At the end of January, I joined colleagues and product providers at our annual conference in Monaco. We heard a range of insightful presentations from companies including Evelyn Partners, iPensions, Momentum, New Horizon, VAM Alquity, LGT Wealth Management, Novia Global, Rathbones, Utmost, Prudential and RBC Brewin Dolphin.

French Financial Update February 2026

By Katriona Murray-Platon

This article is published on: 10th February 2026

There is often a difference between what dominates the headlines and what investment managers focus on. While it has become increasingly difficult to ignore what is happening in America, it is important to remember that we maintain a long-term focus for our clients’ investments.

As outlined by the fund managers, markets remain heavily tech-focused. However, although stocks from the companies known as the “Magnificent Seven” dominated markets in 2023 and 2024, there has been some broadening in 2025. Nvidia shares have recently flatlined and Microsoft was down 20%. Even though European stock markets are performing better, fund managers are not yet ready to abandon US equities in favour of European ones.

Unfortunately, the UK economic outlook remains gloomy. For several years now, fund managers have highlighted how little exposure they have to UK stocks within their portfolios. However, the FTSE 100 performed well in 2025, largely because many UK companies generate profits outside the UK.

There was considerable discussion around artificial intelligence.

While some may view AI as potentially similar to the dot-com bubble, our product providers demonstrated how the underlying economic fundamentals are very different.

Many people now use AI, but the key question remains: who is actually making money from it?

AI also requires significant infrastructure, including large data centres and substantial energy supply. Its influence is now extending into emerging markets as well.

Fund managers have reduced their oil exposure as energy prices continue to decline. Sovereign bonds, however, are becoming more attractive, with yields of between 1% and 3%, particularly Norwegian, Australian, New Zealand and Japanese bonds.

Novia announced its new GIA product which, like its SIPP, can hold funds denominated in HKD and Australian dollars, as well as GBP, EUR, CHF and USD. Currently, UK SIPPs sit outside a deceased person’s estate for inheritance tax purposes. However, proposals from the UK Chancellor will bring defined contribution pensions into the inheritance tax net from 6 April 2027.

Evelyn spoke about the digital data boom, describing it not as a fad but as a generational shift (anyone with teenagers will relate). Their aim is to “turn data into dollars” in 2026, and they continue to see opportunities, particularly among companies utilising AI. Stronger earnings and a weaker dollar are also supporting emerging market equities.

In French financial news, from 1 February 2026 the interest rates on French savings accounts have been reduced as follows:

Livret A: 1.50%

Livret de développement durable (LDDS): 1.50%

Livret Jeune: 1.50%

Compte Épargne Logement (CEL): 1.00%

Returns from euro funds in French assurance-vie policies appear to have stabilised. The average rate of return in 2025 was 2.65%, compared with 2.63% in 2024 and 2.60% in 2023.

After social charges taken at source, the average net return is 2.19% — only 1.5 percentage points above inflation.

While these assets are often viewed as safer options, cautious investors may benefit over time from increasing equity exposure to achieve stronger long-term growth.

Local taxes, in particular taxe foncière, are not expected to increase by more than 0.80% in 2026, due to the increase in the rental value of properties.

Other key changes from 1 January 2026 include:

- The annual social security ceiling is set at €48,060 (€4,005 per month).

- The legal interest rate is set at 6.67% for loans between individuals (for example, late custody payments) and 2.62% for loans between professionals.

- The maximum amount that can be withdrawn from a deceased person’s bank account to cover funeral costs is €5,965.

- Medication, treatment or services provided by non-contracted doctors (those who set their own fees) will no longer be covered by social security from January 2027.

- Fees for certain medical specialists have increased (€40 for a gynaecologist, €42 for a geriatrician and €57 for a neurologist).

- Stamp prices have increased, as they do each year, to €1.52 from €1.39. Postal costs for other services have also risen.

- Interest earned on PEL savings accounts is subject to income tax (12.8%) and social charges (18.6%), bringing the flat tax rate to 31.40%. Holding a PEL allows access to a mortgage at 3.2%.

- If you are expecting a baby in 2026, you may be entitled to an additional two months of maternity, paternity or adoption leave.

In January, if you benefited from specified tax credits or reductions (for example, home help), you will have received a payment equal to 60% of the total amount. The remaining balance will be reconciled through your 2025 tax return in September 2026.

After catching up with work following the conference, I will be spending time with my family from 16 to 20 February during the half-term holidays. If you have any questions about the information above, or would like to arrange a time to discuss your financial matters, please do get in touch.

The Spectrum IFA Group annual conference

By Peter Brooke

This article is published on: 9th February 2026

I’ve just returned from the 23rd Spectrum annual conference — my 22nd — which this year was held in Monaco, making it refreshingly easy travel for me.

Each year we bring together Spectrum advisers from across Europe, along with our support and management teams, and a carefully chosen group of investment managers, pension specialists, and tax experts. It’s a chance to step away from the day-to-day detail, compare notes, challenge assumptions, and make sure the advice we give clients continues to stand up in a changing world.

One thing that’s worth sharing, because it underpins everything else in this update, is what Spectrum actually is. We’re a large, international advisory firm — but we’re also owned by the advisers who work in it. We’re currently restructuring the business to widen that ownership further, so more advisers have a direct stake in the firm’s future.

That matters because we’re not building towards a quick exit. We’re building something designed to last, we are proud of the longevity of the business and the strong retention of our advice team. The conversations at the conference reflected that long-term mindset — less about chasing the next headline, and more about understanding the forces that genuinely shape investment outcomes over time.

With that in mind, here are the main themes I took away from the conference, and why they matter for expatriates and internationally mobile families.

1. Artificial intelligence: real change, not just hype

Artificial intelligence was easily the dominant topic of the conference — but not in the “buzzword of the month” sense. The most interesting discussions weren’t about which stock has run the hardest, but about where AI is genuinely changing productivity, margins, and long-term business models.

The key message from managers like Rathbones and Evelyn Partners was that we’re moving into a second phase of the AI story. The early gains were very concentrated — a small group of large US technology companies driving market returns. That phase isn’t necessarily over, but it is evolving.

What’s happening now is a broadening out. AI is starting to affect industrial businesses, healthcare, logistics, energy management, data infrastructure, and even areas like waste management and defence. In other words, it’s moving from “who builds the chips” to “who uses the technology well”.

That distinction matters. History shows that transformative technologies don’t just reward the obvious early winners — they reward companies that apply them intelligently, efficiently, and profitably. For investors, this reinforces the importance of looking beyond the headlines and staying diversified, rather than assuming yesterday’s winners will automatically dominate tomorrow as well.

2. A return to fundamentals and sensible diversification

Another strong theme that came through very clearly was a return to fundamentals.

Markets over the last couple of years have often felt narrow and momentum-driven, with a small number of stocks (mainly AI/Tech) doing most of the work. Several managers made the point that this sort of environment can feel exciting — but it also increases risk if portfolios become too concentrated – at one point just 7 companies made up nearly 35% of the size of the US stock market (S&P 500)!

Rather than trying to predict short-term market moves, the emphasis is now firmly back on:

-

cash flow and balance sheet strength

-

sensible valuations

-

real earnings growth

-

businesses with pricing power and durable demand

For clients, this translates into something reassuringly familiar: diversification still matters. Not just across regions, but across styles, sectors, and asset classes. It’s rarely the most exciting message — but it’s consistently one of the most effective.

3. Looking beyond markets: private assets and the real economy

Several presentations also focused on areas outside traditional listed markets.

There was strong interest in private assets and real assets — things like infrastructure, property, and long-term income-producing investments. These aren’t about quick wins; they’re about accessing different return drivers and reducing reliance on public market volatility alone.

For many expatriate investors, this can be particularly valuable. Income that’s less sensitive to daily market swings, assets linked to real economic activity, and structures designed with long-term planning in mind can all play a role alongside more traditional portfolios.

As always, these areas need careful selection and suitability — but the message was clear: a well-built portfolio doesn’t rely on a single engine to get where it’s going.

4. Scale, governance, and why “size matters”

Another interesting thread was the importance of scale and governance, particularly in uncertain markets.

From an investment perspective, larger, well-capitalised businesses tend to have more resilience: better access to finance, more flexibility in downturns, and greater ability to invest through cycles rather than cut back at the wrong time.

That same principle applies at an advisory level too. Spectrum’s size, international reach, and shared ownership model allow us to invest in systems, compliance, and expertise in a way that simply isn’t possible for smaller, standalone firms.

It’s not about being big for the sake of it — it’s about stability, continuity, and quality of advice over decades, not just years.

5. Who we choose to work with — and why it matters

Another reassuring takeaway from conference was spending time with the firms we work with on clients’ behalf — not just listening to presentations, but understanding how they think, how they’re governed, and how decisions actually get made.

One of the advantages of being part of a group like Spectrum is that we’re able to be selective. We don’t work with managers because they’re fashionable or because they shout the loudest — we work with them because they have depth, longevity, and a track record of navigating change.

- A few examples give a flavour of this:

LGT Wealth Management is owned by the Princely House of Liechtenstein and has been for several generations. That sort of long-term, family ownership creates a very different mindset — one focused on wealth preservation, discipline, and thinking in decades rather than quarters. - Prudential International is part of a wider group that manages around £350 billion of assets. That scale brings financial strength, deep governance, and the ability to invest heavily in systems, risk management, and long-term product development.

- Rathbones, one of the UK’s largest private asset managers, looks after approximately £115 billion of assets and has been in existence for over 250 years. Very few firms survive that long without adapting repeatedly to political change, market cycles, and economic upheaval.

None of this guarantees outcomes — nothing ever does — but it does give us confidence. These are organisations built to endure, with governance structures and cultures that align closely with how we think about long-term planning for clients.

For me, this is a crucial but often invisible part of the job: doing the work behind the scenes so that clients don’t need to worry about whether the foundations are solid. The conference reinforced that the partners we choose, and the effort that goes into maintaining those relationships, genuinely matters.

6. What this all means in practice

Stepping back, the conference reinforced something I see year after year: successful long-term investing is rarely about prediction.

It’s about:

- understanding structural change (like AI) without overreacting to hype

- staying diversified when markets feel narrow

- focusing on quality and fundamentals

- using scale, governance, and expertise to manage risk properly

- ignoring the inevitable noise of geopolitics and political posturing, it rarely has long term impact.

- and keeping plans aligned with real lives, not just market cycles

That’s particularly important for expatriates, where cross-border rules, currencies, tax systems, and future uncertainty add extra layers to every decision.

If you’d like to talk through how these themes relate to your own situation — or simply want a sense-check that your plans still reflect what matters most to you — that’s exactly what I’m here for.

If you want to dive a little deeper into any of this detail, there are some great articles at these links.

Evelyn Partners Turning data into dollars in 2026

Rathbones Video Market broadening and Geopolitical noise

If you feel this would be helpful to friends, family or colleagues, please do feel free to forward this on to them.

As always, I’ll keep translating what we hear from conferences like this into practical, real-world advice that fits your life, not just the markets.

With thanks

Finally, I’d like to say a genuine thank you to the firms who took the time to join us in Monaco, share their thinking so openly, and engage in thoughtful, sometimes challenging discussion.

In particular, my thanks go to the teams from Rathbones Asset Management, Evelyn Partners, LGT Wealth Management, Alquity VAM Investment Management, New Horizon Asset Management and Prudential International, and the other investment, pension, and tax specialists who contributed to the conference.

These events only work because people are willing to go beyond polished presentations and talk honestly about risks, opportunities, and uncertainties. That openness is exactly what helps us refine our thinking and, ultimately, improve the advice we give to clients.

It was a privilege to spend time with such high-quality partners — and it left me confident not only in the ideas discussed, but in the people and organisations helping us put those ideas into practice.

The unusual aspects of taxation in Italy?

By Gareth Horsfall

This article is published on: 5th February 2026

We are a team of fully regulated financial advisers working across Europe, with a strong presence in Italy since 2010. Our focus is on helping expatriates, and returning Italians from abroad, who are residents or want to become residents in Italy.

- Needing a professional to help you – Unless your financial affairs are really simple then you will likely need a professional to help you complete your tax return. Self declaring is complicated due to the codes used to complete the forms and so might not be worth your while due to the risks of getting it wrong. That being said you can get info online as to how to complete your tax return which is helpful.

- Reddito diverso e reddito di capitale – If you have investments in something like Exchange Traded Funds, for example, the income and capital gains are treated as one type of income (reddito di capitale) and the losses as another (reddito diverso). You can’t offset one from the other even though they derive from the same asset.

- Wealth taxes – Many countries do not have wealth taxes. Italy introduced them in 2014 when Mario Monti was Prime Minister. At the time politically, Italy was under the spotlight for its mounting debt and so wealth taxes were introduced as a way to generate more revenue for the country. Also, it harmonised the fact that taxes were paid on domestic assets but not on assets held abroad, at the time and so capital flight was rampant to evade taxes.

- Wealth tax on property – If you have a property outside the EU, then the wealth tax is calculated on the purchase value. This may seem strange but the market value is largely subjective depending on market supply and demand and would be difficult to determine. The purchase price is documented in the purchase contract and so is a definitive sum which reference can be made to.

- Choosing your tax rate – You can choose to have your investment income and/or gains taxed at your lowest rate of income tax IRPEF (23%), if available, or the standard flat rate on investment income (26%). This comes in useful if your total income is low and you can use up your first band of income tax. Otherwise, it’s normally better to go with the standard flat tax rate. You can also deduct certain expenses from the IRPEF choice, which can lower the rate even more. This is not possible on the standard rate.

- There are no personal allowances or nil rate tax bands for personal income. You start paying tax on Euro No 1. If you are in retirement and in receipt of a pension/ retirement income, you may get an age-related credit, depending on your income, otherwise you can deduct some expenses such as some building costs, vets bills, pharmacy expenses and doctors bills, which can reduce your income tax bill further.

Specialised financial planning for expatriates across Europe

By Craig Welsh

This article is published on: 5th February 2026

Brexit significantly altered the financial planning landscape for expatriates in Europe, particularly for UK nationals. Many expatriates now face challenges in managing investments, pensions and long-term wealth due to changes in cross-border financial regulations.

As part of the UK’s exit from the European Union, financial services were excluded from the Withdrawal Agreement. This removed passporting rights that previously allowed UK-based financial advisers to operate across the EU. As a result, many UK advisers and institutions are no longer authorised to provide financial advice to clients living in the EU, leaving many without access to suitable planning and guidance.

For expatriates, this can create serious risks. Existing investment structures may no longer be tax-efficient, pension arrangements may not comply with local regulations, and important considerations such as inheritance planning, currency exposure and local tax reporting can be overlooked without properly authorised advice.

The Spectrum IFA Group specialises in financial planning and wealth management for expatriates throughout Europe. Licensed across the entire European Economic Area (EEA), Spectrum has offices in six EU countries, and Switzerland; however, we are also able to offer advice to expatriates living further afield, including for example in Germany, Poland, Greece and across Eastern Europe.

Our clients benefit from access to secure, well-regulated, and tax-efficient investment solutions designed specifically for expatriates. We also help with cashflow forecasting, modelling a range of retirement scenarios, such as when you can retire and whether your current assets will be sufficient to provide financial security for the long term. By working with experienced and qualified advisers who understand both UK and EU financial and regulatory frameworks, our clients can reliably protect their wealth, reduce tax exposure, and plan confidently for the future.

With expertise in cross-border financial planning, The Spectrum IFA Group helps expatriates across the EU make their finances truly Brexit-proof, providing clarity, stability, and long-term financial security.

Financial life in Italy 2026

By Gareth Horsfall

This article is published on: 22nd January 2026

For those of you who read my last Ezine you will be happy to know that I got my wellies for Christmas and also a more than welcome surprise of a toolbelt. I feel complete! I have been putting both to good use in the last week (seeing as though we have a good weather spell), by doing some early morning ‘potatura‘ of the olive trees.

I thought I would have a go myself this year since the chap who came last year hasn’t committed and it appears to be quite hard to find people in the area who are not already booked up. So, I thought I would give it a try after reading a few books, speaking with numerous people about it and watching far too many Youtube videos on the subject.

I am quickly realising how obsessive one can become when you are pruning olive trees, regarding correct shape, removing too much or too little and wondering whether the tree is growing too high, how to train it further down, whether to cut this branch or the other one. It’s quite therapeutic actually although it appears to be rather arbitary because we have no idea where the olives will produce, how many, and if environmental factors will affect production this year. However, as my 7.30am to 9 am morning routine (when not travelling) it is a good way to start the day.

Anyway, for my readers who have been doing this for many years, I will let you be the judges. See some fotos below. (Feel free to send comments about where I might be going wrong).

Moving on from land work I wanted to send this brief Ezine out just to reconnect in the New Year. 2025 proved to be a positive year for our investment accounts and it is anyone’s guess what is in store for 2026.

I am attending the Spectrum IFA Group annual conference from the 26th to 30th January and will be doing my usual round-up Ezine when I get back. We will be speaking with Rathbones Asset Management, Evelyn Partners, Prudential, New Horizon Asset Management, LGT Wealth Management and others as well.

But, before I return (hopefully Greenland will still be a part of Europe by then) I wanted to share some information on Italy with you, as a light hearted read.

On Facebook I follow a page called Dataroom di Milena Gabanelli. You may know of her from the programme ‘Report’, which is where I first became familiar with her around 15 years ago. Now she works for Corriere della Sera and has her own FB channel. It’s very interesting as they regularly put out content about Italy and global events but backed up with solid facts.

The most recent one I saw was ‘Chi paga meno tasse’. A look at the health system and exactly where tax revenue is coming from to support the system itself.

The following is summary of the video, which is only a few minutes long, but provides some quite interesting information, which I wanted to share with you.

(The data is taken from studies of contributi previdenziali relative dichiarazione 2023.)

Did you know that 76% of taxpayers in Italy declare less than €29000 gross per annum.

This group do not pay towards the health service because they are exempt. Their income is below the threshold set by the Italian government. (The ticket)

9% of taxpayers in Italy declare between €29000 and €35000 gross p.a.

This group pays for health expenses but not for welfare (pensions and schools!).

Only 15% declare over €35000pa.

This group contributes to both the health system and the welfare. They pay for the majority.

Let’s analyse things a little further

With an income of €29000 gross pa there is likely to be very little margin to pay your health care expenses. In this category fall many ‘pensionati and dipendenti’ and so we can exclude them for the purposes of the analysis.

The rest are autonomi ( self-employed people- like myself)

- 1.8 million autonomi in Italy are on the flat tax regime and so cannot be considered.

- 2.2 million autonomi pay IRPEF (normal income tax rates) and of these 1.3 million declare income under €29000pa. This means that they pay €2 billion in tax or ONLY 8% of the whole category for the autonomi.

To analyse further to see whether any of these people have a real need or if they are working in nero, we can look to the index ISA which looks at fiscal ability to pay. They work on a points based system and if a contribuente has under 8 points then there is the risk of fiscal evasion.

Tax Evasion vs Tax Avoidance

Here we have some interesting facts:

- 78% of restaurants declare less then €28000pa gross

- 70% mechanics under €20700 pa gross

- 60% alimentari under €10700 pa gross

- 48% hairdressers under €11900 pa gross and also 45% of balneari

Anyone who is declaring less than they actually bring in is also paying less contributions towards the health service and also they will receive less pension, which means that the people who are paying will have to pick up the bill.

The Agenzia delle Entrate are not funded well enough, even though they have some interesting tools at their disposal, and can do controls on only 4.5% of people / businesses annually.

It’s no surprise that the Italian government really doesn’t have much, if any, room for manoeuvre to change tax rates and why the health service is underfunded.

Short term rentals

If you like those facts you may also like the following ones about the explosion in short term rentals in Italy (affitti brevi), which go some way to explain why many cities and famous locations in Italy are now almost impossible to visit without a tremendous amount of people all doing the same.

- In 2011 short term rental advertisements didn’t exceed 20000 in the whole of Italy

- In 2021 this number had exploded to 620000

- In 2022 to 644000

- and 2023 to 700,000 which equates to approximately 11 billion euro invoiced a year

In the market of short-term rentals Italia is No 3 in the world behind the France and the USA!

If we analyse some of this data then we can see that 75% of these rentals are in the hands of private landlords and 25% managed by agencies.

Agencies, in general, retain 35% of the income to manage the cleaning and change of sheets etc. Almost all of the advertisements are now on the digital platforms like AirBnb and Booking.com, who in general keep between 14 and 18% of the income. The same platforms have been obliged since 2017 to apply a withholding tax of 21% on gross income.

In the Legge di Bilancio 2026 this withholding tax of 21% now applies to the first property. For the second a witholding tax of 26% and for owners of 3 properties or more, they are now deemed to be a business activity and must open a partita IVA (VAT position). The war on private landlords continues, not just here in Italy but across many countries, but whether it will make much difference in the long run is anyone’s guess.

If you have enjoyed this information so far, then I will leave you with the world of Italian politicians and how they are paid (c/o Dataroom di Milena Gabanelli)

They are paid well because they should, in theory, not be corruptible and should work in the interests of the country.

An Italian politician is entitled to a number of benefits, ranging from:

Indennità parlamentare, which is a compensation payment for being a politician and spending time away from home. It is currently €10435pm Gross or €5000-5300 pm after taxes and contributi.

Diara (per deputati e senatori) – just €3500pm

+ Expenses reimbursement.

These do not always have to be documented!!!!

They also qualify for reimbursement of travel expenses

And reimbursement of telephone expenses

Pensions

The same politicians are entitled to a pension after only 5 years of working in Parliament. (versus 20 years for the rest of us!)

Interest payments

They are also entitled to an interest rate of 5.4% on the money in their savings and current accounts. The bank pays this automatically versus the average rate for us , at about

0.2 %

And on that note I will leave it there. This Ezine was really was meant to be a light-hearted way of staying in touch.

I will be following this up from our conference with a market review from the week after next, followed by some other Ezines on tax and also organising your affairs for your loved ones.

Fraud and cyber-security

By Andrew Lawford

This article is published on: 14th January 2026

It’s time to pay (even more) attention!

We all know that we have to be careful when we are dealing with financial matters, especially when we are online.

I appreciate that this isn’t news to anyone, but it is easy to become complacent, as well as to fall behind in our awareness of the sophistication fraudsters have available to them in the era of Artificial Intelligence. I honestly think that we are all vulnerable to frauds, but if we have the humility to admit this, we can better protect ourselves against the most common pitfalls.

I recently watched a webinar made available by Cazenove Capital in the UK and whilst there were things in it that I already knew, I must admit that it also opened my eyes to how frauds are developing as well as reiterating what our best practices should be online and when dealing with financial matters generally.

I would strongly suggest that everyone takes the time to watch the full webinar, but here are a few bullet points that we all need to reflect upon:

- The golden rule in life is that if something seems too good to be true, it most probably isn’t true. However, human nature means that it is a good idea to be reminded of this fact on a regular basis.

- Most frauds are still relatively “low-tech” and involve things like hacking e-mail accounts – the fraudster may monitor e-mail traffic for a while before finding their opportunity, maybe by sending messages from your e-mail account to financial institutions you deal with. Two-factor authentication is an excellent protection against this possibility – if you don’t have it set-up on your e-mail accounts, do it now!

- Be careful clicking on links in e-mails you receive! These communications seem ever more credible nowadays and can easily trap the unwary.

- Any financial transaction that someone is urging you to carry out in a hurry should instantly raise a red flag. If you are being pressured to transfer funds, even by someone you know, hang up the phone, take a few deep breaths and call the person back on a number you know can be trusted. If you aren’t sure what to do, seek counsel from someone you trust who is not connected to the situation at hand. Deep-fake calls are a possibility (where it will appear that you are speaking to someone you know), but there are also cases where people have been contacted by complete strangers who claim that a family member is in trouble and needs money transferred in a hurry.

- If you do expect to have to make urgent payments to someone – maybe a family member or a business associate – use code-words or agree a protocol that only you and the person concerned will know. Agree in advance which accounts any payments will be made to. SEPA transfers in the EU will now confirm the identity of the beneficiary account holder – if your bank flags up any discrepancy between the name you have entered as beneficiary and the actual account holder, take time to check!

What is Spectrum doing to protect me?

For some time now, all Spectrum advisers are required to conduct video calls or in-person meetings when processing withdrawal requests from any investments we intermediate. The fact that withdrawals generally take some time before being paid out also takes away the threat of panicked decisions being made. Of course, one day deep-fake videos will likely become a reality and so even video calls may not be trustworthy, but for today this procedure will protect against all but the most sophisticated fraudsters (and these aren’t the ones who are targeting the likes of us – they will be defrauding multinational institutions).

We must make our job that of being a harder nut to crack compared with those around us. Rather like home security alarms: they will not be sufficient to stop the world’s most sophisticated thief, but they will be enough to make the opportunistic criminal move on to an easier target.

If you find yourself confused or worried about any of the above, please don’t hesitate to give me a call to discuss. The more we are aware of the risks we face, the better we can protect ourselves.

Tax & Financial Webinar in Portugal

By Portugal team

This article is published on: 12th January 2026

The 2026 Markets Crystal Ball

Tuesday 20th January 2026

As we begin 2026, it is a natural moment to reflect on the previous year and more importantly, to consider what could shape investment outcomes in the year ahead.

We would like to invite you to a forward-looking webinar designed to provide clarity on the key themes, risks, and opportunities investors may face in the year ahead and to explore the key financial, economic, and policy themes likely to shape 2026.

Date: Tuesday, 20 January 2026

Time: 11:00am (GMT)

Format: Live online webinar

Why this session matters

Markets closed 2025 in an unusual position and whilst optimism remains high into 2026, risks are increasingly less obvious, more interconnected and capable of emerging quickly. At the same time, powerful forces such as artificial intelligence, geopolitics, and shifting fiscal and monetary policy continue to reshape global markets.

Webinar agenda

- 2025 Crystal Ball Scorecard

What we got right, what we didn’t, and why it matters. - The Big Picture for 2026

Growth, inflation, policy, AI winners and losers, and global market dynamics. - Potential “Grey Swans”

The shocks no one is forecasting — but everyone will talk about if they happen. - Practical takeaways for investors

Clear, actionable insights to help you feel informed, confident, and prepared for 2026.

This webinar is designed to be informative, balanced and accessible – offering clear insights without unnecessary jargon.

There will be time for questions at the end of the webinar, however to avoid disappointment we welcome questions ahead of the session via this link.

Your hosts

- Mark Quinn & Debrah Broadfield | Tax advisers & Chartered Financial Planners, Spectrum Portugal

- Chris Saunders | Co-Founder and Chartered Investment Manager, New Horizon Asset Management

Secure your place for Tuesday 20 January 2026 at 11:00am GMT

Our services include:

Tax planning

Efficient tax planning is about ensuring you pay the right amount, in the right place.

Many people have income arising from many different jurisdictions, whether that be rental, pension or investment income, and each will be treated differently and may even be taxable in different jurisdictions. Even if you believe your situation is relatively simple, there are always planning opportunities and pitfalls as an expat, so it is best to take qualified advice.

We can advise on effective tax-saving structures in your country of residence, restructuring for improved tax efficiency and tax-saving opportunities, whilst ensuring fiscal compliance.

Investments

How you hold and structure your wealth can impact how you are taxed on your investment returns, but personalised investment advice is also very important. It must be looked at in the wider context of your total asset base, financial goals, tax residency, your attitude to risk and capacity for loss.

You should also regularly review your investment strategies to ensure ongoing suitability, not only because of the ever- changing nature of investment markets but also because family and personal circumstances change, as well as one’s attitude towards investing. For example, you might be more risk-averse as you near retirement, or you may need to plan for future income or lump sums.

We are supported by internal and external investment specialists and can advise on the most appropriate investment strategy for you and work with you over time to help reach your financial goals.

Pensions

There is more choice than ever for individuals in respect of their pensions and getting your planning right is critical, as it can have far-reaching consequences.

We are qualified to advise on UK and offshore pension schemes and can offer a wide range of solutions to ensure that your pension planning is right for your retirement goals, lifestyle and country of residence.

Succession planning

Succession planning is decidedly more complicated in Europe, as each country has different rules. These rules not only affect the level of taxation, but who can receive your estate, who pays the tax, and what assets attract tax.

Additionally, many individuals do not realise that they might still have a UK inheritance tax consequence even if they have been living abroad for many years.

We are best placed to look at your position from a multi-jurisdictional perspective, ensuring that your wealth is passed to your loved ones in a simple, controlled and tax-efficient manner.

Trust planning

Trusts are commonly used by families to preserve and protect wealth, and in succession planning.

There are many types of trust and corporate structures and the right one for you and your family, if at all, will be dependent on several factors. Additionally, choosing independent, experienced trustees is also extremely important.

We can guide and advise you on new and existing trust and corporate structures, and their suitability for your personal and family goals.

Managing savings and investments in Spain

By Chris Burke

This article is published on: 9th January 2026

Happy New Year and welcome back to the “normal” world – although I’m not entirely sure normal is the right word anymore.

If personal finances had a gym, January would be packed. Some people are here for a quick fix. Others are here to make a lasting difference – those who want their money to work properly for the long term, remain tax-efficient, well organised, and (just as importantly) keep calm along the way.

This month, I’m focusing on why anyone with savings or investments should seek professional advice when managing them – particularly here in Spain.

You’ve Made the Money. Now Let’s Not Lose It.

First of all – congratulations.

Making money is hard. You’ve done that part.

The next phase, however, is less about earning and more about not undoing your own success. This is where managing savings and investments properly really starts to matter – especially in Spain, where tax, structure and timing can quietly erode wealth if left unattended.

Here’s why smart people take wealth management seriously (and no, it’s not because they enjoy spreadsheets).

1. Because “Good Returns” Are Meaningless After Bad Taxes

A portfolio that performs well on paper can look very different after Spanish capital gains tax, wealth tax or the solidarity tax are applied.

Managing investments without considering tax efficiency is like filling a bucket with a small hole in the bottom – it works, but not for long.

Good wealth management isn’t about chasing higher returns. It’s about keeping more of the returns you already have.

2. Because Complexity Grows Faster

Than You Expect

At some point, money stops being “a portfolio” and starts becoming a system:

• different assets

• different jurisdictions

• different timelines

• sometimes different family members

Left unmanaged, complexity creates friction. Managed well, it creates flexibility. The goal isn’t simplicity – it’s clarity and tax efficiency.

3. Because Liquidity Is Underrated (Until It Isn’t)

Most financial problems aren’t investment problems – they’re liquidity problems.

Opportunities appear.

Life happens.

Markets wobble.

When everything is tied up, even good decisions become difficult ones. Smart planning ensures you can act when you want to, not only when you’re forced to.

4. Because Markets Are Emotional – and Humans Are Worse

Even experienced investors aren’t immune to poor timing, overconfidence or “just this once” decisions.

A structured, disciplined approach removes emotion from decisions that should be boring, deliberate and repeatable.

Ironically, the less exciting your financial strategy feels – supported by knowledge and research – the better it usually performs.

5. Because Wealth Should Support Your Life, Not Complicate It

Well-managed wealth should reduce stress, not add to it.

It should support your lifestyle, your family and your long-term plans – whether that’s freedom, security or simply peace of mind.

If managing your money feels like a second job, something isn’t working properly.

6. Because Spain Has Rules (Quite a Few of Them)

Spain is a wonderful place to live – and a nuanced place to manage wealth.

From wealth and succession taxes to residency and reporting obligations, the details matter. Ignoring them doesn’t make them go away; it just makes them more expensive later.

Good planning is proactive. Bad planning is retrospective.

The Bottom Line

Managing your savings and investments well isn’t about being aggressive, clever or constantly active.

It’s about being intentional.

You’ve already done the hard part by building wealth. Managing it properly is how you ensure it continues to work for you – quietly, efficiently and for a long time.

Many people only review their financial strategy after something changes: markets, regulations, residency or family circumstances. The most effective planning tends to happen before it’s needed.

If you ever feel it would be useful to sense-check your current approach, explore alternatives or simply have a thoughtful conversation about how your wealth is structured, I’m always happy to do so – discreetly and without obligation.

Sometimes clarity starts with a conversation.

You can arrange an initial consultation to explore your situation [here]. You can also [read independent reviews of my advice and service here].

Financial update January 2026 – France

By Katriona Murray-Platon

This article is published on: 7th January 2026

Happy New Year!! I wish you all the very best for 2026. I hope that you had an enjoyable festive season. We spent Christmas at home, which was very nice and relaxing, so now I am well rested, ready for the new year and looking forward to seeing all my clients.

On 9th December the Law for the Financing of the Social Security was adopted by the National Assembly and, pending any issues with the Constitutional Court, it is now enacted into law. Under this law, the official retirement age is now 62 years and 9 months, with a required contribution of at least 170 semesters set until 1st January 2028 for pensions taking effect from 1st September 2026. As a result, anyone born between 1964 and 1968 may retire 3 months earlier than previously expected. Furthermore, as from 1st January 2026, the French state pension increased by 0.9%.

This law also increased the CSG social charges on interest, dividends and capital gains from 9.2% to 10.6%. The flat tax (PFU) on this income has therefore risen from 30% to 31.4%. However, withdrawals from assurance vie policies, PEL and PEP (plan épargne populaires) accounts, rental income and capital gains on property are not affected. So for people with money in UK saving accounts, the interest will now be taxed more heavily in France. It is worth considering whether it remains appropriate to keep such accounts, or whether it would be more tax-efficient to move funds into French savings vehicles such as a Livret A or LDDS, or into an assurance vie for longer-term planning.

If you have up to €61,200 that you need to put away for a year or two, a PEL account opened from 1st January 2026 now offers an interest rate of 2% compared with 1.75% for PELs opened after 1st January 2025. The interest rate for a PEL is determined at the time the account is opened.

From 1st January 2026, cash gifts now need to be declared online via your account on the impots.gouv.fr website. This applies to gifts of money, shares or valuable items such as a car. You will be asked to declare any money or gifts of value and state whether they fall under the €100,000 allowance between parents and children or the €31,865 made by a relative under 80 years old to a recipient who is over 18 years old. If the recipient is a minor, their parents should do the declaration for them on their online account. Christmas gifts remain exempt and do not need to be declared.

Since 1st December 2025, parents who are divorced or separated, will now both receive childcare benefit (complement de libre choix de garde) provided the child is cared for by a registered childminder either at the childminder’s home or at the child’s home.

For those looking for a bargain or waiting to buy something special, the sales in France will begin on Wednesday 7th January at 8am and will continue until Tuesday 3rd February.

If you are considering choosing an electric vehicle for your next car, the good news is that government incentives will continue in 2026.

Low-income households may receive a bonus of €5,700, middle-income households €4,700, and all other buyers €3,500, when purchasing a brand-new electric car.

An additional bonus of between €1200 and €2000 may also be granted if the battery of the car was manufactured in Europe.

Furthermore the thresholds for what is considered a low income and middle income households have been increased.

Later this month, I will be attending our annual conference in Monaco with colleagues and meeting with our product providers to review the past year and discuss the factors likely to influence investment strategies in 2026. I will share key insights from our conference in the next Ezine.

In the meantime, if you have any questions about the topics above or would like to discuss your personal financial situation, please do not hesitate to get in touch to arrange a free phone call or meeting.

It’s been another unusual year

By Peter Brooke

This article is published on: 25th December 2025

As we come to the end of the year, we wanted to share a brief reflection on what has been a challenging but ultimately rewarding period for investors.

It’s been another unusual year (I think I wrote that in my last Christmas newsletter!!). We began 2025 with talk of a Trump tariff driven recession, interest rate cuts and the end of US dollar dominance. Instead, growth has slowed but not collapsed, interest rates have stayed higher for longer, and after weakening early in the year, the US dollar has strengthened again in the second half of 2025.

Equities experienced volatility along the way, driven by geopolitics, policy changes and concerns around inflation. Despite this, strong company earnings — particularly in technology and AI — helped global markets finish the year close to record highs. This was a reminder of the value of staying invested through short-term uncertainty.

Bonds quietly did their job. While yields rose earlier in the year, they provided attractive income and stability, reinforcing their role as a key diversifier within portfolios.

Gold stood out as a strong performer, offering effective protection against geopolitical and economic uncertainty while contributing positively to returns.

Overall, 2025 reinforced an important lesson: diversified, multi-asset portfolios can help investors navigate uncertainty and capture long-term opportunities — even in unsettled markets.

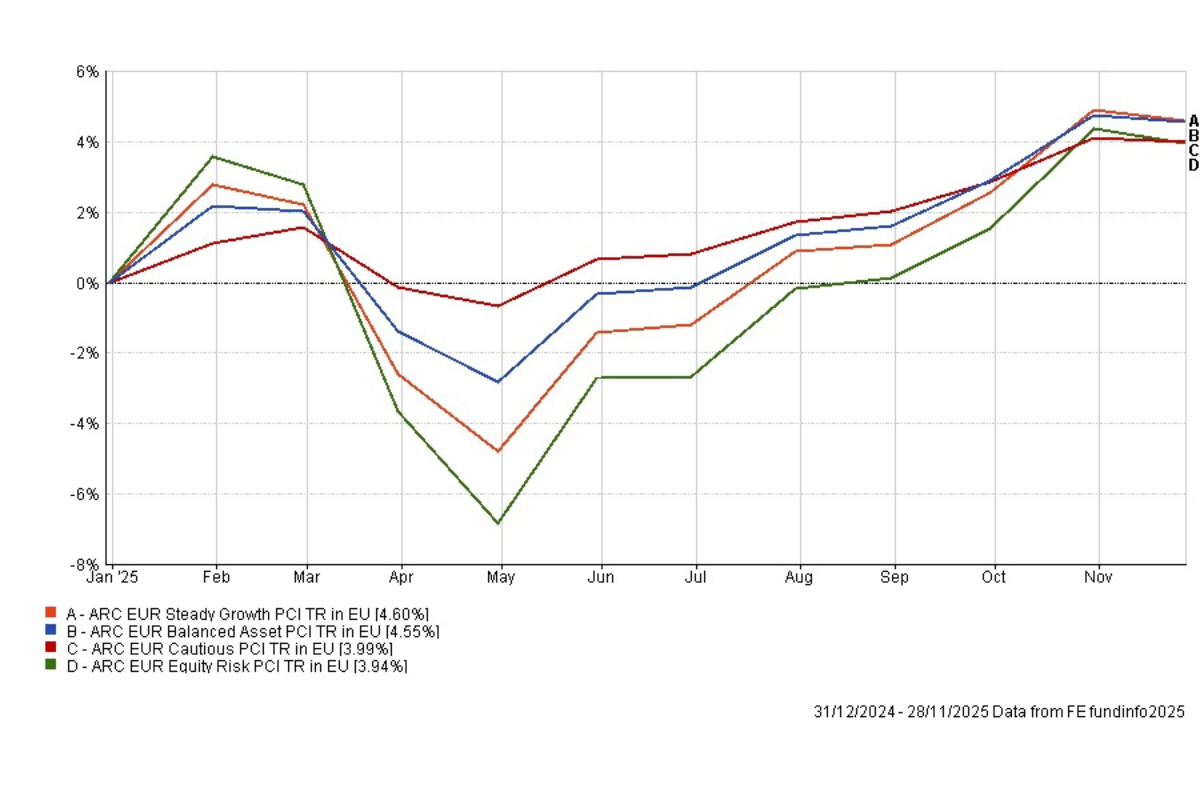

You’ll see below a chart showing the ARC Euro Indices for this year; the movements reflect the periods of volatility investors experienced, especially post ‘Liberation Day’ followed by a recovery as confidence improved.

It’s a helpful visual reminder that while markets rarely move in a straight line, staying invested through the ups and downs has historically been key to achieving long-term outcomes.

As we head into the festive season, I’d like to thank you for your continued trust and wish you and your family a very happy Christmas and a healthy, prosperous New Year.

I will be back in touch in January with a financial outlook for 2026 following our next annual Spectrum conference and, of course, I plan to continue to provide you with updates, developments and new support tools over the year ahead…