IHT in the UK is now a 40pc “death tax” charge on someone’s estate.

Everyone gets an allowance of £325,000 before anything is due, with the possibility of another £175,000, known as the nil-rate band, if you’re bequeathing a property to your children or grandchildren.

There’s nothing to pay on what you leave to a spouse or civil partner and, even if you’re widowed when you die, your late partner’s allowance can still be used. However, 40pc of anything you inherit above your allowances must go straight to the taxman. Neither allowance has increased since 2020 and they’re both frozen until at least 2028. There were hopes Chancellor Jeremy Hunt would scrap IHT in this year’s Budget, but he didn’t.

As a result, HMRC is already reporting that families handed over a record £7.5bn in IHT last year – an increase of £400m – and forecasts suggest it could rise another £2bn before 2030.

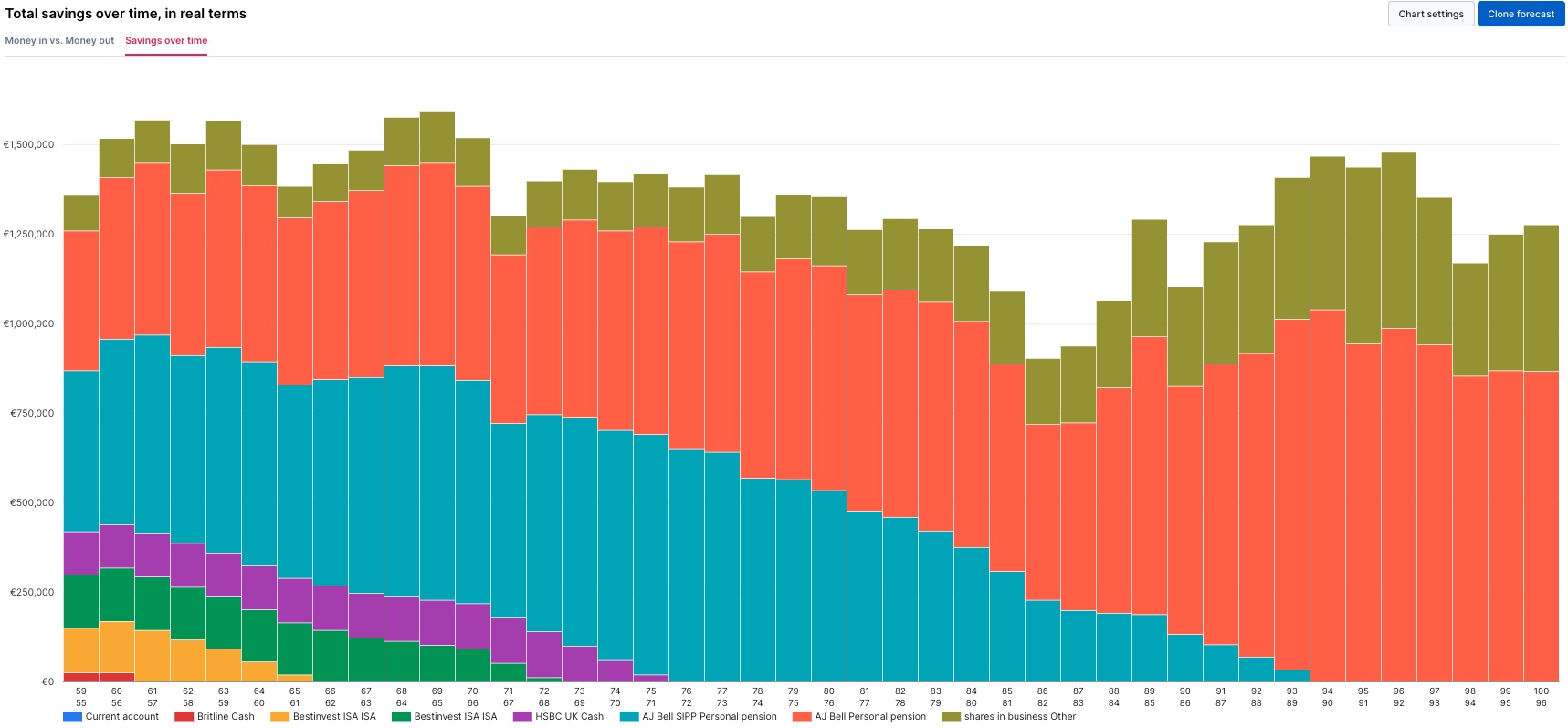

The amount of IHT paid by families is climbing rapidly.

Experts fear this is all combining to create a major problem for the UK housing market.

When someone dies, the executors of a will have to apply for probate to legally deal with the estate. However, it often isn’t granted before IHT becomes due. Although you can pay it with cash from the estate, such as the deceased’s savings, you cannot sell their assets before probate is granted.

This can mean people are not only forced to sell, they’re also pushed into taking expensive, long term loans until completion – all at a time of mourning.

Harry Bell, of wealth managers Charles Stanley, said: “Being an executor is not an easy job and it’s very stressful. Often, they’re the children of the deceased, so they’re already in a fragile and difficult position and are constantly reminded they’ve lost a loved one.”

“To add insult to injury, the IHT bill has to be paid within six months and probate usually takes longer than this. This often means money must be borrowed at punitive rates to cover the bill. If there isn’t enough cash in the estate, investments and property will have to be sold to cover the bill. This can be a long process, all while the funds borrowed are accruing more punitive interest.”

Chris Rudden, of investment platform Moneyfarm, said: “The average 35-44 year old has less than £7,000 in savings and they’re the first generation that’s poorer than the one before.”

“Property prices are generally very high now, particularly in the south, where there are 600,000 properties over £1m. If you’ve suddenly got £100,000 IHT to pay and only £20,000 in the bank, it’s not going to get you very far.”

“Many, many estates will have one of these properties, possibly even two, and would be way above the threshold with other assets. A lot of the next generation don’t have the money sitting around to pay the tax, so they may have to sell the assets they’re inheriting.”

“That will negatively affect house prices, both for those selling and those not. We saw in 2008 and 2009 what falling house prices can do, particularly in the US. Either the Government will change the policy on IHT, or people may have to foot the bill for something they can’t afford.”

“We could be looking at a property fire sale and the next generation is sleepwalking right into it.”

Please get in touch if you would like to discuss tax efficient investments that can be left to your loved ones and beneficiaries outside of your taxable estate.