Buying your dream home in France – webinar

By Peter Brooke

This article is published on: 20th June 2024

I have worked with many of the panelists for a number of years and their knowledge and experience is valuable to me and my clients; so if you are looking at buying and/or relocating to France then please join us for this live webinar.

Our experienced panelists are here to discuss all nature of topics to do with buying and relocating to France:

Karen Tait – Webinar host

Peter Brooke – Wealth & tax planning from The Spectrum IF Group

Joanna Leggett – French Property Expert from Leggett

Jonathan Watson – Currency Expert from Lumon

Paulette Booth – Banking and insurance expert from AXA

Tracy Leonetti – Visa & paperwork expert from LBS

Sharon Revol – Mortgage expert from Cafpi

The Value of Seeking Financial Advice

By Peter Brooke

This article is published on: 26th March 2024

My name is Peter, and I am a financial adviser!

There, I have said it, and I can own it!

The personal financial advice industry has often been regarded as a home for insurance salesmen in shiny suits or as an out-of-reach luxury for the very wealthy. It hasn’t helped with various mis-selling scandals over the years and high levels of hidden fees, but after 25 years in this industry I wanted to make the case as to why we are not all the same and show what true value can be taken from seeking professional advice.

Fortunately, our industry has changed a lot over those 25 years and transparency, communication and ‘putting the client first’ have now become the values most of us live and work by.

As a little background, I wanted to be a Vet or a Doctor when I was at school, I loved science and maths but didn’t truly focus enough on my A-Levels and was found wanting when it came to getting into Medical School. I ended up studying Molecular Genetics at Sussex University but discovered that I also didn’t want a life in a lab. As a ‘frustrated Doctor’ I ended up in Pharmaceutical Sales… great fun as a young man straight out of Uni but it became a very demoralising job and one which I discovered was really all about making money, not helping people.

I was encouraged by a family friend to look at stockbroking or financial planning as a change of track and started work in 1999 (dot com!!) at an investment advisory business in London. We introduced the UK’s first ‘advisory-discount’ services where we would provide personalised investment recommendations at discounted fees.

Ironically, it took moving to an industry that concentrates solely on money to realise that I could actually help people achieve wellbeing and peace of mind through my abilities to discuss and explain complex issues.

In 2004 I moved to France and started working with The Spectrum IFA Group, helping English speaking expatriates to create and realise their plans for living in France, I have been here ever since. I especially wanted to join a fully regulated company which gave me the independence of my own business and together we have grown to where we are today – 50 advisers operating across Europe, in France, Spain, Portugal, Italy, Luxembourg, Malta and Switzerland.

What should we, as financial advisers, aim to provide to our clients?

I believe our true value lies in helping our clients answer two main questions:

1. Am I going to be ok, financially, and if not, what do I need to do to make sure I am?

2. What have you, as my adviser, done for me?

The first question is the core of a good adviser’s skill set and business strategy – it is all about helping identify and plan for different stages of life. Correctly laying out a ‘roadmap’ for the future and asking the difficult questions; this can truly provide the peace of mind that you, as my client, are on target, and if not what do we need to change or compromise on to ensure you get there.

This roadmap then needs ongoing reviews, especially as life throws various obstacles at us along the way.

The second question is the ‘HOW’ of the first question. Historically we have valued good advice, and what we pay for it, as a percentage measurement of investment performance, which the adviser actually has minimal control over.

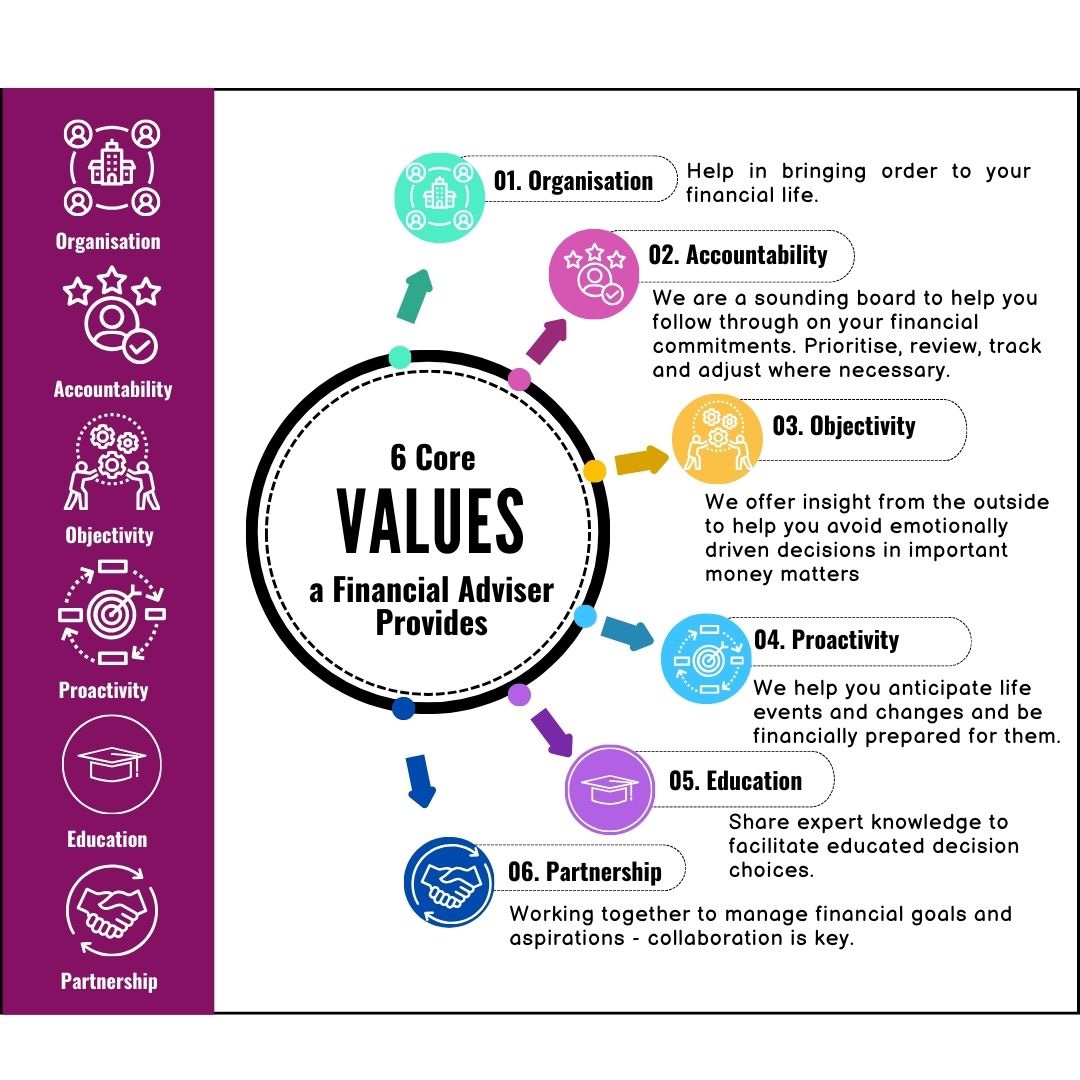

I believe it is more nuanced than this and can be broken down to six key areas in which we can (and should) add value and help answer that first very important question:

We help to bring order to your financial life by assisting setting budgets and cash flow targets as well as overseeing and reviewing investments, insurance, estate plans, taxes, etc.

We are a sounding board to help you follow through on your financial commitments, by identifying and prioritising goals, and then explaining, in plain english, the steps to take, and then regularly reviewing your progress towards them.

We offer insight from the outside to help you avoid emotionally driven decisions in important money matters; we are available to consult with you at key moments of decision-making, providing the necessary research to ensure you have all the information to make the best choices.

We help you anticipate life events and changes and be financially and emotionally prepared for them. We can help in creating, ahead of time, the action plan necessary to address and manage any life transitions that inevitably appear.

We explore what specific knowledge will be needed to succeed in your plans by understanding your situation and then providing the necessary resources to facilitate your decisions, and explaining the options and risks associated with each choice in a clear and simple manner.

We aim to help you achieve the best life possible but will work with you, not just for you, to make this possible. We will take the time to clearly understand your background, philosophy, needs and aspirations and will work collaboratively with you and on your behalf (with your permission, of course).

Upfront about what it costs

For me, helping people is at the centre of my personal values – being paid to do this is a welcome bonus and I have long believed that our jobs find us, not the other way round. I have always been a bit of a ‘planner’ and see ‘the big picture’ in most situations – helping people see that ‘they are going to be ok’, or explaining ‘what they need to do to get there’ is a truly pleasurable challenge for me.

Price is what you pay, Value’s what you get

I firmly believe my clients get value for money. In Europe we are not regulated to handle client money so will never send you a bill for you to pay us directly.

Spectrum is remunerated by the insurance or investment company which provide the final financial solution to you and with whom you have a direct relationship, with us ‘appointed’ as your adviser.

I believe in transparency of all costs and charges so you know exactly what you are paying and to whom. Our charges are competitive, we only use clean share classes of funds so there are no hidden or double fees.

Making the time – ‘How can I help?’

I live and work in a community of English speaking expatiates where referrals and recommendations count for a great deal. I always feel very proud and grateful when an existing client refers me to another family member or friend who might be able to benefit from the services that I offer. So thank you for trusting me with them and I look forward to helping more in the future.

Snapshot of our services

- Financial Planning & Budgeting

- Family protection

- Cash Flow Planning

- Investment Management Advice/Guidance

- Tax optimisation through tax efficient products

- Estate & Inheritance planning

- Risk Management, diversification & asset allocation

- Retirement planning

- Education cost planning

- Long term care planning

- Pension advice including transfer and consolidation

If you know someone who might need our services, feel free to get in touch and forward them this email – the link above can be used to book a 30 minute call with me directly. If I can’t help then I may be able to direct them to someone who can.

If you have any questions or would like a catch up then please use any of the below communication channels or the booking system – always drop me a quick message if you need a time slot outside of those available.

For existing clients the CashCalc secure portal is a great place to update any information, send me documents or even a direct secure message.

If you have missed any previous emails, click here to access the Archive.

The view from the Danube

By Peter Brooke

This article is published on: 4th February 2024

2024 marks my 20th year as a financial adviser at The Spectrum IFA Group and I am lucky to have been invited to every one of our annual conferences since I joined in June 2004. Last week more than 40 members of the Spectrum family got together in the beautiful Hungarian city of Budapest for our latest conference.

We are always delighted and grateful to welcome excellent external speakers from some of the big investment and insurance firms we work with throughout the year who share their wisdom (and/or best guesses) for the months and years ahead; it was therefore an ideal time for me to pick brains over some goulash and a glass of wine and bring you some considered observations for investing in 2024.

But before looking forward, let’s look at how we got here.

2022 was a very tough year for investors with the hangover from the Covid pandemic and the war in Ukraine creating a perfect inflation storm which led to the most aggressive interest rate hiking cycle in over 40 years. This significantly depressed bond and share values.

Through 2023 there were four distinct periods of rhetoric and market behaviour… it started with the Artificial Intelligence (AI) “revolution” and a huge rally in the “Magnificent 7” stocks in the US, then attention turned to likely recession… but was it going to be a “soft or hard landing” and then a considered period of ‘is this the end of inflation?’ followed by a change in attitudes to try and guess when the first interest rate cuts would start… we even ended the year with a ‘Santa Rally’ in global stock markets…. confusing times!

“Anyone who isn’t confused really doesn’t understand what’s going on!”

- In 2024 nearly half of the global population will be going to the polls; will this influence investments?

- Can we avoid a recession, and if not, what will it look like?

- Will interest rates be cut and if so, what does this mean?

- Is AI really going to change the world?

Most of the investment managers we spoke to last week had the same view on these sorts of questions…

Politics rarely has a material long term effect on investment returns but can create short term uncertainty and opportunities – be active and don’t get caught up in the hype!

Recession

- Soft Landing = inflation comes down and economic growth is moderate – the ‘Goldilocks’ scenario

- Hard Landing = inflation comes down but the economy shrinks – leads to higher unemployment, default on debt and lower consumption

The consensus view is that we will probably avoid a hard recession, especially in the US, which is still the most important economy on the planet. US households still have high levels of savings and long-term debt structures, so aren’t too affected by higher short term interest rates; unemployment remains low and the ‘Inflation Reduction Act’ is still pumping money into the economy.

However, there is a case for a hard landing with some indicators predicting one, but we live in a world of probability and not certainty and this is changing constantly.

“Don’t be too pessimistic but remain cautious … and don’t be too optimistic… anyone still confused?”

We are at the end of the inflation cycle now and so interest rates are likely to start being cut in May (US) and June (Europe). This will be good for bond values, so don’t sell them now.

Artificial Intelligence will destroy some businesses and will make some very profitable. “It’s like internet 2.0”. It is also unlikely to be the companies that ‘started’ the AI revolution which will do best from it… it will be the companies who best embrace it and who create the infrastructure for it, that will profit most.

Demographics – nothing has changed – there are more of us than ever and we are living longer… and the Obesity epidemic is not cured by one or two weight loss drugs, there is a long way to go.

Retreat from globalisation

“Protectionism”/“MAGA”. We are not going back to globalisation and is it a coincidence that geopolitical instability has also increased? The world is a more dangerous place – we must consider greater Geopolitical risk.

So, with all these factors to consider how do we invest for 2024?

Retreat from globalisation = Defence companies and Oil producers, this might not sit well with all investors.

- AI = hardware, chip makers, nano technology, semiconductors

- Demographics = MedTech – improved prevention and treatment efficiency as opposed to just buying more drugs

- Hard Recession = own government bonds! Also own high quality equities – be active

- Soft or No Recession = own equities – but avoid those with high debt – be active

Even with all of the confusing narrative there are some reasons to be positive in 2024:

- Geopolitics will remain the same, protectionism will continue

- Interest rates are moving back to ‘normal’

- Strong labour market

- Housing set for recovery…. Falling interest rates

- Productivity growth from technology and AI – leads to greater profits

- Markets go up 70% of the time

“Look through the hype and stick to your own personal investment commitments and goals … oh… and employ an active manager!!”

I would very much like to thank the investment management teams at RBC Brewin Dolphin, Rathbones Investment Management, Evelyn Partners, New Horizons and The Prudential for their time and expert views on the content in this email.

If you would like to dive deeper into these subjects please check out the following links:

5 Investment themes for 2024: from Evelyn Partners

Some predictions for the year ahead from David Coombs at Rathbones

If you like podcasts then I highly recommend David Coombs amusing and insightful monthly Sharpe End Podcast

Feel free to get in touch if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day, speak soon…

Spectrum supporting Mimosa Matters

By Peter Brooke

This article is published on: 25th October 2023

The Nice to Cannes Relay Marathon

As we gear up for the upcoming Nice to Cannes Relay Marathon on November 5th, I wanted to take a moment to share with you the reason behind my choice to support Mimosa Matters, a charity that holds a special place in my heart.

In a world that often seems to move too quickly, community stands out as a pillar of strength and support. It’s a reminder that we are not alone and that, together, we can make a meaningful impact. The Nice to Cannes Relay Marathon embodies the spirit of community, with individuals coming together to achieve a common goal through teamwork and perseverance, and having a bit of fun together through the aches and pains.

Don’t worry, I am not running the entire Marathon – that would be crazy – I will leave that for those whose fitness levels are way better than mine!

I am running the final 6.4km leg…. some might say the ‘taking-all-the-glory-leg’… for Team Early Birds, a gang of super women who are doing all the hard work over the proceeding 35.6km; if you have a spare euro or two, please do consider empowering our legs to carry us all to the end by helping us raise some funds for the important work that Mimosa undertake.

The fundraising link for our team is here

I was hoping to run a longer leg but a recent bout of bronchitis and a lower back injury have curtailed my training a little but I am back hitting the tarmac again and as I lace up my running shoes for my leg of the Relay Marathon, I am not just running for personal achievement; I am running to try and make a difference.

Mimosa Matters shares this commitment, and by supporting their cause, we can collectively contribute to creating a stronger, more compassionate community.

Your contribution, no matter the size, will help make a positive impact on the lives of those in need. Together, we can run towards a brighter and more connected future. Of course, please don’t feel any pressure to contribute at all… instead perhaps share this email or come and encourage us all on the road a week on Sunday, you won’t miss us, we’ll all be in bright yellow.

Why Mimosa Matters

Spectrum and I have chosen to support Mimosa Matters again because of the incredible work they do in fostering a sense of community and making a positive difference in the lives of others. Mimosa Matters goes beyond traditional charity by actively engaging with local communities and addressing their specific needs in the fight against cancer.

They work closely with local cancer professionals & associations to create and fund projects to increase awareness of the causes of cancer and to channel funds into cancer research and into associations that directly support patients and their families living with cancer in our region.

Sadly, too many of us have been directly affected by this relentless disease and we must stand, walk or run together to try and stop it.

Please follow these links if you would like more information about Mimosa Matters

https://www.mimosamatters.org/

and the Marathon https://www.mimosamatters.org/project/nice-cannes-marathon-2023/

And, in case you missed it, the all important fundraising link again for our team is here

https://www.helloasso.com/associations/mimosa/collectes/team-early-birds-running-for-mimosa

https://www.facebook.com/mimosamatters and https://www.facebook.com/financial.advisors

Thanks for taking your valuable time to read through this, I really appreciate it.

Finance update Q3 2023

By Peter Brooke

This article is published on: 13th October 2023

Let’s talk about CASH

Since my last quarterly update in August the mood in markets has been a little confused.

After the more optimistic start to the year when stock markets, especially in the US, showed resilience and the roots of recovery from a horrendous 2022, the summer was much more mixed. The Bank of England and the US Federal Reserve didn’t raise interest rates in September, though the ECB did but from a lower level.

August was much more volatile than expected with investors trying to work out if inflation had peaked and if central banks were done with their unprecedented interest rate hikes, and when they might start thinking about cutting rates.

The oil price has also settled at a higher-than-expected level, which might be a sign of increased economic activity, but it doesn’t help to get rid of sticky inflation.

Higher for longer

Interest rates are a means of dealing with inflation. Central banks raise rates to increase costs and reduce spending power with the aim of lowering demand and squeezing prices. This is an art rather than a science. Central banks need to find the right balance of weakening demand, while avoiding a recession. This has proved fiendishly difficult and tackling inflation has seldom been achieved without some economic pain.

We are currently in the eye of the storm. Over the past 18 months, global interest rates have moved from near zero to over 5% in some places. Inflation is coming down and interest rates may have peaked, but monetary policy operates with an unpredictable lag. It is difficult to know how much of these interest rate rises have fed into the economy and whether a recession is just round the corner.

Investors will have to start getting used to these elevated levels of interest rates for longer as the consensus opinion is now that interest rate cuts won’t come quickly and won’t be significant until inflation is firmly under control. We are still very much in a holding pattern.

So should I keep my cash in my bank?

Of course, one of the few benefits of these hikes in interest rates is that you can now achieve some positive return on cash, which hasn’t been possible for around 15 years!!

I am having a lot of conversations with people asking why they should consider investing rather than leaving money in the bank.

This is a very good question… equity and bond investors have had very little, if any, positive returns since January 2022 so why invest now when I know I can now get returns on cash?

For someone with a very short-term time horizon, and therefore a very low risk profile, then cash earning around 5% will look attractive. Clearly tax is an issue, which will diminish this return but still it is at least a certainty.

What about those with longer time horizons – should they stay in cash given the high returns relative to recent history?

There are several considerations here:

1. Sticky Inflation

If base level inflation is to remain higher for longer then we still need to consider the NET return you will be getting on your cash.

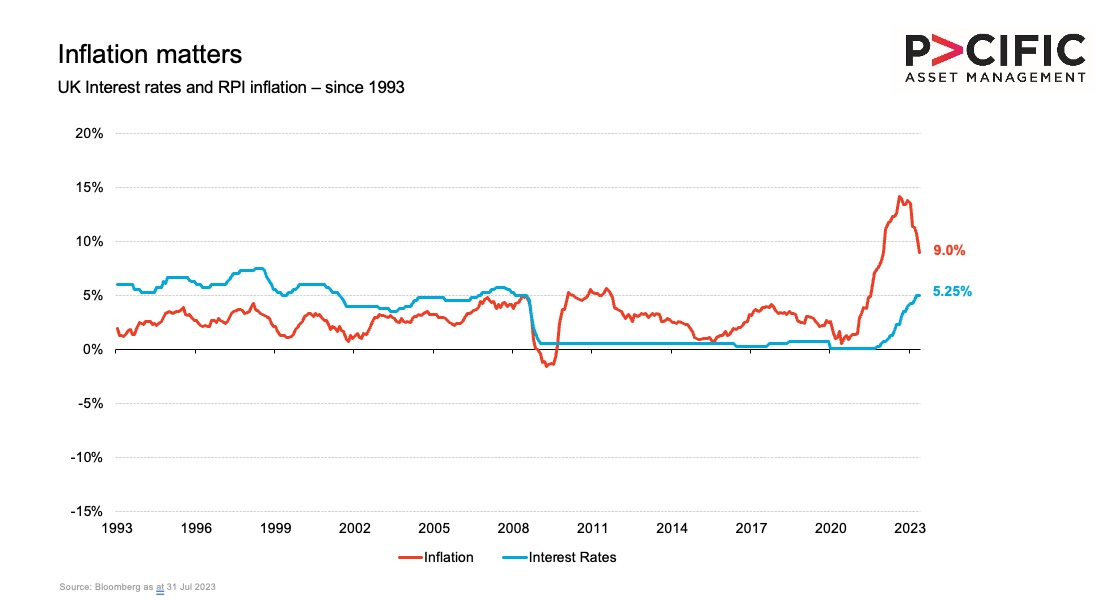

Here is a chart showing UK Inflation and UK interest rates over the last 30 years – even today inflation, though falling, is still above base rates:

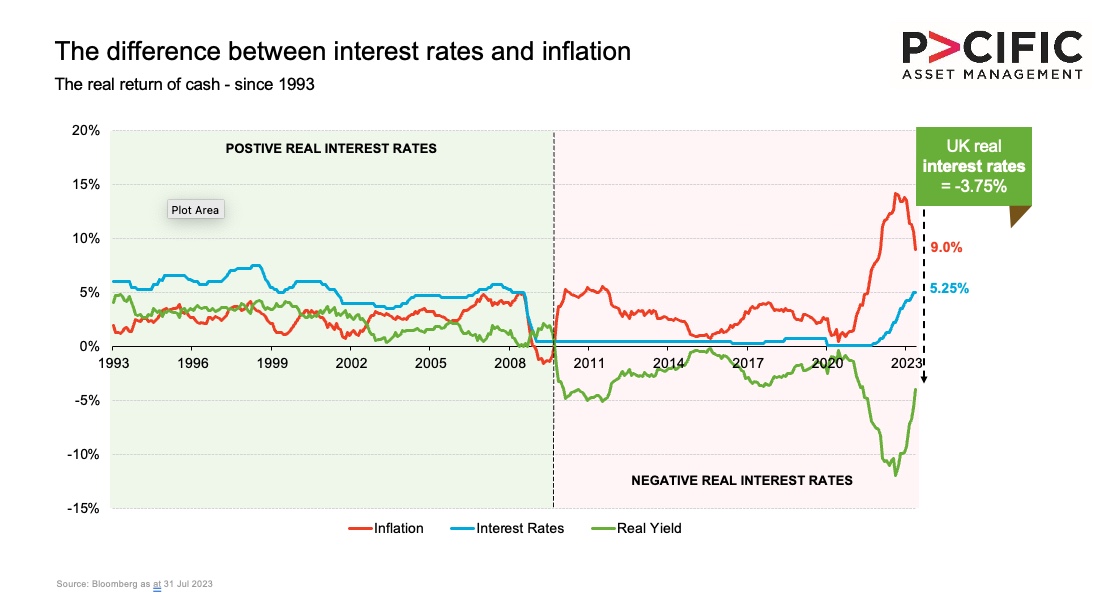

Put another way – if we take one away from the other we can see that the REAL return on cash today is still negative (the green line) – that’s a guaranteed loss of 3.75% over the next 12 months.

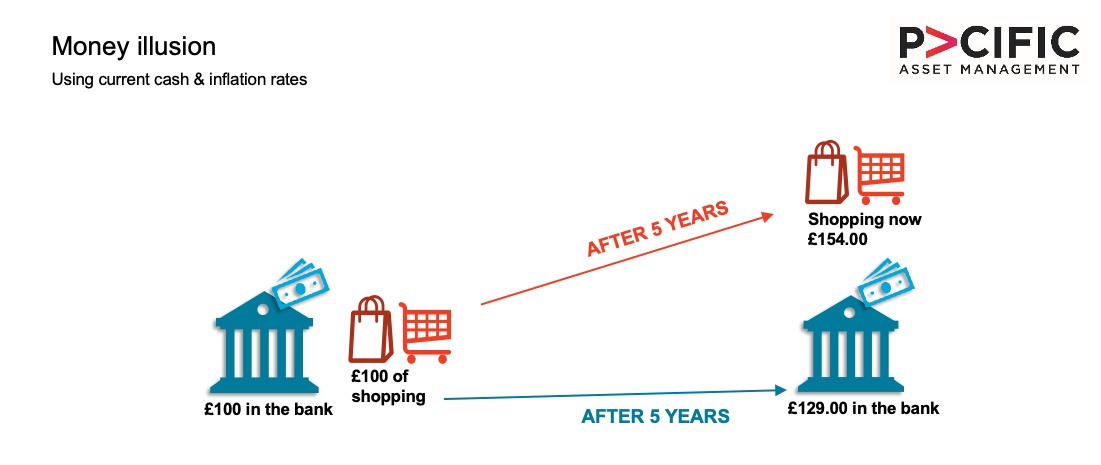

Put another way again… what can you buy in 5 years if things remain as they are today? See below for a real world example of how inflation affects us all:

2. Other investments should do better…

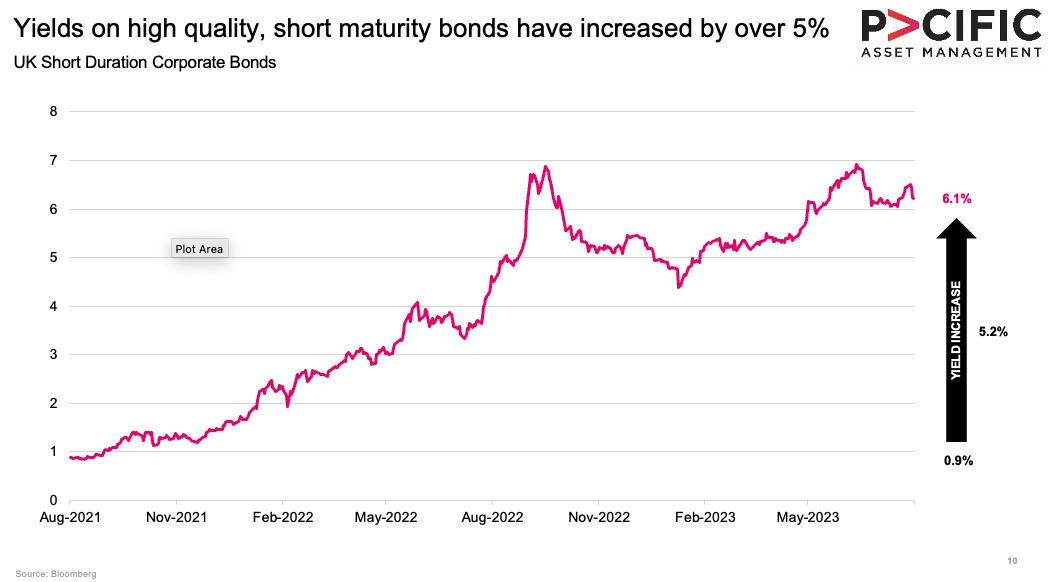

BONDS:

Most investments are valued versus the ‘risk-free’ rate of return (ie cash).

So when cash was paying you 0.1% many investors were happy to accept 1.5% to 2% from high-quality investment grade bonds, even though they come with a little more risk….

… so there is a strong case for buying bonds today yielding 6% to 7% because we are happy to be paid the extra 1.5% to 2% for the extra risk we are taking… this is exactly where bond ‘yields are today’.

SHARES:

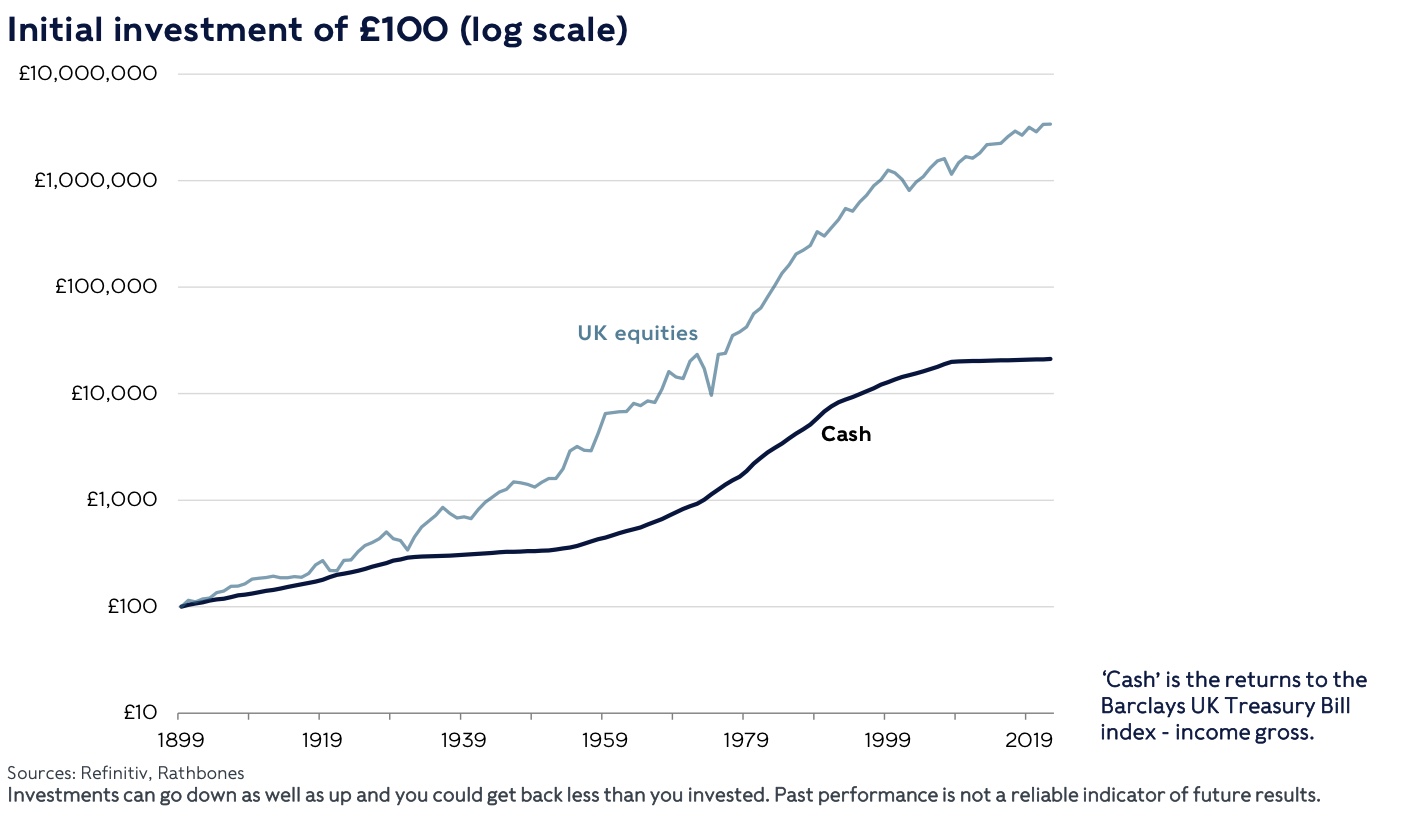

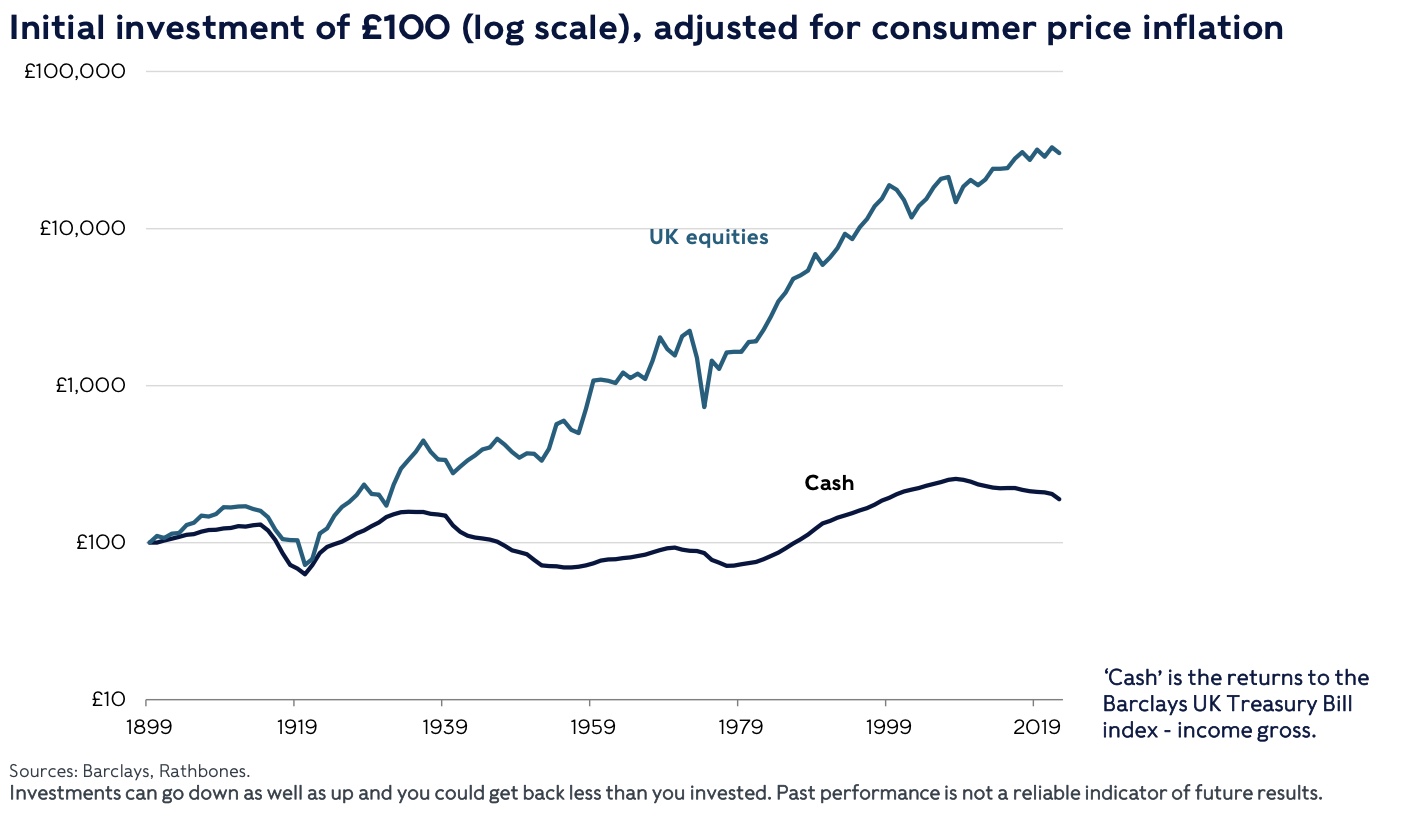

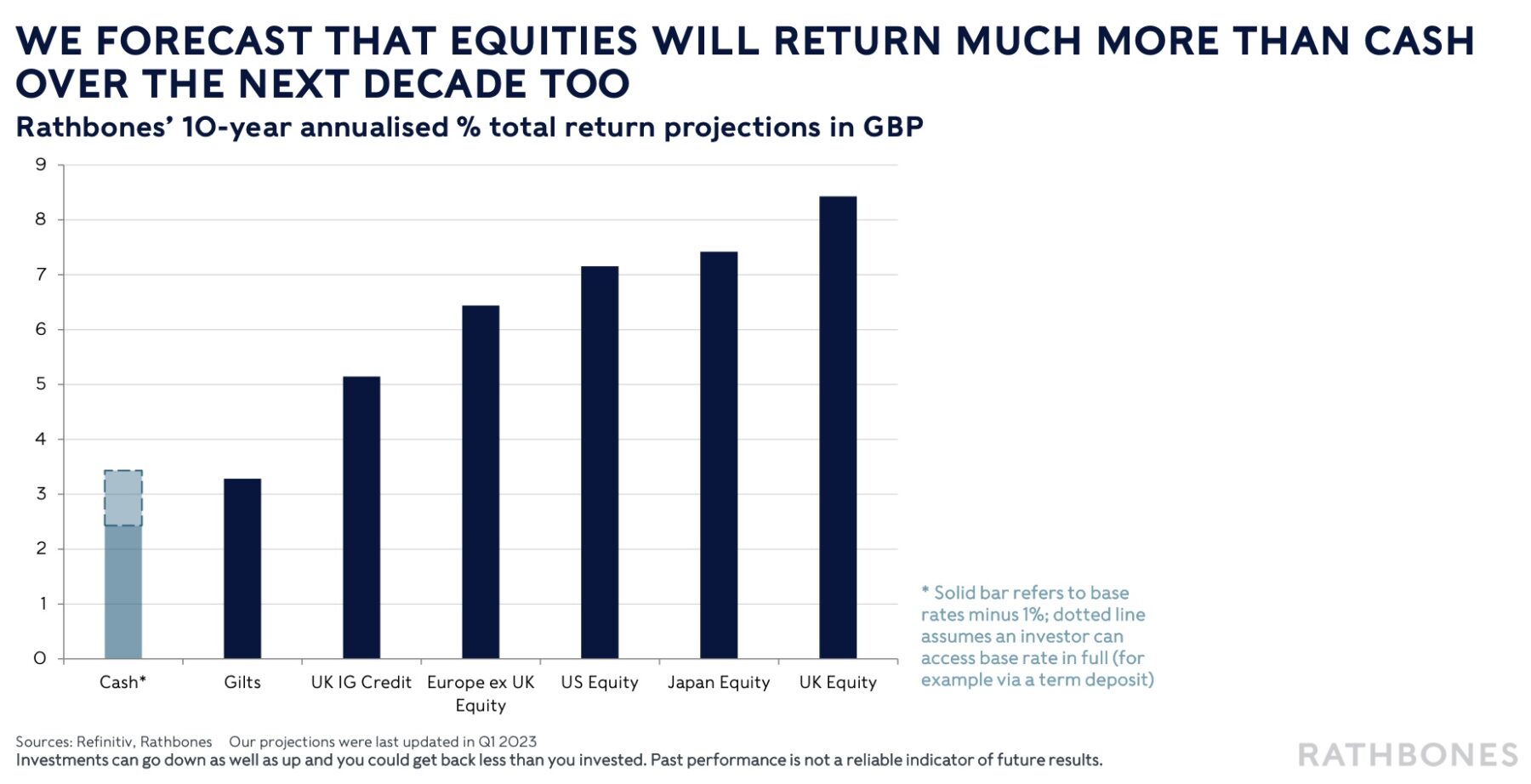

Though more volatile, shares have always outperformed cash AND inflation over the longer term.

And expectations over the coming years are that shares will continue to outstrip returns on cash:

In Summary

We feel that we are getting closer to understanding a little more about how the future might look. Inflation seems to have peaked but will remain sticky for a while, which will mean interest rates are likely to stay higher too for longer than originally thought.

The chance of global recession is still there but nor lower and the consensus appears to be that it will be soft and short if it emerges at all. This can be good for stock market performance but in the meantime cash and bonds are, for the first time in a very long time, a genuine investment option; though sticky inflation must be taken into account when choosing how much to leave in cash.

Inflation is a financial reality that we all need to navigate. By proactively addressing this challenge and exploring investment opportunities that protect your wealth, we can work together to ensure your financial future remains secure.

If you have capital to invest for longer than the next couple of years then an actively managed multi asset approach should be considered to minimise the effects of inflation on your hard earned funds.

I would very much like to thank the investment teams at Pacific Asset Management, Rathbones Investment Management and Evelyn Partners for their input into this data and summary.

If you would like to dive deeper into these subjects please check out the following links:

3rd Quarter Outlook from Pacific Asset Management

Why do interest rates and inflation matter for investors from Evelyn Partners

Feel free to get in touch if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day, speak soon…

Introducing your Client Portal

By Peter Brooke

This article is published on: 5th October 2023

CashCalc

What is the Cash Calc Secure Client Portal?

Cash Calc was launched back in 2014 by a UK IFA who was unimpressed with the digital tools available to our industry. It was initially launched as a Cash Flow Planning Calculator – more on this later, but has developed into a broad suite of great tools for advisers like me and their clients.

“seek first to understand, then to be understood”

In order to best advise my existing and future clients I need a full picture of their current situation and an understanding of their objectives, aspirations and goals – we rather boringly call this ‘fact finding’… though it is not all just facts!

A recent addition to the Cash Calc tools is the ability for my clients to complete or update their own fact find in their own time from the comfort of their own homes via the Client Portal, if they want to. It is totally secure and can be updated as little or as often as necessary.

We can also use the portal for the secure sharing of documents, like investment statements, passports, utility bills etc AND for secure two way messaging.

For those who prefer not to use this service, please don’t worry, I will still use it as a data storage tool but will manage the access and information myself.

Please check out this video for more:

Hop Onboard

If you are already ‘onboarded’ and have your Portal login details please do have another look and send me a quick message (top right corner of the screen) to say hi and confirm it is all working OK.

Some of my existing clients have stated a preference to have their quarterly investment statements shared via the portal as a more secure option than email – please don’t hesitate to let me know if you prefer this too?

If you are not yet ‘onboarded’ please don’t worry, as part of our review process I will be sending you a personalised ‘secure invitation’ to the portal to set it all up; it is very easy.

Of course, if you just can’t wait please drop me a line and I will send your personalised login details immediately.

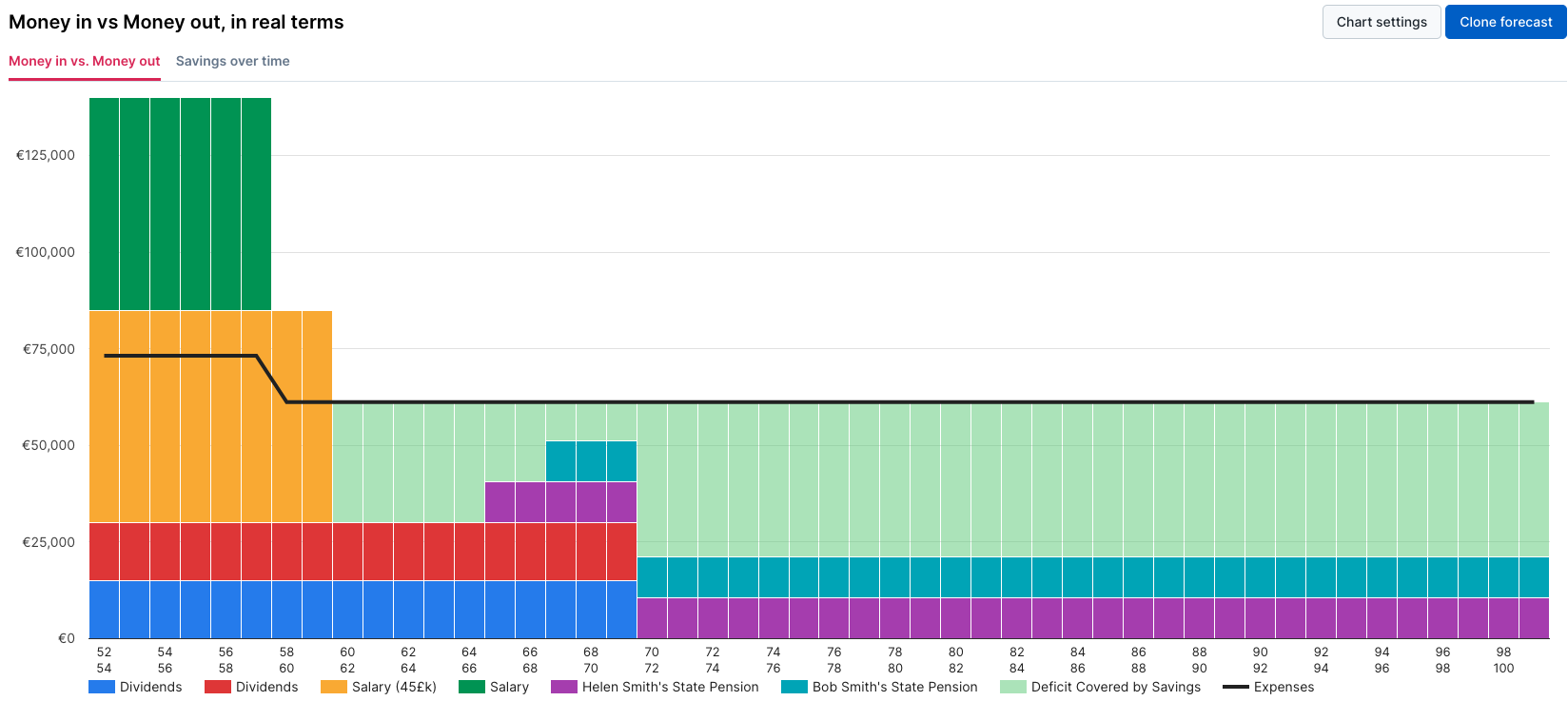

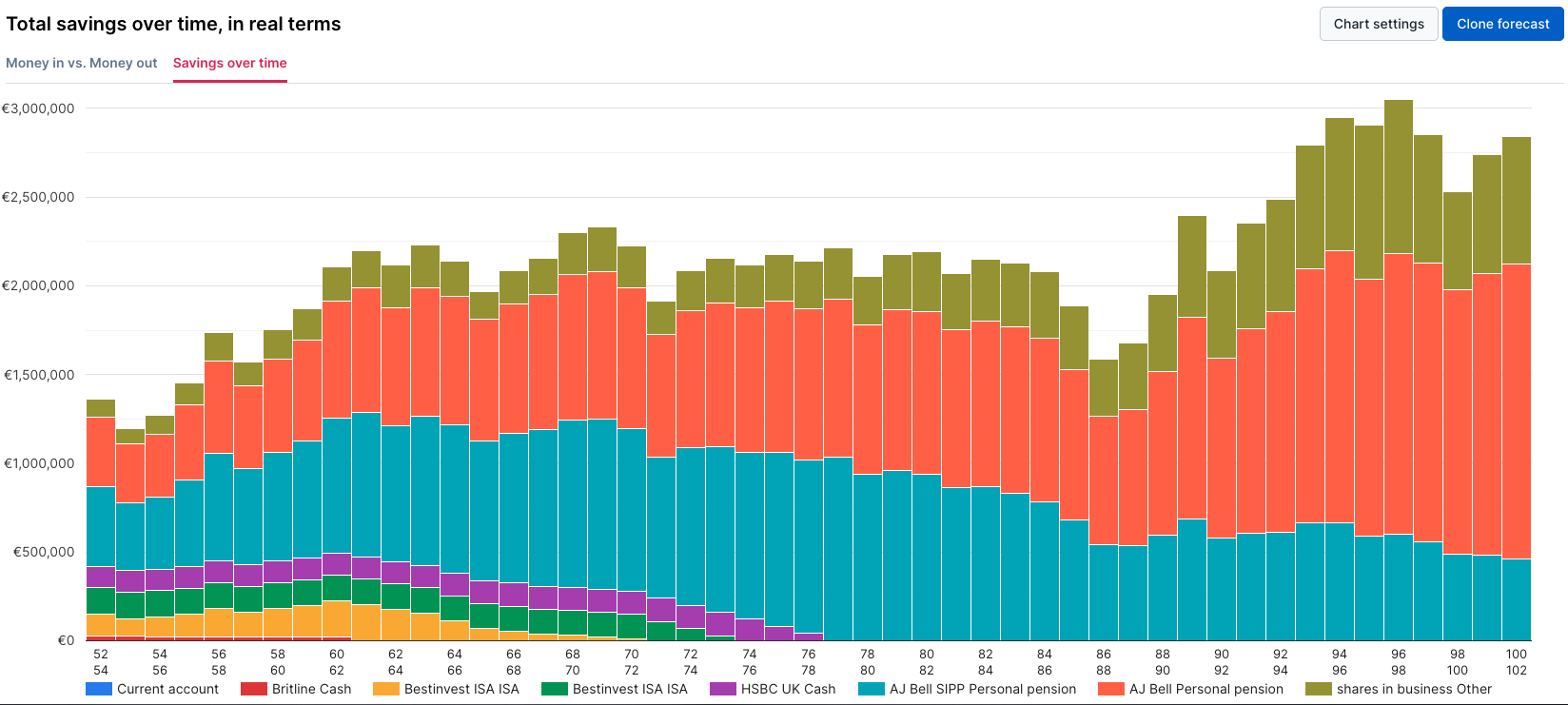

Cash Flow Financial Modelling Tool

As mentioned above Cash Calc started as a ‘Cash Flow Planning Calculator’ and though it is now so much more, this remains one of the most powerful and useful tools for creating truly personalised financial plans.

Using the ‘fact find’ data you provide in the portal I can create multiple bespoke cash flow plans to look at various scenarios and forecast how your financial situation will evolve over time.

“can I afford to retire now?”

“can we pay for our daughter’s wedding?”

“can we fund our Grandchildren’s education?”

We can see graphically where you are today and what changes, tweaks or decisions need to be made to ensure you will be ok long into the future.

Why I love it…

- Its not time critical – you can upload and enter your details in your own time, at your own pace

- Totally Secure – bank level encryption, customised for the Spectrum IFA Group

- Simple interface between us for sharing of documents, messages and, most importantly, for uploading up-to-date financial information

- I am notified as you make changes to your profile

- ‘Virtual’ Modelling tool with scenario based examples

- Very Visual – it’s easy to see how changes will directly impact your situation as we tweak your plans

- Digitally and securely accept and sign-off on a range of documents

- Quarterly Financial statements can also be shared here instead of emailed

….. oh, and it has a load of other great tools we can use too…..

Finance update Q2 2023

By Peter Brooke

This article is published on: 4th August 2023

This update is a look back at 2022 and the year so far in 2023! I believe that 2022 was one of the toughest years of the 25 of my career in terms of the very difficult conversations I had with many of my clients. Those 25 years included the DotCom Bubble, 9:11, the invasion of Afghanistan, the second Iraq war and the Global Financial Crisis.

2022 was different for one main reason… it seriously affected Cautious and Balanced investors and as most of my clients are retired and therefore dependent on their capital for income, it means they need to take a more cautious or balanced approach to managing their money.

So what happened?

At the start of 2022 markets were pricing in a low to moderate increase in interest rates for the whole year, how wrong they were … in fact, the US Federal Reserve raised rates by 4% in 2022 and have carried on into 2023 and many other central banks followed suit.

When interest rates rise, the values of government and corporate bonds fall but long-standing portfolio theory states that bonds must always make up a large part of cautious portfolios, hence the very difficult year for cautious investors. Equities (shares) didn’t fare much better but have shown a faster recovery towards the end of 2022 and into 2023.

This chart shows four different typical risk profiles over the last 2 ½ years taking in the recovery from Covid to the inflation spike, invasion of Ukraine and the year so far. Highlighting the tough times that cautious (green line) and balanced (orange line) investors have had over the past few years.

So why did this happen?

Inflationary pressures had started to build up as economies reopened after the Covid pandemic. Supply chain disruption during the pandemic created shortages, which collided with a sudden increase in demand. An under-investment in energy, particularly fossil fuels also contributed to inflation through higher oil and gas prices.

The war in Ukraine shifted this inflation problem to a full-blown cost-of-living crisis. Central banks were slow to act initially, thinking it was all linked to the pandemic, but it soon became clear that rising prices would be more persistent than expected. Central banks had no alternative but to raise interest rates.

Financial Markets in 2022

Equities

2022 was a year most investors would rather forget, with bond and equity markets seeing significant falls and uncomfortable volatility. Importantly, holding a portfolio of bonds and equities provided little protection, as both asset classes proved correlated to high inflation.

The year also saw a considerable rotation from “growth” to “value”, ending the long dominance by the technology sector. In particular, many of the stock market darlings of the previous decade saw weakness – Meta Platforms, Amazon, Alphabet and Netflix. At the same time, investors had assumed the strong performance of areas such as e-commerce during the pandemic would persist in a normal environment. It didn’t, earnings fell and share prices were hit hard.

Energy was the only obvious victor at a time when commodity prices were high, though share price rises slowed in the second half of the year as governments demanded a share of their windfall profits. Nevertheless, the sector remained the best performing of 2022.

The UK stock market outpaced most of its international peers due to a bias in the year’s most popular sectors such as mining, commodities, oil and gas, and the shift away from growth sectors such as technology, which are only lightly represented in UK equity markets.

Bonds

It was a grim year for bond markets, which had to contend with rising inflation and interest rates. Where the US led, other bond markets followed. The UK has its own idiosyncratic problems, when an ill-judged ‘mini-budget’ under new Prime Minister Liz Truss in September 2022 crashed the pound and caused a spike in UK borrowing costs.

As discussed above, rising yields meant significant losses for investors. Most bond investors saw double-digit falls in their bond investments over the year. It may be little reassurance, but bond prices have recovered from those lows and yields are now at more reasonable levels reflecting the interest rate environment more accurately. They may once again be able to fulfil their traditional role in portfolios – as a source of income and a diversifier from equities.

Financial Markets so far in 2023

So, with this backdrop and a difficult year behind us how have things fared so far in 2023?

Firstly, the gloomy scenario envisaged by many economists at the start of the year has not come to pass. The much-anticipated US recession has been deferred, while financial markets have remained resilient.

The IMF is now predicting a rise in global growth for 2023 though much of this growth won’t becoming from developed economies while emerging markets economies are expected to expand led by China and India.

Inflation has come down but has proved far stickier than many expected, with labour markets remaining healthy across most major economies. This has forced central bankers to continue raising interest rates. While the US Federal Reserve appears to have paused with central bank rates of 5.25%, the UK and eurozone central banks are still raising rates and have indicated further rises may lie ahead.

Financial markets have been resilient. The disruption created by the collapse of several banks proved short-lived, with swift action from policymakers and regulators preventing wider problems.

The US stock market has seen a surprising surge from the technology sector. After a grim year in 2022, against expectations, they roared back in 2023. The galvanising force has been generative artificial intelligence, with excitement around Chat GPT creating interest in semiconductor companies such as Nvidia as businesses look to invest in this new technology.

The US economy continues to deliver mixed messages. A buoyant labour market has continued to reduce expectations of a deep recession.The Fed has remained resolute on interest rates, although it paused rate rises in June, it has made it clear that it is willing to raise them again should inflation continue to rise.

Recession appeared an inevitability for the UK economy at the start of the year. As it is, it has not materialised, with falling energy prices, government support and a resilient consumer all acting to shore up growth. Inflation has remained stubbornly high and so the Bank of England has been forced to keep raising interest rates, which are now expected to peak at around 6%.

The UK stock market had a weak start to the year as commodity prices fell and the banking sector was hit by the failures of Credit Suisse in Europe and Silicon Valley Bank in the US. The resurgence of US technology stocks also impacted the UK market as investors swapped from “value” back to “growth” companies.

It was a stronger period for stock markets in Europe as company earnings improved and outstripped the US early in the year. A mild winter and prompt action by governments across the region saw an energy crisis averted. The region was also lifted by the resurgence of China, which is an important export market, particularly for Germany and Spain.

The European Central Bank raised interest rates to 3.5% in June, their highest level in 22 years. Eurozone Consumer price inflation declined steadily from over 10% in October 2022.

The outlook for Asia has been dominated by China. The country’s reopening in October 2022 led hopes of galvanising global economic growth at the start of the year. However, the initial stock market rally petered out as growth has not bounced as many had hoped. Confidence has not yet returned to pre-pandemic levels.

Asian markets have continued to lag their global counterparts as expectations of a swift return to economic growth in China have receded. Nevertheless, there remain plenty of reasons to be optimistic as Chinese stimulus for infrastructure projects is beginning to feed through to the economy.

Japan has been rediscovered by investors in 2023, with veteran investor Warren Buffet making a high-profile investment in the country’s stock markets. The Japanese economy is also starting to improve as reopening gathers pace and wage growth drives consumer spending. As a net importer, it is also benefiting from lower oil prices, which is helping to improve the Government’s fiscal position.

Bonds

The yield (interest paid) on US ten-year government bonds dipped in April, but moved back up as investors started to anticipate more rate rises ahead. Short-dated bonds now have higher yields than longer-dated bonds. This situation is known as an inverted yield curve and means investors expect rates to be cut over the longer term.

This “inversion” is currently common place, with 37 countries now trading with inverted yield curves, including the UK,Germany, France and Canada.

Conclusion

Financial markets seem to be in a holding pattern, waiting to see how much impact higher interest rates will have on economic activity and looking for clear signs that the interest rate cycle has peaked, and the next rate move is downwards. From the strength of China’s recovery to a potential recession in the US to the resilience of the corporate sector, there are major questions going into the second half of this year.

I am, once again, very grateful to the team at Evelyn Partners for their help in putting this summary together and hope it is useful in framing where we are today and how we got here.

They have some excellent articles on the impact of AI and the basics of how Bonds work.

https://www.evelyn.com/insights-and-events/insights/the-basics-of-bonds

Unlock Your Financial Success with Our Exclusive Guides!

By Peter Brooke

This article is published on: 3rd July 2023

As part of my commitment to providing you with the knowledge and resources to navigate the complex world of finance with ease, I am pleased that you can now download four indispensable guides that cover a range of important financial topics.

- Understanding Investment Risk

- French Tax Changes and Planning Opportunities for 2023

- Responsible Investing and ESG Funds – The Spectrum Approach

- Unveiling the Benefits of Assurance Vie – Tax Efficient Saving and Investments in France

To access these resources, simply click on each of the links.

I am a firm believer that knowledge is the key to financial success, and these guides are designed to empower you on your financial journey. Whether you’re an experienced investor or just starting out, these guides offer valuable insights to help you make well-informed decisions.

Understanding Investment Risk

Investing can be both rewarding and challenging – in this guide, we try to demystify investment risk. I believe risk can be thought of like energy: it is neither created nor destroyed, it simply changes from one category to another.

↵Click the image to find out more.

French Tax Changes and Planning Opportunities for 2023

Taxation is a crucial aspect of financial planning, particularly if you reside in France or have financial ties to the country. Our guide summarises the current French tax landscape for 2023 – providing you with an overview of tax changes and planning opportunities.

↵Click the image to find out more.

Responsible Investing and ESG Funds – The Spectrum Approach

Environmental, Social, and Governance (ESG) investing has gained significant momentum, allowing investors to align their portfolios with their values. This guide delves into the world of sustainable investing, providing insights into ESG principles, investment strategies, and the potential impact of ESG factors on financial performance.

↵Click the image to find out more.

Tax Efficient Savings & Investments in France 2023

Unveiling the Benefits of Assurance Vie

Assurance Vie is a popular long-term savings and investment product in France. Discover the advantages, tax benefits, and investment options associated with Assurance Vie in our comprehensive guide. Learn how to leverage this powerful tool to secure your financial future.

↵Click the image to find out more.

Remember, I am here to support you. If you have any questions or need further assistance, please feel free to reach out via the below contact form, or the booking system below.

Tax time in France

By Peter Brooke

This article is published on: 9th May 2023

Its that time of year again….

The tax season is underway and whilst those who are declaring for the first time by paper have until 22nd May to complete their returns, most other people in most departments have until early June. Of course many people want to get it done as soon as possible. Now that all the forms are available, which can be downloaded here from the French Government website, you can have a clearer idea of how to declare.

If you have employed someone to do your tax return, the chances are you have already sent off all your information. However if you want to have a go at doing your own tax return, then here are some tips for this year!

First tip – I would highly recommend investing in the Income Tax Return guide from the Connexion magazine – which can be bought online here.

Please note that we, at Spectrum, are not accountants and do not complete tax returns for our clients, in fact I personally find the process as complicated as I am sure you do.

Hopefully some of these tips will help – of course if you do need help then I would recommend speaking to the team at French Tax Online who have a lot of information and experience with French Tax returns: https://www.frenchtaxonline.com/

Tips for your taxes

Everything is declarable, not everything will be taxable!

1. Get organised first – have all your information together before you start. If you are using your Self Assessment Tax Return from the UK, make sure you decide which number you are using (April 22 or April 23) and stick to that method for UK based income. If you suddenly change and start taking the figures from your bank account then you will be double taxed on the first four months of the year. Collect all your statements, payslips, tax certificates together in the one place and note down the figures for all your sources of income and the exchange rate at the date of payment (or the annual average)

2.You must declare ALL of your worldwide income. French income is declared on the main tax form (called the 2042) and put any foreign sourced income on the 2047 form. You need to declare all of your non-French bank accounts on the 3916 form. If you are doing the return for the first time on paper you will need a paper copy of all these forms

You will also need the 2042 C form as that is where you will find boxes 8SH and 8SI that you must tick if you have an S1 certificate so that social charges aren’t charged on your pensions and that the reduced rate of social charges of 7.5% as opposed to 17.2% are charged on any investment income

All of the forms can be downloaded here from the French Government website

3. Healthcare: If you are declaring online you need to tick box 8SH and 8SI to inform the French authorities that you are covered for your healthcare by another system of the EU (including the UK)

4. Foreign Bank accounts and Assurance Vie (AV): If you are declaring online you need to tick box 8TT (for Dublin or Luxembourg AV) and 8UU (for non French bank accounts) in order to create the 3916 form which needs to be completed with the details of these accounts. If you are declaring on the paper form, these boxes are at the bottom of the main 2042 form. If you are declaring an assurance vie you will need to have the value (in euros) of the account as at 1st January 2022, you should receive statements from your AV provider with this information during April and May each year

5. Foreign sourced income must go on the 2047 form (the pink one). Most foreign pensions and salaries go in section 1 of this form but UK salaries, UK rental income, UK Government pensions, which are all declared in France but given a tax credit equivalent to the tax that would have been paid in France all have to go into Section 6 of this form in order to get the tax credit (box 8TK on the 2042 form)

6. Don’t forget any charitable donations that you made in 2022. French based charities send you a tax certificate, so you can use this to enter the correct amount

7. Don’t forget the kids! The tax credit for child care costs for children under 6 (born after 1st January 2016) have increased from €2300 to €3500 per child and you get 50% of this amount. This is for expenses for a nanny (nounou), nursery, after school care and holiday club. If however your child is now over 6 but you still have someone to collect them from school, this is counted as a home help tax credit (see next point)

8. Tax credits for home help. If you have a gardener or cleaner or have had some other home help in 2022, and you haven’t already received the tax credit automatically, you can declare these amounts on the 2042 RICI form here You are allowed at tax credit of 50% of any expenses up to a maximum of €12,000

IMPORTANT

Not everything has to be 100% accurate.

If you get close to the deadline, just submit your tax return as it is, you can amend the tax return, without penalties, through the correction service which will open at the beginning of August.

Currency… all hail to the Euro

If you are receiving income in any currency other than Euros you need to convert it to Euros for your declaration.

You should use the exchange rate on the day the you received the income into your account and daily rates are available here:

If you don’t have access to the accurate data it is possible to use an average rate for the year which is shown in the Connexion guide as £1 = €1.158

Finance Update Q1 2023

By Peter Brooke

This article is published on: 27th March 2023

The Great Moderation & The Next Decade.

Is it really different this time?

The finance industry is often guilty of a very short term view. I read at least two emails every day that focus solely on the last 24 hours, which is probably not particularly healthy. It is also ironic that my industry then tells all its clients to only judge performance over the medium to long term … whatever that means.

Of course, understanding how daily events can affect performance is important, but from time to time we really must put this into the context of the long term, and sometimes the VERY long term.

Our friends at Evelyn Partners have created a terrific piece of research considering the last 40 years (yes, 40) and then looking forward at the next decade, where they feel there really is something different happening. Here I will summarise their musings – I hope you find it interesting.

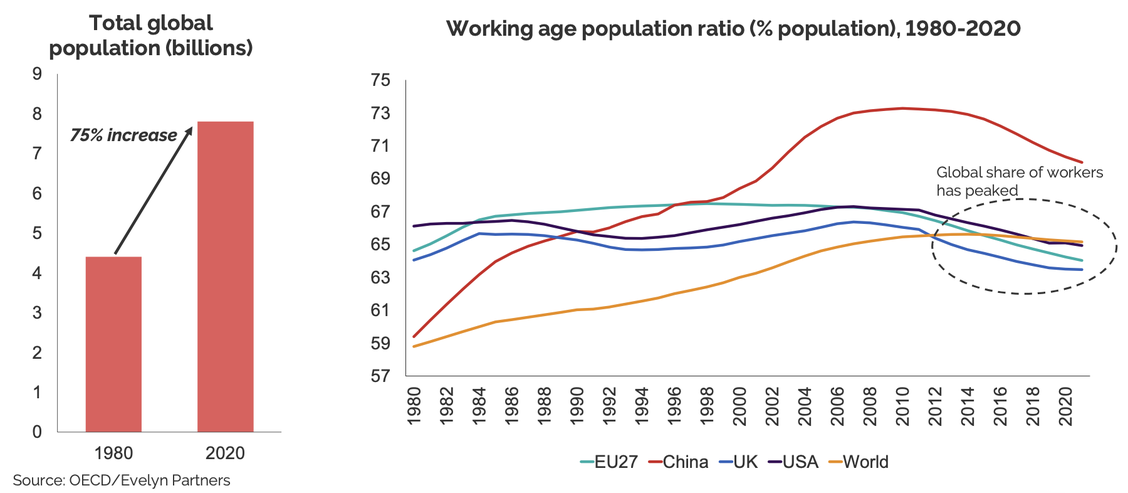

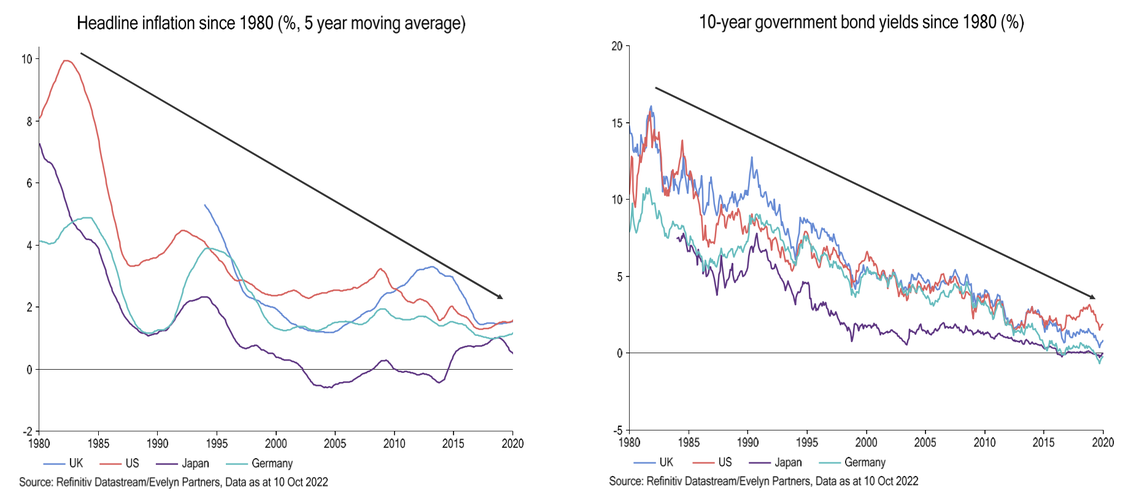

The Great Moderation 1980 to 2020

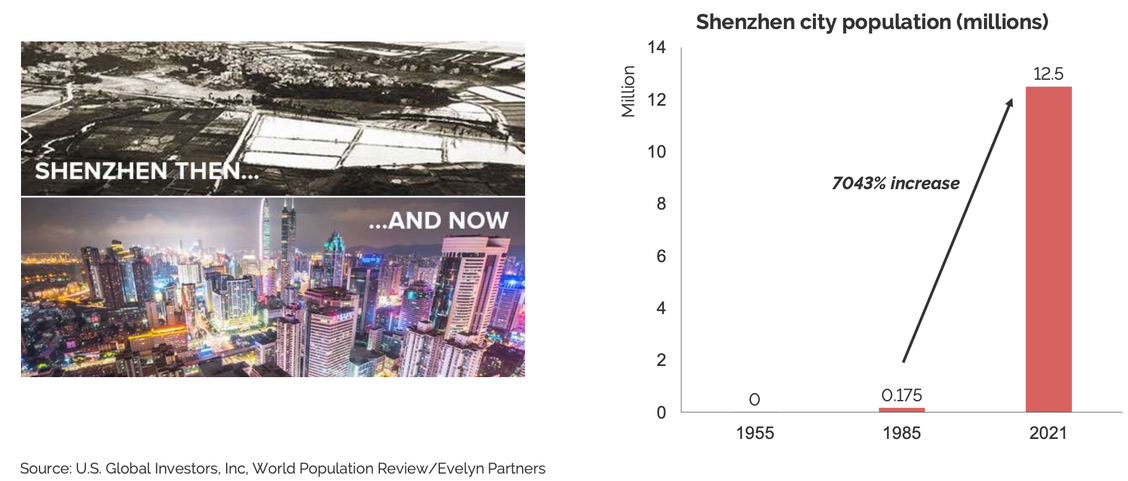

The economic impact of China’s emergence over the last 40 years has contributed to lower inflation and lower interest rates this impact is particularly characterised by

- Favourable Demographics

- Movement of workers

- Globalisation

1. Favourable Demographics – massive growth in global population AND in the numbers of ‘working age people.

2. Massive movement of workers from rural regions into new cities facilitated rapid growth in manufacturing and economic output.

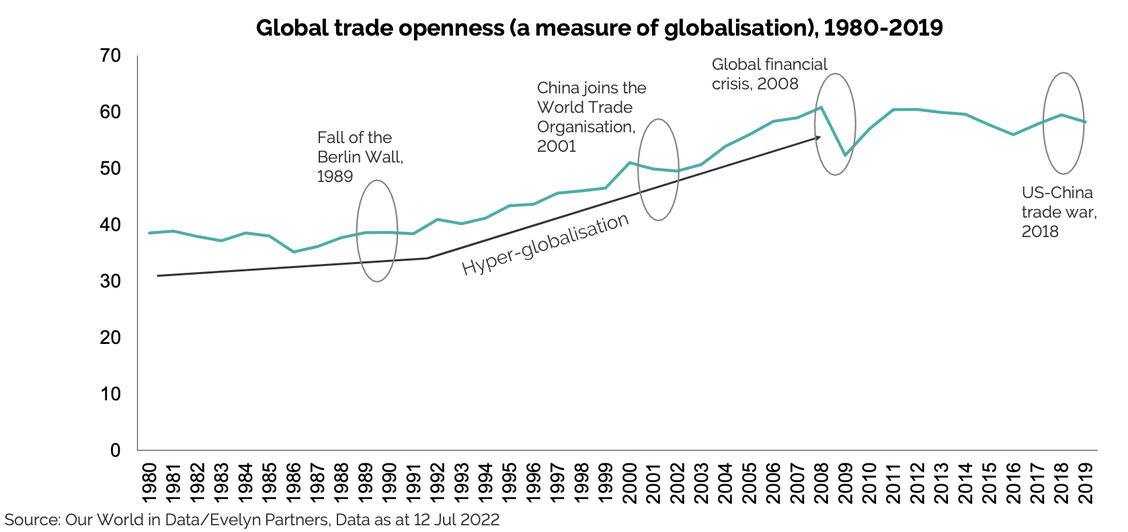

3. Globalisation enabled advanced economies to tap into this pool of cheap labour. But it now seems to be slowing…

The economic impact has been significant: 40 years of falling inflation and interest rates!!

The Next Decade

So is it really different this time?

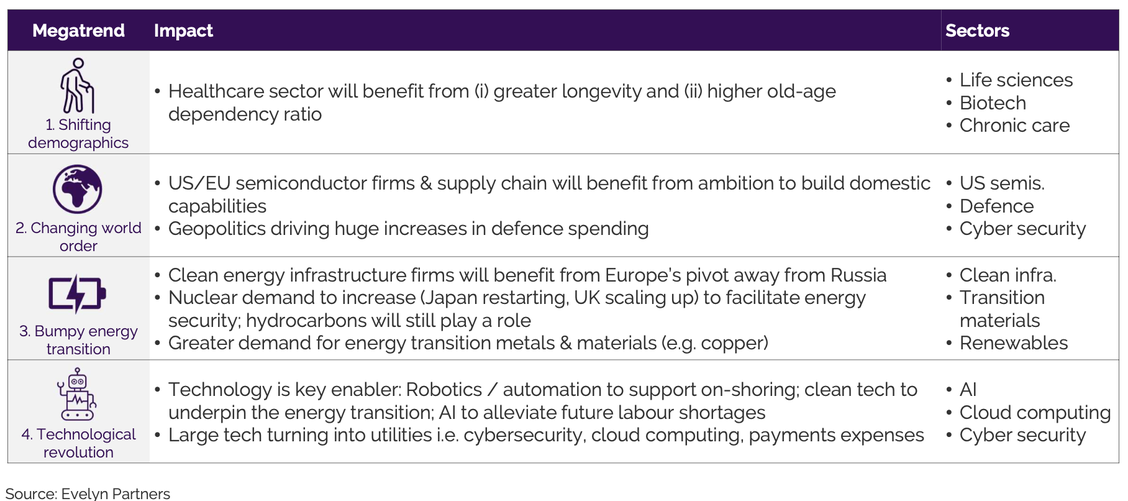

YES – We are at an inflexion point. 4 “Megatrends” will shape markets over the next 10 years – and beyond!

- Shifting Demographics

- Changing World Order

- Bumpy Energy Transition

- Technological Revolution

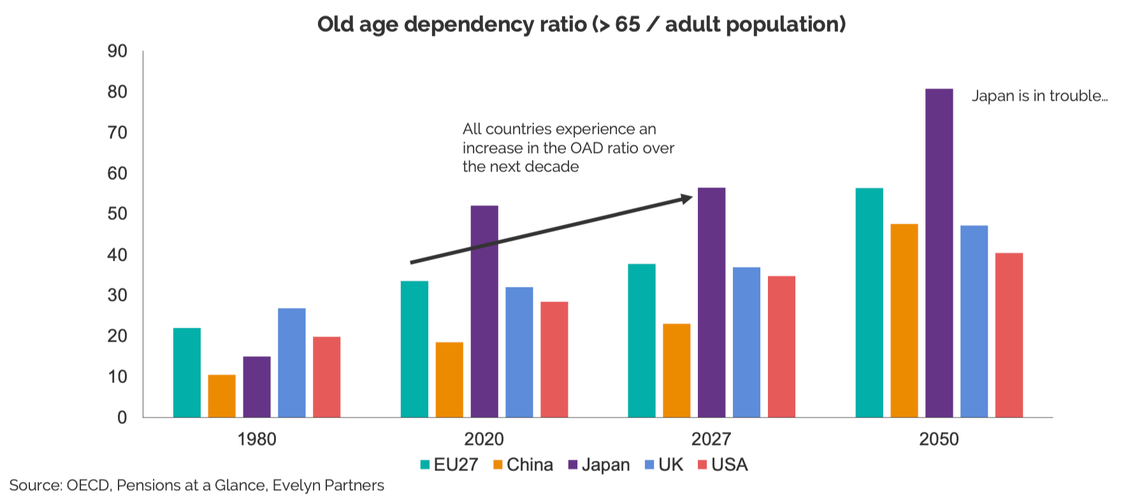

1. Shifting Demographics: The old-age dependency ratio is set to increase sharply & population growth will slow

2. Changing World order: US-China decoupling and the war in Ukraine will result in ‘slowbalisation’.

3. Bumpy Energy Transition: The war has undermined energy security & accelerated the energy transition… But the transition is likely to be bumpy. It will bring new energy trade patterns and geopolitical considerations into play…

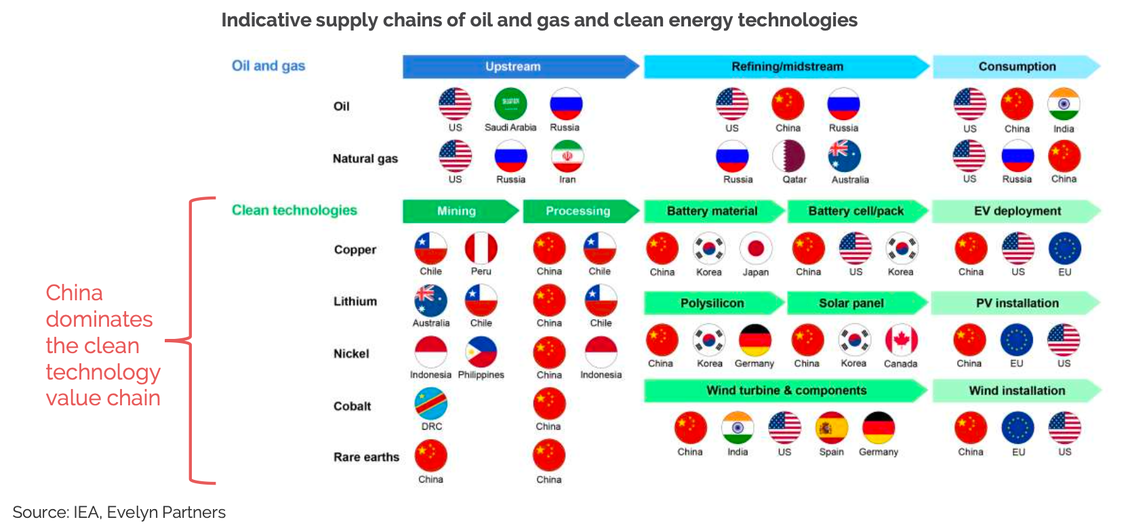

Who really owns the infrastructure which will help our Energy transition?

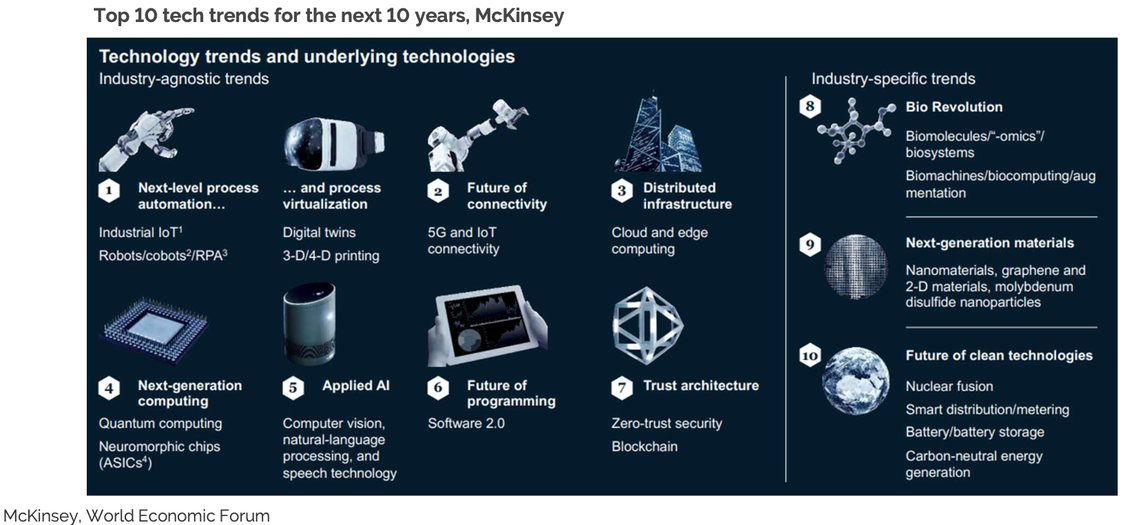

4. Technological Revolution: New technologies will underpin the future of business and most areas of our lives… for example Artificial Intelligence and Automation

So if we really are entering a genuinely different world, how do we manage our money over the next decade and beyond?

All of these factors will present challenges AND opportunities and so it is important to align our approach to benefit as much as possible from these opportunities and minimise the risks of being on the wrong side of the challenges.

Is it time to review your investments?

I hope this ‘longer term’ view has helped you put your existing investment choices into perspective or helped you when choosing new investments.

If you want help with reviewing existing or choosing new funds then don’t hesitate to get in touch.

I want to sincerely thank the team at Evelyn Partners, one of the investment management firms we work closely with, for this excellent piece of research and its refreshingly long term approach.

For more information on this please visit Evelyns Megatrends Hub here www.evelyn.com/good-advice/megatrends/

Make a time to call – it’s good to talk

If we haven’t spoken recently and you want to get in touch via my new booking system then please click on the link to book a quick call.

I have linked my diary to the excellent ‘Calendly app’ which allows us to arrange our next call, zoom or face to face meeting more easily – feel free to forward to family or friends who might need my services.