: 3rd May 2024

Tax season is in full swing at the moment and as with every year I have been getting lots of questions and queries relating to tax matters in France.

Over the April holidays I did sit down to do our own tax return and therefore was able to see whether there were any new aspects in the online declaration. I’m one of those people who prefers to know rather than waiting for surprises and this particularly applies to tax returns. Either we will have more to pay in which case it would be best to be prepared or we have less to pay in which case I want to know how much the tax refund will be. Because of the increase in the tax bands, if your income was comparatively the same in 2023 and in 2022, then you should have less tax to pay this year. In spite of my many years of experience of doing tax returns, I am not infallible and I did actually have to go back into our tax return to correct it. So based on my own mistakes I thought I would give you some tips about what to do and what not to do!

- COLLECT YOUR FIGURES – Make sure that you know what kinds of income you and your partner received and what the figures are whether they are taken off a bank statement or a certificate. If you have foreign income you will also need to know the exchange rate on the date on which you received the income or the average Bank of France rate for 2023.

- CHECK THE FIGURES ALREADY ENTERED ON THE TAX FORM – if you or someone in your tax household has received income from a French source (pension, salary, French bank income etc) then this should already be entered on the tax form. Nonetheless it is still worth checking that these figures correspond with any certificates issued by the relevant body or the December 2023 payslip. Even though my husband works for a French public body they don’t always communicate the right figures to the French tax office so I have learnt that it is worth checking and querying any differences.

- CHECK THAT ALL THE DIFFERENT TYPES OF INCOME ARE TICKED – Before you get to actually declaring the income you need to tick the boxes of which type of income you will be declaring. Some may already be ticked from previous years but others may not be even though you have been declaring the same type of income for years. If you have received another source of income then you need to tick the box for this new category of income. If you are declaring online not all the pages and the boxes will appear and it is easy to overlook something.

- REMEMBER THE ANNEX FORMS – in particular the 2047 for foreign income and the 3916 for foreign bank accounts. Regarding the latter, your information from the previous year should already be entered so you only have to carry over this information from last year but if you have opened or closed an account in 2023 or one is not mentioned on the form you will have to fill in the details. You will also have to declare the value as at 1st January 2024 of any foreign assurance vies. For the 2047 you may need to swap between this form and the main 2042 form to check that all the income is correctly entered and carried over onto the 2042.

- DON’T FORGET YOUR TAX CREDITS – We have had a piano teacher paid via CESU and the amounts declared were already entered on the tax form however the amounts paid to our cleaning company were not. So if you have had any home help (cleaners; gardeners, lessons etc) they should have sent you a tax certificate for last year so you will need to enter that amount in the tax credit section.

- RETIREMENT CONTRIBUTIONS – more and more of us work in France and contribute to some sort of retirement (PERP or PER). This was where I made a mistake this year because whereas the amount showed on the form, it is not deducted from your tax until you reenter these amounts in the correct box. Given that this is a deductible expense from your income it can amount to a significant tax reduction, so it is important to make sure that it is is correctly entered.

- CHARITABLE DONATIONS – this is another one often overlooked. Normally any charity you donate to should have sent you a tax certificate and you will need this document to claim the tax deduction. If you know you have made a donation make sure that you find the tax certificate or request it from them if they haven’t already sent it.

- NOBODY IS PERFECT – you can start your declaration and go back to it. You can do one version and then go back and change it. Once you get to the signature page which shows the tax due (this won’t appear if you have foreign income that will receive a tax credit) if something seems wrong you can go back and amend it. You can do this as many times as you like until the official deadline without it generating separate tax bills and even after the deadline provided you have submitted something before the deadline. If it gets close to the deadline it is better to declare something and sign the tax return and then correct it at a later date rather than incur a fine for late submission.

The tax filing deadlines are as announced in my previous Ezine however the deadline for filing the paper return is Tuesday 21st May before midnight.

You need to get it into the post box before this time even if it will be collected the next day.

If you haven’t already engaged a tax lawyer or accounting firm to help you out with your tax return then it is too late to do so as they will be too busy at this time of year. Therefore you need to get something onto the tax form and get it submitted by the deadline. It doesn’t matter if it is incorrect you can always amend this year’s tax return at a later date.

If you have any questions on your taxes or finances in France please do send me an email and I would be happy to arrange a time to speak to you.

British expats living in France may soon pay no UK inheritance tax

By Richard McCreery

This article is published on: 10th April 2024

Recently announced changes to the non-domicile system in the UK could be extremely beneficial for Brits living in France.

The Chancellor of the Exchequer, Jeremy Hunt, said in his Budget speech in March that the government intends to reform the existing Inheritance Tax scheme which is based on domicile rather than residency. In legal terms, your domicile is considered to be the country to which you have the strongest ties and that is often simply due to the fact that you were born there.

Relinquishing your UK domicile is very difficult, even if you have lived outside of the country for many years. Domicile tends to be permanent, unlike residency for tax purposes which changes according to your home, your centre of interests and where you spend most of time throughout the year. The Teflon-like nature of domicile means that the UK can still apply its 40% rate of Inheritance Tax to your estate when you die and, at the same time, all your worldwide assets can fall into the scope of French inheritance tax if you live full-time in France.

However, from April 2025 this situation should change so that British expats in France will no longer be taxed in both countries if they have lived abroad for more than 10 years and they have no assets in the UK. The detail is not yet set in stone, but this is our current understanding of how the new rules will work. The changes might encourage some people to consider moving assets out of the UK in order to avoid any liability there, and the government knows this, so we’ll have to see the finalised details before we can judge how beneficial the changes really are. The prospect of a new party in government following this year’s general election also adds a further element of uncertainty about what the rules will eventually look like.

France also applies Inheritance Tax at rates that can be quite punishing in some circumstances. Beneficiaries can inherit a defined amount of money tax free, depending on their relationship to the deceased, but these allowances can be swallowed up quite quickly, especially where a property is included in the estate. Fortunately, France does provide residents with some very attractive ways to reduce any such tax bill and with the right advice an ordinary family can shelter hundreds of thousands of Euros from Inheritance Tax.

If you would like to discuss your family’s estate planning, or any other financial issues that are important to you, please get in touch to arrange a no-obligation meeting or conversation.

Financial update France – April 2024

By Katriona Murray-Platon

This article is published on: 4th April 2024

April is an important month of the year as, not only is it the end and beginning of the UK tax year but it is also the beginning of the French tax season.

If you are impatient to start declaring your income for 2023 then the tax forms should be available in the next week or so (at the time of writing no official date has been given) but whether you decide to get started in April or wait until May it is important to know the deadlines for submitting the forms.

If this is your first year submitting your tax return you will need to do a paper declaration by the 20th May 2024 (date to be confirmed). Which means that you need to collect the paper forms from the tax office and fill out the information by hand.

The other dates for the online tax declaration service are:

| Department | Filing deadline |

| 01 to 19 | Thursday 23 May 2024 at 23h59 |

| 20 to 54 (including 2A and 2B) | Thursday 30 May 2024 at 23h59 |

| 55 to 974/976 | Thursday 6 June 2024 at 23h59 |

| Non-residents | Thursday 23 May 2024 at 23h59 |

I shall be tackling our tax return in the April school holidays so in my next Ezine I shall be addressing any issues that I have noticed and be giving you all my tips for filing your 2023 income tax declaration.

Do you remember the fun you had last year doing the occupied properties declaration? Well, the good news is that you don’t have to do it every year! You only need to do another one if there are any changes to the occupancy of your properties. Whilst the declaration does have to be done online,18% of property owners did not do a declaration last year and the tax authorities shall be issuing a new paper declaration for those who are unable to do their declaration online.

Did you know that students do not pay taxe d’habitation on their student accommodation (CROUS)? However, a ministerial response in January (no 7826 of 09.01.2024) has clarified that this exemption also applies to students who are still included on their parents’ tax returns but who live away from their parents in private student accommodation or who flat share.

As from 1st April many benefits, including family allowance, disability allowance and RSA, will increase by 4.6%, as a measure to mitigate the effects of inflation.

Those of you who do furnished rental were quite alarmed by the French government’s “faux pas” in the 2024 finance bill which lowered the micro threshold to €15,000 and the abatement to 30% thus forcing those who were over this limit to go into the costs (regime reel) based system. As expected, this has now been rectified and landlords can use the former thresholds (€77,700 micro-BIC with a 50% abatement for costs – https://bofip.impots.gouv.fr/bofip/3610-PGP.html/identifiant%3DBOI-BIC-CHAMP-40-20-20240214). Hopefully all the organisation will have got the memo but if you do have any problems please do refer to the link above. As always, if I hear anything further on this I will let you know.

There are three pillars to the French pension scheme, the basic social security pension, the complementaire points based system and the private PERs. I strongly advise anyone who has worked in France to create their profiles on the www.info-retraite.fr website and to regularly consult this website especially when you are getting closer to retirement age. I noticed on my own account that whilst I had accumulated points as a salaried worker, since starting my business in 2017 I had not received any further points nor had I been asked to contribute to receive them. This has now all been cleared up by a decision of the Council of State on 9th February 2024 (no 471203) which nullified a decree that provided that auto-entrepreneurs under the micro-BNC regime and micro-social regime that pay a set rate of social contributions of 21.1% do not acquire points under the complementaire retirement scheme. A new law should be published soon rectifying this as from 1st June. This will however imply that the rate of social charges will increase.

If you have any questions on your finances or taxes in France please do get in touch and I would be happy to arrange a phone call or meeting to discuss your concerns.